The information provided is based on the published date.

Key takeaways

- Stocks rose last week, with tech stocks dominating returns.

- Macroeconomic data was mixed, with job growth solid but manufacturing and other data suggesting some softness in the economy.

- Next week the Federal Reserve meets on Wednesday, the same day as a key inflation report.

- The 10 largest companies in major U.S. indexes are bigger than ever. How should you handle this new level of portfolio concentration?

Hello, I’m Tom Graff, your Chief Investment Officer and welcome to another edition of the Facet Investor newsletter. This was a big week in markets, and next week promises to be even bigger. In this edition, we’ll cover a surprisingly strong jobs report, a surprisingly weak manufacturing report, the plunge in Gamestop, and answer a member question about increasing concentration within index funds.

If you have a question about investing or the markets, please send it in at [email protected]. I’ll either personally answer or maybe even cover your question in a future edition of this newsletter. We’d love to hear from you.

Market recap

The market started out June on the right foot, with the S&P 500 advancing 1.4% for the week, hitting a new all-time high on Wednesday before retreating a bit on Thursday. Tech stocks were the leaders, while energy stocks lagged behind as oil prices fell to 4-month lows. Small caps underperformed a bit, while emerging markets stocks rebounded after a brutal end to May.

Bond yields traded lower for most of the week on a series of relatively weak economic reports. That was basically all reversed on Friday when the May jobs report came out much stronger than expected. More on that below. Notable that stocks initially sold off substantially on the strong jobs report, but traded back to about flat by the end of Friday.

This week’s chatter

All eyes are on the Federal Reserve, which will meet next week. They’ve got a lot to chew on. Most of the economic data released so far in June indicates the economy softened a bit in May. On Monday, the ISM Manufacturing report showed that new orders fell to their lowest level in a year. On Tuesday, Job Openings fell again, now at the lowest level since early 2021.

This leads us to the jobs report on Friday. The official Bloomberg Economist survey had expectations at +185,000 for the May payroll level, but market expectation was actually skewed to the downside. The actual payroll gains came in at +272,000, beating everyone’s expectations.

How is the Fed going to react to all this? I’d say the strong jobs report eliminates any faint chance of a July rate cut that still remained. However I still think a September rate cut is still more likely than not. The May jobs report was solid but no sign of real overheating. All the Fed really needs to see is continued improvement on inflation, even if it is very slight. If that happens, the Fed probably cuts in September and maybe again in December. If inflation doesn’t improve, then all bets are off.

Lastly, there was certainly chatter about Gamestop stock, which plunged 39% on Friday despite Keith “Roaring Kitty” Gill holding a Youtube livestream to express how bullish he was on the company. The whole Gamestop episode, whether the last couple weeks or the even more wild 2021 period, is my go-to example of how the market is obviously not perfectly efficient. Rather I’d say it is mostly efficient, and when it isn’t efficient, it is mostly unpredictable. And if it is unpredictable, then there is no edge in trying to play the inefficiencies. You may as well just use index funds.

Pro corner

In last week’s newsletter we talked about dealing with concentration in your portfolio. One reader emailed in asking about concentration in the market itself. Today, the top 10 companies in the S&P 500 account for about 35% of the total index value. Ten years ago that was only 17%. Is this growing concentration something to worry about?

I decided to throw this into the “Pro corner” section of this newsletter because this is something actively being debated in the pro community. Some think it is a sign of an unhealthy market and others think it is no big deal. I’ll try to give you the short version of both arguments before giving my own take.

The argument that this concentration is concerning is similar to the bubble argument some people are making. This is something we’ve addressed in other articles. Specifically, there’s a claim out there that all the buying is concentrated in just a few stocks, implying that the rest of the market isn’t very healthy.

I don’t think this argument holds up to scrutiny. So far this year, the S&P 500 is up 12.8%. About 7.9% of that came from companies in the top 10 of weighting. But it isn’t like the other 490 companies are down. The weighted average return for the remaining companies is 6.9%. In other words, if Nvidia, Alphabet, Meta and the rest of the 10 largest companies didn’t exist, the market would be up 6.9% this year.

In reality what we have is most companies are doing well. A few companies are doing really well. That’s totally normal for a bull market. What’s abnormal is that the companies doing especially well happen to also be some of the largest companies in the index. I’m not sure why there’s anything unhealthy about that.

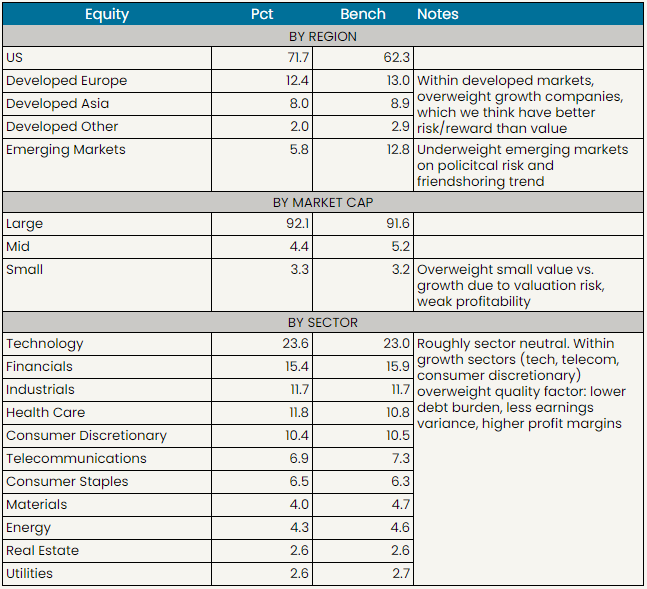

Now it is true that given how concentrated the top of the S&P 500 is, there is a risk that some of those companies could perform poorly and drag down the index return. To me, the best way to mitigate this risk is to be more diversified. The top 10 in the S&P 500 makes up 35% of the index, but the top 10 in Facet’s overall ETF mix only makes up 21%. That’s because our ETF mix also includes small cap, international, etc.

The other important reality is that today’s 10 biggest companies probably aren’t going to be in the top 10 forever. Say that over the next 2-3 years NVIDIA stock underperforms. Maybe it's because Qualcomm or AMD come up with new innovations that eat into NVIDIA’s dominance in AI-related chips. For index-based investors, this isn’t such a problem. You don’t need to correctly pick the winner! You own all three!

I think a lot of the worry over index concentration within the professional community comes from stock pickers. It does make stock picking more difficult when missing on just one of these mega cap winners can ruin all of your other good stock picks. This also isn’t new. The same complaints were being made about Apple a decade ago. I think for index-based investors, as long as you stay well diversified, this concentration risk isn’t something to be overly worried about.

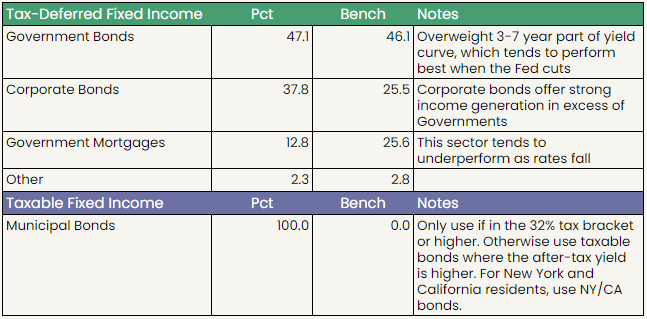

Facet portfolio positioning

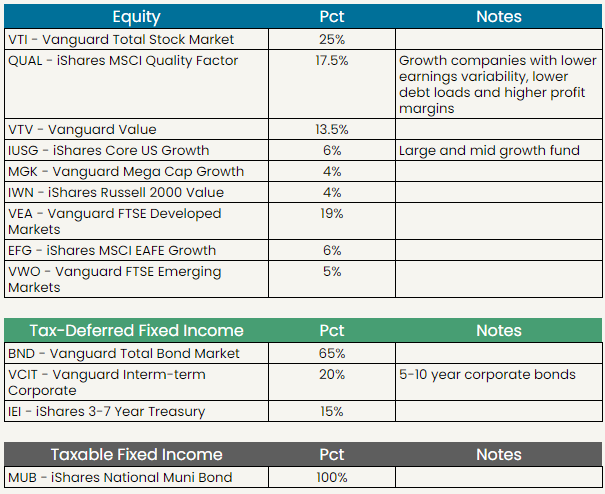

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.