The information provided is based on the published date.

Key takeaways

- Geopolitical events are always highly uncertain, and the conflict in Iran is no different. Investors should be careful trying to predict the outcome.

- If there is an economic impact related to this conflict, it’s most likely to come from fluctuating oil prices. However, oil may have less of an effect on the U.S. economy than many assume.

- Because most Iranian oil is already isolated from Western markets, a disruption in its supply would primarily impact China, having a more indirect effect on oil prices for the U.S. and Europe.

- For U.S. investors, the complexity of Iran's sanctioned oil trade underscores why a long-term, diversified portfolio is a better strategy than trying to time the market based on geopolitical events.

The recent escalation of tensions between Israel and Iran, alongside the United States' involvement, has understandably put investors on edge. A cease fire seems to have been reached for now, but it is difficult to know if that will hold. The situation is tenuous and hostilities could reignite. So what might the actual economic impact of this conflict be? Does it suggest any portfolio changes? During times like these, it's crucial to step back and apply a disciplined framework to understand how such events could, or could not, impact your long-term financial goals.

Respect the unpredictability of conflict

The first and most important principle when considering geopolitics is to have immense humility about our ability to predict outcomes. War and international conflict are notoriously difficult to forecast. Intelligence agencies with access to classified information are often surprised by events; for those of us in the financial world, predicting the precise path of a conflict is even more challenging.

When thinking about the current situation, it's helpful to run a simple narrative exercise. First, imagine a story where the conflict escalates significantly, perhaps leading to broader regional instability. Then, come up with the opposite narrative, one where diplomatic off-ramps are found, and the situation de-escalates or becomes a contained, low-level conflict. The ease with which one can create both plausible best-case and worst-case scenarios highlights the profound uncertainty involved. This exercise helps us avoid anchoring to any single outcome and reminds us that market reactions are often tied to which narrative investors are believing at any given moment.

Focus on economic impact, not headlines

For long-term investors, the only thing that ultimately matters for stock prices is the effect on corporate earnings. In the very short-term—a day or a week—markets can certainly decline on fear alone. But over any meaningful investment horizon, even a month or two, the market's focus will inevitably shift from headlines to the tangible economic consequences.

When analyzing the Israel-Iran conflict, we must think in these terms. A common analogy I use is to think about the consumption of regular households. Are people going to buy fewer Ford cars, or toasters from Walmart, or be less likely to go see a Disney movie? Probably not. For most U.S. and global companies, the direct impact is likely minimal.

The risk comes from second-order effects, with the most cited concern being the impact on global energy prices.

Iran conflict and energy prices

Anytime there is a conflict in the Middle East, the most obvious impact is on oil. The Middle East accounts for roughly 30% of world oil production, so a significant disruption would be a real macroeconomic event. The concern wasn’t just with oil production but also critical shipping lanes like the Strait of Hormuz. Indeed, crude oil prices rose 10.1% from the day of Israel’s first direct strikes against Iran through Friday, June 20th, just before the U.S. bombing of Iranian nuclear facilities.

Should the cease fire fail, Iran could choose to close the Strait of Hormuz. About 25% of the world’s oil is transported through this small waterway that connects the Persian Gulf with the Indian Ocean. On June 22, the Iranian Parliament voted to authorize closing the Strait, so clearly the regime views this as an option, or at least something it can use as a threat.

If Iran were to attempt to block this key passageway, the U.S. would be almost forced to respond. While there is little doubt that the U.S. Navy could reopen the Strait by force, this would be a major escalation of the conflict. In the meantime it would probably cause oil prices to spike. Some analysts believe oil could jump from around $65 per barrel now to something like $110 in certain scenarios.

However even in such an extreme scenario, oil prices would have to stay that high for an extended period in order to have a meaningful economic impact. Iran would not be able to maintain a blockade of the Strait for long, either militarily or economically. Iran relies on oil and natural gas exports for their economy. If it were to line the Strait with mines, it would hurt themselves as much as other countries. It would also further isolate Iran, as countries like Saudi Arabia would also be severely impacted by being unable to move exports through the passage. Even among Iran’s few friends there would be political pressure. China gets more than half of their oil through the Strait.

All this is why Secretary of State Marco Rubio said that closing the Strait of Hormuz would be "suicidal" for Iran. It may still happen, but it isn’t clear that such a move would have a lasting impact.

Putting the risk of oil price spikes into context

Even if oil prices were to remain elevated, the relationship between oil prices and the broader economy is complex. While higher energy costs do act as a tax on consumers and businesses, the magnitude of the impact might be smaller than you think. Energy spending makes up a relatively small portion of total production costs for businesses and of average household budgets.

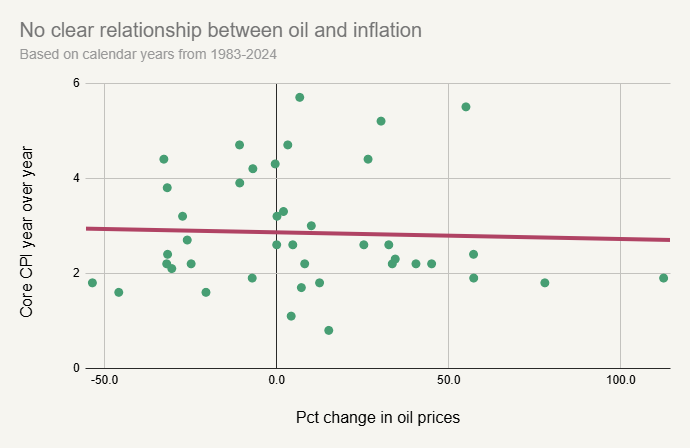

Household spending on “energy commodities,” which is a category including gasoline and home heating, is only 3% of consumer budgets. For businesses, the equivalent category is about 5% of spending. Partially for this reason, there has not been any noticeable relationship between oil prices and core inflation over the last three decades. The chart below shows a scatter plot of the change in oil prices vs. Core CPI.

Source: Bureau of Labor Statistics, Bloomberg

The solid red line represents a “trendline.” As you can see, it is basically a flat line. That suggests that there’s no consistent relationship between the change in oil prices and consumer prices overall. Higher oil would undoubtedly cause gas prices to rise, but if history is any guide, that’s about it.

It is also important to note that for the U.S. specifically, higher oil prices also benefit the large domestic energy production sector, creating a partial offset within our own economy. Higher oil prices may increase U.S. production, which would likely stimulate job growth. This would at least be a partial offset to any harm done by higher oil prices.

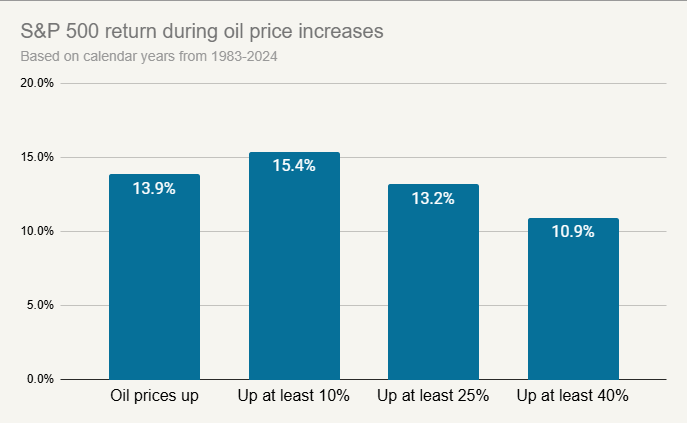

History shows that the stock market can perform well even when oil prices are rising. Looking at market returns since 1983, the S&P 500 has, on average, posted positive returns in years with rising oil prices, even in years with substantial price spikes of 25% or more.

Source: Dow Jones S&P Indices, Bloomberg

Iran’s oil and China

It's also important to contextualize the conflict within the existing international sanctions landscape. For years, Iran has operated under a comprehensive sanctions regime, primarily led by the United States, designed to restrict revenue from its key oil and petrochemical industries. To counter these measures, Iran has developed sophisticated evasion tactics, including the use of a "shadow fleet" of oil tankers and alternative financial channels that bypass the Western banking system.

This has allowed it to maintain significant trade relationships, with China remaining its most critical economic partner and the primary buyer of its oil. It is estimated that China buys as much as 90% of Iran’s oil supply. Because Iran has few other outlets, China is said to be able to buy this oil at below market prices.

If Iranian oil became less available, perhaps because facilities and/or infrastructure is damaged during the fighting, the main loser would be China. For all intents and purposes, Iranian oil isn’t part of the functional supply available to the U.S. or most other developed countries. Oil prices overall may still rise, as China would be forced to buy its oil elsewhere, but the effective price in China would rise much more than elsewhere in the world.

Salience bias and the danger of market timing

A major reason why geopolitical events feel so threatening to our portfolios is a cognitive bias known as "salience bias." We tend to overrate the importance of events that are rare, dramatic, and emotionally resonant. A war in the Middle East is a very big deal from a human and geopolitical perspective; therefore, our minds assume it must be a very big deal for our investments.

This is where having a disciplined process is critical. By focusing on tangible economic effects, we can avoid making rash decisions based on fear. This is crucial because trying to time the market around geopolitical events is an especially perilous exercise.

Over the last few decades, we have seen a wide variety of major geopolitical events, from 9/11 to the Iraq war to Russia’s invasion of Ukraine. Each of these have had lasting effects, but it isn’t clear what the lasting market effect was. Selling stocks after any of these events would have been a mistake. You would have lost out on market gains and probably harmed your ability to meet your financial goals.

Conclusion: Stay the course

This analysis is not meant to downplay the seriousness of the conflict in the Middle East. The risks are real, and the human consequences are tragic. However, for a U.S.-based investor with a diversified, long-term portfolio, the conclusion is almost always the same: stay the course. History has shown time and again that selling into a panic based on geopolitical fears is a losing strategy. The most reliable path to achieving your financial goals is to stick with your well-thought-out investment plan, which was designed to weather periods of uncertainty just like this one.