The information provided is based on the published date.

Key takeaways

- The Fed took no official action on interest rates at the January meeting, and signaled they weren’t “in a hurry” to cut rates.

- Powell expressed optimism that inflation would continue to subside however, and said if this happened that at least some rate cuts in 2025 would be appropriate.

- The press conference was full of questions about policy changes coming from the White House, but Powell said the Fed couldn’t say much about this until they know what actual policies are enacted.

- The Fed is telling us they don’t want to damage economic growth just to get inflation down to exactly 2%. This is a positive sign for stocks, but could mean that longer-term interest rates stay high.

While the Federal Reserve took no official action at its January meeting, Fed Chair Jerome Powell’s post-meeting press conference had plenty of fireworks. Between questions about Fed independence, to tariffs, to future rate cuts, the Chair gave investors plenty to think about. Here’s our take on what was said and what it means for your money.

Fed on hold, but signals cuts are still likely

Powell was careful to not commit to anything, saying that the Fed didn’t “need to be in a hurry” to cut rates again. However he also seemed confident that inflation was indeed going to keep subsiding. “What we expect to see is further progress on inflation” and that if that occurs, the Fed would be in a position to “make further adjustments” to interest rates.

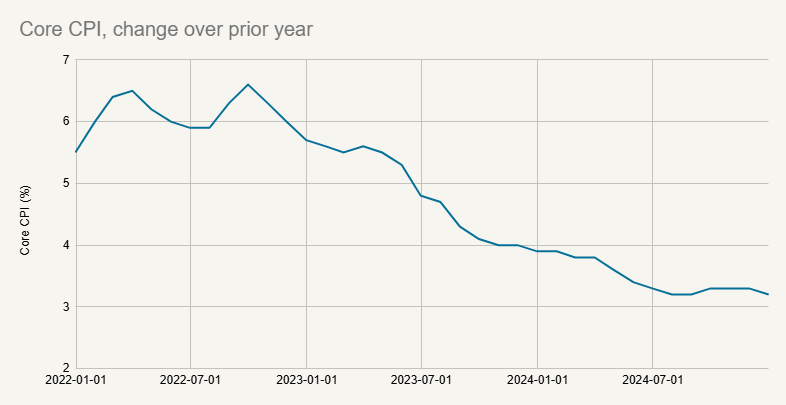

Progress on inflation has been slow lately, but Powell made a case for why it could be turning a corner. In the press conference he mentioned that inflation stemming from housing seemed to be subsiding, and this had been one of the key drivers of stubbornly high inflation.

Indeed, in the most recent Consumer Price Index (CPI) report from December, CPI inflation came in lower than expected.

Source: Bureau of Labor Statistics

Markets definitely reacted to Powell’s tone in describing future rate cuts. Stocks had come into the press conference down sharply, but erased most of those losses as Powell spoke. Treasury bond yields also declined during the press conference. Both of these are a sign that the market viewed Powell’s statement as supportive of at least some rate cuts in 2025.

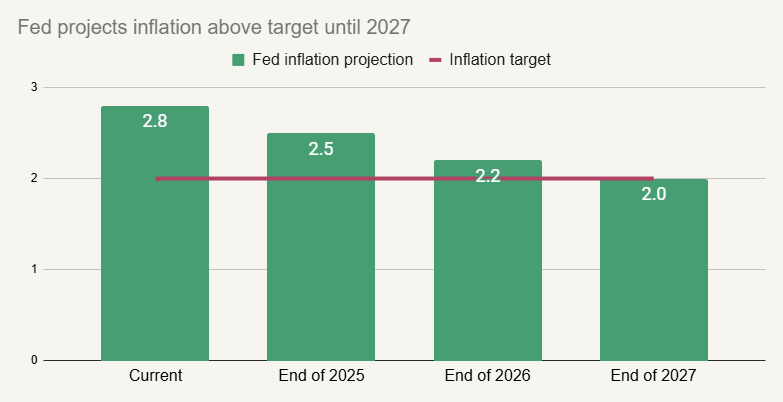

What he’s saying makes perfect sense relative to what we were told after the December Fed meeting. At that time the Fed’s projections suggested that inflation would only mildly improve in 2025, but that the Fed would wind up cutting rates twice over the course of the year.

When Powell says that there is a “pathway” to inflation getting to 2%, what he means is that the Fed expects the inflation rate to slow, but only incrementally. As long as that’s the case, the Fed is inclined to cut at least once or twice in 2025.The Fed doesn’t need to see rapid progress on inflation to cut rates again.

Powell reveals his preferences

The fact that the Fed is inclined to cut rates at all even as inflation remains materially above its target tells us something crucial: the Fed prefers to risk higher inflation as opposed to a recession.

Source: Federal Reserve

At this meeting, Powell reiterated that the Fed sees risks as “two-sided.” By this he means, there is a risk that the labor market weakens as well as a risk that inflation stays too high.

However on its face this is a pretty odd statement. There isn’t a “risk” that inflation will be above target. It is above target right now. On the other hand, job growth remains steady with no obvious sign of weakness. It is fair to say there are “risks” to the Fed’s employment mandate, but only in the sense that there are always risks. There are no signs that the labor market is softening right now.

Taken literally, Powell’s “two-sided” claim makes little sense. However, what Powell is actually saying is subtly different from this literal interpretation. What he’s saying is that while inflation is technically above target, it isn’t problematically high. Moreover, the types of actions the Fed would need to take to squeeze the last bit of inflation out of the economy would create risks to employment.

In other words, Powell is saying that the Fed is OK living with mildly high inflation if it means that unemployment stays low. You can agree or disagree with that tradeoff, but Powell and the Fed have clearly revealed their preference.

What about tariffs?

Powell was asked a few questions about how tariffs or immigration policy might impact the economy and/or the Fed's decisions. Powell did say that the Fed was running various scenarios on how these policies might impact the economy. However he also said that the Fed would “need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be.”

Powell is right to be cautious about making big pronouncements about tariffs before knowing what President Donald Trump is actually going to enact. During the campaign Trump promised he would implement universal tariffs, but this hasn’t happened yet. The delay could mean that Trump wants to use tariffs as a negotiating tool, and thus will ultimately stop short of the “universal” program he has promised. On the other hand, Trump continues to claim that universal tariffs are in the works. Powell can’t react to a hypothetical policy that may or may not even happen.

In addition, Powell is probably cognizant of the politics at play. While the Fed likes to claim they are free from political influence, Powell is also wise to not pick unnecessary fights. If Powell were to sound overly negative about tariffs, it could provoke the White House to challenge the Fed’s independence on rate setting. Powell, wisely, sees that there is no upside of going there.

Is Powell being influenced by the White House?

The very first question Powell was asked during the press conference was about pressure from the President. In particular Trump’s recent “demand” that interest rates come down. Powell responded the way he always does, vociferously defending the Fed’s independence: “The public should be confident that we will continue to do our work as we always have.”

Reality is that Trump is dealing with two problems. One is that inflation remains a major problem in the mind of voters, and is probably a key reason why he was elected in the first place. In fact Trump has signed an executive order directing Federal agencies to “deliver emergency price relief” to households. This order won’t do much in and of itself, but it shows that Trump knows solving inflation is key to his Presidency.

On the other hand, the high cost of housing is also weighing on voters' minds. It may even be that many voters conflate the home affordability crisis with generalized inflation. While these things are related, they also aren’t exactly the same.

In the case of interest rates, they actually run counter to each other. Lower interest rates would make buying a home cheaper, all else being equal. But were the Fed to keep lowering interest rates, this would certainly risk broader inflation accelerating.

This is a perfect example of why Fed independence is so important. The Fed needs to focus on generalized inflation. If the White House or Congress wants to improve home affordability, they need to use other tools to do so. Forcing the Fed to solve this problem would do more harm than good.

Lower short-term rates could mean higher long-term rates

Right now there are some signs the economy could be gaining momentum. Job openings have increased two months in a row after falling for most of the last two years. Business confidence seems to be picking up. Bank earnings reports have suggested that business investment activity could be expanding.

Whether the Fed actually winds up cutting rates in 2025 will come down to inflation. If indeed economic growth accelerates in 2025, this could cause inflation to stay steady or even rise. If so, the Fed certainly won’t be cutting rates. It is also possible that Trump’s tariff or immigration plans could also impact inflation. This in turn will influence whether the Fed cuts rates or not.

If inflation does recede, even slowly, expect the Fed to follow-through with some amount of cuts. However even if this happens, longer-term interest rates may remain high. While the Fed more or less controls short-term rates, longer-term rates, like Treasury bond yields or mortgage rates, are more a function of economic growth.

For the stock market, this is less of a concern. Stocks can handle higher rates so long as they are caused by a strong economy. But for bond investors and mortgage lending, we may need the economy to slow substantially in order to get any relief.