The information provided is based on the published date.

Key takeaways

- The Great Recession was triggered by housing market collapse and other financial causes.

- Americans experienced massive job losses, foreclosures, and devastating impacts on retirement savings that changed financial behaviors for years.

- Building an emergency fund, diversifying investments, and staying calm during market turbulence are crucial lessons for protecting yourself from future recessions.

Economic downturns are an inevitable part of our financial system. Since World War II, the US has experienced a recession about every 6.5 years, making it a predictable if unwelcome feature of our economy.[1] The Great Recession stands out for its severity and how it fundamentally changed our approach to financial regulation, personal finance, and economic policy.

Understanding what happened during this historic downturn and the lessons it taught us can help us better prepare for future recessions in the US and protect our financial wellness when the next one inevitably comes.

- What was the Great Recession?

- What caused the Great Recession?

- What we learned from the Great Recession

- Other major recessions in the US

- Protecting yourself from future recessions

- US Recession FAQs

- Small steps today can make a big difference tomorrow

What was the Great Recession?

The Great Recession was the most severe economic downturn in the United States after the Great Depression. So, when was the Great Recession? Officially lasting from December 2007 through June 2009, this 18-month period was characterized by a catastrophic housing market collapse and subsequent financial crisis that reverberated throughout the global economy.[2]

What made the Great Recession significant was not just its severity but its long-lasting impact on economic policy, public trust in financial institutions, and household financial behavior. While the US experiences a recession every few years, none have matched the depth and breadth of the Great Recession.

Economic impact in the US

The Great Recession devastated the American economy and fundamentally changed how many households approach their finances. Here's what people experienced during the Great Recession:

- Unemployment: Unemployment peaked at 10% in October 2009, with over 8.7 million jobs vanishing during the recession through 2010.[3,4] Countless Americans faced prolonged periods without work, depleting savings and dramatically altering career trajectories.

- Housing crisis: More than 3.8 million foreclosures occurred between 2007 and 2010, with national median home prices falling by 29% from their peak.[5,6] Millions of homeowners suddenly found themselves owing more on their home loans than their properties were worth.

- Household wealth & retirement accounts: The median net worth of American households plummeted by approximately 29.4% from $135,700 to $82,300 between 2007 and 2010.[7] Retirement planning took a hit, too, with retirement accounts hit particularly hard. 401(k)s and IRAs lost nearly $2 trillion in value when markets bottomed out in March 2009.[8]

- Consumer confidence & spending: Consumer confidence plunged from slightly positive to deeply pessimistic by Summer 2008.[9] Consumer spending concerns resulted in tightening credit as lenders increased margins, making loans more expensive and harder to obtain for both households and businesses.[10]

Global ripple effects

The Great Recession quickly transformed from an American crisis into a global economic emergency, showing just how interconnected the world's financial systems had become. Here's how this recession affected the rest of the world:

- European banking crises: European banks heavily exposed to US mortgage-backed securities suffered massive losses, leading to government bailouts in the UK, Ireland, and Germany. The eurozone subsequently faced its own sovereign debt crisis as countries struggled with mounting deficits.[11]

- Emerging markets: Developing economies saw exports collapse due to plummeting demand in the US and Europe.[12] Many experienced capital flight and currency crises as investors rushed to safer assets, severely hampering economic growth in regions that had seen steady progress.[13]

- Coordinated global response: The unprecedented nature of the crisis prompted the G20 (a group of 20 major economies including the US, China, Japan, Germany, and the UK) to meet and coordinate stimulus programs and banking reforms. Central banks worldwide slashed interest rates to near-zero and launched quantitative easing programs to stabilize financial markets and encourage lending.

What caused the Great Recession?

The Great Recession resulted from a perfect storm of economic and regulatory failures that combined to create the most damaging financial crisis in generations. So, what caused the Great Recession? Factors included:

- Housing bubble burst: Excessive speculation in real estate pushed home prices to unsustainable levels. Easy credit and relaxed lending standards encouraged risky borrowing by people who couldn't truly afford the homes they purchased.

- Toxic financial products: Banks packaged subprime mortgages into complex financial products called structured finance.. Credit rating agencies gave many of these products high ratings despite the substantial risks of the underlying loans.

- Banking system collapse: Financial institutions became dangerously over-leveraged, meaning they had to borrow heavily to invest in these risky assets. When mortgage defaults rose, confidence in the banking system collapsed.

- Regulatory failures: Government oversight agencies failed to rein in increasingly risky practices. Derivatives like credit default swaps operated in a regulatory shadow, allowing massive risk to accumulate undetected until it was too late.

Timeline of major events

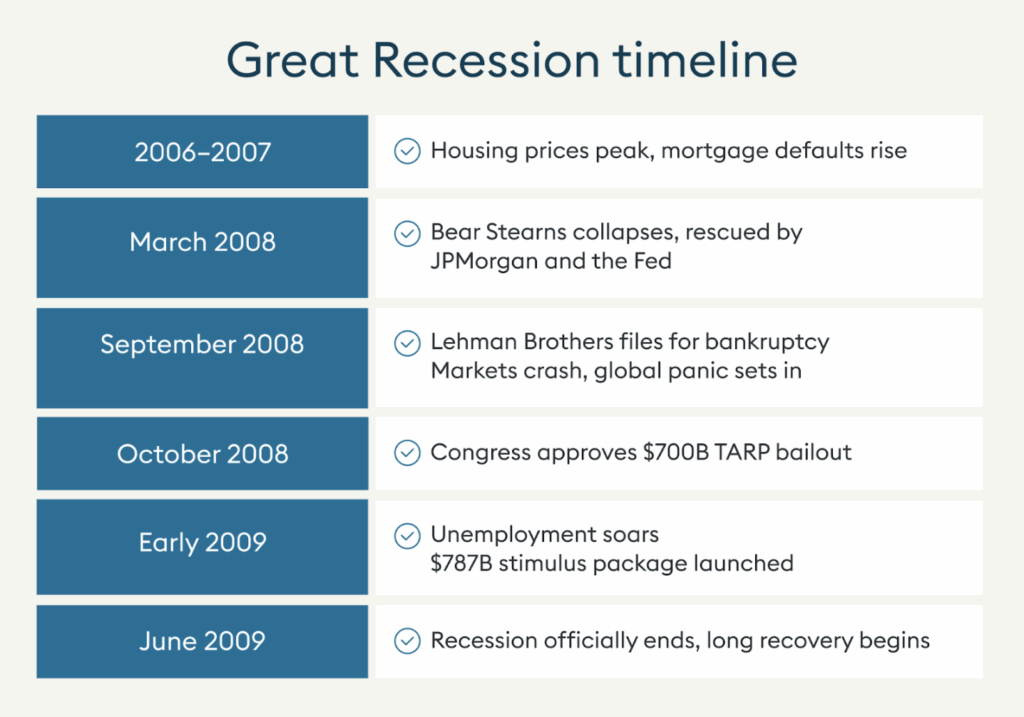

The Great Recession unfolded through a series of increasingly alarming events that turned from a housing slump into a full-blown global financial crisis. These key moments mark the recession's progression:[14]

- 2006-2007: Home prices peak and begin to decline as mortgage delinquencies start rising

- March 2008: Bear Stearns collapses and is sold to JPMorgan with Federal Reserve backing

- September 2008: Lehman Brothers files for bankruptcy, triggering global financial panic and stock market plunges

- October 2008: Congress passes the $700 billion Troubled Asset Relief Program (TARP) bailout

- Early 2009: Unemployment spikes dramatically; Obama administration launches $787 billion stimulus package (ARRA)

- June 2009: NBER identifies this as the official end of the recession, though recovery remained slow for years

What we learned from the Great Recession

The Great Recession brought us painful but valuable lessons about financial security and system-wide risks that are still relevant today. These include:

Systematic risk matters

The crisis revealed how interconnected financial institutions had become and how hidden leverage through derivatives and credit default swaps could magnify collapse. Financial reforms have since emphasized transparency and stronger regulation to prevent similar meltdowns.

Emergency funds are crucial

Millions of Americans had no financial cushion when the recession hit. Recent surveys show that nearly 40% of Americans still couldn't cover a $1,000 emergency expense without borrowing in 2025.[15]

This problem extends beyond individuals to state governments, where only a handful of states maintain rainy day funds equivalent to at least 10% of annual expenditures, while some have no emergency funds at all.[2]

With many states experiencing tax revenue drops exceeding 10% during the Great Recession, both households and governments have learned that having 3-6 months of expenses saved provides crucial protection against economic shocks.[2]

Diversification is not optional

Investors who concentrated their portfolios in real estate or financial stocks suffered catastrophic losses during the Great Recession. Those with properly diversified investments still experienced declines but were better positioned to recover as markets eventually rebounded.

Timing the market rarely works

During the Great Recession, countless investors panicked and sold near market bottoms, locking in losses and missing the subsequent recovery. Emotional investing during downturns often leads to poor outcomes compared to maintaining a long-term perspective.

Government response is key

The recession taught valuable lessons about monetary and fiscal policy. Federal Reserve intervention, stimulus packages, and even controversial bailouts likely prevented a much deeper depression.

Other major recessions in the US

While the Great Recession was severe, it wasn't the first major economic downturn the US has weathered.

The Great Depression (1929–1939)

The Great Depression was the most devastating economic collapse in American history, lasting nearly a decade and fundamentally reshaping the government's role in the economy.

- Cause: Stock market crash of 1929, bank failures, deflation, and inadequate policy response

- Impact:

- Unemployment reached a staggering 25%

- Widespread poverty and homelessness swept the nation

- Banking system collapsed with thousands of bank failures

- Legacy: Led to massive financial reforms, including the creation of the FDIC, the SEC, and the New Deal programs.[16]

The 1973–1975 Recession (Oil crisis & stagflation)

This recession marked the end of the post-WWII economic boom and introduced Americans to the painful phenomenon of "stagflation."

- Cause: OPEC oil embargo, energy crisis, and the collapse of the Bretton Woods monetary system

- Impact:

- Unemployment reached 9% by May 1975, while inflation soared to 12.3% in 1974[17,18]

- Gas shortages and rationing became commonplace

- Stock market lost over 45% of its value

- Legacy: Demonstrated the economy's vulnerability to global energy markets and challenged traditional economic theories about inflation and unemployment[19]

The Early 1980s Recession (Volcker shock)

This "double-dip" recession was deliberately triggered to combat the inflation crisis of the 1970s.

- Cause: Federal Reserve under Paul Volcker raised interest rates to 17.6% to combat inflation[20]

- Impact:

- Unemployment peaked at 10.8% in December 1982

- Manufacturing and farming sectors faced severe contractions

- Housing market collapsed under the weight of 18% mortgage rates[21]

- Legacy: Successfully broke the back of inflation, setting the stage for decades of relatively stable prices and economic growth

The Early 2000s Recession (Dot-com bust & 9/11)

This milder but significant downturn followed the bursting of the dot-com bubble and was exacerbated by the September 11 attacks.

- Cause: Tech stock bubble collapse, corporate accounting scandals, and economic uncertainty after 9/11

- Impact:

- Technology sector shed thousands of jobs

- Stock markets declined sharply, with the NASDAQ losing over 70% of its value[22]

- Business investment contracted for nearly three years

- Legacy: Led to stricter corporate governance rules through the Sarbanes-Oxley Act, which required executives to personally certify financial statements, established independent audit oversight, and created new standards for corporate accountability and financial transparency[23]

Protecting yourself from future recessions

Learning from past US recessions can help you build financial resilience for inevitable future downturns.

- Build a strong emergency fund: Build and maintain 3-6 months of essential expenses in a high-yield savings account. This financial buffer provides crucial protection against job loss or income reduction during economic contractions.

- Keep your budget lean and flexible: Create a spending plan that distinguishes between needs and wants, making it easier to quickly reduce expenses when necessary. Having "emergency budget" scenarios ready can reduce stress during uncertain times.

- Diversify your income streams: Develop multiple income streams beyond your primary job, whether through side businesses, freelance work, or passive income sources. This provides financial stability if one income source is affected during economic turmoil.

- Invest for the long term: Invest in different types of assets based on your time horizon and risk tolerance. Don't panic and sell during market declines because it often leads to missing the eventual recovery.

- Pay off high-interest debt while the economy is strong: Prioritize paying off high-interest debt while the economy is strong. Entering a recession with minimal debt obligations gives you greater financial flexibility when you might need it most.

- Avoid over-leveraging, especially in volatile sectors: Don't take on excessive debt or financial commitments, particularly in industries that tend to be hardest hit during downturns. This helps protect you from getting caught in a financial squeeze if conditions deteriorate.

- Monitor leading indicators: Pay attention to economic signals like unemployment rates, GDP growth, and yield curve inversions that can warn of potential downturns. Being informed allows you to make proactive rather than reactive financial decisions.

- Recession-proof your career: Invest in developing in-demand skills and building a strong professional network. Certain fields like healthcare, utilities, and essential consumer goods tend to remain more stable during recessions.

US Recession FAQs

What are the warning signs of a recession?

Watch for several consecutive quarters of declining GDP, rising unemployment rates, an inverted yield curve (when short-term interest rates exceed long-term rates), falling consumer confidence, and declines in manufacturing activity or housing starts.

Should I stop contributing to retirement accounts during a recession?

Generally no. While it may feel counterintuitive, continuing contributions during market downturns means you're buying assets at discounted prices. This dollar-cost averaging approach has historically benefited long-term investors.

How can I reduce financial stress during a downturn?

Focus on what you can control: reducing unnecessary expenses, increasing emergency savings, avoiding major financial decisions made from fear, and maintaining perspective about the temporary nature of most recessions in the US.

Small steps today can make a big difference tomorrow

The Great Recession taught us that economic downturns, while painful, are ultimately cyclical parts of our economic system. Sound financial planning strategies can help you manage future economic uncertainty with greater confidence.

Preparing for recessions isn't about predicting exactly when they'll happen – it's about building resilience so that you can weather the storm when it inevitably arrives. Whether you're focusing on retirement planning, looking into savings accounts with FDIC protection, or learning how to navigate a bear market, taking proactive steps now can help you maintain financial stability regardless of economic conditions.

Get started today on building your recession-resistant financial plan.

Article References

- “Recessions: 10 Facts You Must Know.” Kiplinger, www.kiplinger.com/slideshow/investing/t038-s001-recessions-10-facts-you-must-know/index.html.

- Boddy, David, et al. “Nine Facts about the Great Recession and Tools for Fighting the next Downturn.” Brookings, 23 May 2016, www.brookings.edu/articles/nine-facts-about-the-great-recession-and-tools-for-fighting-the-next-downturn.

- U.S. Bureau of Labor Statistics. The Recession of 2007–2009: BLS Spotlight on Statistics. U.S. Bureau of Labor Statistics, Feb. 2012.

- “Public Sector Impacts of the Great Recession and COVID-19.” UC Berkeley Labor Center, laborcenter.berkeley.edu/public-sector-impacts-great-recession-and-covid-19/.

- Dharmasankar, Sharada, and Bhash Mazumder. “Have Borrowers Recovered from Foreclosures during the Great Recession? - Federal Reserve Bank of Chicago.” Www.chicagofed.org, 2016, www.chicagofed.org/publications/chicago-fed-letter/2016/370.

- The Housing Downturn in the United States 2009 First Quarter Update. 2009. https://www.chicagofed.org/publications/chicago-fed-letter/2016/370

- Kochhar, Rakesh, and Richard Fry. “Wealth Inequality Has Widened along Racial, Ethnic Lines since End of Great Recession.” Pew Research Center, 12 Dec. 2014, www.pewresearch.org/short-reads/2014/12/12/racial-wealth-gaps-great-recession/.

- Ydstie, John. “Rebuilding a Nest Egg after the Great Recession.” NPR, 2 Mar. 2010, www.npr.org/2010/03/02/124131819/rebuilding-a-nest-egg-after-the-great-recession.

- “Great Recession: Monthly U.S. Consumer Confidence 2007-2010.” Statista, www.statista.com/statistics/1346284/consumer-confidence-us-great-recession/.

- Kehoe, Patrick J., et al. “On the Importance of Household versus Firm Credit Frictions in the Great Recession.” Review of Economic Dynamics, vol. 37, Aug. 2020, pp. S34–S67, https://doi.org/10.1016/j.red.2020.06.006. Accessed 10 Mar. 2022.

- “Banking Distress in Europe in the Context of the Global Financial Crisis – the Role of Capital Flows.” HNB, 2019, www.hnb.hr/repec/hnb/survey/pdf/s-036.pdf.

- Baldwin, Richard . “The Great Trade Collapse: What Caused It and What Does It Mean?” CEPR, 27 Nov. 2009, cepr.org/voxeu/columns/great-trade-collapse-what-caused-it-and-what-does-it-mean.

- Salman, Ferhan, et al. “The Impact of the Great Recession on Emerging Markets.” IMF Working Papers, vol. 10, no. 237, 2010, p. 1, www.imf.org/external/pubs/ft/wp/2010/wp10237.pdf, https://doi.org/10.5089/9781455209378.001.

- “Great Recession Timeline - Recovery, US & 2008 | HISTORY.” HISTORY, 4 Dec. 2017, www.history.com/articles/great-recession-timeline.

- Giovanetti, Erika, and Gina Freeman. “Survey: 42% of Americans Don’t Have an Emergency Fund.” US News & World Report, U.S. News & World Report, 2025, www.usnews.com/banking/articles/2025-financial-wellness-survey.

- Pells, Richard, and Christina Romer. “Great Depression.” Britannica, 23 Oct. 2024, www.britannica.com/event/Great-Depression.

- Sumner, Scott. “Unemployment Was 9.0% in May 1975, and Money Was Too Easy - Econlib.” Econlib, 6 Mar. 2014, www.econlib.org/archives/2014/03/unemployment_wa.html.

- Howes, Cooper. “Inflation in 1972: A Cautionary Tale.” Kansascityfed.org, July 2022, www.kansascityfed.org/research/economic-bulletin/inflation-in-1972-a-cautionary-tale/.

- “Oil Embargo, 1973–1974.” State.gov, Office of the Historian, 2023, history.state.gov/milestones/1969-1976/oil-embargo.

- “Volcker Shock: Key Economic Indicators 1979-1987| Statista.” Statista, 2024, www.statista.com/statistics/1338105/volcker-shock-interest-rates-unemployment-inflation.

- “High Mortgage Rates Recall an Era of … High Mortgage Rates.” Marketplace.org, 2023, www.marketplace.org/story/2023/08/18/high-mortgage-rates-recall-an-era-of-high-mortgage-rates.

- Goldman Sachs. “The Late 1990s Dot-Com Bubble Implodes in 2000.” Goldmansachs.com, 5 Apr. 2019, www.goldmansachs.com/our-firm/history/moments/2000-dot-com-bubble.

- U.S. Congress. “H.R.3763 - 107th Congress (2001-2002): Sarbanes-Oxley Act of 2002.” Congress.gov, 24 July 2002, www.congress.gov/bill/107th-congress/house-bill/3763.