The information provided is based on the published date.

Key takeaways

- Market downturns are a normal part of investing and should be anticipated in your long-term financial plan.

- Don't make reactive decisions based solely on current negative headlines, such as those surrounding tariff impacts, because markets are forward-looking and have likely already priced in much of that known information.

- Attempting to time the market by selling now and buying back later is highly risky, as rebounds often occur suddenly and before uncertainty fully disappears, meaning you could miss substantial gains.

- Focus your energy on actions within your control, such as maintaining disciplined investing, reviewing portfolio risk and diversification, and exploring potential opportunities like tax-loss harvesting, rather than trying to predict market movements.

The early months of 2025 have presented challenges for investment markets. With widespread tariffs being implemented by the Trump administration, both stocks and bonds have faced pressure. Concerns center on the potential impact of these tariffs on economic growth, input costs for businesses, consumer prices, and the risk of retaliatory actions impacting global trade. While these sorts of markets can make even seasoned investors nervous, managing through them effectively remains a key component of long-term investment success. Here are a few ways to handle the current market environment.

Drawdowns were always part of the plan

Your financial plan was constructed anticipating both up and down markets. Periods like the one we're experiencing now don’t fundamentally alter our strategic approach to your asset allocation or your overall plan. While we never know precisely when a bear market will occur, their eventual arrival is a certainty we plan for. A sound investment strategy, aligned with your time horizon, is designed to capture long-term returns while acknowledging that fluctuations will happen along the way.

A critical part of realizing those long-term returns is avoiding unnecessary withdrawals from your investment portfolio during down periods. This underscores the importance of maintaining an emergency fund, typically covering 3 to 6 months of essential expenses. Selling investments when they are down permanently locks in those losses. An adequate emergency fund provides a buffer against unexpected needs, helping you avoid decisions that could impair your portfolio's long-term growth potential, especially when market anxieties are high due to factors like the current trade policy uncertainty.

Markets are forward-looking

It's one thing to acknowledge intellectually that downturns are part of the plan, and quite another to live through one. Reading headlines about tariffs, potential impacts on specific industries, or rising costs might understandably make you question owning stocks right now.

However, it's crucial to remember that financial markets are inherently forward-looking. When stock prices fall, it's typically because the market is anticipating future events – perhaps slower economic growth, squeezed corporate profit margins due to higher input costs from tariffs, or reduced international sales from retaliatory measures. For instance, if the market initially expected a company to profit $100, but new tariff announcements lead investors to anticipate only $90 in profit due to disrupted supply chains or higher costs, the stock price will likely fall before the company actually reports those lower earnings.

The silver lining here is the concept of being “priced in.” When that company eventually reports earnings of $90, the stock might not react much because that outcome was already expected. Intriguingly, if earnings came in at $92 (an 8% drop instead of the expected 10%), the stock price could actually rise. Why? Because the result, while negative, was better than the already negative expectations baked into the price.

The takeaway is that much of the negative news and potential economic impact you're reading about today concerning tariffs is well known to Wall Street. Today’s stock prices reflect all of that news. Therefore you have to be better than all of Wall Street at guessing the future in order to have an edge. In other words, selling based solely on today's headlines doesn’t provide an advantage.

Rebounds tend to be sudden and violent

During periods of instability, the temptation to sell stocks with the intention of buying back later, when uncertainty subsides, can be strong. We generally advise against this approach. Market declines aren't just driven by a worsening outlook; the uncertainty itself weighs heavily on prices. Often, all that's needed for a rebound is not necessarily a complete resolution of all issues, but simply a reduction in uncertainty or signs that the worst-case scenarios are less likely.

Recent history provides examples. In 2009, the market bottomed well before the housing crisis fully resolved. Similarly, in March 2020, markets began to rebound long before a COVID vaccine was available. In both cases, the turn happened not when the bad news ceased, but when uncertainty began to lessen.

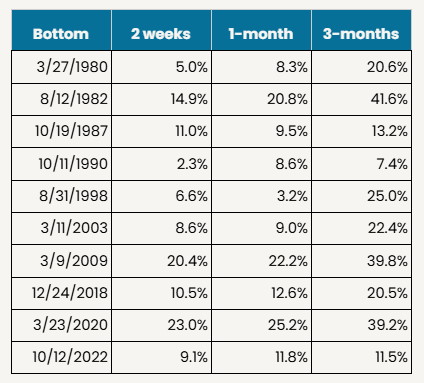

Applied to today's conditions, this suggests the market might find its footing long before the full impact of tariffs is clear or resolved. Timing this shift is notoriously difficult, particularly given how quickly and sharply rebounds often occur. The table below, showing historical data from the last five instances where the S&P 500 declined at least 15%, illustrates this point. While every market period is unique, history suggests rebounds can be sharp:

Source: Dow Jones S&P Indices

Significant gains often materialize within the first three months, sometimes even within weeks, of a market bottom. Exiting the market risks missing these powerful initial upswings, which can be crucial for long-term returns.

Making lemonade

Depending on your circumstances, market downturns can present opportunities. Is your emergency fund larger than necessary? Perhaps consider investing some excess cash while asset prices are lower. Can you increase contributions to your 401(k) or similar retirement plans, potentially benefiting from employer matches at more advantageous price points? If you were already dollar-cost averaging (investing fixed amounts regularly), continuing this discipline during a downturn means your fixed dollar amount buys more shares.

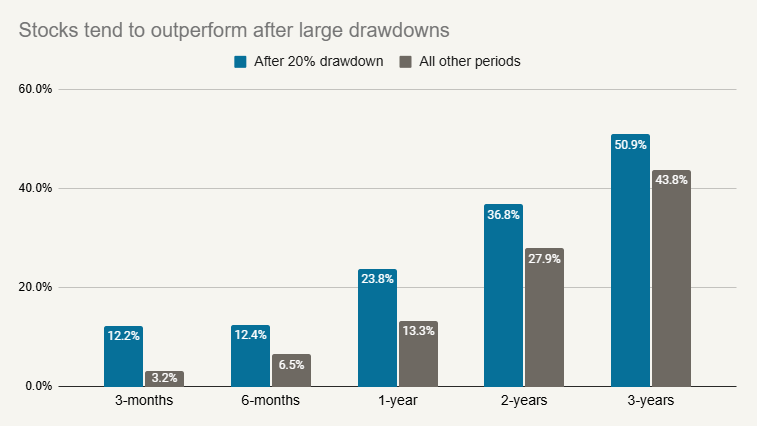

History suggests that investing new capital during significant market drawdowns often proves beneficial over the long term. At one point in early April, the S&P 500 had declined 20% from its all-time high point on February 19. We went back and looked at every 20% decline the S&P has had since 1978 and measured what would have happened had you invested in the market at that moment. The chart below shows the average result over various time periods.

Source: Dow Jones S&P Indices

The blue bars show the average return over various periods of investing when the market drops 20%. Note that for this analysis we didn’t assume you had perfect timing. In years like 2008 or 2001 the market kept dropping even after falling 20%. The grey bars measure the average return if you invested at all other time periods.

What we see is that times like this have generally produced above-average returns in subsequent time periods. Not every time, but more often than not.

Check for opportunities to lower your tax exposure

Now is also an opportune time to consider tax-saving strategies. Tax-loss harvesting involves selling an investment that has declined in value to realize a capital loss. This loss can offset capital gains realized elsewhere in your portfolio and potentially even reduce your ordinary taxable income, subject to annual limits. Market dips can also create favorable conditions for considering strategies like Roth IRA conversions, though these should always be discussed with your financial planner and tax advisor.

Make sure your portfolio has the right kinds of risks

Market downturns offer a chance to review and potentially adjust your portfolio. Consider rebalancing back to your target asset allocation if market movements have caused significant drifts. It's also a good time to assess concentrated positions – do you hold too much in a single stock, perhaps one particularly vulnerable to current trade policies? Lower market prices might make it less costly from a tax perspective to diversify such positions.

Reassessing your overall risk tolerance is wise, but be cautious not to let short-term fear dictate long-term strategy. Discuss with your planner whether your current investment mix aligns with the returns needed to meet your goals and your capacity to withstand volatility. Conversely, if you've been considering increasing your allocation to stocks and have the appropriate risk tolerance and time horizon, periods of market weakness can present attractive entry points.

Focus on what you can control

Ultimately, amid the uncertainty surrounding trade policy, economic growth, and market direction, it's crucial to focus on the elements within your control. You cannot dictate tariff levels, inflation rates, or geopolitical events. However, you can control your savings rate, your investment strategy, your portfolio's diversification, the level of investment risk you take, and efforts to minimize fees and taxes. Maintaining discipline in these areas provides the most reliable path toward achieving your long-term financial goals, regardless of the market environment.