The information provided is based on the published date.

Key takeaways

- REIT fundamentals are challenged in 2025 by record-high office vacancies and a historic influx of new apartment supply, which is pressuring rent growth.

- Despite recent underperformance, REIT valuations appear stretched, as their dividend yields are not compelling when compared to safer alternatives like 10-year Treasury bonds.

- REIT stock prices are highly sensitive to interest rate movements, historically performing poorly when rates are rising, making them a risky investment in the current environment.

- Investing in REITs today is largely a "one-way bet" on falling interest rates, a scenario most likely to occur in a recession, offering a poor risk/reward profile for most other outcomes.

For many investors, Real Estate Investment Trusts (REITs) offer an accessible way to gain exposure to the real estate asset class. However, the current economic landscape presents a challenging trifecta of headwinds for REIT investors. A closer look at the sector's fundamentals, valuations, and sensitivity to interest rates suggests that caution is warranted for those considering adding or increasing their allocation to REITs right now.

What even is a REIT?

The acronym REIT stands for “Real Estate Investment Trust,” which is a specific type of legal entity first created by Congress in 1960. Two primary rules define a REIT: first, it must invest the majority of its assets in real estate, and second, it is required to pay out at least 90% of its taxable income to shareholders in the form of dividends. By adhering to these rules, the company itself avoids paying corporate income tax; taxes are only paid by investors upon receiving their dividend distributions.

REITs can invest in nearly any kind of real estate, including shopping centers, office buildings, apartments, and warehouses, as well as more modern infrastructure like data centers and cellphone towers. Some REITs also invest in real estate-related debt, such as mortgages. They can be publicly traded on stock exchanges, allowing you to buy and sell them just like regular stocks, or they can be private, which may come with restrictions on when and how you can buy or sell shares.

Challenging fundamentals

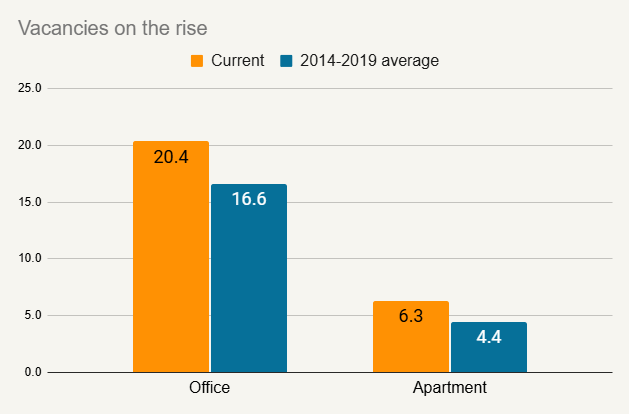

The first major reason for caution is that the basic fundamentals for many key real estate sectors are currently weak. Despite ongoing "return to office" discussions, office building vacancies continue to climb. According to data from Moody’s, 20.4% of U.S. office space is currently sitting empty, an all-time high.

The apartment sector, often referred to as “multi-family” real estate, is in better shape, with a vacancy rate of 6.3%. While this is far less worrisome than the office market, this vacancy rate has been rising steadily since 2021 and is currently at its highest level since 2010.

Source: Moody’s CRE

When vacancy rates are high, it becomes very difficult for property owners to raise rents. Landlords are focused on filling empty space, and increasing rent is not conducive to that goal. This trend is clearly visible in the data. According to Apartmentlist.com’s national rent report, the median apartment rent has been flat to slightly down since early 2022. When occupancy is declining and rent growth is stagnant, it becomes very difficult for these companies to generate meaningful revenue and profit growth.

This situation doesn't look poised for a quick improvement, largely because the supply of new buildings remains very robust. According to real estate research firm Yardi Matrix, over 536,000 new apartment units are expected to come online in 2025, which would be an all-time record. This new supply includes an estimated 71,000 units from office-to-apartment conversions, a trend being encouraged by many local governments. While making housing more affordable is great news for society, a record influx of new supply on top of already rising vacancies is not great news for real estate investors.

Valuations appear stretched

A sector facing fundamental headwinds can still be a good investment if stock prices are sufficiently cheap. However, despite pretty severe underperformance over the last three years, it is not clear that REIT stocks are, in fact, cheap.

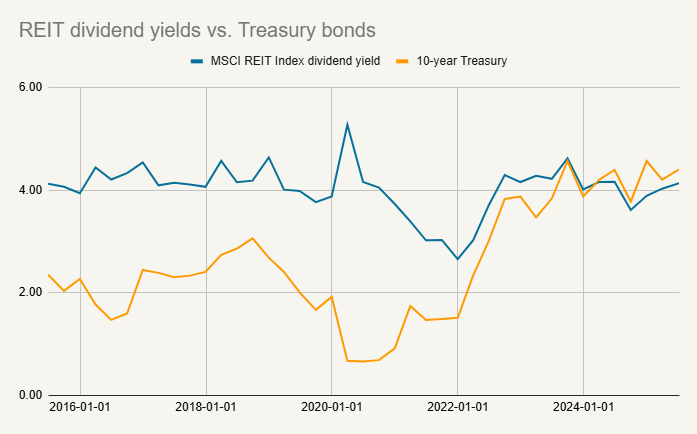

One way to assess this is by looking at the dividend yield of REITs, which is the annual dividend paid per share divided by the share's price. If REIT stocks were cheap, you would expect their dividend yield to be high relative to history, but the opposite is true. Today, the dividend yield of the MSCI REIT index is about 4.1%, which is roughly in line with its average over the last 10 years. This doesn't tell the whole story, however, because general interest rates are much higher today than they have been for most of that decade.

A more sophisticated approach is to compare the dividend yield of REITs to a risk-free benchmark, like the 10-year U.S. Treasury bond yield. This comparison is what traders often call a "spread." Historically, the REIT dividend yield has been, on average, about 1.4% higher than the 10-year Treasury yield. Today, however, the REIT yield is about 0.3% less than the 10-year Treasury yield.

Source: MSCI, Bloomberg

This suggests that, relative to a safe alternative, REITs are actually quite expensive, despite their fundamental challenges. To put this into context, for the dividend yield spread to return to its historic average, the price of REIT stocks would need to decline by approximately 26%, all else being equal. It is worth noting that this situation may be better in the private real estate market, where funds with new capital may be better positioned to find attractive deals on individual properties.

The headwind of interest rates

The third element creating concern for REITs is interest rates. The real estate business model generally involves a significant amount of debt. When interest rates are high, the increased cost of borrowing money erodes the potential return on an investment property. It makes sense, therefore, that rising interest rates are a negative for REIT stocks.

This relationship is evident when looking at the performance of REITs over the last few years. From the end of 2020 to the present, REITs posted an average monthly return of +3.2% in months when the 10-year Treasury rate declined. Conversely, they lost an average of -1.5% in months when rates were higher. No matter how you analyze the data, the conclusion is inescapable: a bet on REITs today is largely a bet on interest rates declining.

As we've discussed in other analyses, a significant drop in interest rates seems unlikely unless the economy enters a recession. In a recessionary scenario, REITs could potentially outperform other types of stocks due to the benefit they would receive from falling rates. However, this positions REITs as something of a one-way bet. The sector appears poised to outperform only in that specific scenario and may struggle in most others. For investors seeking defensive positioning in their portfolio, we believe there are better risk/reward opportunities available.