The information provided is based on the published date.

Key takeaways

- Inheritance tax is levied on inherited assets, paid by the recipient, and varies by state

- Inheritance tax is calculated using a progressive rate dependent on the value of the inheritance and the beneficiary's relationship with the deceased

- Six US states impose inheritance tax: Pennsylvania, New Jersey, Nebraska, Maryland, Kentucky, and Iowa (phasing out)

- Heirs may qualify for exemptions based on their relationship with the deceased and the size of the inheritance in their state

- Capital gains tax may be owed if inherited assets appreciate and are sold

How do inheritance taxes work?

Inheritance tax is levied on beneficiaries of inherited assets. It's different from estate tax. The former is paid by the recipient of an inheritance, and the deceased's estate pays the latter.

In the US, inheritance taxes are rare. Currently, only six states impose an inheritance tax.

- Pennsylvania

- New Jersey

- Nebraska

- Maryland

- Kentucky

- Iowa (started phasing out in 2021; plan to eliminate by 2025)

Moreover, the amount of tax owed on an inheritance is determined by the state where the deceased person lived or owned property, the value of the inheritance, and the relationship between the beneficiary and the deceased.

How are inheritance taxes calculated?

Inheritance taxes are calculated using a progressive rate that varies from state to state.

Generally, tax increases depend on the value of the inheritance and who receives it.

If you have to pay an inheritance tax, it will only be for the part of the inheritance above the exemption amount.

Tax rates are calculated on a sliding scale once income surpasses certain thresholds. These rates usually start in single digits and gradually increase to 15-18%.

The amount of exemption you receive and the tax rate you are charged depend more on your relationship with the deceased than the value of the assets you inherit.

Generally, the closer your relationship to the deceased, the higher your exemption and the lower your rate will be.

Inheritance tax laws vary by state. In all six states, surviving spouses are exempt from inheritance tax. In New Jersey, domestic partners are also exempt. However, in Nebraska and Pennsylvania, descendants may need to pay inheritance tax.

Learn more: How to create a will

Inheritance tax limits by state

Most states have an inheritance tax applicable for bequests over a specific amount. In Maryland and Iowa, the size of the estate is especially important.

- Maryland: Estate inheritances less than $50,000 are exempt.

- Iowa: Estate inheritances less than $25,000 are exempt.

Depending on their relation to the deceased, heirs may qualify for additional exemptions. Here's a breakdown of state-specific details.

- Pennsylvania: The tax exemption applies to spouses and minor children. Adult children, grandparents, and parents have an exemption of up to $3,500. The tax rate varies based on the relationship and can be 4.5%, 12%, or 15%.

- New Jersey: The tax exemption applies to immediate family members, including spouses, children, parents, grandparents, and grandchildren, as well as charitable organizations. Siblings and sons/daughters-in-law are exempt from inheritance taxes up to $25,000. The inheritance tax rate depends on the familial relationship and the size of the inheritance, ranging from 11% to 16%.

- Nebraska: Immediate family members such as parents, grandparents, siblings, children, and grandchildren are exempt up to $100,000, while other relatives are exempt up to $40,000 and unrelated heirs up to $25,000. The tax rates are 1%, 11%, and 15% for these amounts. Spouses and charities are fully exempt.

- Maryland: The tax exemption only applies to immediate family members (parents, grandparents, spouses, children, grandchildren, siblings) and charities. Other recipients can be exempted up to $1,000. Tax rate: 10%

- Kentucky: The tax is based on a sliding scale that ranges from 4% to 16%, depending on the size of the inheritance. Immediate family members such as spouses, parents, children, and siblings are exempt from the tax. Other recipients are exempt up to $500 or $1,000.

- Iowa: The exempt include spouses, direct ascendants (parents, grandparents, and great-grandparents), and direct descendants (children, stepchildren, grandchildren, and great-grandchildren). Charities are exempt up to $500. The tax rate on other inheritors ranges from 2% to 6% in 2023, down 20% from 2022.

Learn more: What is a trust and how does it work?

What's the difference between inheritance tax and estate tax?

Most people think inheritance and estate taxes are the same, but there are distinct differences.

And even though most people will never have to worry about either tax, it's good to know the differences if you live in one of the previously mentioned states (inheritance tax) or you have a very large estate.

The main difference is the inheritor pays that inheritance tax, and the deceased's estate pays estate taxes.

The amount of inheritance tax you pay depends on your relationship to the deceased and the size of your inheritance.

Estate taxes, on the other hand, take into account all assets owned by a person at the time of their death, regardless of who receives them.

The IRS only requires estates worth over $12.92M (double for couples) to file federal estate tax returns in 2023. No estate tax is assessed if the estate is passed down to the deceased person's spouse.

If a person receives an estate that is big enough to require the federal estate tax—and if the deceased person lived or owned property in an inheritance tax state—then the beneficiary will have to pay both the federal estate tax and the state inheritance tax if the inheritance is not completely exempt under the state's law.

Before the inheritance is distributed, the estate is taxed. Then, it's taxed at the state level.

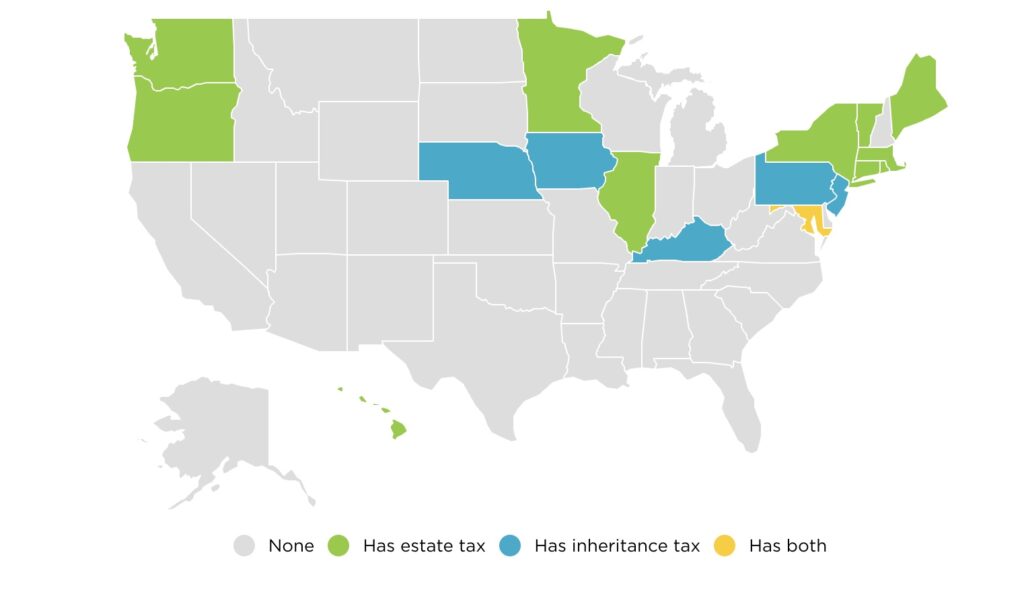

States with inheritance taxes, estate taxes, or both

What happens if inherited assets appreciate?

If assets increase in value after you inherit them, you may owe capital gains tax. This taxable event is triggered when you sell some or all of your inherited property. Capital gains tax is applied to any profits (gains) you make above the original value (cost basis).

For example, say you inherit a $100,000 portfolio of investments. Then, a few years later, you sell the whole thing when it's valued at $200,000. You will potentially owe capital gains tax on the $100,000 profit.

The inheritance tax rules are similar if you inherit retirement accounts like IRAs or 401(k)s. In this case, your withdrawals (distributions) may be taxable.

How to avoid inheritance tax

Dealing with the loss of a loved one is already a difficult process, and the added stress of paying taxes on inherited assets can make it even more challenging. Nevertheless, there are methods to prevent paying inheritance tax.

Gifting

To avoid inheritance tax, you can gift a portion of inheritance money to a loved one before you pass away.

2023 maximum gift limit (without incurring taxes): $17,000 (individuals); $34,000 (married couples)

Create a Trust

You can also set up a trust to earmark assets for your beneficiaries.

There are two different types of trusts. Which one you choose depends on how much control you wish to have and how you want the transfer to be managed after you pass away.

Revocable Trusts

Pros:

- During the trust's lifespan, terms are modifiable.

- You own the trust's assets while you're living.

Cons:

- The assets are still linked to your estate, which could result in increased estate taxes and involvement in probate court for your heirs.

Irrevocable Trusts

Pros:

- Assets are not linked to your estate.

- Your beneficiaries will avoid probate and estate taxes.

Cons:

- You relinquish control of your assets.

- You cannot modify the terms.

Final word

Inheritance tax is a critical part of the estate planning process and has major implications for individuals receiving assets from an inherited estate. Understanding the differences in inheritance tax by state and whether your heirs may qualify for exemptions when you plan for the future is essential.

Thinking ahead about the potential capital gains tax that could apply if inherited assets appreciate is also important. While it can be difficult to think about money during a time of mourning, understanding how inheritance taxes work—and may affect your heirs—can save them money down the line.

To have Facet’s team of experts take a comprehensive look at your estate plan and learn how it relates to your overall financial picture, click the button below.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.