The information provided is based on the published date.

Key takeaways

- The Fed left interest rates unchanged but their projections show they're considering cuts later in 2024.

- Recent data shows the economy might be slowing down, which makes the Fed more open to rate cuts.

- Potential interest rate cuts could lower recession risk and benefit stock prices.

- The impact on long-term interest rates like mortgages is unclear and depends on the strengths of the economy.

The Federal Reserve’s June meeting concluded with no formal action on interest rates. However, based on some new projections from the Fed as well as Chair Jerome Powell’s press conference, we believe the Fed is inching closer to cutting rates sometime later this year.

Here’s our take on what happened at this Fed meeting and how it matters for your money.

Dot plot shows Fed still inclined to cut

The most anticipated part of this Fed meeting was the Summary of Economic Projections (SEP). This is a series of economic forecasts by each Fed committee member, including things like unemployment and inflation, for each of the next three years. Committee members also include where they would set the Fed’s target rate if their own economic forecast came to fruition. This is the so-called “dot plot.”

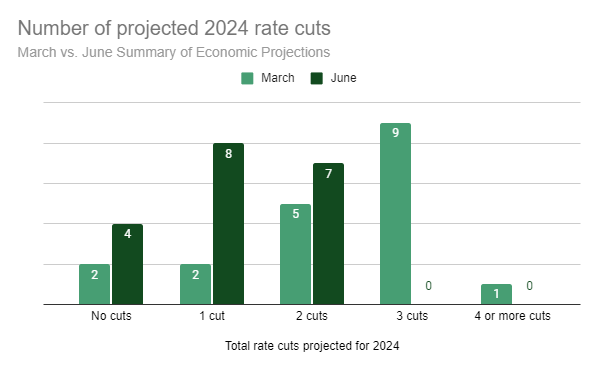

The dot plot had a pretty big change from the prior SEP, which was done in March. At that time the median member had projected three rate cuts in 2024 and another three in 2025.

The new dot plot is much more divided. Members are about evenly split between one and two cuts, with eight members indicating the former and seven the later.

Source: Federal Reserve

This tells us that most Fed officials are still inclined to start cutting rates later this year. They’ve backed off from the three cuts most expected back in March, but still think one or two will be appropriate.

In his post-meeting press conference, Powell was careful to not imply rate cuts were a given, emphasizing uncertainty in the data and the Fed’s commitment to bringing inflation down: “We are prepared to maintain the current target range for the federal funds rate as long as appropriate.” That being said, no members are anticipating hiking rates for this cycle and that “if the labor market were to weaken unexpectedly or if inflation were to slow more quickly than anticipated, we are prepared to respond.”

Based on the SEP and Powell’s press conference, our opinion is that the Fed remains more likely than not to cut at least once in 2024. This will be contingent on inflation improving somewhat in the second half of the year, but it appears that even a slight improvement will be enough to elicit some number of rate cuts.

Slow progress on inflation is good enough for Powell

With the economy still strong and inflation still high, one might wonder why the Fed is inclined to cut at all. There are two big reasons.

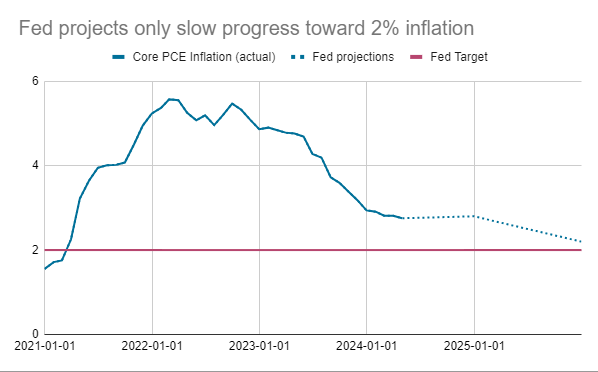

The first is that the Fed is comfortable with inflation improving slowly. Based on the SEP, the Fed’s own projections show inflation at 2.8% for calendar 2024 and 2.2% for calendar 2025. In other words, they don’t expect to hit their inflation target until sometime after 2025.

Source: Bureau of Economic Analysis, Federal Reserve

The Fed is in a tricky spot. The public consistently lists inflation as one of their top economic concerns. Yet the Fed knows that fine tuning inflation is very difficult. Monetary policy has long been called a “blunt” instrument. In other words, the impact of rate changes on the economy is hard to predict, and can have wide ranging effects. .

Powell said during his press conference that current policy is “sufficiently restrictive” to bring inflation down to 2%. He also said that if inflation ended 2024 at 2.6 or 2.7%, “that’s a really good place to be.” He is clearly signaling that the Fed is willing to be patient with inflation.

The Fed did get one piece of good news on inflation. The same day as the June Fed meeting, the Bureau of Labor Statistics released the May Consumer Price Index. While this isn’t the inflation measure the Fed uses as its inflation target, it is still a closely watched data point. For the 12-months ending in May, Core CPI was 3.4%, which is the lowest since April 2021. This better CPI number may have been why the Fed’s press release said that there had been “modest further progress” whereas in May they said there had been “lack of further progress” on inflation.

Fed growing worried about soft economic data

The other reason the Fed is considering rate cuts are some budding signs that the economy could be softening. Not so much that the Fed is panicking about a recession, but enough to convince them that policy is currently restricting economic growth. Since the Fed’s meeting in May all of the following data points have shows some weakness:

- Job openings fell to the lowest level since February 2021.

- The Unemployment Rate hit the highest level since January 2022.

- The ISM Manufacturing index fell into contraction territory, with New Orders the lowest level in a year.

- Consumer Sentiment, Retail Sales, Existing Home Sales, and New Home Sales all contracted.

Again, this is nothing to panic about. None of this data suggests a recession is imminent. However it does drive home that there are risks if the Fed remains too restrictive. This is what Powell meant when he said that economic risks had “moved into better balance” at the press conference. He also said that “reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

In other words, they’d like to start slowly “reducing policy restraint” (a.k.a., cut rates) before economic data turns much weaker. In addition, the fact that economic data is currently softening increases their confidence that inflation will continue to subside.

That doesn’t mean rate cuts are guaranteed, but it does mean the bar for the Fed to start cutting isn’t especially high.

What does this mean for your portfolio?

Stocks have been rising pretty consistently in 2024 as the outlook for profit growth has been improving. If this trend continues, we think it will probably be a good year for stocks, regardless of what the Fed does.

However, it wouldn’t hurt if the Fed were able to cut a couple times also. Such a thing would lower recession risk as well as lowering the cost of capital for companies. Both of those things would be good for stock prices all else being equal.

For longer-term interest rates (including mortgage rates), the picture is much more mixed. The Fed only controls very short-term interest rates. Longer-term rates are more sensitive to things like long-term inflation and economic growth. Unless there is a surprise slowdown in the economy, it could be that longer-term rates stay about as high as they are now.