The information provided is based on the published date.

Key takeaways

- The Federal Reserve's decision to cut interest rates was primarily driven by a weakening job market, which is showing signs of "stall speed" and increasing recession risks.

- Despite a recent uptick in inflation, the Fed proceeded with a rate cut, signaling a belief that current price increases are a temporary, one-time effect caused by tariffs.

- The Fed's own projections, known as the "dot plot," indicate that most members expect at least two more interest rate cuts before the end of 2025.

- For investors, Fed rate cuts are only beneficial for the stock market if a recession is avoided, and mortgage rates may not fall significantly without further economic slowing.

The Federal Reserve cut its target interest rate by 0.25% at the September 17 meeting. This has Wall Street wondering what comes next. Is this the start of a series of rate cuts? Or will lingering inflation problems make future cuts difficult? Here are our views on these questions and more.

Weakening labor market convinced the Fed to cut

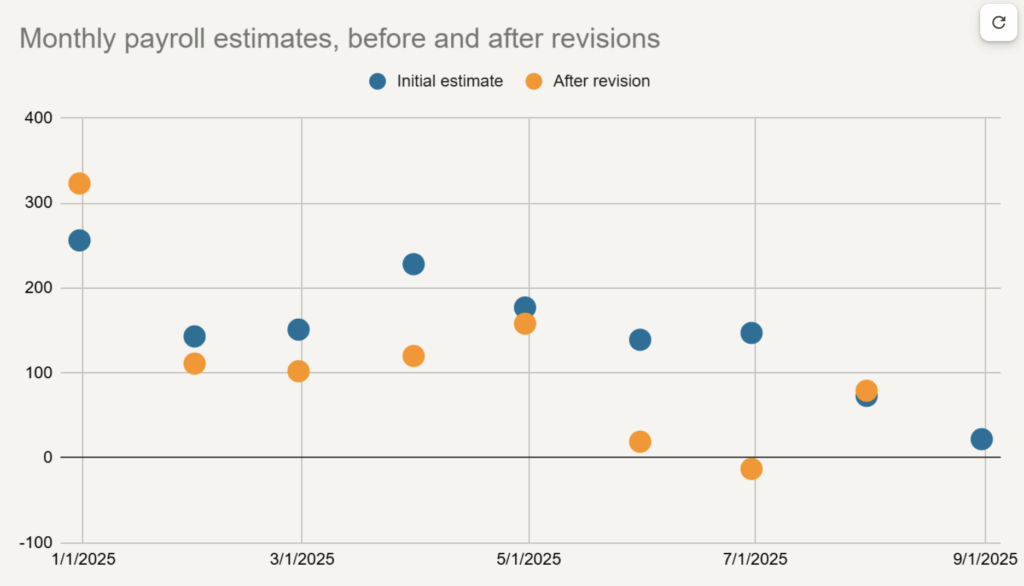

A lot has happened since the Fed’s last meeting in July. Most importantly, we got significantly more evidence that the jobs market is softening. At the time, it was estimated that the economy added 150,000 jobs per month over the prior three months. Not only were the months of May and June revised down substantially from the initial numbers the Fed had at that July meeting, but job growth in July and August was also quite weak.

Source: Bureau of Labor Statistics

As we have said several times in past articles, every other time that job growth has slowed to near zero, a recession has followed. The Fed is aware of this history. Fed Governor Chris Waller recently said that job growth is “near stall speed and flashing red.”

Powell highlighted the slowing jobs market during the post-meeting press conference, saying that “labor demand has softened.” He also highlighted that “downside risks to employment appear to have risen.”

Job market might have been weakening before tariffs

The situation might be even worse than it appears. On September 9, the Labor Department announced that job growth would likely be revised down by 911,000 for the 12-month period ending March 2025. This is part of a normal annual revision process that has produced other large revisions in the past, although this would be the largest. Bear in mind that the monthly jobs figures that are reported come from a survey of about 121,000 businesses. This annual revision involves supplementing that monthly data with far more comprehensive data available from tax returns and unemployment insurance claims.

There are a lot of details we don’t know about this large revision. We don’t know the why behind the revision. There are certain kinds of job market shifts that the monthly survey tends to miss, such as firms that go out of business entirely or self-employment. More detail will help us understand what this large revision tells us about the labor market.

We also don’t know the timing of the revision. We know that roughly 911,000 fewer jobs were added during a 12-month period ending in March. But we don’t know if those downward revisions will be spread across those 12 months evenly or not. I would interpret the strength of the labor market very differently if the revisions were more significant in the second half of that period vs. the first half. We won’t know this detail until February of next year.

Powell was asked about the revision during his press conference, but he said this was not a major driver of their decision to cut rates now. He also defended the quality of the data, mentioning some of the reasons I highlighted above as to why these revisions happen. Regardless, this revision does tell us that the economy may have started this period on shakier ground than we realized.

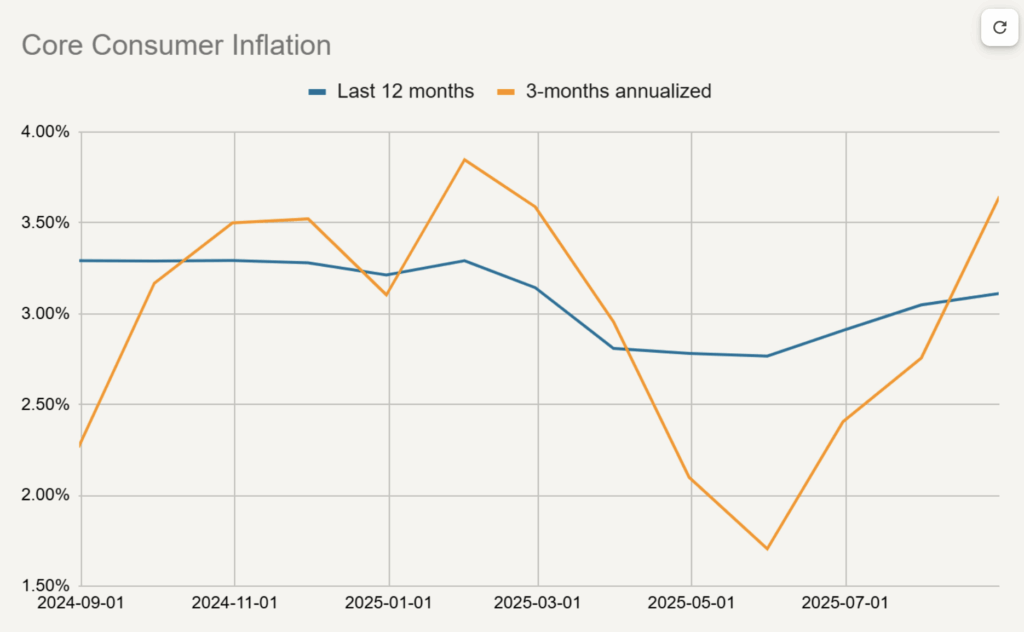

Inflation picking up, but may just be tariffs

Complicating the Fed’s decision making is the fact that inflation has started to tick higher. Over the last year, Core CPI inflation has risen 3.11%. Inflation had been declining consistently from 2023 through the first half of this year, but has moved noticeably higher the last few months.

Source: Bureau of Labor Statistics

The Fed has a dual mandate: to promote full employment and to keep prices stable. Right now those two goals would seem to be in “tension” as Powell put it. The job market is weakening at the same time that inflation is rising. This is a phenomenon called "stagflation."

During the press conference, Powell suggested it was possible that this small inflation spike will be “relatively short lived—a one-time shift in the price level.” That is to say that tariffs make the price of a lot of goods higher, but that is a one-off impact. The rate of inflation doesn’t stay high even if prices stay high.

If this is the case, it will make it a lot easier for the Fed to keep cutting rates. As Powell himself pointed out, there’s good reason to believe this is what is happening. In the most recent CPI report, items like clothing, automobiles, furniture, appliances, etc., have seen significant price increases the last couple months. Most of these categories were in deflation earlier this year. Tariffs are the most logical explanation for why these prices are rising.

We do think this is the right base case: tariffs will cause a spike in inflation over the next couple months, but the rate of inflation will probably subside thereafter.

Powell won’t commit to additional hikes, but “dots” tell a different story

As is typical for Powell, the Fed Chair was unwilling to commit to additional rate cuts, saying that “we are in a meeting by meeting situation.” However, it seems most of the Fed Committee is expecting two more cuts this year based on the so-called dot plot. This is a quarterly exercise where each member of the Fed Committee estimates where they would set the Fed’s target rate if their own economic forecast came to fruition. Of the 19 total members, 9 estimated 0.5% worth of cuts, presumably meaning 0.25% each in October and December. Two more had just one more 0.25% cut, while one estimated 1.25% worth of cuts. The other six indicated no additional cuts.

This makes at least one more cut in October extremely likely. It also probably means that unless either inflation or jobs surprise significantly to the upside, there will be another cut in December as well.

Is Trump influencing the Fed?

Powell was asked a number of questions about President Donald Trump’s efforts to influence the Fed. This meeting marked the first time Trump nominee Stephen Miran joined the Fed board, and he immediately dissented, instead preferring a 0.5% rate cut. Powell was asked about this dissent and said that each Committee member was free to express their opinion, and Miran was given the same latitude afforded to anyone else. Miran was also almost certainly the member who indicated a preference for 1.25% worth of cuts for the remainder of the year.

Powell was also asked about Trump’s efforts to fire current Fed Governor Lisa Cook. Cook was accused by Trump administration officials of lying on a mortgage application prior to joining the Fed board, specifically, that she claimed multiple houses as her primary residence. Trump subsequently declared that was reason enough to fire her. Note that the Supreme Court recently ruled that Fed officials can only be fired for cause, not because of policy disagreements.

In the days leading up to this Fed meeting, an appeals court ruled that Cook could stay in her job as on the Fed board while a lawsuit between Cook and the White House plays out. In addition, various news outlets reported that Cook had listed her second home in Georgia as a “vacation” home, not her primary residence as Trump officials had claimed.

Powell avoided talking about all this drama, saying he had no comment on on-going litigation. Note that the Fed as an institution has said they will abide by whatever the courts rule in this case.

Powell was also asked if he plans on leaving the Fed board when his term as Chair is up in May of this year. He has been asked this same question the last several meetings, and again this time he refused to answer.

All this being said, I don’t think the President is currently having undue influence over the Fed. It is true that Miran is unusually close to the White House as Fed officials go. However, he is just one voice among many. For any individual to actually make a difference in the Fed’s decision making, they have to persuade other Fed Committee members of their point of view. Simply voting for a larger rate cut, as Miran did this time, doesn’t have any practical effect.

Meanwhile, reports in the last couple weeks have indicated that Trump has narrowed his list of candidates for the Fed Chair down to three. They are the same three candidates we highlighted in a recent article on our website: Christopher Waller, Kevin Hassett, and Kevin Warsh. For what it is worth, betting markets have Waller as the current favorite, who would also happen to be the most traditional choice for Fed Chair.

What does it mean for stocks and interest rates?

The prospect of Fed rate cuts have been a major reason why stocks have continued to rise over the last month. However, investors should be cautious. Historically rate cuts have only kept boosting stocks if the economy actually rebounds. For example, periods like 1996 or 2019. In periods where the economy slips into recession, rate cuts haven’t been enough to keep stocks rising. You may hear some market pundits say that “bad news is good news” because it means more rate cuts. I suspect that won’t remain the case for long.

In terms of interest rates, the impact of Fed rate cuts could get complicated. Right now, longer term rates, which includes mortgage rates, are priced assuming the Fed cuts 2-3 more times. If that’s all that happens, mortgage rates probably don’t have much further to fall. However if the economy keeps weakening, then there is probably considerably more downside for mortgage rates.