The information provided is based on the published date.

Key takeaways

- Prioritize reducing portfolio risk when dealing with a large concentrated stock; managing tax efficiency, while important, should be a secondary consideration to safeguarding your overall financial plan.

- Understand that taxes on significant stock gains are often inevitable; delaying diversification of an outsized single-stock holding typically increases your financial risk over time rather than solving the tax issue.

- Common hedging strategies, including those using options, may sound like a solution but don’t actually solve either the concentration or the tax problem.

- Recognize that even stocks of "great companies" can experience significant volatility and large drawdowns; diversify your holdings to protect your accumulated wealth, especially as you approach financial goals like retirement.

A common problem we see among Facet members is how to handle a single stock that has become too large within your portfolio. I recently was sent this question specifically:

“I have worked for Amazon for over 10 years and have built up over $500,000 in company stock with roughly a 2x gain for tax purposes. This is the majority of my net worth outside of my house and my 401k. I know I should diversify, but how can I do so in a tax-efficient manner?”

This situation, while a fortunate one, presents a real challenge. Let's explore some general principles for approaching this, applicable whether the stock is from your employer (like Amazon, as in the message above) or simply a long-held investment that has become an outsized part of your portfolio. It's important to remember that these are general considerations, and specific advice would depend on individual circumstances.

Prioritizing risk over tax considerations

The first and most crucial principle is that tax implications should never be the primary driver of portfolio decisions. As one of Facet’s founders often says, "Taxes won’t ruin a financial plan, but risk can." The main objective should be to bring your portfolio to an acceptable level of risk first; only then should you focus on optimizing for tax consequences.

One key reason for this approach is that with a concentrated stock position, delaying diversification rarely makes the problem better. Only two scenarios can unfold:

- The stock continues to rise. While this increases your wealth, it also exacerbates the concentration risk and increases the potential tax bill upon eventual sale.

- The stock declines. In this case, you'll likely regret not having sold earlier.

Unless you plan to hold the stock indefinitely (which is rarely a sound strategy for a concentrated position), you will eventually pay taxes on the gains. The choice isn't if you'll pay taxes, but when.

Resisting the urge to time the market

Often, when discussing this situation, individuals ask for an opinion on the current valuation of the specific stock – is it cheap or expensive? What about upcoming product launches or other company-specific news? It's advisable to avoid letting these stock-specific issues dominate your diversification decision.

Attempting to time short-term stock movements is exceedingly difficult for anyone. More importantly, the decision to diversify a large concentrated holding is fundamentally about risk management, not about picking the absolute perfect moment to sell. There will always be reasons to believe a stock might go up, and there's rarely an obvious, unambiguous signal that "now" is the ideal time to divest.

Understanding the risk of holding "great" companies

When the concentrated stock is in a large, highly successful company like Amazon, it's easy to underestimate the ongoing risk. People often say, "Amazon is a great company," or "Amazon isn't going away." While these statements are generally true – such companies are unlikely to suddenly go out of business – they still carry significant investment risk.

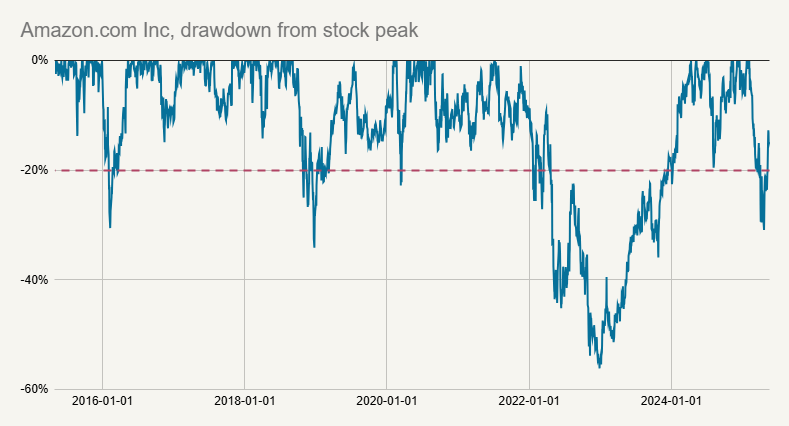

Consider this: over the last 10 years, even a stellar performer like Amazon has experienced multiple drawdowns of 20% or more, and it fell by over 50% during 2022.

Source: Bloomberg

Even the best companies are subject to this kind of market volatility. What if such a 50% drawdown were to occur around the time you planned to retire or needed to access those funds? An event like that could severely impact your financial plans.

Examining common "tax-efficient" hedging strategies

When researching solutions, you might encounter suggestions to hedge a large stock position, often using options strategies, as a supposedly more tax-efficient approach because it avoids an immediate sale. However, these strategies often don't truly solve the underlying problem.

If you attempt to hedge the downside risk of the stock (e.g., by buying put options), you are, by necessity, giving up some or all of the potential upside. Most investors still need the value of their holdings to grow to meet their financial goals; simply freezing the value often isn't sufficient. More critically, to actually use the stock's value to fund expenses or other investments, you still need to eventually sell it. This brings us back to the earlier point: you can delay taxes, but you generally can't avoid them entirely.

Another strategy often mentioned is selling "covered calls." This involves selling call options on the stock you own, allowing you to collect a small amount of income (the option premium). The issue here is that this strategy doesn't truly hedge your downside risk significantly, but it does cap your potential upside if the stock price rises above the strike price of the calls you sold. If the stock price plunges, you still bear the brunt of the loss. Furthermore, the income received from selling covered calls is taxable. This approach introduces complexity for a highly uncertain and often limited benefit.

What can you do? A practical approach

Given the limitations of other strategies, it's usually the case that selling at least some of the concentrated stock is the most logical course of action. The exact amount to sell depends on many personal factors:

- How long until you need to access this money?

- Do you expect to receive more stock from your employer in the future?

- What other assets do you own?

- What is your overall risk tolerance and financial goals?

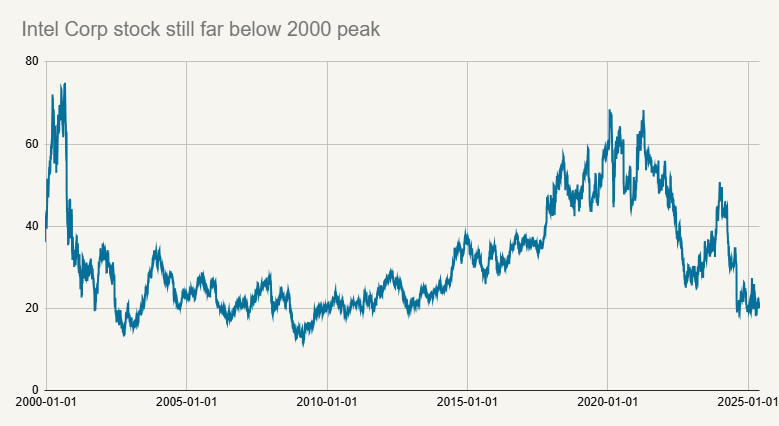

Here's a framework to begin thinking about how much you might want to sell: Imagine your concentrated stock drops by 50% from its current value and never fully recovers. Before dismissing this as impossible for a "great company," consider historical examples. In the 1990s, Intel was widely revered, much like today's tech giants. Yet, Intel's stock price today (as of May 2025) is still more than 50% below its peak reached in the year 2000.

Source: Bloomberg

Perform this "down 50%" hypothetical analysis. Then, assess what your long-term financial plan would look like under that scenario. Compare this outcome to one where you sell, for example, half of your concentrated stock today, pay the estimated taxes on the gain, and reinvest the proceeds into a diversified portfolio (perhaps assuming a conservative long-term growth rate of 7-8% per year for the broad stock market). From there, you can model different sale amounts until you arrive at a plan where the potential downside risk feels acceptable to you.

Managing taxes is a portfolio-level exercise

Remember, you don't necessarily need to sell the entire desired amount all at once. You can often spread out sales over two to three years. This can help manage the tax impact by potentially keeping you in lower capital gains tax brackets each year, though this also means you remain exposed to the stock's volatility for longer on the unsold portion.

In addition, you may be able to offset some of the gains from selling the concentrated stock with loss, using something called “tax loss harvesting.” In some cases, we can also use our Direct Indexing strategy to help diversify concentrated positions quicker and with less tax impact. Consult with your Facet team to discuss your specific situation.

Conclusion: Embrace diversification

If you find yourself with a highly concentrated stock position that has generated significant wealth, congratulations – it's a good problem to have. However, don't let the prospect of paying taxes paralyze you from taking prudent steps to diversify. There's generally no magic way to avoid taxes on investment gains indefinitely, and the longer you wait to address concentration risk, the more vulnerable your financial future may become. Prioritizing a sensible risk level for your overall portfolio is paramount.