The information provided is based on the published date.

Key takeaways

- Focusing on an investment's total return (capital growth plus income) is often a more effective strategy for long-term investment growth than narrowly chasing high yields for passive income.

- Many popular income strategies, such as covered call funds and high-dividend stocks, inherently limit your portfolio's upside potential during strong market rallies.

- The dividends and distributions from income-focused investments are typically taxed annually, creating a "tax drag" that can reduce your overall returns compared to tax-deferred growth.

- For most investors, a diversified portfolio focused on total return provides greater flexibility and a more tax-efficient way to generate cash flow by selling appreciated assets as needed.

For many investors the appeal of creating passive income from their portfolio is strong. The idea of generating a steady stream of cash flow from income-based investments is intuitively attractive. However, focusing too narrowly on income can often lead to unintended consequences, such as lower long-term growth and tax inefficiencies. A more effective approach for most is to focus on the portfolio's "total return"—the combination of both income and capital appreciation—to meet financial goals.

What are common income-based strategies?

When investors seek income, they often turn to a few specific types of equity-based strategies. These typically promise higher yields than the broader stock market, but each comes with its own structure and trade-offs.

- High Dividend Stocks: These are shares of companies, often in mature and stable sectors like utilities or consumer staples, that distribute a significant portion of their earnings to shareholders as dividends. The appeal is a consistent, predictable income stream.

- Buy-Write (or Covered Call) Funds: These funds typically own a portfolio of stocks and simultaneously sell call options on those same stocks. This strategy generates income from the premiums received for selling the options, but it also caps the potential upside if the underlying stocks rise significantly in price. This strategy has exploded in popularity over the last few years.

- Master Limited Partnerships (MLPs): These are publicly traded entities primarily engaged in the transportation, processing, and storage of natural resources like oil and natural gas. They are required to distribute most of their cash flow to investors (unitholders), often resulting in high yields, but their performance is closely tied to the fortunes of the energy sector.

- Real Estate Investment Trusts (REITs): As we've discussed previously, REITs are companies that own or finance income-producing real estate. They must pay out at least 90% of their taxable income as dividends, providing investors with a way to receive income derived from a portfolio of properties.

The trade-off: Sacrificing long-term growth

While the income from these strategies can be attractive, it often comes at the cost of lower long-term capital appreciation compared to a diversified portfolio of regular stocks. There are fundamental reasons why this is often the case.

High-dividend stocks, for instance, are frequently found in slower-growth, more mature industries. Because these companies are paying out a large portion of their profits as dividends, they are retaining less cash to reinvest in new projects, research, and expansion, which can limit their future growth potential.

Buy-write funds, by their very design, explicitly trade away upside potential in exchange for income; if the market rallies strongly, these funds will lag significantly because their gains are capped.

The performance of MLPs is heavily dependent on the volatile energy sector, and REITs are subject to their own unique headwinds, such as rising interest rates and shifts in property market fundamentals. This concentration in specific sectors or strategies means these investments often miss out on the broader growth that drives the overall stock market higher over time.

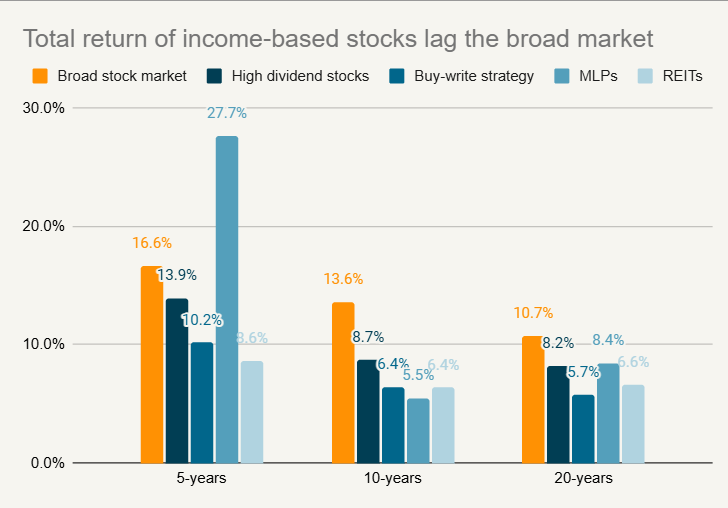

The chart below shows the 5, 10 and 20-year return of each of these strategies. Over almost all time frames, stocks have performed substantially better.

Source: Dow Jones S&P indices (stocks and high income stocks), CBOE (buy-write), Alerian (MLPs) and MSCI (REITs)

Downside protection: A closer look

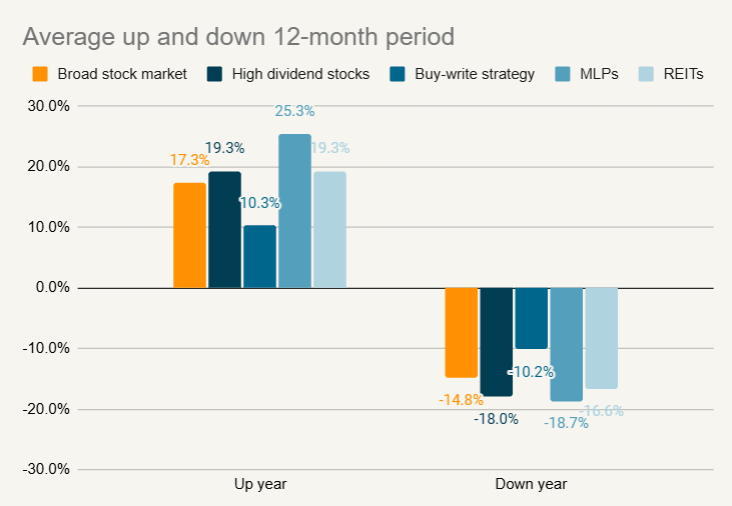

Proponents of income strategies often argue that the regular dividend payments provide a cushion during market downturns, offering some downside protection. While it is true that receiving income can buffer total returns when stock prices are falling, the degree of this protection is often smaller than the upside potential that is sacrificed during bull markets. The income stream can help, but it's rarely enough to prevent significant losses in a major market correction, and the long-term performance drag from capped upside can be substantial.

We can see this by looking at the average up and down year for each of these strategies. In the chart below we measured the rolling 12-month total return of each, and then averaged the negative periods over the last 20 years. Here we see that most strategies have had larger down periods than stocks have.

Source: Dow Jones S&P indices (stocks and high income stocks), CBOE (buy-write), Alerian (MLPs) and MSCI (REITs)

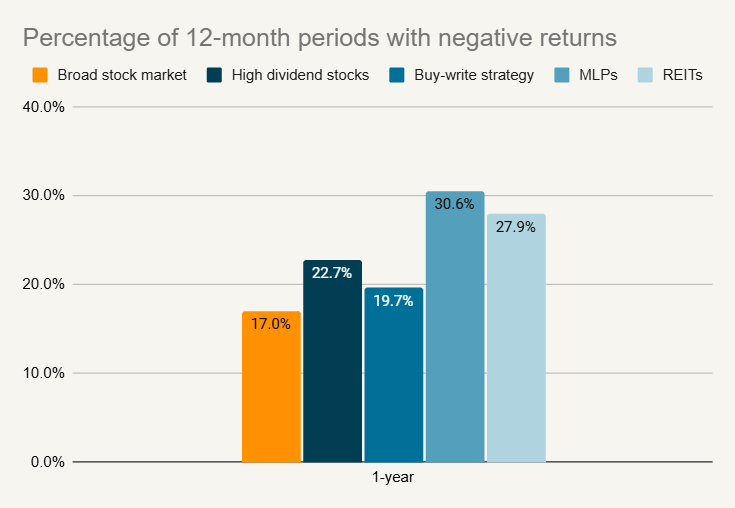

In addition, all of these strategies have declined more often than stocks have. The chart below shows the percentage of 12-month periods where each strategy posted a negative return. Combining theses two graphs, we see that these “income” strategies have produced negative returns more often than traditional stocks, and the negative periods are more severe than stocks as well.

Source: Dow Jones S&P indices (stocks and high income stocks), CBOE (buy-write), Alerian (MLPs) and MSCI (REITs)

The impact of taxes on total return

Another critical consideration is the tax inefficiency of many income-focused strategies. When you receive dividends or distributions, that income is typically taxable in the year it is received. This creates a "tax drag" that reduces your net return and means less of your money stays invested and compounding for the future.

In contrast, with growth-oriented investments that don't pay large dividends, you primarily realize gains only when you choose to sell the asset. This allows you to defer capital gains taxes, potentially for many years, letting your entire investment grow unimpeded. This tax deferral is a powerful, and often underestimated, tool for wealth creation.

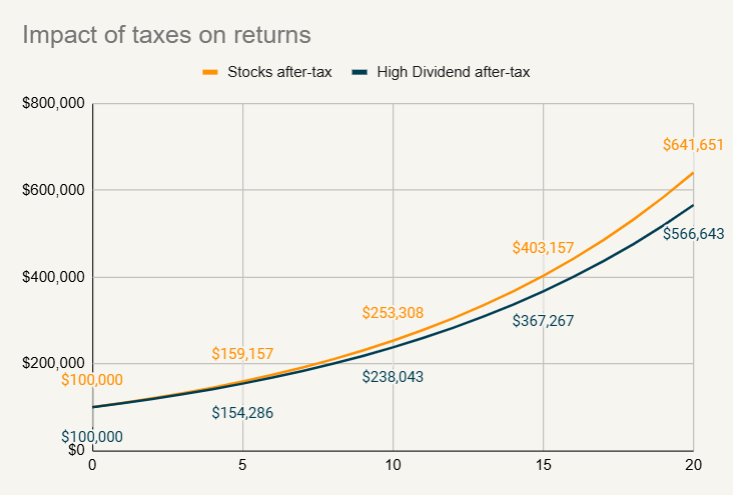

The chart below illustrates this point. Here we assume two funds: one that tracks the S&P 500 and the other that tracks the S&P High Dividend Index. In this example, we’ll assume both indexes produce a 10% total return per year over a 20-year period. For the S&P 500, 1.3% of that return comes from dividends, while that same figure is 4.7% for the high-dividend index. Both those figures are approximately the dividend yield on each index today. We then assume that an investor pays 20% tax on the dividends received.

Source: Dow Jones S&P indices

Here we see that by the end of the period, the low dividend index is worth about $75,000 more than the high-dividend index. Remember, we assumed both indexes produced the same pre-tax return. So even if the history of dividend underperformance mentioned previously were to change, dividend stocks still have a major disadvantage for tax-paying investors.

Note that some income vehicles, like MLPs, come with complex tax reporting requirements (such as K-1 forms) that can add administrative burdens.

A note on private income investments

Beyond the public markets, there are also private investments that can generate income, such as private credit funds or direct investments in private real estate. These can be attractive options for sophisticated investors, sometimes offering higher yields and diversification benefits. However, the core principle remains the same: the focus should always be on the total, risk-adjusted return, not just the income component itself. For example, this is the approach we took when constructing the Facet Alternative Income strategy. Whether we’re talking public or private, don’t put more weight on income generation than is warranted.

Conclusion: A total return approach to managing risk

For most individual investors, building a portfolio solely focused on generating passive income from high-yield strategies often leads to suboptimal outcomes like sector concentration, limited growth, and tax inefficiency. A more effective and robust approach is to focus on maximizing total return for a given level of risk. You can then create your own reliable cash flow by periodically selling a small portion of your appreciated, diversified portfolio to fund your spending needs. This method allows your portfolio to benefit from broad market growth, provides greater flexibility, is often more tax-efficient, and ultimately offers a better way to manage risk while also supporting the longevity of your assets.