The information provided is based on the published date.

Key takeaways

- Stocks rose this week, touching a new all-time high.

- The Federal Reserve cut interest rates by 0.50%, larger than the more typical 0.25%.

- This outsized rate was an attempt to get ahead of any developing economic weakness. If early Fed cuts help the economy avoid recession, history says this could be good for stocks.

- Longer-term interest rates climbed modestly, despite the Fed rate cut. This shows the importance of understanding what is “priced in” to markets.

Hello and welcome to the latest Facet Investor Newsletter. I’m your Chief Investment Officer, Tom Graff. I want to let everyone know that this is our final Investor Newsletter. But it’s not the end of our market insights. We’re moving that content to our YouTube channel where I’ll provide weekly updates. Additionally, please stay tuned for our member newsletter for more news and info from me and other Facet experts.

So, onto the news. It was a big week for the markets, and we’ll try to cover it all as best we can. The big event was of course the Federal Reserve cutting interest rates by 0.50%. We wrote a deep dive into why the Fed opted for the bigger cut in a Learn page article here. In this newsletter we’ll walk through how traders are thinking about the Fed’s next moves, plus how the pros deal with the challenge of knowing what is “priced in” ahead of events like Fed meetings.

Market recap

Stocks rose this week, with the S&P 500 adding 1.4%. The index hit an all-time high on Thursday before retreating slightly Friday. Gains were driven by a combination of the Fed’s 0.5% rate cut and some favorable economic news. This combination fueled hope that economic growth might reaccelerate.

Non-U.S. stocks had another strong week, continuing a recent pattern. The Fed rate cut helped push the dollar weaker, which boosted all non-U.S. returns. If the U.S. Fed winds up cutting more aggressively than other major central banks, this is a trend that could continue.

This week’s chatter

Coming into the Fed meeting, I’d say the trading community was divided into two major camps. One thought that the Fed should cut by 0.5% in response to nascent signs of labor market weakness. The other felt that a 0.5% cut was too much given that inflation is still above 2%, stocks are near all-time highs, and the jobs market isn’t that bad.

I was in the first camp and here’s why. Monetary policy operates with a lag. What this means is that when the Fed hikes or cuts rates, it probably takes several months for that change to reverberate through the economy. Because of this, the Fed can’t wait around for there to be obvious economic weakness to start cutting. By then it is too late.

We saw exactly this happen in 2021, only in reverse. In the summer of that year, inflation started to rise rapidly, but the Fed insisted inflation would be “transitory” and didn’t raise rates. That turned out to be a mistake. Had the Fed started hiking rates sooner, maybe inflation wouldn’t have been as bad as it was. But because they waited, and because policy works with a lag, it was two years before inflation started to come down in a meaningful way.

I argue Powell is trying to not repeat this mistake. By cutting 0.5% today (and probably cutting another 0.5-0.75% over the course of their next two meetings), the Fed is trying to get ahead of any weakness. Now we can’t know if it will be enough. I’m not super worried about a recession, but I do think that’s a much more salient risk right now than inflation.

Now let me quickly bust a couple myths running around the internet. First, the Fed doesn’t “know something we don’t” about the economy. In other words, this doesn’t reflect some behind the scenes panic by Fed officials. This is just risk management.

Second, let me bust the myth that the Fed rarely cuts rates with stocks near all-time highs. Generally speaking, the internet way over-rates how much the Fed even cares about the stock market. The Fed tracks inflation and unemployment. That’s it. They don’t try to manage stocks higher or lower. In reality, stock prices reflect how strong the economy is, so if the Fed does its job well, stocks should generally rise. But they aren’t trying to make stocks go up. It is just a consequence of good policy.

That being said, the Fed absolutely has cut several times with stocks near all-time highs. Since 1990, there’s been eight other times when the Fed has cut in such a situation. The average return for the S&P 500 over the year following those eight cuts? 25%. And all eight were positive.

Of course, we can’t guarantee that this time will produce the same results. But what this does say is if the Fed manages to get ahead of economic slowness with early rate cuts, the results have usually been quite good for investors.

Pro corner

We have talked in past newsletters of the challenge of determining what’s “priced in.” We used the example of Nvidia’s very strong earnings report last month as an example. By any normal metric, that earnings report was excellent. However traders were expecting it to be even better. Because of that, the stock dropped.

The Fed and interest rates are another great example of this problem. Hopefully this illustrates how critical analyzing the “priced in” effect is for getting any investment decision right.

On Wednesday, just before the Fed announced the 0.5% rate cut, the 10-year Treasury bond yield was 3.68%. Remember that markets were pretty evenly split on whether the Fed would cut by 0.5% or 0.25%, so no matter the outcome, markets would have to make an adjustment to reality. In other words, you would expect that Treasury bond yields would definitely move depending on what the Fed actually did.

So you might have been surprised to hear what happened next. Despite the fact that the Fed cut by the larger amount, bond yields rose on Wednesday and continued to rise on Thursday. It wasn’t by a huge amount. The 10-year yield was 3.73% at the end of Thursday. That’s nothing too momentous. But it is interesting that it was in the wrong direction.

What we are seeing here is that the long-term interest rate markets reflect a series of assumptions, not just one. Specifically, the 10-year Treasury yield today reflects the market’s assumption of Fed rate cuts over the course of the next several years. It is plausible that by cutting more aggressively up front, the Fed is actually reducing the total number of cuts necessary. Or put another way, if this rate cut helps avoid a deeper slowdown in the economy, that may result in higher interest rates down the road.

I bring this up for two big reasons. One is that we hear a lot of members asking about how lower interest rates will impact them. Be careful assuming that longer-term rates like mortgage rates will decline just because the Fed cuts. We talked about why this might not be true in our Fed reaction piece.

But more broadly this “priced in” concept tells us that the price of any investment reflects a series of known information as well as assumptions about the future. You won’t have investment success betting on events that everyone sees coming. You have to have a strong understanding of what is priced in to any investment you decide to make, and if you can’t figure that out, then don’t invest.

Facet portfolio positioning

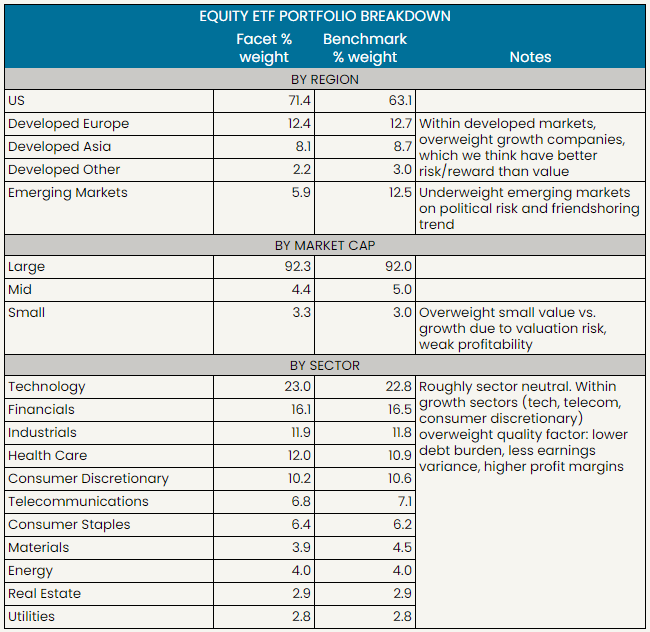

Here is a brief summary of how Facet’s exchange-traded fund portfolio breaks down in terms of regions, sectors and market capitalization. The benchmark is the Morningstar Global Index. This essentially allows for a comparison between Facet’s portfolio and the broad world stock market.

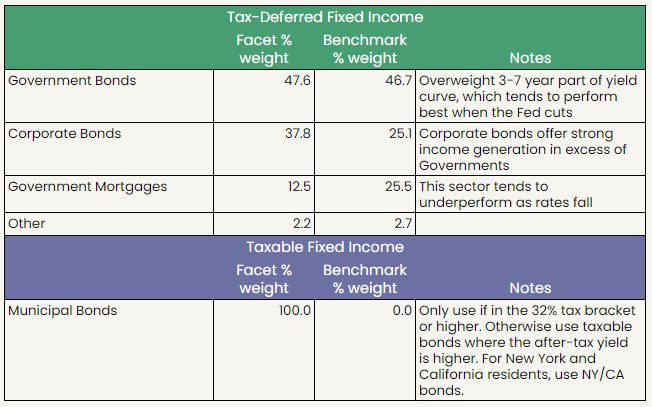

This is the same view but for Facet’s fixed income allocation. The benchmark here is the Morningstar U.S. Core Bond index.

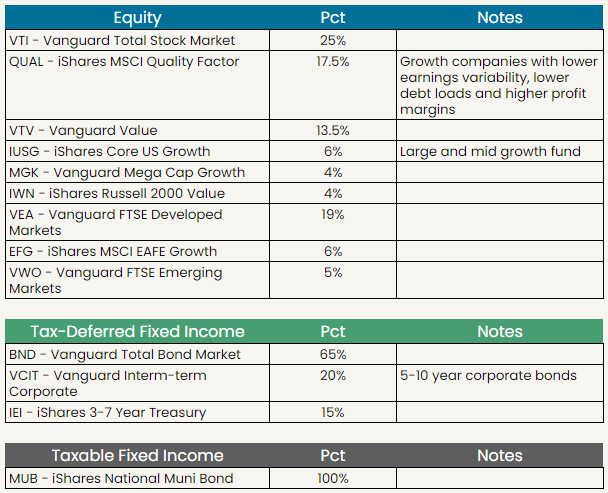

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.