Learn How You Can Secure Your Child’s Educational Future with Expert Financial Planning

Whether you have young children, high schoolers preparing for college, or recent graduates with student loans, we’ve got you covered. Our goal is to help you make informed decisions and secure your family’s financial future. Want more help with planning the finances for your child’s education? Schedule a call with Facet to learn more.

See How Financial Strategies Can Help Your Child's Education Success.

Preparing Young Kids for College Financially

An important key is to start early to ensure your child’s educational success. By planning ahead, you can alleviate future financial stress and provide a solid foundation for your child’s college education. Here are some answers and strategies to common questions:

What is the best way to save for my child’s college education?

- Start saving early to benefit from compound interest. Diversify with tax-advantaged accounts and other investments. Automate contributions for consistency. Explore financial aid, scholarships, and grants. Balance college savings with other financial priorities like retirement and emergency funds. [1]

What is a 529 Plan?

- A tax-advantaged investment account for education savings. Contributions grow tax-free, and withdrawals for qualified expenses are tax-free. Usable for K-12, college, and some apprenticeships. Many states offer additional tax benefits, making it an attractive option for families. [2]

How do I start a 529 plan for my child?

- A 529 plan can be opened through a financial institution or your state’s plan provider. You’ll need to choose the type of plan and make regular contributions. [3]

How can I estimate the cost of college for my child?

- You can use a college cost calculator to estimate tuition, fees, and other expenses. Include potential financial aid and scholarships in your calculations. Regular reviews ensure you’re on track to meet education funding goals. Various worksheets are also available to aid in estimating the potential college costs. For one-on-one help navigating all the details, Facet is here to help. Schedule a call to learn more details. [4]

What options do we have if we don’t qualify for financial aid?

- If a student or their parents make over $75,000 per year, they do not qualify for financial aid. Consider private student loans, scholarships, and grants. Building a strong financial plan with savings and investments is also strongly encouraged. [5]

Parents with High School Students

As your child approaches college age, it’s crucial to understand and navigate the financial landscape. Common questions include:

What’s the Best Ways to Get a Student Loan?

- Start by filling out the Free Application for Federal Student Aid (FAFSA). This opens doors to federal loans, which typically offer better terms than private loans. After federal options, explore private lenders if needed. Eligibility often depends on factors like enrollment status and satisfactory academic progress. [6]

How Do I Apply for a Federal Student Loan?

- Create an FSA ID at studentaid.gov. Complete the FAFSA online, starting October 1st for the next academic year. Gather your SSN, tax returns, and bank statements (and parents’ info if you’re dependent). After processing, you’ll get a Student Aid Report. Schools use this to create your aid package. Review offers carefully and accept only what you need. Reapply annually for continued aid. [7]

Federal Student Loans vs. Private Student Loans?

- Federal loans often offer lower, fixed interest rates and income-driven repayment plans. They don’t require credit checks for most loans. Private loans may have higher rates and fewer protections but can cover funding gaps. Always exhaust federal options before considering private loans. [8]

What are Subsidized Student Loans?

- These federal loans are need-based and don’t accrue interest while you’re in school or during deferment periods. They’re available to undergraduate students with financial need. The government pays the interest, reducing your overall loan cost significantly compared to unsubsidized loans. [9]

Can an 18-Year-Old Get a Student Loan Without a Co-Signer?

- For federal student loans, most 18-year-olds can borrow without a co-signer. However, private lenders typically require a co-signer for borrowers with limited credit history. Some lenders offer co-signer release options after a period of on-time payments. [10]

Can I Get a Student Loan with Bad Credit?

- Federal student loans don’t require a credit check, making them accessible even with bad or no credit. For private loans, options are limited without a credit check, but some lenders offer loans based on future income potential rather than credit history. [11]

Paying Back Student Loans: Post-Graduation

Graduating from college marks the beginning of student loan repayment. To manage this phase effectively, consider:

What’s the Best Way to Navigate Student Loan Repayment?

- The key challenge is balancing affordable payments with minimizing long-term costs. A financial advisor can offer personalized strategies, helping you evaluate repayment plans and forgiveness options. They’ll integrate loan repayment into your overall financial plan, ensuring decisions align with your career and financial goals.

Where Do I Pay My Student Loans?

- Federal loans are paid through designated servicers found on StudentAid.gov. Private loans are paid directly to the lender. Many offer automatic payments, sometimes with interest rate reductions. Keep your contact info updated with your servicer. [12]

What is Student Loan Forgiveness?

- Options include Public Service Loan Forgiveness, Teacher Loan Forgiveness, and forgiveness through income-driven repayment plans. Each has specific requirements. [13]

Can I Qualify for Student Loan Forgiveness?

- Various programs offer loan forgiveness based on your profession, income, and other factors. A financial advisor can help you research your eligibility criteria and apply if you qualify. [13]

What is the Student Loan Repayment Start Date?

- Most federal loans have a six-month grace period after leaving school. Private loans may differ. Mark your start date and consider setting up automatic payments to stay on track. [14]

Ready to Take the Next Step?

No matter where you are in your educational savings journey, Facet can help you navigate the complexities of financial planning. Our personalized flat-fee membership is designed to provide you with expert guidance and support at every stage.

Learn more and schedule a call with Facet. We can work together to help secure your family’s educational future.

Sources:

https://www.savingforcollege.com/intro-to-529s/what-is-a-529-plan

https://www.savingforcollege.com/article/how-to-open-a-529-plan

https://studentaid.gov/understand-aid/types/loans/federal-vs-private

https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

https://www.experian.com/blogs/ask-experian/how-to-get-student-loan-without-cosigner/

https://studentaid.gov/articles/plus-loans-denied-adverse-credit/

https://studentaid.gov/manage-loans/forgiveness-cancellation

https://www.consumerfinance.gov/ask-cfpb/when-and-how-do-i-start-paying-my-student-loans-en-585/

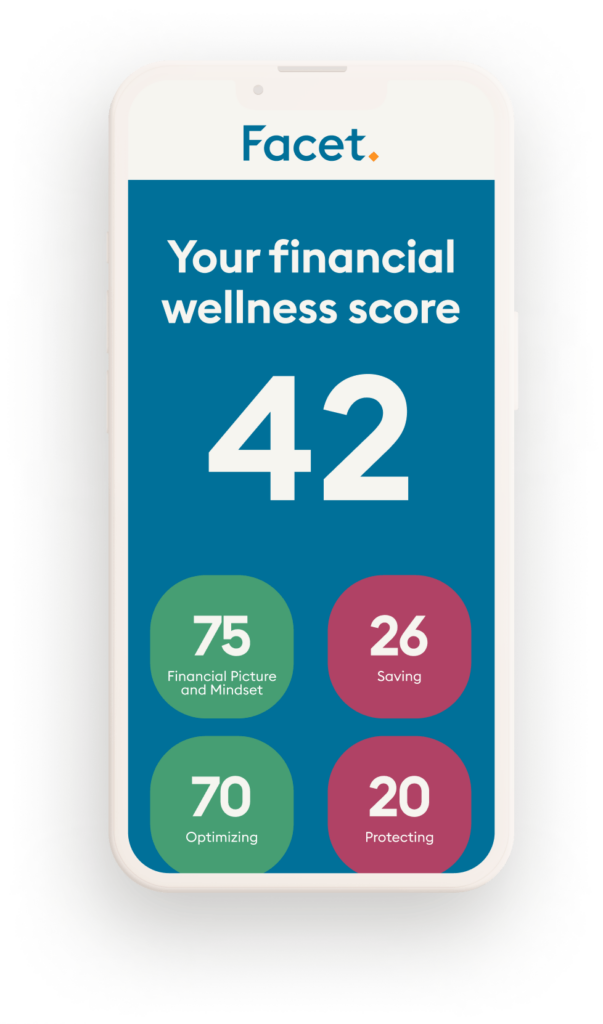

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

Schedule a call with a Facet expert

Get help with catch up contributions and every important financial decision with an affordable flat fee membership.

How we’re different.

What Facet members are saying.

Testimonials were provided by current members of Facet ("Facet Wealth, Inc."). Members have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other members, and do not provide a guarantee of future performance success or similar services.