The information provided is based on the published date.

Key takeaways

- Many individual investors struggle with the decision of whether or not to invest in the stock market due to fear of short-term losses

- Investing in the market is necessary for reaching financial goals and achieving long-term growth

- The stock market can be thought of as a game of chance, like a roulette wheel, but the odds are in favor of those who stay in the game

- There will always be a bear case for the market, but efficient markets mean that each investors' argument has an equal chance of being right or wrong

- Time is an arbitrage advantage for long-term investors, as trends show that stocks increase in value over long periods of time

- Despite short-term volatility, it is almost always a good time to start investing in the stock market to reap the benefits of long-term growth

We often find individual investors caught between two thoughts: they know that markets tend to go up over the long run and, therefore, want to be fully invested. But in the shorter term, they worry about taking losses. Hence, one of the most common questions is, “is now a good time to invest?”

The consternation over putting money in the market is understandable. Watching the value of your hard-earned money whirl around with the whims of the market doesn’t feel good.

Additionally, it is well established in the field of psychology that human beings feel more pain when they lose money than when they feel joy when they win. This leads most people to feel better about money sitting in the bank, not changing in value, vs. putting it “at risk” in the stock market.

Yet there is a simple reality: almost no one will reach their financial goals without putting their savings to work in the market. Unless you are already independently wealthy, you need your assets to grow. For that to happen, you need help from the market.

If you are going to enjoy the benefits of investing over the long run, at some point, you have to pull the trigger and put your money into the market. In other words, you have to make a decision in the short term to get those long-term rewards.

Here are a few thoughts on how we think about the challenge of taking that short-term leap and putting your cash to work.

The stock market is an unfair game

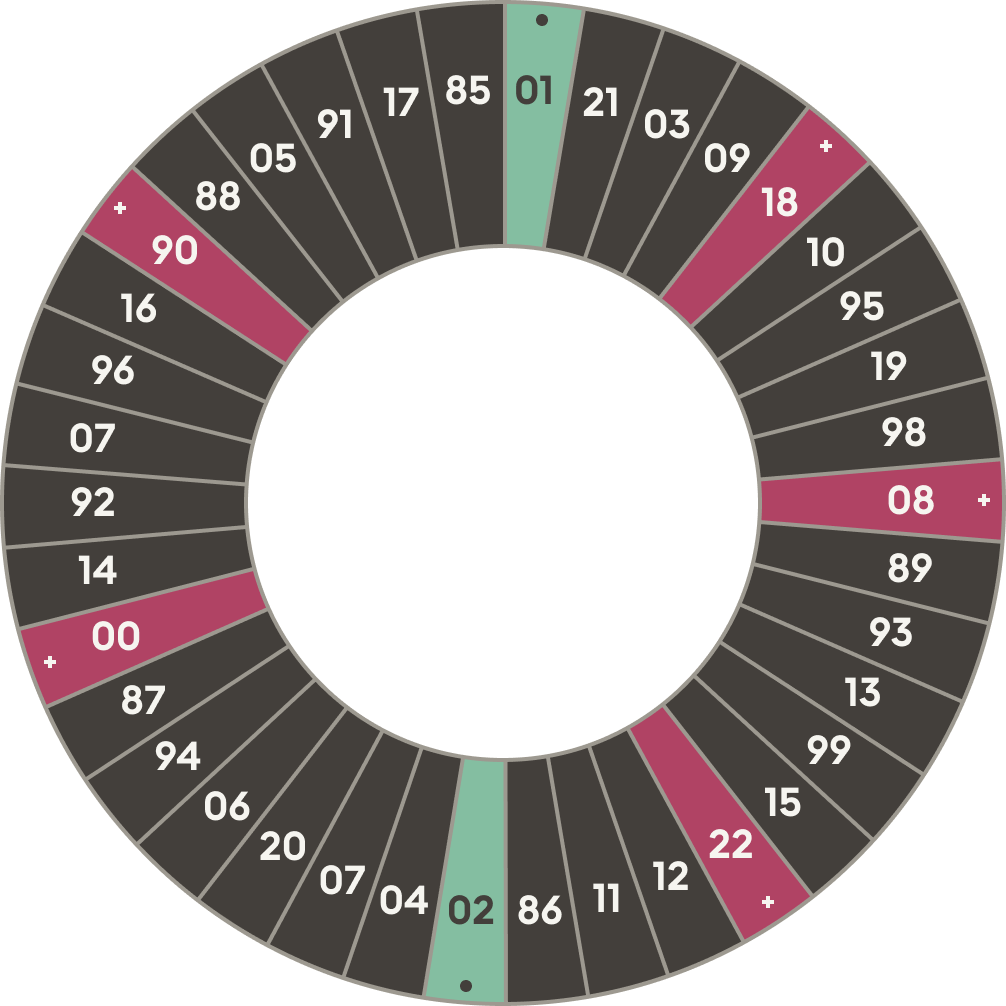

Say that you were in a casino and you walked up to a roulette wheel that looked like this:

Source: S&P Dow Jones Indices

You see that of the 38 spaces on the wheel, 31 of them are black. You ask the dealer, “why shouldn’t I just bet on black every time?”

The dealer says, “Because sometimes it comes up red. Most people worry too much about that possibility to just keep betting on black.”

You respond, “Is there a pattern? Or is the wheel actually random?”

“Well, a lot of people claim there’s a pattern. They switch their bets from red to black based on whatever system they have devised. Or they quit playing the first time they hit a red. But in my experience, the only people who win are the ones who keep playing and who keep betting on black.”

As you may have already guessed, the numbers on the wheel above represent years. We used the last 38 calendar years since that is how many slots are on a typical roulette wheel.

Each black slot is a year where the S&P 500 produced a positive return. Each red is a negative return, and the two green slots are the only two years where there were back-to-back negative returns.

Is the stock market really random, like a roulette wheel?

Strictly speaking, no. When there are down years like 2022, there is a reason why the market is down.

But it can be useful to think of the market as random: each year you stay in the market (or add more money to your portfolio), you are taking another spin at the wheel. Like the wheel in our example above, the stock market is an unfair game, but that unfairness actually works in your favor.

You may very well come up red on your first spin, but if you stay at the table, it’s very likely there will be more spins landing in black than red. And, like the market, the key to this game is to play as much as possible.

There’s always a bear case

If you turn on the financial news or read markets-focused websites, you will inevitably see some commentator making a case for why the stock market will take a fall. Maybe it is because of some political issue, perhaps something to do with the Federal Reserve, or a claim that a recession is just around the corner. They might even simply claim that the market has risen too much recently and is set for a “pullback.”

This kind of talk certainly encourages one to think in terms of timing the market. If these seemingly intelligent, experienced people believe the market will fall, shouldn’t you wait until that happens to invest?

The problem is that there is always a reasonable argument for why stocks could fall, or what Wall Street calls a “bear” case.

At Facet, we talk a lot about “efficient markets,” or the idea that the price of a stock today reflects all known information about that stock. In real life, this means that a stock’s price keeps going up until there is a balance of buyers and sellers.

That can only be possible if the price is low enough to entice some buyers but also high enough that some sellers want to sell. That would only happen if there was a good argument for why the stock might go up and for why it might go down.

The same follows for the whole market. When you hear about “smart” people betting the market will go down, remember that just as many people are betting the market will rise.

Don’t get wrapped up in the specific argument for why the market might fall in the short term. Instead, remember that in every past year where the market went up, there were any number of perfectly reasonable bear arguments.

When you hear today’s bearish case, just try to remember that “today” isn’t special. There always has been and always will be a bear case to be made.

Time arbitrage

In finance, an arbitrage is a trade that can’t lose. Its original meaning was when a trader would buy and sell virtually identical assets at two different prices, therefore locking in an instant gain.

An example of arbitrage is an investor buying and selling the same stock listed on two different exchanges. Today, these kinds of pure arbitrages don’t really exist. That’s because hyperfast computers make it virtually impossible for those kinds of price discrepancies to occur.

These days, traders use the term arbitrage to mean an instance where one can gain an absolute advantage over the market, generally by making a trade that, for some reason, other players cannot.

Time is one way for the average investor to gain this kind of arbitrage advantage. Some market players have short horizons for how they invest, sometimes days or even hours.

For those people, day-by-day stock volatility truly matters. For example, if you have a horizon of 5, 10, or even 20 years, that kind of volatility doesn’t matter. That affords you an absolute advantage over shorter-term investors: you get to reap the benefits of the long-term upward bias of markets without having to account for short-term fluctuations.

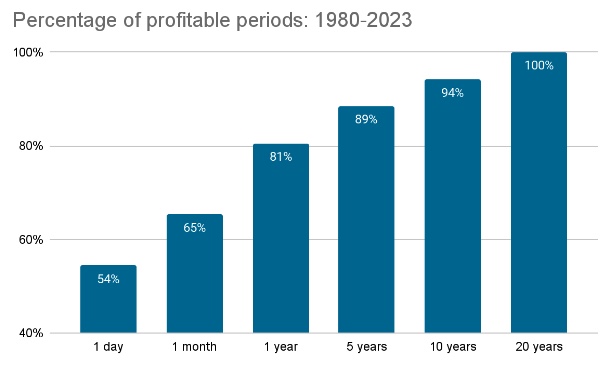

We looked at the percentage of rolling periods where the S&P 500 was positive using different time frames to see what we mean. In other words, we looked at any given day from 1980 to the present and looked ahead to see if buying the market on that day would have made you money.

Source: S&P Dow Jones Indices, measured from 12/31/1980 to 6/30/2023

As you can see, betting on the market being up is basically a 50/50 proposition if you only have a one-day horizon.

But for 5 and 10-year horizons, it gets closer to a 9/10 bet. And at least during this period, if you had a 20-year horizon, you could have literally started on any day and wound up making money.

Of course, it’s possible the future may not match this pattern exactly. However, it is worth noting that there is a fundamental reason why this pattern has occurred historically, and it has every reason to persist.

When you are betting on stocks rising over the day or month, dozens of variables influence that bet: geopolitical events, surprise earnings reports, speeches from Fed officials, etc.

But if you are betting that stocks will go up over the long term, all you are betting on is that corporate profits will go up over time in general.

If you try to time your entry into the market, you are squandering your greatest advantage as a long-term investor.

This chart shows you only have a 50/50 chance of getting a short-term bet right, but if you can afford to stick with the market for 5 or 10 years (or more), the odds skew very heavily in your favor. We think that’s the better bet.

We also believe this illustration shows the crucial importance of having a plan for your money. The better you can define your time horizon, the more you can take advantage of time arbitrage. You can’t know your horizon unless you know your purpose for your money.

The time is now

When we are asked if now is the right time to put money into the market, the answer is pretty much always yes.

Of course, we know that markets might go down in the short term, like landing on red in our roulette wheel example. But we also know the best way to win at the stock market game is to start playing and play for as long as you can.

The sooner you get started, the more time you have to reap the benefits of investing.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.