The information provided is based on the published date.

Key takeaways

- Successfully timing the market by predicting recessions is nearly impossible, even for professional economists, making it a highly unreliable strategy for individual investors.

- The long-term financial cost of missing a market upswing is often greater than the benefit of avoiding a downturn, as historical data shows market gains are both larger and more frequent than losses.

- Instead of selling your investments due to fears of an AI bubble or a recession, a better approach is to build defense into your portfolio through strategic diversification and risk management.

- For long-term investors, focusing on the high probability that the market will be higher in five years is a more reliable guide for decision-making than trying to guess short-term market movements.

There’s a lot for investors to worry about right now. I’m pretty worried that a recession could be on the horizon. Job growth has recently slowed rapidly, while consumer confidence remains low, and tariffs are just starting to have an effect. Meanwhile, the stock market is trading near all-time highs. I’ve got some concerns that tech stocks in particular could have too much optimism embedded in current stock prices. I’m not alone in this concern. Recently Open AI CEO Sam Altman, which is the company behind ChatGPT, said that AI stocks may be in a bubble. Meanwhile, a recent report from MIT said that 95% of corporate AI projects fail to produce any results.

Despite these concerns, I’m not selling any of my investments, either personally or for Facet members. That may seem odd to you, I understand. But selling your stocks out of fear is almost always a bad idea. Even when those fears are legitimate. Here’s the reasons why.

The economy is difficult to predict

To start, predicting recessions is extremely hard. There are a lot of variables influencing the macro economy, and getting all of those right is a tough task.

To illustrate how difficult forecasting recessions, we can look at the Survey of Professional Forecasters, one of the most widely cited surveys of economists. In the 4th quarter of 2007, the survey indicated economists thought there was a 17% chance the U.S. economy would contract in the first quarter of 2008, and a 20% chance of contraction by the end of 2008. Note that by the 4th quarter of 2007, home prices had already been declining for more than a year and mortgage delinquencies were at multi-decade highs. And yet most economists only saw a 1 in 5 chance of a recession.

Perhaps even worse, when the NBER eventually dated the so-called Great Recession, they determined it began in the 4th quarter of 2007. So these economists thought there was only a 1 in 5 chance of a recession when in fact the recession had already begun.

Now this may sound like I’m poking fun at economists, and really I’m not. What I’m saying is that if professional economists can’t predict a recession that is already underway, then we should be humble about our ability to predict recessions in general.

In my career, there have been lots of moments where a recession seemed like a major risk, only to see the economy rebound. One such period was 2015, when a large drop in oil prices caused a sudden bust in U.S. production. This bled into the manufacturing sector and resulted in many energy-related companies to go bankrupt. And yet the economy kept growing.

Then again in 2022, it looked like Fed rate hikes could cause business spending to contract. The 4th quarter of 2022 was actually the highest recession odds ever recorded in the 57 year history of the Survey of Professional Forecasters. But in reality the economy accelerated and the stock market boomed in 2023.

Missing upside could be more impactful than avoiding downside

This might be a bit counterintuitive, but it is important to note: missing upside is worse for your portfolio than suffering through downside. The reason is because when the market declines, you know it will eventually come back. But when the market rises and you miss it, you can’t get that upside back.

Here’s an illustration of this point. Over the last 50 calendar years, the S&P 500 has had negative performance 18% of the time. So roughly 1 out of every 5 years. The average up year saw the S&P gain 19.6%, the average down year suffered a 13.1% decline.

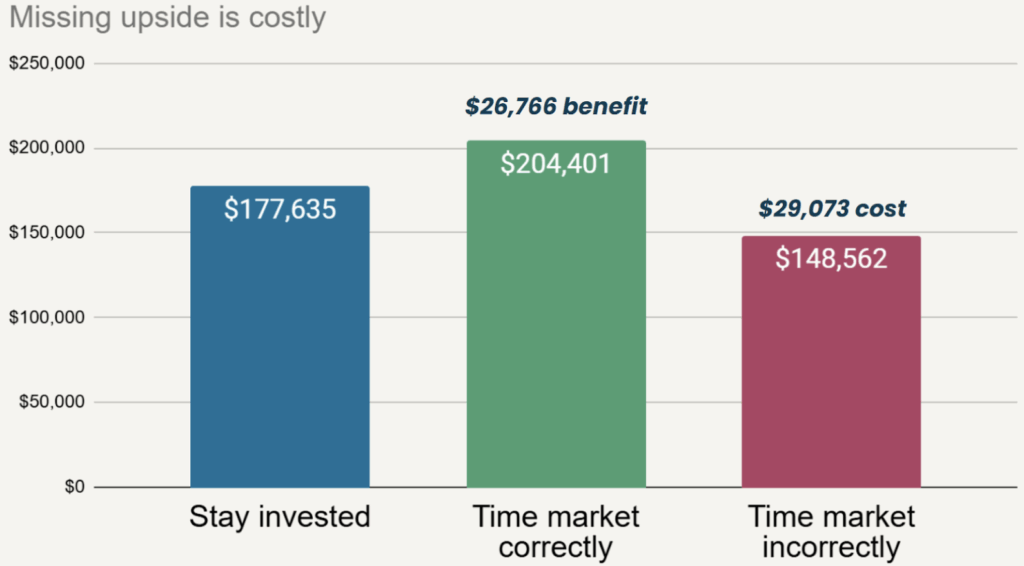

So let’s say you invest $100,000 for the next five years. One of those years the market will decline by 13.1%, the other four it will rise by 19.6% each. If you stayed invested all five years, your $100,000 will have turned into $177,635

Now let’s say you try to time the market, guessing that next year will be the one negative year. If you are correct and you avoid the down year, that boosts your return significantly. You’d end the five year period with $204,401. But if you guessed wrong and missed an up year instead, your portfolio would end at just $148,562.

Source: Dow Jones S&P Indices

Here we see the cost of being wrong is a bit higher than the benefit of being right. It gets even worse when you consider that stocks rise about 4 years out of 5. So if you try to time the down year, the odds are stacked against you.

It gets even worse when you consider how difficult it is to get back in the market after you sell. Say you tried to time the market in year 1, but turns out you were wrong. Stocks rose that year. Will you give up on market timing and buy back in? In my experience, most people don’t. They double down: guessing that if the down year wasn’t year 1, maybe it will be year 2!

This is how people fall irreparably behind. I knew people who sold stocks in the early days of COVID hitting. They looked like geniuses for a month or two, but who never got back into the market. As we now know, the market rose substantially for the full year of 2020 as well as 2021. Missing those big years would be incredibly damaging to your long-term portfolio results.

AI could be a bubble, or could save the economy

There’s no doubt there is a lot of hype around AI. In the intro I mentioned that OpenAI CEO Sam Altman has himself said the AI market might be a bubble. If you want evidence, look no further than the value of OpenAI itself. The company’s latest funding round values it at over $300 billion despite the company continuing to lose substantial amounts of money. The cost of creating new models is huge, and OpenAI needs to keep making these costly investments in order to keep up with competitors.

On one hand, you might say that such a thing isn’t sustainable. Eventually these AI companies need to start making real profits. If each new model of ChatGPT costs more money than the last, will there be commensurate profits? If not, at some point money from venture capitalists will dry up. Investors won’t be willing to continuously fund money losing investments. If that happens, it could severely impair the growth of cloud computing, which is big business for the likes of Alphabet, Microsoft and Amazon. That in turn would have a big impact on the Nvidia semiconductor chips that power these AI datacenters.

On the other hand, companies may decide that AI is too important of an innovation to slow investment spending. The collective capital expenditures on AI-related projects may have accounted for half of all GDP growth in the second quarter. Consulting firm McKinsey & Co. argues that AI spending will top $7 trillion over the next decade. If spending remains that strong, it could forestall a recession all on its own.

Here again is a great example of why trying to guess when to exit the market is so difficult. You can read about why AI is a bubble and feel like you should sell everything, but then read about how much real companies are investing in AI infrastructure and see it as a huge opportunity.

Better to build defense into portfolio

Here’s the good news: you don’t have to sell everything to play a little defense in your portfolio. Rather than try to time the market, I prefer to think in terms of risk and reward. We do think that some of the more speculative parts of the tech/AI world have more risk than opportunity right now. So we own less of those in our ETF mix. This is just one of several examples of how one can add some defense into your portfolio without selling everything. If it turns out AI is in a bit of a bubble, we will have saved ourselves from a little bit of downside. However if AI stocks keep powering higher, we think we’ll still mostly participate.

Alternative investments can be another option for building some defense. Or if you are mostly in U.S. stocks, consider adding some non-U.S. exposure. All of these are ways you can lean a little away from the riskiest parts of the market without all of the risks associated with market timing.

Focus on what you know, don’t guess

If you clicked on this article prepared to sell your stock portfolio, hopefully I’ve at least given you some pause. Let me leave you with one last thought. Most of us are investing for the long-term. Even if you are currently retired and drawing from your portfolio, most of your money is still going to stay invested for years to come. So ask yourself which of the following do you have the most confidence in being correct?

- That you’ll be able to correctly time both an exit and a re-entry into the market?

- Or that the market will be higher five years from now?

As I said at the outset, I do have my worries about the market right now. But I’m still equally confident the market will be higher in five years than it is today. Maybe returns will be mediocre over the next few years, but even if that’s true, I’m better off being invested than not.