The information provided is based on the published date.

Key takeaways

- Spending on AI-related investments was a major driver of company earnings this quarter.

- This impacted some obvious industries like semiconductors, but also some less obvious ones like electric utilities.

- The market is not displaying blind optimism about AI however. The market will punish any company without a clear plan and timeline for how any long-term investment turns into profits.

- Price competition is heating up in the consumer sector, which could provide some relief on inflation.

- Strong earnings reports have pushed stocks to all-time highs despite rising interest rates.

Earnings season is drawing to a close for this quarter, and it has been a strong one. Through May 24, 443 companies within the S&P 500 had reported financial results for the prior quarter. Of those, 81% reported profits better than Wall Street expectations, according to Bloomberg data. This has helped power stocks higher so far this quarter.

At Facet, we are not stock pickers, but these earnings reports are still extremely useful for us to analyze. It can give us some critical clues about the macroeconomy and broader business environment. In that vein, here are a few of the highlights from this earnings season and what we think it tells us about what comes next.

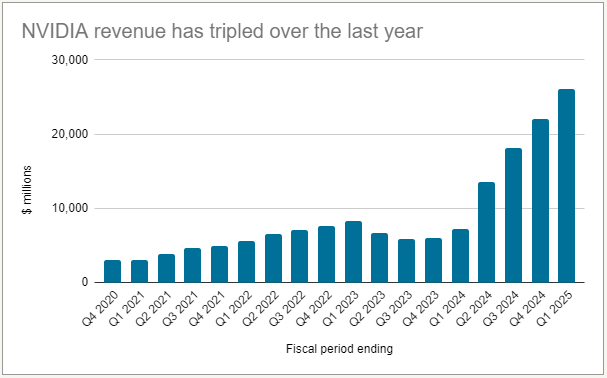

AI spending remains strong

The boom in artificial intelligence spending is showing no signs of letting up. The most obvious beneficiary has been NVIDIA, which makes the semiconductor chips at the leading edge of AI development. The firm’s revenue has tripled over the last year as companies have ramped up spending on NVIDIA’s high-end chips.

Source: Company reports

NVIDIA hasn’t been the only beneficiary of the AI boom however. While NVIDIA has a dominant market share in the kinds of chips used to train AI models, the implementation of AI is changing demand for various kinds of semiconductors. That has led to the whole sector rising more than 11% so far this quarter.

Another big winner is cloud computing. When you type something into ChatGPT, Gemini or any other AI system, the actual computing isn’t happening on your laptop. It is happening in the “cloud,” which really means, it is happening at a huge remote server out on the internet. The three biggest providers of cloud computing, Microsoft, Alphabet and Amazon, all reported big jumps in cloud revenue.

Taking all of these reports together, we can say that the boom is AI is very real, and is translating into big business for the companies involved.

Market still values profitability over growth

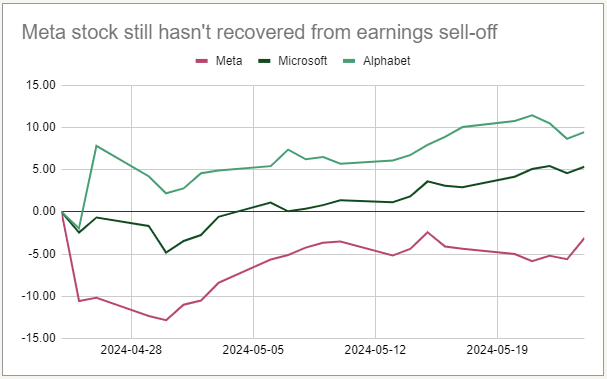

That being said, not everything that touches AI has turned to gold this quarter. Meta, parent of Facebook and Instagram, announced strong earnings this quarter, but also said that they would “accelerate our infrastructure investments to support our AI roadmap.” The company said that would increase costs by $5 to $7 billion, and declined to give any guidance as to when that extra investment would turn into increased profits.

Despite the market’s overall positive attitude toward AI, Meta’s stock was punished after their earnings were announced. The stock dropped almost 11% that day, and still hasn’t recovered those losses.

Source: Bloomberg

A few weeks ago we wrote a piece discussing the idea that a bubble might be forming in AI-related stocks. This Meta earnings report is a great case study in how to read market sentiment. A bubble forms when there is unbridled optimism that becomes divorced from financial discipline. In a bubble, markets hear plans for big growth at a company and assume success.

Here the opposite happened. Meta isn’t a newcomer to AI. They have been using it successfully as part of ad targeting for many years. But when Meta CEO Mark Zuckerberg talked about grand plans with uncertain payoffs, the market assumed the worst. There was no unbridled optimism to be found.

Meta’s results show the market is still focused on financial discipline. Investors want companies to grow, but do not want to see firms taking big (and expensive) swings to do so. Profits are currently valued more than growth.

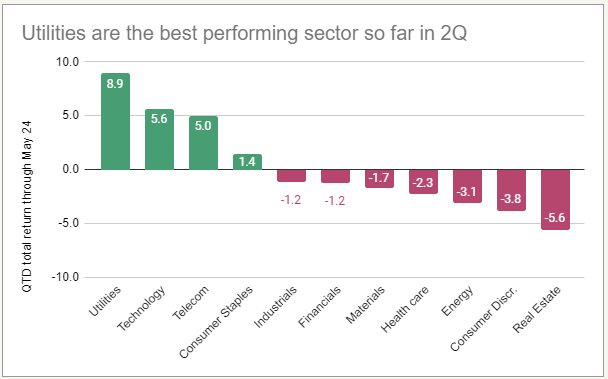

Utility stocks are surprise winners

All of this AI talk might lead one to assume tech stocks are dominating returns this quarter. However it is actually Utilities that are the leader in 2Q.

Source: Bloomberg

This is ironic because typically utilities have been a defensive sector that usually only outperforms during bear markets. Moreover, electric utilities have had very little revenue growth in recent decades. Total electricity generation in the U.S. has been basically flat since 2004.

That may all be changing now. The data centers that house those cloud computing servers require power. In addition, efforts to bring more semiconductor manufacturing to the U.S. is also creating more demand for electricity. These may provide a catalyst for utilities to expand generation capacity substantially. During the company’s earnings call, Constellation Energy CEO Joseph Dominguez said that the data economy and utilities go together “like peanut butter and jelly.”

This is a good example of how AI growth is impacting a variety of companies. We have been talking about the potential for a business investment boom, centered around AI and semiconductor production. If this kind of investment continues, it is important to think broadly about how many companies could benefit.

Price competition heating up in the consumer sector

One area of the economy that has struggled a bit is consumer spending on so-called “durable goods.” This is any physical good that is not consumed, including everything from coffee makers to t-shirts to smart TVs. Aggregate spending on these kinds of goods has only increased 2.4% in the last year, vs. spending on services which has increased 6.9%.

It is not obvious this trend is about to change based on what we heard during this earnings season. What we did hear is that most firms do not expect to raise prices meaningfully on general merchandise.

For example, Walmart had one of the better results of large retailers this quarter. After posting sales growth of 5.7% for the quarter, CEO Doug McMilon said that results were not inflation-driven” explaining that overall price increases was averaged 0.4% for the quarter. Rather the sales improvement was due to “growth in units sold” including market share gains coming from “rollbacks” on prices.

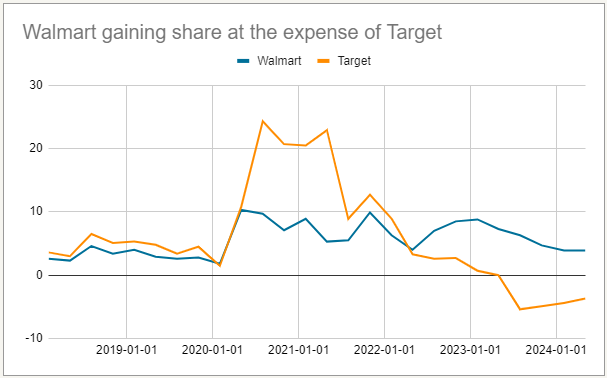

The implication was that consumers have reached a limit with inflation and are now looking for bargains. By lower prices on certain goods, Walmart has been able to increase sales at the expense of competitors. This idea is supported by looking at so-called “same store sales” for both Walmart and Target. Same store sales is the growth rate of sales from stores that have been opened for at least a full year compared to the same quarter in the prior year.

Source: Company reports from Walmart and Target

For those of us hoping to see inflation subside, this is good news. We want to see companies competing on price as opposed to trying to increase profits by just raising prices. Goods prices have been declining in recent months, and based on what we’ve heard this earnings season, that trend looks likely to continue.

Earnings continue to be more important than interest rates

We have been saying for over a year now that company profit growth was going to be the main driver of stock market results, while the Fed and interest rates would be a secondary factor. So far in 2024, that has definitely been the case. Long-term interest rates have risen substantially so far this year and hopes for Fed rate cuts have been fading.

And yet the global stock market has powered higher, with the Morningstar Global index up 9.4% though May 24. We can’t know what the future holds, but if earnings results continue to be as strong as they have been recently, stocks have a very good chance to keep rising.