The information provided is based on the published date.

Key takeaways

- The 2026 mortgage rate forecast is directly tied to future Federal Reserve policy, as mortgage rates follow 10-year Treasury yields, which are driven mostly by Fed rate cut expectations.

- A significant drop in mortgage rates, possibly into the low 5% range, would likely require a U.S. recession, forcing the Fed to cut rates more aggressively than the 2-3 cuts currently expected.

- If the economy remains steady and the Fed only delivers the expected 2-3 rate cuts, mortgage rates will likely stay stable near their current 6.2% level through 2026.

- While the Trump administration is exploring 50-year mortgages to improve housing affordability, it's uncertain if this would truly lower costs or just be offset by higher rates and home prices.

After hitting 7% in January, home mortgage rates have fallen consistent ever since. Currently the national average mortgage rate is 6.22%. If mortgage rates were to keep declining, it could be a boon to both prospective home buyers and current owners who have high-rate mortgages from 2023 and 2024. So will mortgage rates keep falling? We see three major possible scenarios looking forward, some where mortgage rates do fall, but others where they rise.

Source: Freddie Mac

What will drive mortgage rates lower?

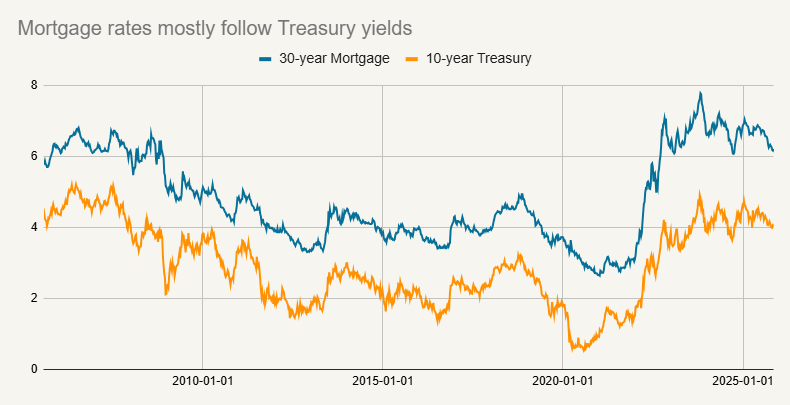

Mortgage rates are primarily driven by longer-term Treasury bond rates. This is because about 70% of all home mortgages are packaged into bonds, guaranteed by one of the government agencies, and sold to investors. Because mortgage bonds compete for capital with Treasury bonds, there tends to be a pretty consistent relationship between the two rates.

Source: Freddie Mac, Bloomberg

You can see in the chart above that mortgage rates tend to be about 1.5 to 2% higher than 10-year Treasury rates. In bond trader-speak this is called the “spread.” The spread exists mainly because of the risk that mortgage borrowers will refinance their loan early. Hence there is some room for mortgage rates to move something like 0.5% higher or lower as this spread moves around. But for larger changes, there has to be a corresponding change in Treasury rates.

Ergo, if we are asking what might drive mortgage rates lower, the real question is what might drive Treasury bond yields lower?

Treasury bond yields are a function of several factors, but perhaps the most important is anticipated future Federal Reserve target rates. As a rough approximation, you can imagine that traders value a 10-year Treasury bond at the average yield of expected Fed target rates over those ten years. So this mostly means that in order for the 10-year Treasury yield to drop in a substantial way, the Fed has to cut rates more than is currently expected.

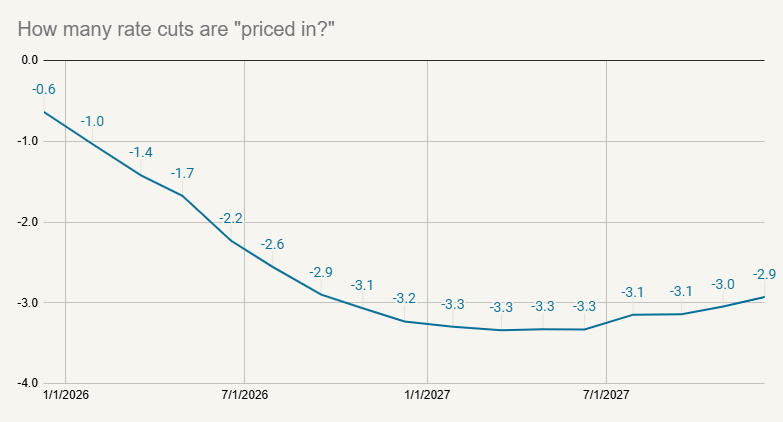

Fortunately, we can get a good idea of what is currently expected by looking at the futures market. These are contracts that trade based on future Fed target rates. Assuming each Fed rate cut is 0.25%, here is approximately how many rate cuts are priced into futures markets over the next two years.

Source: CME

Where there are decimals, think of that like traders being split between the number of cuts. For example, in March 2026, there are 1.4 cuts “priced in.” Obviously the Fed won’t actually cut 1.4 times. Rather think of this as traders thinking there will definitely be one more cut by then, and approximately 40% odds of a second cut.

For those focused on longer-term Treasury rates, the specific timing of cuts doesn’t matter that much. What matters is there are about three more rate cuts priced in over the course of 2026, and no additional cuts priced into 2027. If the Fed cuts more times than three, we can expect Treasury rates (and thus mortgage rates) to decline. If these cuts don’t materialize, or worse, if the Fed winds up hiking, mortgage rates are very likely to rise.

We think there are three broad scenarios that will dictate what rates do over the next six months or so.

Scenario #1: Economy steady

With the government shutdown, there has been a dearth of official jobs data. However, as best we can tell, job growth is soft but still positive. If that were to remain the case over the next few months, the Fed would likely stop cutting after 2-3 more cuts. That is especially true if inflation remains materially above the Fed’s target, as we know the Fed is currently somewhat divided about cutting in December due to worries about inflation.

In that scenario, I would expect mortgage rates to remain in a range close to where they are now. Usually if the Fed simply delivers on the rate cuts markets expect, there isn’t much volatility in Treasury yields, which in turn would limit volatility in mortgage rates. It is possible there could be other drivers of Treasury market volatility, such as an unexpected increase in the budget deficit. However, the market knows that the deficit is large. The market also is expecting that some or all of President Donald Trump’s reciprocal tariffs will be declared illegal by the Supreme Court. It is unusual for anticipated events to create market volatility.

Scenario #2: Economy regains momentum

Another possible scenario is that job growth rebounds. Maybe the relatively weak job growth of recent months is due to consumers and companies adjusting to tariffs. It may also be that some of the tax cuts from the Big Beautiful Bill have a more noticeable effect in 2026 after impacted consumers file their 2025 taxes.

Regardless of the reason, if job growth were to rise back into the 100,000 per month range or higher, the Fed would certainly stop cutting. In fact, rate hikes would become a very real possibility. Right now labor force growth is very slow, due in large part to a lack of immigration. If hiring demand were to increase, firms would likely have to start raising wages to attract new workers. Rising wages can turn inflationary, which could spur the Fed to hike rates.

In this scenario, mortgage rates would almost certainly rise, probably back into the 7% area where they were in January. That was the last time the market had a high degree of optimism on the economy.

We think this is a somewhat less likely scenario. Most of the current indicators suggest that hiring demand is pretty weak, and there could even be signs that companies are increasing layoffs. For job growth to suddenly accelerate from these conditions would be unusual without some specific catalyst.

Scenario #3: Recession

If indeed layoffs become more prevalent, then a recession becomes a real risk. As we have highlighted in past articles, job growth has never previously been this slow without the economy subsequently falling into a recession. In addition, the Fed has clearly prioritized reviving job growth over fighting inflation, which suggests the Fed could get a lot more aggressive about rate cuts if there are even nascent signs of negative job growth.

In this scenario, mortgage rates could fall substantially. While we wouldn’t expect the Fed to cut rates all the way to zero as they did in 2008 or 2020, there is a lot of room for cuts. Currently the Fed’s target range is between 3.75% and 4.00%. It wouldn’t be hard to see them cutting into the 2% range given a real recession.

Exactly how much mortgage rates would drop in this scenario is tricky. Typically during aggressive Fed cutting cycles, Treasury rates fall, but longer-term rates don’t fall as much as shorter-term rates. Still, if the Fed were to cut all the way to 2%, we could certainly see mortgage rates fall into the low 5% area. If the Fed doesn’t cut that aggressively, perhaps because the recession is mild, then mortgage rates might end up somewhat higher.

What about 50 year mortgages?

The Trump Administration has said that housing affordability is a major priority. Although there are limits to what the Federal government can do on housing affordability, it does have some influence over the mortgage market. As we said previously, about 70% of all mortgages are guaranteed by one of the government agencies. These agencies are overseen by the Federal Housing Finance Administration (FHFA). President Trump as well as the FHFA director, William Pulte, recently said on social media that the agency was looking into creating 50 year mortgages as one idea to help with housing affordability.

The benefit of such a move for borrowers is that longer terms tend to lower the monthly payment, all else being equal. The monthly principal and interest payment on a 30-year mortgage for $500,000 at a 6.22% rate is $3,069. If that exact same loan were a 50-year term, the payment would be $2,713. That’s about a 12% savings, which initially sounds like a lot.

The key is whether “all else being equal” would actually hold in this case. First, when you add in insurance and property taxes, the percentage savings would be lower. Second, it is almost certainly the case that the rate on a 50-year mortgage would be higher than a 30-year. That would erode the savings. It is also the case that easier payment terms could cause home prices to rise. One of the reasons why home prices rose so rapidly in the 2003-2007 period was the proliferation of “affordability” mortgages. Rather than actually bring the cost of buying a home down, the cheaper mortgages just allowed buyers to bid up the price of the house.

So we shall see how serious this idea actually is. The Administration may just be brainstorming ideas, and this could have some kind of positive effect on affordability. But it may also be that when they analyze the impacts, net of all of the factors I mention above, it might be too small to be worth doing.

Will mortgage rates keep falling?

In the short-term, there probably is more room for mortgage rates to fall rather than rise. In the recession scenario, mortgage rates could fall by a lot. Whereas in the more optimistic economic scenarios, mortgage rates rise mildly if at all.

If you are hoping to refinance, unfortunately you might have to wait for a recession to do it. If you are looking to buy a home and are hoping that lower mortgage rates will help make that more affordable, don’t get too caught up in timing. It could be that falling rates cause home prices to rise, and you aren’t better off for waiting on rates. Or for that matter, rates might subsequently rise and you’ll wish you would have bought when you could have. Remember, you can always refinance!

More generally, buying a house is both a financial decision but also a life decision. If you can think about it in those terms, we believe you’ll tend to make better housing decisions.