The information provided is based on the published date.

Key takeaways

- Positive drift assets like stocks and bonds have historically produced more consistent long-term results than gold

- Gold's value is mainly driven by speculation, making it a guessing game for investors

- Historical data does not support the idea that gold is a good hedge against economic downturns or inflation

- Over just about any extended time horizon, gold's return pales in comparison to stocks, making it a drag on long-term portfolio goals

We are frequently asked why gold isn’t part of our asset allocation since it’s often touted as a good diversifier and protector against inflation and economic downturns.

But we find none of these claims are supported by actual data. In fact, our analysis indicates that the only thing a long-term bet on gold accomplishes is dragging down your returns.

Facet invests in assets with “positive drift”

We believe the best investing strategy is one that maximizes your chance of meeting your goals. As part of this, we prefer to use investments that have a fundamental reason why they should appreciate over long periods of time. The technical finance term for these assets is called positive drift.

One common analogy for positive drift is a drunk person being led home by their dog. When the owner occasionally takes a wrong turn, the dog directs them back in the right direction. Eventually, they’ll make it home, but the path might be a bit circuitous.

We think this is a good metaphor for investing in the big picture. Yes, the market is going to take some wrong turns. But what really matters is that, in the end, you’ve met your financial goals.

Investments with positive drift

Stocks and bonds are two easy examples of investments with positive drift. Stock values go up over time because, in general, companies earn profits, and these accrue to shareholders.

Bonds produce returns over the long run because they pay you interest. While we can’t know exactly what return either of these assets will produce in the future, we can have confidence that they will likely produce positive long-term results.

Gold’s value is in the eye of the beholder

Gold does not produce any cash flow. Only a tiny percentage is used for industry. You can’t use it to buy regular goods and services.

Gold’s value really comes from two sources: jewelry and speculation. Since global jewelry demand is basically flat over time, it is speculation that drives gold’s price.

This means to invest in gold successfully, you need to anticipate whether speculative demand is likely to rise or fall in the future. In other words, buying gold is a game of making a guess today as to whether people will want more gold tomorrow.

Contrast that with Facet’s preference for positive drift assets. When we buy stocks or bonds, there is certainly a risk that our timing is not ideal.

For example, we could buy just before stocks decline in the short term. But if we just stay invested over the long term, stocks generally recover, usually making up for any short-term loss. This is not the case with gold.

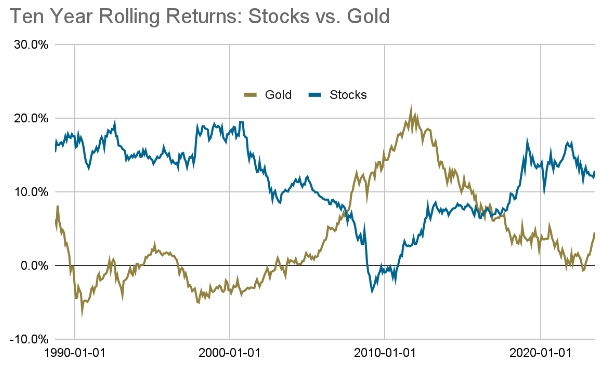

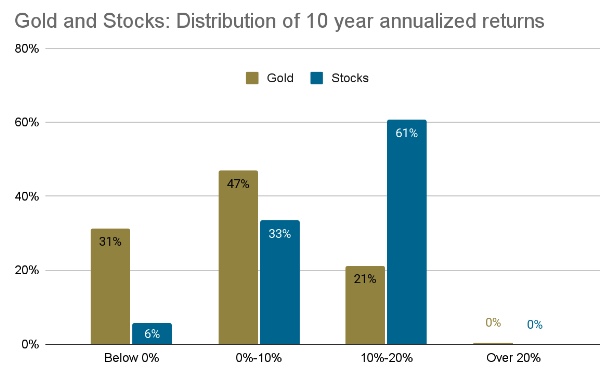

The chart below illustrates this point. It shows the rolling 10-year return for both stocks (represented by the S&P 500) and gold.

Source: Bloomberg, S&P

You can see from the chart that gold returns are sometimes very strong but, at other times, very poor, whereas long-term stock returns are much more consistent.

For example, in only 6% of these ten-year periods were stock returns negative compared to 31% for gold. In 61% of periods, stock returns were between 10% and 20% vs. just 21% for gold.

Source: Bloomberg, S&P

Is gold a good hedge?

Sometimes those advocating for gold as an investment claim it is a good hedge against economic downturns, inflation, or both. However, historical data does not support this idea.

First, let’s consider what a “hedge” is, or at least what it should be.

A hedge is kind of like insurance. When you buy insurance on your house or car, you make small payments to protect yourself against large losses in the event of a disaster.

A good portfolio hedge should work similarly: it shouldn’t cost you much most of the time, but when a problem hits, you want a large positive return.

Gold fails on both accounts

Gold costs way too much in good times and doesn’t do that great when disaster strikes.

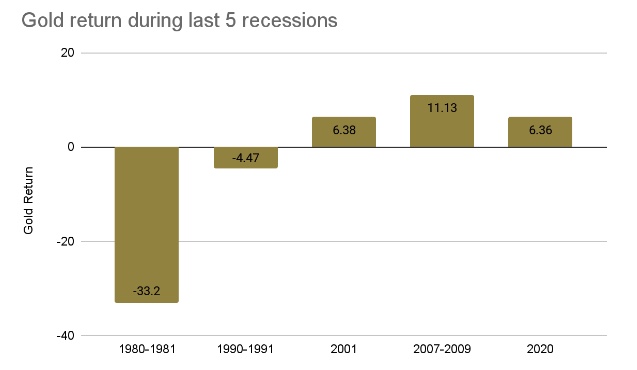

Let’s look at gold returns during recessions. Over the last five recessions, gold has produced a positive return three times.

The chart below shows the return of gold from the start of an official recession until its end.

Source: Bloomberg, National Bureau of Economic Research

Only hitting on a positive return in 60% of these periods isn’t what you want from a hedge. In comparison, bonds produced positive returns in all five recessions. That is closer to what we are looking for in a portfolio hedge.

What about gold as an inflation hedge?

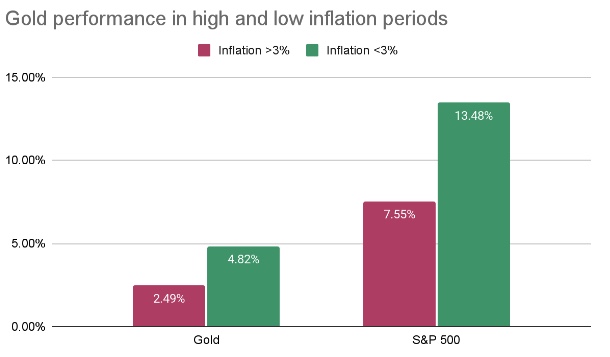

Gold doesn’t have a terrific record there, either. The chart below shows the annualized return of gold vs. stocks during periods of relatively high or relatively low inflation over the last 40 years.

Source: Bureau of Labor Statistics, S&P, Bloomberg

When the Consumer Price Index (CPI) was 3% or higher on a yearly basis (red bars), gold’s average return was 2.49%.

Yes, that’s right. Gold’s return was below the rate of inflation during these periods -- quite odd for a supposed inflation hedge.

When inflation was below 3% (green bars), gold actually had a higher annual return of 4.82%. Again, it sure doesn’t seem like something that functions as an inflation hedge.

But it gets even worse for gold when you compare it against stocks. In both high and low inflation periods, stocks have outperformed gold.

This analysis shows that gold doesn’t keep up with inflation when it is high and performs worse than stocks, whether inflation is high or low.

You won’t meet your long-term goals by investing in gold

This gets us to the most important point. We simply do not believe you will meet your long-term portfolio goals by investing in gold.

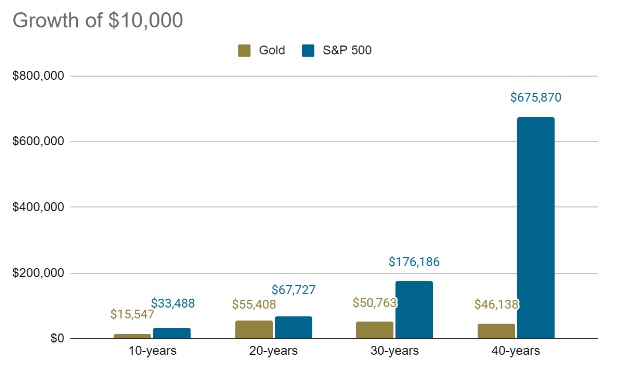

This belief is backed up by history. Over just about any long time horizon, gold’s return pales in comparison to stocks. The chart below shows the growth of $10,000 invested 10, 20, 30, and 40 years ago, ending June 30, 2023.

Source: Bloomberg, S&P

As we said at the outset, the purpose of investing is to meet your long-term financial goals. Leaving your money in gold has historically been a huge drag on your results.

We believe it is more likely than not that gold will continue to be a drag in the future.