The information provided is based on the published date.

Key takeaways

- Stocks were extremely volatile last week, suffering a 3% drop on Monday before rebounding later in the week to end almost unchanged.

- This volatility was brought on by some technical factors related to the Japanese yen and certain derivatives, but it was also partly about concerns over earnings and the state of the economy.

- The concerns about the economy could linger until at least the next jobs report, which does not come until early September.

- With heightened volatility, it can be especially difficult to maintain a long-term investing mindset. We give some tips on how to keep your focus on the right things even amidst volatility.

Greetings, I’m Tom Graff, your Chief Investment Officer. Welcome to the latest edition of the Facet Investor newsletter. It was quite a week and we’ve got a lot to cover. What caused the sudden market plunge on Monday? Why did the market rebound later in the week? And is all this volatility over or is this a preview of what’s to come? We’ll cover all that plus some tips on keeping a long-term mindset even when the short-term is so volatile.

Got questions about anything you read here? Or have something you’d like to see covered in a future edition? Please send us an email at [email protected]. We’d love to hear any feedback you have.

Market recap

It was certainly a wild week. On Monday the S&P 500 fell 3%, the worst single day for the index since September 2022. Monday was just the latest big move by stocks in what has been an increasingly volatile market over the last month.The culprit for all this volatility is really four things that came together at once:

- A surging Japanese yen. Many global investors borrow in Japan and invest that money elsewhere around the world. Therefore the surge in the yen’s value was effectively making this borrowing more expensive, forcing some to sell assets to cover.

- A jump in the VIX. The VIX is an index of implied volatility of the S&P 500. Essentially this is a measure of how expensive it is to buy and sell options on stocks. On Monday the VIX nearly quadrupled at one point before finishing the day about double the price from Friday. This caused a lot of challenges for traders in options.

- Worries of a U.S. slowdown. The most recent jobs report as well as a weak ISM Manufacturing survey sparked some worries that the odds of a recession have increased.

- Concerns about tech earnings. Overall this earnings season has been pretty good. Even in the tech space, revenue growth has been strong. However there’s concern that increased spending on new AI capabilities and capacity could crimp profits in the coming quarters.

We went into more detail on all this in our recent Town Hall which I hope you managed to attend. If not, we will have a link to the recording available soon.

For the rest of the week though, stocks managed to rise, erasing most of Monday’s losses. By Friday, the S&P finished almost exactly unchanged.

What happened to get markets to calm down? Some of it was actual news. On Wednesday Bank of Japan Deputy Sinichi Uchida said that Japan was unlikely to keep hiking rates if the market was unstable. This took considerable pressure off the yen. In addition, there was relatively benign report on new U.S. jobless claims on Thursday which allayed some fears of a deteriorating labor market.

However some of the rebound was probably that the forced selling caused by the yen and the VIX subsided. Eventually everyone who needs to sell has sold, and perhaps that was part of why the market was able to rebound later in the week.

I should mention that Facet did a tax-loss harvest on Monday. We managed to time that well, but I would encourage you to check your own portfolio for any tax benefits you can harvest.

This week’s chatter

Traders spent the week debating whether this recent bout of volatility was just a blip, caused by technical factors like the yen and the VIX, or is the volatility symptomatic of a shift into a longer-term negative trend.

Here’s my take. If we look at the four driving factors I listed above, two of them are short-term and two of them could be longer-term. I.e., if the U.S. economy is really slowing and if tech earnings continue to disappoint, those issues will keep driving the market. As I said above, technical things like the VIX can’t keep driving the market lower for weeks on end.

Right now, I don’t see the ingredients for either an extended earnings slump or a substantial recession. As we’ve discussed previously, the problem with tech earnings this quarter has been overwhelmingly about capex spending. Markets are worried that companies will invest too much in AI and not get the return on that investment. However as long as revenue continues to grow rapidly, this is just an expectations problem. Once the market adjusts expectations, the stocks won’t keep going down.

On the broader economy, it is slightly trickier. Recessions do come on suddenly. For example, job growth was solidly positive in the 6 months leading up to our last three recessions. Then suddenly, it shifted. This is why it isn’t completely unreasonable that some analysts took the soft jobs report from July concluded that recession risk had risen a bit.

That being said, there are constant recession head fakes. In other words, if you try to extrapolate every soft jobs report into more lasting weakness, you will wind up predicting several recessions that never come. As an example, the total number of U.S. jobs only increased by 0.07% in July, which is the slowest single month since 2020. However, consider that in the five years ending in 2019, monthly job gains were that slow or slower 11 times. It rebounded in subsequent months all 11 times.

This uncertainty is why we prefer to think in terms of possibilities not predictions. We aren’t predicting a recession or a prolonged earnings downturn. But we want to be prepared for either and have some parts of our ETF mix built to be more resilient in these scenarios.

Regardless, there will be a dearth of new data on either tech earnings or the economy for the next few weeks. This probably means the feeling of uncertainty among traders is going to stay with us at least until the data provides more clarity. Key upcoming dates are Nvidia’s earnings on August 28 and the August jobs report on September 6. Fed Chair Jerome Powell will also be giving a major speech at the Jackson Hole conference on August 22.

Pro corner

There is overwhelming evidence that market timing doesn’t work. And yet when the market is as volatile as it has been lately, many investors are tempted. Watching your portfolio go down in value triggers a well-documented response called “loss aversion.” It can make you forget about all the upside potential of staying invested over the long-run, giving you the urge to just sell everything and get out.

One solution is to just not look at the market. Now I admit, this is better than jumping in and out of the market. However if you are going to successfully manage your own portfolio, you have to take in the feedback the market gives you. Hence, you can’t just bury your head in the sand during down markets.

So how can you keep your focus on the long-term while still watching your portfolio in the short-term? Part of this comes from experience. I’ve been through several bear markets, and even more threatened bear markets, which definitely helps. But even if you are less experienced, here’s a few ideas that might work for you.

First, have a process around your decision making. If you have a system, you won’t just log into your account and do something rash. I find it helpful to have within your process rules for certain kinds of decisions you just won’t do. For example, our belief is that staying consistently invested has proven benefits, so we aren’t going to ever make the decision to completely exit the market.

Next, remember that we always assumed there would be volatility. In other words, you knew there were going to be bad days, months, years, etc., when you started investing. Just because those days come is no reason to panic. The S&P 500 is up 14% annualized over the last five years despite two bear markets. Volatility is just part of the game.

I also suggest not keeping score. When the market is up, everyone likes to calculate their net worth. It feels good! But then when the market is down, you start thinking in terms of a “loss” from your peak value. That can make the loss feel worse than it really is. Focus on analyzing how your investments are moving compared to each other. Don’t fixate on your total portfolio value day by day.

Lastly, don’t get wrapped up in narratives. When the market is down, all the people you’ll see on TV will be talking about the reasons why it is down. So these negative arguments will sound more convincing at that moment. Remember that there is always a bullish and a bearish argument. Don’t assign more weight to one or the other just based on short-term market movement.

I know all this can be tough. I’ve been at this for 25 years and I still build in various ways of guarding against my own psychology. So don’t forget to use Facet as a resource. You can email me at the address above or contact your planning team. Helping you stay on track is part of our job, so make sure you take advantage of that!

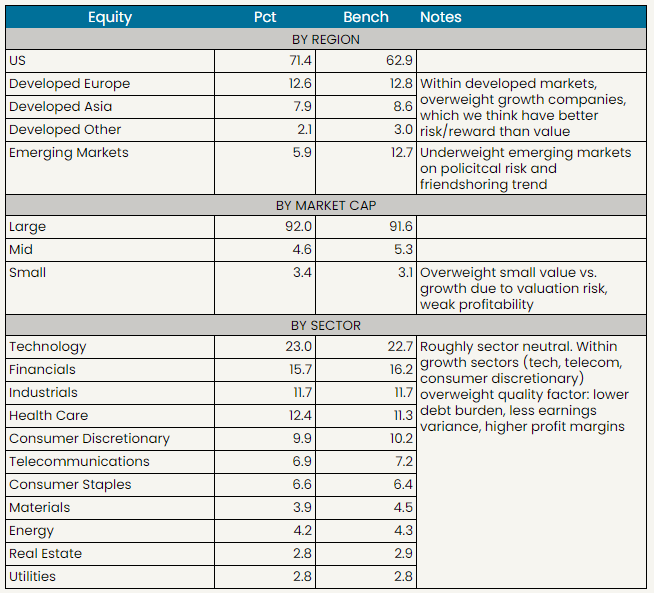

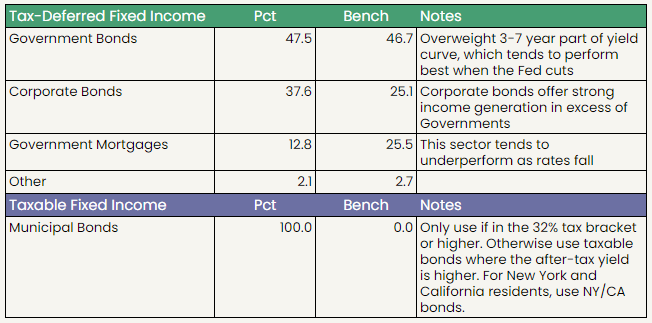

Facet portfolio positioning

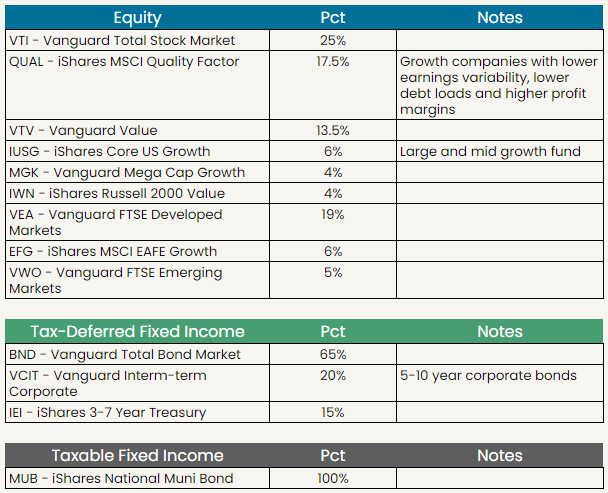

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.