The information provided is based on the published date.

Key takeaways

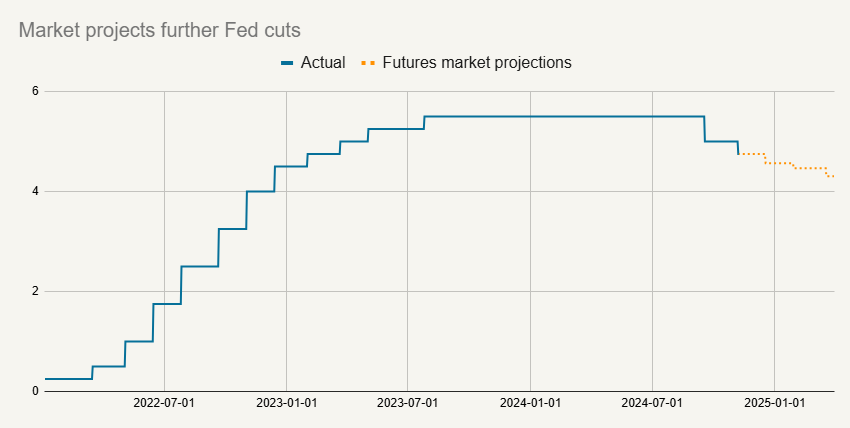

- The Fed cut its target interest rate by 0.25%. They signaled that more cuts are likely but the timing is highly uncertain.

- The Fed has some concerns about the jobs market after a surprisingly weak October employment report.

- It is also possible that inflation progress is stalling, which could make it harder for the Fed to keep cutting rates.

- The election had no impact on the decision to cut rates now, but it is possible that changes in tariffs or government spending could have a major economic impact, and if so, the Fed may need to respond down the road.

The U.S. Federal Reserve cut their target interest rate by 0.25% at its November meeting. However the prospects for additional rate cuts beyond this one is very much up in the air. What led the Fed to cut rates? And how might the economy and the election results influence the Fed going forward? Here’s our views on the state of the Fed today.

Fed cuts rates, outlook murky

Fed Chair Jerome Powell had telegraphed that additional rate cuts were likely during the Fed’s September meeting. At the time, this led most investors to assume the Fed would be cutting rates steadily over the next several months.

Source: Bloomberg

However an uncertain economic picture has made this less obvious. During his post-meeting press conference, Powell said that “we are prepared to adjust our assessments of the appropriate pace and destination” for where rates will end up. He also said “we are not on any preset course.”

We think another 0.25% rate cut in December is still more likely than not. However a very mixed picture on employment, and even some doubt about inflation progress, could convince the Fed to pause rate cuts next month. Hence why Powell is sounding equivocal. He wants to leave all his options open, especially given how mixed the economic data has been.

Inflation progress could be stalling

First let’s start with inflation. To be sure, inflation has improved substantially in the last year. What is less clear is whether inflation is still on a downward trend. The chart below shows the Core PCE, the Fed’s favored inflation measure.

Source: Bureau of Economic Analysis

The blue line shows the 12-month change in prices. We can see that inflation steadily improved through most of 2023 and 2024. However the last four months, it has been steady between 2.6% and 2.7%. While that is a lot better than the 5% inflation rate at the end of 2022, it is still a long way from the Fed’s 2% target.

Moreover, the single month figure was on the high side in September at 0.25%. In order for inflation to fall to 2%, it has to average about 0.16% per month. It has been higher than that in three of the last four months.

The Fed isn’t overly concerned about this just yet. Powell said that the Fed is “confident” that inflation will continue to improve. However the Fed dropped the word “further” in the sentence saying that “inflation has made further progress” in their press release. I think this tells us that the Fed needs to see renewed disinflation if rate cuts are going to continue. The Fed’s most recent forecasts projected that core inflation would end 2025 at 2.2%. They may still cut in December, but without signs of more inflation progress, they may pause cuts after that.

Jobs picture mixed

The labor market is even more clouded than inflation. The September jobs report was so strong that I called it a “game changer.” On top of the 254,000 reported jobs added that month, there were some large upward revisions to prior months. The two combined seemed to erase what had looked like some summertime weakness.

Then the October jobs report threw us for another loop. According to that report, released November 1, the economy only added 12,000 jobs for the month, the lowest single month since 2020. Economists expected this report to be impacted by two hurricanes that hit Florida as well as a strike at Boeing. Still, the 12,000 job gain figure was far below the 100,000 gain expected based on the Bloomberg economist survey. In addition, the prior two months were revised down by 112,000.

Powell downplayed the importance of the October report, saying the Fed isn’t going to be swayed by a single month’s worth of data before also mentioning the weather and strike impact. This is absolutely right. It is very common to get outlier months in job market data, and the Fed shouldn’t overreact to these outliers.

That being said, I believe the Fed remains attentive to labor market risks. Yes, there were special reasons why the economy only added 12,000 jobs in October, but neither weather nor strikes can explain why there were 112,000 downward revisions the last two months. The Fed is right to not freak out about this one number, but you can bet they are paying close attention to the next report, which will come out about two weeks before the Fed’s December 18th meeting.

If that report shows a big rebound, say above 250,000, then we can conclude that October’s weakness was nothing to worry about. But if it comes in below 200,000, then the Fed might consider doing a 0.5% cut in December.

Election had no impact on decision, but could matter in the future

During his press conference, Powell was asked about how the election might influence the Fed going forward. He gave his obligatory answer that politics don’t play into the Fed’s decisions. In a sense this is absolutely true. The Fed does not make rate decisions to favor one candidate or the other.

However, the Fed does have to react to economic conditions. For example, the Fed didn’t directly react to the political decision to send out stimulus checks during COVID. Ultimately though that led to high inflation, which forced the Fed into action. Powell acknowledged this in his press conference, saying that the “economic effects” would be “taken into account” of any Congressional or White House action.

For example, President-elect Donald Trump has campaigned on a broad increase in trade tariffs. Economists generally agree that tariffs tend to cause higher inflation and lower growth, all else being equal. Whether or not Trump’s policies will actually cause inflation isn’t totally clear. Many have suggested that tariffs will actually be used more as a negotiating tactic and most of what Trump is currently threatening won’t actually be enacted.

Regardless, this is an example of how the Fed can act in an apolitical way, but still be highly influenced by politics. If Trump’s policies cause higher inflation, the Fed will likely act. Indeed, after the election was called for Trump, longer-term interest rates rose modestly, suggesting investors are attuned to the risk of higher inflation.

Fed wants to get to neutral

If unemployment stays steady and inflation continues to improve, the Fed will want to get its target rate to “neutral.” Powell said during his press conference that “we’re on a path to a more neutral stance.” This is a term for the target rate that is neither stimulative nor restrictive for the economy. The problem is that no one knows exactly what the “neutral” rate is.

So the Fed will try cutting rates slowly, trying to feel their way to neutral. The pace of rate cuts will come faster if there are signs of trouble in the jobs market. But they will go slower if there’s even a hint that inflation is rebounding.

Our best guess is that the Fed keeps cutting over the next two meetings (December and January) barring a major surprise. From there if the labor market looks strong, the Fed may take a pause and wait for more data. However if there are any signs of labor market weakness, the Fed could get much more aggressive very quickly.