The information provided is based on the published date.

Key takeaways

- U.S. stocks have performed far better than their non-U.S. counterparts in recent years. However there are good reasons to think U.S. dominance might not last.

- The S&P 500 is heavily concentrated in a few tech companies, creating vulnerability if those companies underperform. Diversifying internationally mitigates this risk.

- A weakening US dollar can boost returns from international investments, offering a potential hedge against a US economic slowdown.

- Normalization of interest rates in Europe and Japan could stimulate economic growth and benefit international stock performance after years of near-zero or negative rates.

International stocks have struggled to keep up with the U.S. in recent years. In the 10 years ending in 2024, the S&P 500 was up just over 13% per year, while non-U.S. stocks were only up 5.4%. This has led some investors to question why they hold international stocks at all. Facet’s investment strategy has a higher weighting to the U.S. vs. non-U.S. stocks, but we still believe in the value of global diversification.

Specifically, we think there are three major reasons why non-US stocks at least could outperform in the coming years. Namely: U.S. market concentration, currency risk, and interest rates.

U.S. markets have become highly concentrated

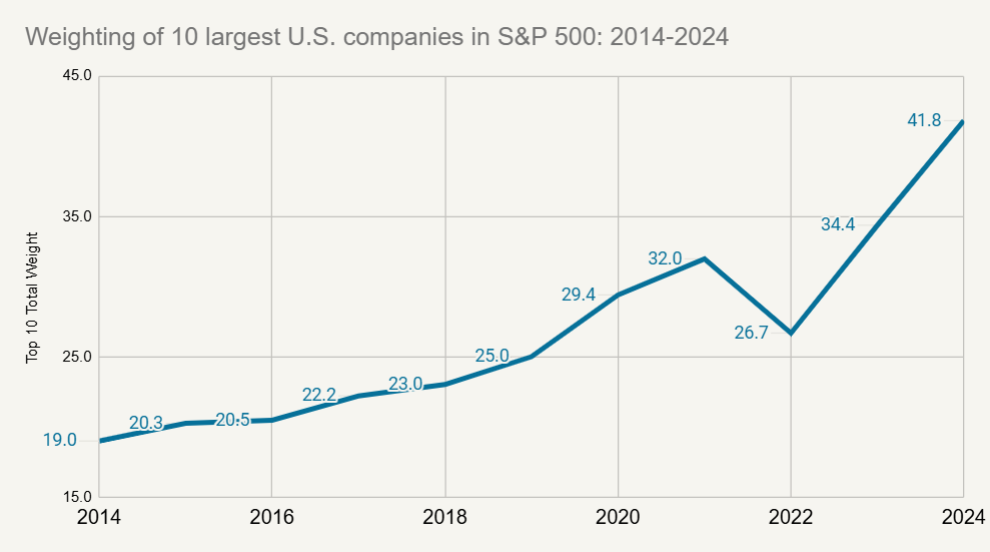

U.S. markets have become extremely concentrated in just a handful of companies. A decade ago, the 10 largest U.S. companies made up about 19% of the S&P 500’s total value. Today the top 10 account for almost 42%. In other words, for every $1 you put into the U.S. market today, more than 40 cents of that will be invested in just 10 companies.

Source: Dow Jones S&P Indices

Already that seems like a big bet to us. But even more challenging is the fact that almost all of those top 10 companies are technology-related companies. These companies have surged in value during the recent excitement around artificial intelligence (AI). This is exactly why the market has become so concentrated.

We’re pretty bullish about AI as an economic driver, but that doesn’t necessarily mean these top 10 stocks will continue to dominate market performance. Consider this: a lot of the big winners in the early days of the internet turned out to be long-term losers. It could easily be that AI turns out similarly.

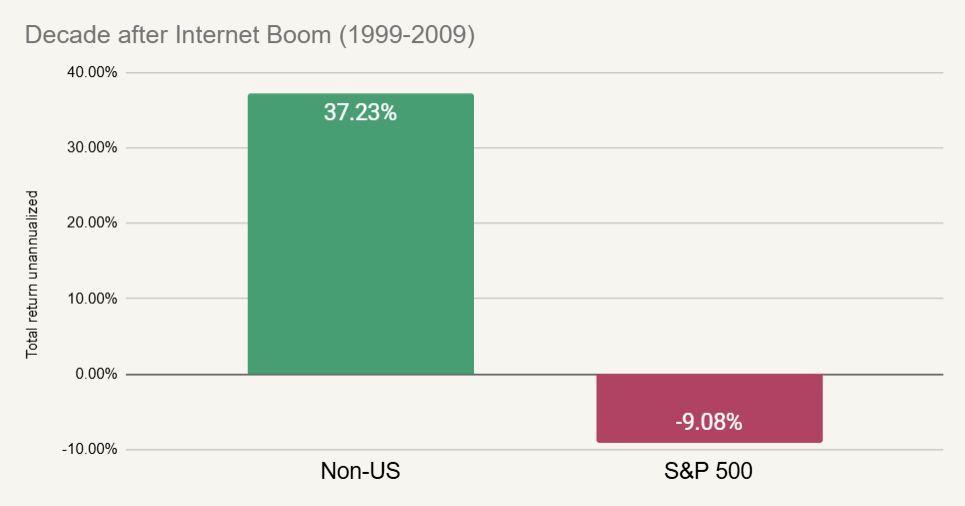

Not for nothing, in the decade after the internet bubble burst, non-US stocks outperformed the S&P 500 by over 45%.

Source: Dow Jones S&P Indices, MSCI

A U.S. only allocation is kind of a one-way bet on today’s AI champions always being the winners. Investing shouldn’t be about one-way bets.

The dollar could decline vs. other currencies

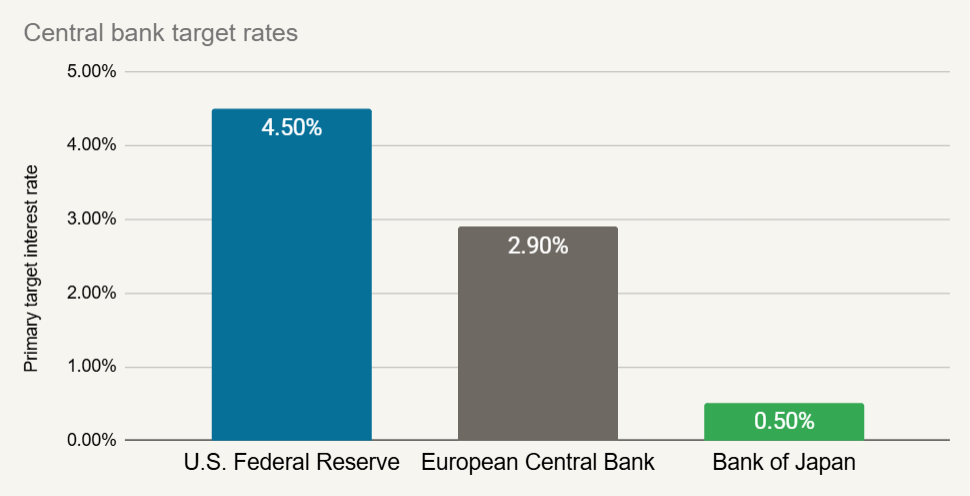

The second reason why non-U.S. stocks could outperform is related to the dollar. If the U.S. economy were to weaken, even mildly, the Fed would probably cut interest rates. Today interest rates in the U.S. are a good bit higher than those in Europe or Japan. As a result, the Fed has a lot more room to cut than central banks in other major markets.

Source: Federal Reserve, ECB, Bank of Japan

Typically when interest rates are falling quicker in one country vs. another, that tends to cause the currency to weaken. Hence, we think it's pretty likely that during the next U.S. recession, the dollar weakens materially.

When you buy an ETF that invests in non-U.S. companies, the ETF converts your dollars into foreign currency and then buys the stocks on foreign exchanges. In other words, your money is functionally stored in another currency. This means if the dollar weakens, it boosts the returns of a non-U.S. stock fund.

In this way, having some international ETFs in your portfolio can serve as a certain level of defense against a U.S. slowdown. If the dollar does weaken during the next slowdown, your international holdings would benefit from a dollar tailwind.

Higher interest rates could benefit non-U.S. economies

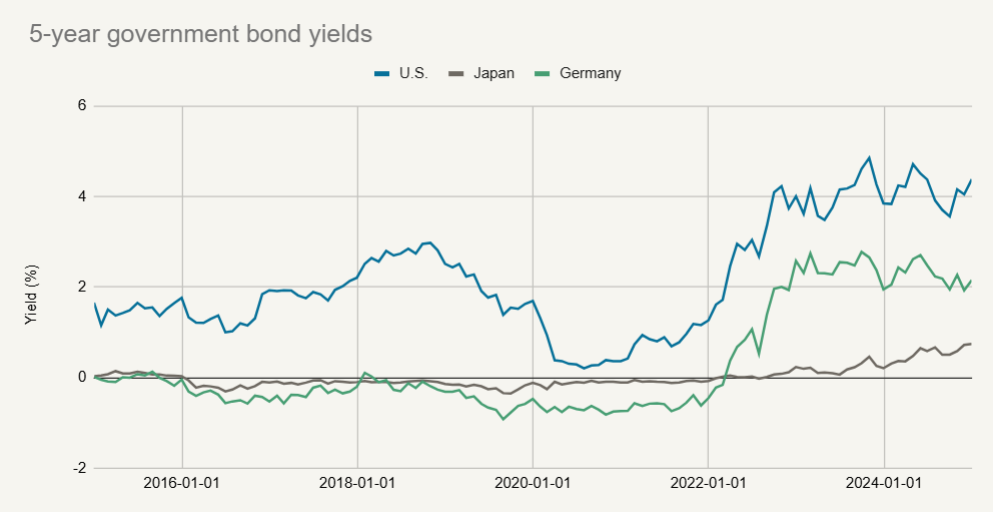

The last reason for optimism about non-U.S. stocks is related to interest rates. For most of the last ten years, interest rates in Europe and Japan have been stuck near zero. In fact, until 2022 government bond yields have been mostly negative overseas.

Source: Bloomberg

Negative rates cause a lot of economic problems. For one, it makes it hard for banks to attract deposits, which makes it hard for them to lend. If lending declines, it makes it harder for businesses to expand, hire more people, etc. Overall this holds back economic growth.

However, in the last couple years, economic activity in Europe and Japan has picked up enough to push interest rates higher. It's possible that just getting away from this negative interest rate problem creates a kind of virtuous cycle that materially benefits these economies.

In fact, it could be that we might look back on the last few years and conclude that negative rates were a bigger factor than we realized. It could be one of the main reasons why non-U.S. stocks underperformed so significantly. Perhaps with interest rates normalizing, returns could become more uniform.

As we said at the beginning, Facet has considerably more weight to U.S. stocks than international. However, don't assume that the future will mirror the past. We think there’s a lot of good reasons to have a healthy weight to non-U.S. stocks right now.