The information provided is based on the published date.

Key takeaways

- The Federal Reserve maintained interest rates at 3.5%–3.75% during its January 2026 meeting, signaling a patient approach as the U.S. economy shows solid growth and stabilizing inflation.

- Fed Chair Jerome Powell faces significant political pressure and a criminal probe regarding a building remodel, raising critical questions about the central bank's future independence from executive influence.

- The Fed Committee is experiencing record dissent, with members split on whether to continue rate cuts or maintain current levels to meet the 2% inflation target.

- With Powell's term ending in May 2026, President Trump is vetting candidates like Rick Rieder and Kevin Warsh to find a successor who balances Wall Street credibility with a pro-growth agenda.

As expected, the Federal Reserve left its target interest rate unchanged after the January meeting. However I might argue this was one of the most intriguing Fed meetings in a long time. Since the Fed last met in December, Chair Jerome Powell was served with a grand jury subpoena, threatening criminal charges over Powell’s handling of a Fed building remodel. Powell called the charges part of “the administration's threats and ongoing pressure” over how the Fed sets interest rates. Regardless of how this criminal investigation plays out, Powell’s time as Fed Chair is coming to a close. He only has two more meetings before his term is up, and President Donald Trump has made it clear he will be selecting a new Chair. However, this announcement is yet to come amidst reports that Trump is struggling to select someone who has both gravitas with Wall Street and is willing to follow-through with the rate cuts the President wants.

All of this loomed over the Fed’s January meeting, and made for a lively post-meeting press conference with Powell. Here’s our take on what happened, and how all of this matters for your investments.

Questions about Fed independence are at the forefront

Normally Powell’s presser is dominated by discussions of interest rate policy. He did say that the economy has “clearly improved” since December, and that there were signs that inflation could be subsiding. Overall, Powell made it seem as though the Fed was likely going to leave rates unchanged until the data indicated the need for a change. If Powell were going to remain Chair for the rest of the year, it might indicate that future rate cuts are somewhat less likely.

However, given Powell’s limited remaining time as Chair, he can only offer so much insight about where interest rates might be heading in the coming months. Indeed most of the early questions posed to Powell during his press conference were related to politics, the criminal probe against him, the next Fed Chair, and Powell’s own future. In other words, Fed independence is the more important question on the table.

Economists overwhelmingly agree that it is important for the central bank to be independent of political pressure. It is generally thought that in the 1970’s, then Fed Chair Arthur Burns kept interest rates too low, possibly due to his tight relationship with President Richard Nixon. This was probably a significant cause of the high inflation of that period. The fear is that if the next Fed Chair were to cut rates too aggressively, ignoring inflation risk, this could touch off another spout of painfully high inflation.

What is tricky is that Fed independence isn’t a binary thing. It is almost certainly true that Fed Chairs have always been aware that public perception matters. Fed Chairs routinely give testimony in Congress, where they are almost always asked some questions with an obvious partisan lean. In other words, it is fair to say that Trump’s pressure on Powell is more overt than any President in the recent past. It isn’t fair to say that the Fed was completely independent from political pressure in the past.

Trump is looking for a Fed Chair that will be somewhat less independent than Powell has been. For example, he has said that he thinks the President should be able to weigh in on interest rates but not necessarily “order” a change in rates. Will the next Fed Chair accommodate this idea with frequent White House meetings? How much will the new Chair allow themselves to be swayed at these meetings?

The Committee is divided

Historically it has been true that the Chair has dominated Fed decision making. However there is nothing in the law that gives the Fed Chair special powers in terms of setting interest rates. Technically the Chair only has one vote out of the 12 voting members of the committee (there are also 7 non-voting members). In practice the Chair needs to get the buy-in of the Committee to take any action on interest rates.

Right now the Committee is unusually divided. There were two dissenting votes today, each of which preferring to cut rates rather than hold steady. In the last five meetings there have been 12 total dissenting votes. Since the Fed started publishing the roll call in 2002, that is easily the most dissentions ever. From 2020-2024 there were only seven dissenting votes total.

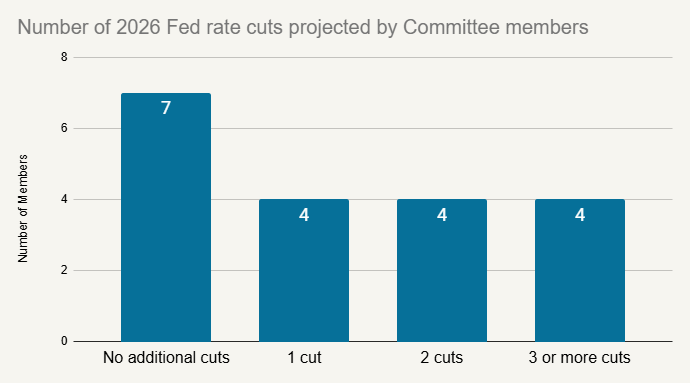

We can also see this divide by looking at the Summary of Economic Projections from December. Included in these projections is how each Fed official would prefer to set interest rates in the future. While 12 members would prefer at least one rate cut in 2026, seven think there should be none. Moreover, right this moment, there appears to only be majority support for one rate cut in 2026.

Source: Federal Reserve

It is no mystery why the Fed is so divided – the economic data doesn’t provide a clear answer for where interest rates should be set. Job growth has slowed to a crawl, which normally would mean the Fed is cutting interest rates aggressively. However the most recent Core PCE inflation report, the Fed’s preferred measure, was 2.8%, far above the Fed’s 2.0% target. This might suggest the Fed should actually be hiking rates.

Even had Powell stayed on as Chair, he would have had a tough time building consensus for multiple future rate cuts. There is a good chance that the next Fed Chair will not immediately have the same relationships and gravitas with the Committee that Powell does. Committee members may also be anxious to show their independence by not blindly following the Chair. Hence we would expect gaining majority support for several rate cuts in 2026 will be all the more difficult for the next Chair.

For his part, Powell was as non-committal as he could be about future rate cuts. He said that interest rates are now “within a range of plausible estimates of neutral” suggesting that additional cuts were not automatically needed. He also said that “monetary policy is not on a pre-set source.” Perhaps economic data deteriorates to the point that the need for several rate cuts becomes obvious. However, if that doesn’t happen, and Trump really wants multiple rate cuts in 2026, the President needs to select a Fed Chair that is respected by the Committee, and who can marshall a convincing argument for lower rates.

Powell may not be going away

While Powell’s term as Fed Chair ends in May, his term as a Fed Governor doesn’t end until 2028. Powell was asked about whether he intended on staying on the Committee, to which he said that he has “nothing for you on that” and offered no further comment. Historically the Chair has usually resigned as Governor when their time as Chair was up. However this is not required. Powell could remain a member of the Fed Board if he so desired.

Several commentators believe the odds that Powell stays on are rising. The thought is that because Powell views Fed independence as so important, perhaps he would want to keep championing that independence from the inside. If Powell does not resign, it would also deny Trump the ability to nominate another member of the board. Right now there is one Governor seat set to expire in January – the one currently held by Stephen Miran. The Fed Chair needs to also be a Fed Governor, so if Powell doesn’t leave the Board, Trump would have to use Miran’s seat to nominate his choice for the Chair.

Powell’s continued presence on the Fed board could create some interesting dynamics. The current members of the Fed Committee have a lot of respect for Powell. His leadership could still carry a lot of weight in interest rate deliberations, even if Powell were no longer formally the Chair.

Who might be the next Fed Chair?

For months it looked like Kevin Hassett, currently a top economic advisor to the President, was the likely choice for Fed Chair. However, there was some pushback within Trump’s circles that Hassett would not be seen as independent enough by markets. Trump himself seemed to rule out Hassett earlier in January, saying “I actually want to keep you where you are.”

This leaves three possible candidates: former Fed Governor Kevin Warsh, Blackrock Fixed Income CIO Rick Rieder, and current Fed Governor Chris Waller.

- Waller is currently viewed as a long-shot. However he probably has the most credibility within the Fed of these candidates. If Trump wants someone who would be most able to convince the rest of the Fed to cut rates, Waller might be the best choice. However, Waller is very much a Fed institutionalist, and is seen as close to Powell. Trump may feel that this tie makes Waller likely to just continue the status quo.

- Right after Hassett was ruled out, Wall Street assumed that Kevin Warsh was the most likely nominee. However, Warsh has historically been labeled a “hawk” for his preference for higher rates and a smaller Fed balance sheet. At Davos, Trump (referring to his Fed Chair search) said “It’s amazing how people change once they have the job.” That swipe seems directly aimed at Warsh, who seems to support rate cuts now, but may not deep down support Trump’s vision for how the Fed should act.

- That leaves Rick Rieder, who has recently surged into the lead for Fed Chair on prediction markets. Rieder has no prior Fed or government experience, which certainly makes him an unusual pick for the Fed. However, he is highly respected on Wall Street. He has also been talking about the benefits of lower interest rates long before he was considered a candidate for the Fed board. Over the years he has argued that higher rates create an income effect, putting more money into the hands of retirees who tend to spend whatever money they make. Therefore raising interest rates isn’t the proper solution to fight inflation. More recently he has harped on the benefits of unsticking the housing market. So many homeowners are unable to move because of high mortgage rates, and he argues this is hurting economic growth. Lower interest rates would be one solution to this problem. Working against Rieder’s candidacy is his lack of a past relationship with Trump, and in particular, his past support for rival political candidates.

It is unclear when Trump will announce his pick for the Fed chief. The President has hinted that the announcement was imminent since mid-December, and several times suggested that he knew who he was going to pick. I expect there to be considerable scrutiny in the Senate with any of these candidates, so if Trump wants his pick to take over right when Powell’s term is up in May, the nomination probably needs to happen within the next two weeks. It took almost three months for Powell to be confirmed by the Senate when he was initially nominated by Trump in 2017, and his nomination was not controversial. There is a risk that this nomination results in a more drawn-out process.

We’ll write more about the selection when it is made. However I will say for now, none of these candidates would be viewed as immediately problematic by the market.

Where does the Fed go from here?

My belief is that no matter who takes over from Powell, the Fed will ultimately make similar decisions on interest rates regardless. There may be a bit of a lean toward lower rates, but Powell was already someone who put more weight on the Fed’s employment mandate vs. the price stability mandate. If this were not the case, the Fed wouldn’t have been cutting rates in recent months given how high inflation was. Trump has said he wants a Fed Chair that will favor a pro-growth agenda. I would argue he already has a Fed Chair doing just that.

Moreover, as we mentioned above, the Chair can’t force the Committee to act in any direction. If the next Chair wants to lead the Fed, he has to convince the Committee to go along. This most likely means making rate decisions that resemble the Fed’s traditional behavior. For all these reasons, I don’t think the next Chair will be a wild departure from the current Chair.

If the economy deteriorates from here, the Fed could wind up cutting several times over the course of 2026. But if the economy stays strong, I’d only expect 1-3 cuts.