The information provided is based on the published date.

Key takeaways

- Stocks fell last week, with tech stocks leading the way down.

- Meanwhile, small company stocks finished the week higher again, spurred higher by increasing odds of a Fed rate cut in September.

- The sudden divergence between tech stocks and everything else highlights the important of having a plan around each item in your portfolio, knowing how you will react to different market possibilities.

- Whether the tech selloff and/or the small cap rally can continue will likely come down to upcoming earnings reports.

Welcome to the latest edition of the Facet Investor Newsletter. I’m Tom Graff, Chief Investment Officer of Facet. It was a wild week in markets with a lot to unpack. We’ll cover a big reversal in tech stocks, the Fed firmly ready to cut rates, and how some traders are placing bets on a Trump win in November.

As always, we want your feedback! Anything from questions about what you are reading to suggestions on how to make this newsletter better would be greatly appreciated. Send me a note directly by emailing [email protected].

Market recap

On the surface, the market didn’t have that big of a move this week. The S&P 500 finished down just 2%. But the details are important here. Tech stocks got hit hard this week, especially the stocks that had been the market’s big leaders. Amazon, Microsoft, Apple, and Alphabet were each down between 3 and 6% last week, while Nvidia was down almost 9%.

Meanwhile most other stocks performed well. Of the 500 stocks in the S&P, 269 of them were higher on the week, and the Russell 2000 small cap index finished 1.7% higher.

The Federal Reserve continues to move closer to cutting rates. Last week Fed Chair Jerome Powell said that the Fed had gained more “confidence” that inflation was on a sustainable downward trajectory. Remember that Powell has been using the phrase “confidence” in describing when cuts might occur for several months now, so we can safely assume this is an overt signal to markets.

This week’s chatter

Traders spent the week debating exactly why the market seems to be rotating away from mega cap tech stocks, and in particular, why now?

On one hand, you could simply say that the AI trade had gone too far too fast. We discussed in our 2Q performance report that AI-related stocks accounted for all of the global stock market’s gains last quarter. Perhaps enough investors became too overweight these stocks and are now deciding to reduce holdings in favor of small caps or other sectors. The only problem with this theory is timing. Why now? AI-related stocks have been performing extremely well for more than a year now. Why the sudden need to rebalance now?

Another theory is that a Trump win in November could mean more tariffs on foreign trade. Larger cap companies tend to be more global in nature while smaller cap companies tend to be more domestic. There’s something to this, but I’m a bit skeptical that’s why tech sold off this week. Other global trade-heavy sectors like industrials and materials did well. If this were really just about trade restrictions, I don’t think the sell-off would be so concentrated in tech sectors.

Perhaps the simplest theory is that with earnings season upon us, some traders are worried that tech company profits won’t match Wall Street’s high expectations. After three consecutive quarters of excellent profit growth from the tech sector as a whole, driven mostly by AI-related spending, maybe this is the quarter where results aren’t as strong.

It is a good illustration of the fact that in real time, it is often difficult even for pros to know exactly why the market does what it does. It is also true that sometimes multiple narratives may be correct. E.g., the motivation for one investor to make a trade might not be the same as other investors.

For most investors the bigger question is whether this rotation will sustain. That will probably come down to upcoming earnings reports. If AI-related spending wanes, then certainly there are some stocks that will suffer a correction. If it doesn’t, then expect tech stocks to resume their upward trajectory. On the other hand, whether smaller cap stocks can keep outperforming large caps is probably also a matter of earnings. Small cap profit growth has lagged far behind their large cap peers over the last several quarters. If that can reverse, expect small caps to keep outperforming.

Pro corner

The volatility of the last couple weeks is a good illustration of why it is so critical to have a plan. Our approach is to outline a number of potential market possibilities over the next 12-18 months. Right now we’ve got 11 of them. One of those is titled “Spending on existing AI-related tech fails to meet expectations.”

Crucially, we didn’t predict that there would be an AI stock correction. Nor are we predicting one is coming. Rather we have a plan in case it happens. Our process outlines what indicators we’re looking for as indicators that this scenario is coming to fruition, what kinds of assets would perform well, what might perform poorly, etc.

Because we already outlined this as a possibility, we aren’t caught off guard when it actually happens. We aren’t scrambling to come up with a plan. We already have one. Specifically, we believe we have enough investments in other parts of the market that the overall Facet portfolio should hold up reasonably well relative to benchmark if this tech-led sell-off were to continue. Time will tell, and of course there are no guarantees, but we do have a plan.

Contrast that with not having a plan. You suddenly see some of your investments performing especially poorly. Maybe you didn’t realize certain ETFs you own are as tech heavy as they are. Or maybe you bought several stocks/funds that have performed well recently only to find that many of them are overexposed to the AI trade. Pros refer to these as “unintentional bets” and I argue they stem from a lack of planning and/or not fully fleshing out why you bought something in the first place.

This situation forces you to make a plan on the fly, and to do so in a high stress moment. It is very difficult to make objective decisions when your investments are dropping in value. In my 25 years in this profession, I’ve seen more critical mistakes made in these moments than any other time, even by experienced pros.

Note that sticking your head in the sand isn’t the same thing as having a plan. It is true that if you are a long-term investor, you shouldn’t get shaken by short-term volatility. But there are moments when it is necessary to make changes to a portfolio. Inaction isn’t having a plan.

Now I don’t want to blow the last couple weeks worth of volatility out of proportion. In the scheme of things, having the S&P drop a couple percentage points, or to have a high-flying sector suffer a minor correction, isn’t such a big deal. These things happen pretty routinely.

However I do think this is a small but important case study in how a well-planned portfolio can weather volatility. Whether this tech sell-off turns out to be a blip or the start of something bigger, you need to be prepared, have a plan, and use that plan to navigate through whatever comes next.

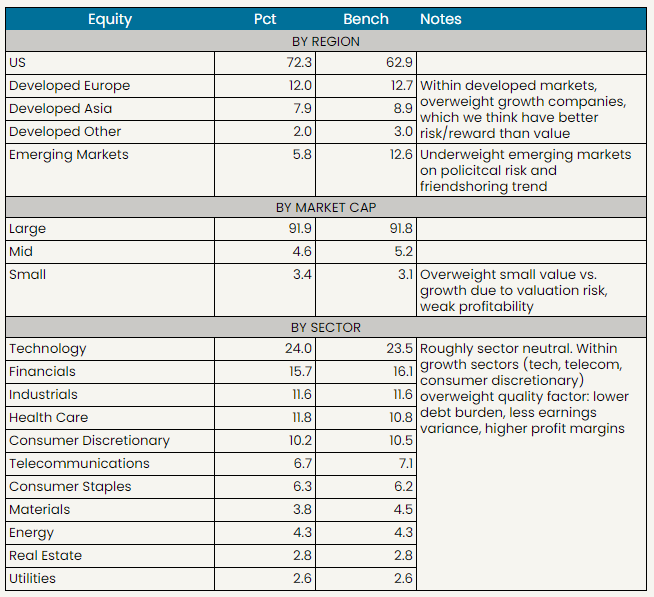

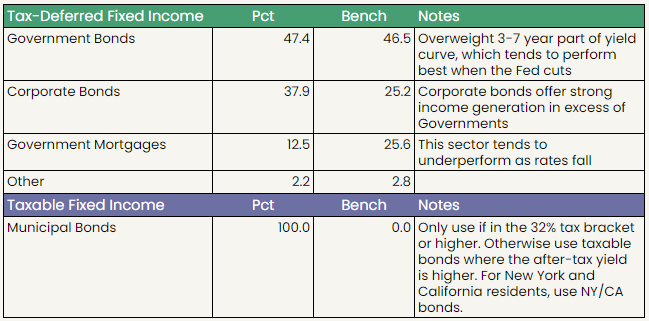

Facet portfolio positioning

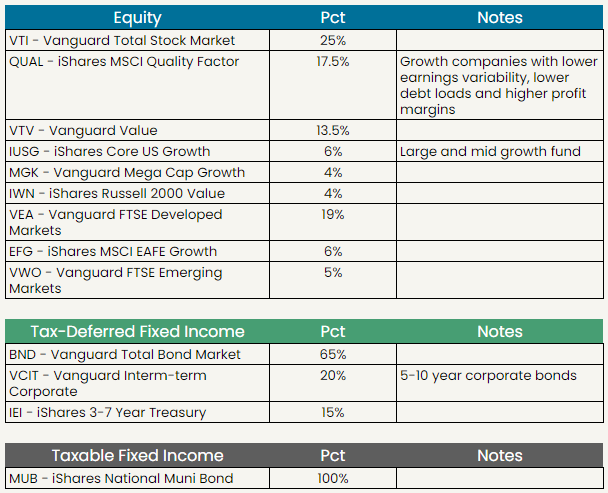

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.