The information provided is based on the published date.

Key takeaways

- Current AI infrastructure investments by major tech firms are outpacing profit growth, raising questions about how long this level of capital expenditure can continue without a clear return on investment.

- Although current tech valuations may seem expensive, they are nowhere close to valuations during 1990’s internet bubble era.

- The S&P 500 has become increasingly concentrated in a few large tech companies, meaning investors in broad index funds may have more exposure to AI-related volatility than they realize.

- Rather than selling out of fear, a more effective strategy involves building "defense" into a portfolio through diversification and professional risk assessment.

As artificial intelligence continues to dominate headlines, many investors are left wondering if we are witnessing a sustainable technological revolution or a repeat of the late-90s dot-com bubble. While AI infrastructure spending has powered stocks higher over the last couple years, concerns are mounting regarding the sustainability of these capital expenditures and the actual pace of enterprise adoption. So are AI stocks a bubble? Here are our thoughts on what the risks are and how we’re navigating those risks.

AI does pose some significant risks

There are actually several ways in which AI creates risks for investors, with each having a somewhat different impact on markets.

AI infrastructure spending plans may be unsustainable

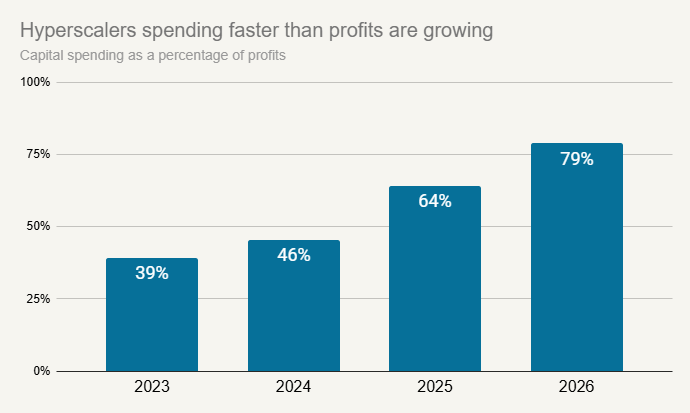

The huge spending on data centers and other AI infrastructure has been the main driver of stocks like Nvidia, Broadcom, AMD, and others the last few years. However, it is unclear this level of spending is sustainable. Among public companies, the so-called “hyperscalers” of Alphabet, Microsoft, Amazon and Meta, have been the biggest spenders on data centers. And yet they seem to be running out of free cash to do so. The chart below shows the percentage of profits (here defined by EBITDA) these companies have spent on capital expenditures, including a projection for 2026. As a rough approximation, this shows us how much free cash these companies have to keep spending on AI-related projects. The higher the number, the less free cash they have.

Source: Bloomberg

What this chart shows us is that spending on AI has far outpaced the growth of profits at these companies. This can’t continue forever. At some point these companies will simply run out of money to keep spending. Either profits need to accelerate or spending needs to slow.

That’s not to mention the private companies driving a lot of this spending. OpenAI has pledged to spend $1.4 trillion on AI infrastructure, but today the company has no free cash flow. They are entirely reliant on raising new money from outside investors. Maybe they can keep attracting new investors at this pace, but maybe they can’t.

Investors could run out of patience with AI spending

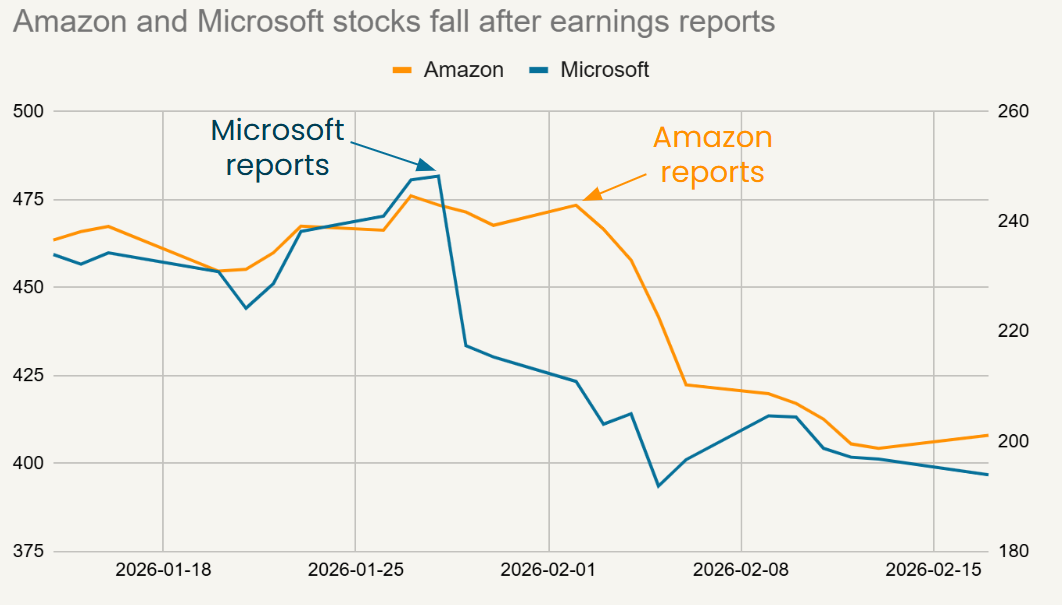

Over the last few weeks, both Microsoft and Amazon announced that spending on AI would be even higher than Wall Street had assumed. Both stocks got slammed in response, with Microsoft dropping 10% and Amazon falling 6% the day after these announcements.

Source: Bloomberg

Company management is in the business of making their stocks go up, not down. They won’t keep making choices that Wall Street doesn’t like for long. If this pattern continues, companies may choose to slow down the growth in spending.

AI adoption could be slower than currently assumed

For all of the hope (and hype) around AI, the actual measurable impact is currently pretty small. An NBER study of 6,000 executives indicated that 90% were seeing no change in employment or productivity due to AI. An MIT study suggested only 5% of enterprise AI projects have made it into production and are having a positive financial impact. The other 95% are showing no value-add. Late last year, Microsoft cut quotas on AI products after their enterprise sales force complained that there was a lack of demand from customers.

It may very well be that AI turns out to be just as transformative as hoped, but it takes a bit longer. Slower adoption would mean lower return on investment for today’s AI investments. It could result in a glut of supply for datacenters, semiconductors, memory, etc., as companies overproduced expecting stronger demand.

AI could disrupt today’s tech companies

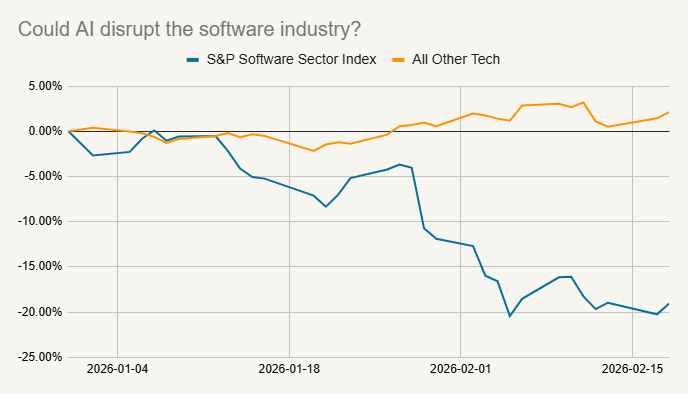

There are risks beyond the stocks we typically think of as AI companies. In February, software stocks have been hit hard on concerns that AI could disrupt those businesses. The software segment of the S&P 500 fell 20%, while the rest of the tech index was slightly positive.

Source: S&P Dow Jones indices

The fear here is that either users could use LLMs directly to get the same value they were getting from software, or else companies could use “vibe coding” to create their own software in-house. Exactly how big of a threat this is probably depends on the particular software company. Point being that AI will probably create both threats and opportunities, even within the tech space.

What is a bubble anyway?

Facet is about 2.5% underweight U.S. megacap tech companies as of this writing. When we go through our process of evaluating risks against opportunities, we think the risks are enough to warrant this mild underweight. That being said, we don’t think “bubble” is the right word to describe AI stocks today.

Granted, what is or isn’t a bubble is somewhat semantic. There is no single definition. For us, we think of it like the soap bubbles we all played with as kids:

- They grow rapidly, but become more fragile as they grow.

- The smallest thing might destroy them.

- When they pop, there is little to nothing left of value.

Markets go up and down all the time. It is routine for smaller segments of the market to suddenly suffer large declines. Certainly it is true that there are always risks in every sector and every individual stock. That doesn’t mean it is a true bubble.

What about the 2000’s internet bubble?

The historic comparison people most often cite in relation to today’s markets is the dot com bubble of the late 1990’s. For those that lived through both periods, they do feel similar. Both involve transformative technologies. Both have invoked hyperbolic predictions. Both even had a Super Bowl dominated by ads featuring the new technology.

However, the comparisons are actually fairly superficial. At the NASDAQ’s peak in March 2000, 49 tech and telecom companies within the S&P 500 had more than doubled in value over the prior year. As of February 17, 2026, only 8 tech companies have doubled in price over the most recent 12 months. The level of speculative behavior is just not the same.

The 1990’s boom was heavily driven by hot IPOs, mostly for companies that were still losing money. Today, the stocks behind the AI boom are mostly highly profitable. Nvidia had almost $100 billion in profits over the last 12 months with a 70% gross profit margin. That doesn’t mean Nvidia’s stock might not decline. However, it does put a certain logical floor on how far it will fall. A large percentage of the 1990’s era IPO boom companies actually went completely out of business in the early 2000’s.

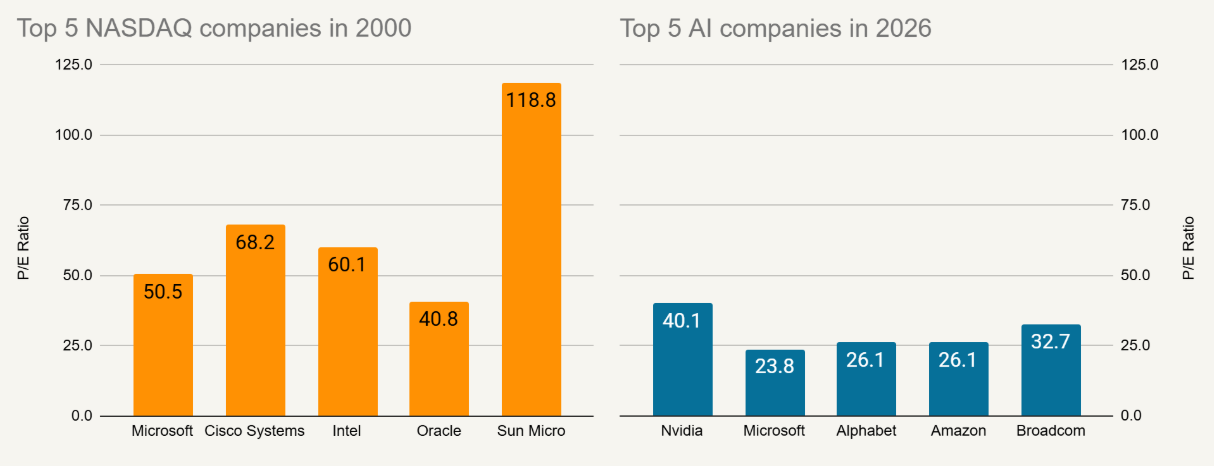

Perhaps the most clear reason why the current market is very different from the dot com bubble is valuations. In March 2000, the five biggest NASDAQ companies had an average price-to-earnings ratio of 68. The average of the top 5 AI companies today is only 30.

Source: Bloomberg

This roughly means that today’s biggest companies would have to double in price in order to have comparable valuations to the peak of the internet bubble.

Putting all this together, we just don’t see bubble-like conditions. High valuations simply mean that expectations are high. While there are risks that reality doesn’t meet those high expectations, we don’t think expectations are impossibly high. Hence why we don’t think “bubble” is the right word to describe risks in AI stocks today.

Risk of concentration

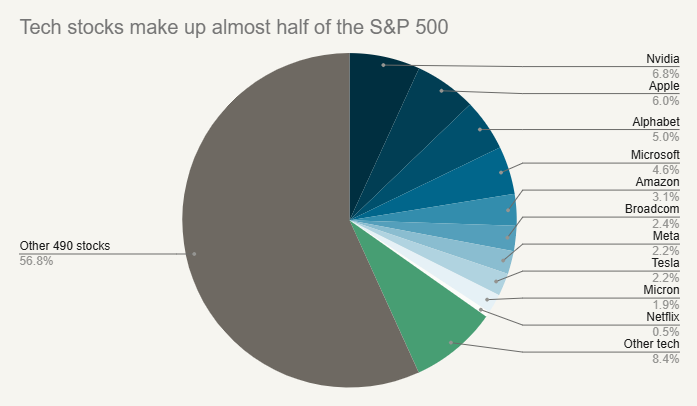

If you are invested primarily in an S&P 500 fund, you may be surprised to find out how much tech you own. The top 10 tech companies make up almost 40% of the index, and all tech combined is close to half.

Source: S&P Dow Jones indices

Just owning the S&P 500 isn’t as much diversification as it once was. If this is all you own, you might be more vulnerable to tech market risk than you think. We believe this is one of many reasons to invest in a wider set of stocks than just large U.S. companies.

The dangers of market timing

In my career, perhaps the trade I’ve seen go wrong most often is selling stocks because they were “expensive.” Here’s why. As we wrote above, when the market is “expensive” that is because investors have high expectations. In other words, things are going well for the economy or some subset of stocks. All that has to happen for stocks to keep going up is that things keep going well.

So let’s say you sell tech stocks today because you deem them expensive. One of two things will happen:

- Tech stocks keep going up. If you thought they were expensive before, you surely think they are expensive as they keep rising. There’s no way to admit you are wrong and buy back in.

- Tech stocks start to drop. If that happens, it will be because there starts to be bad news. When will you buy back in? When stocks are down 10%? 20%? 30%? How will you know enough is enough? And remember, the more the stocks fall, the more bad news has come out. It is extremely difficult to time that re-entry right.

This is why selling some set of stocks because they are “expensive” is so difficult. Unless you time the sale and the re-entry right, the trade winds up a loser.

This conundrum is exactly why Facet seeks to balance risks and opportunities, not time the market. In other words, we prefer to build in defense into our portfolios rather than try to accurately predict exactly when the market will fall, or for that matter, when it has hit a bottom. We think this is the best way to produce consistent results that help drive our members toward their goals.