The information provided is based on the published date.

Key takeaways

- Last week's positive earnings reports, especially from tech companies, outweighed negative news on inflation.

- Meta's increased spending on AI, despite hurting its stock price, indicates a larger trend of companies investing in AI, which could benefit the overall economy.

- Strong earnings growth is a more important driver for stock prices than interest rates given the current market environment.

- We expect the Fed to maintain a data-dependent approach and avoid making strong commitments about future rate cuts.

Hello and welcome to another edition of the Facet investor newsletter. I’m your Chief Investment Officer Tom Graff. This week we’ve got some wild market swings coming from company earnings and macro economic data, which we’ll try to help you sort out. Plus, I’ll go into some detail about how we integrate company earnings reports in our investment process, using Meta, Alphabet and Microsoft’s reports as examples.

If you have any questions about what you are reading, or just about markets in general, please send them in! Access to me and my team is part of your Facet membership, so use it! We’d also love to hear any other feedback you have on this newsletter: what do you like, what you don’t like, should we keep doing this, etc. Email us at [email protected].

Market recap

Stocks rose this week in a broad rally. The S&P 500 was up 2.7%, which marks the first winning week of April. Earnings season continues, and so far things have been broadly quite positive. This week earnings news was able to overwhelm more negative news on inflation. Odds of Fed rate cuts continue to fade, as a relatively high Core PCE inflation report has traders now thinking just one rate cut in 2024 is the most likely scenario. That pushed the 10-year Treasury to a new YTD high in yield of 4.70% before retreating slightly on Friday.

This week's chatter

Earnings was the dominant story this week, with reports from Tesla, Meta, Alphabet and Microsoft among dozens of others. Coming into this earnings season, traders were looking to get answers to two big questions. First, will the boom in AI spending continue to boost tech earnings? Second, can companies overcome interest rates staying higher for longer? I’ll get into more detail in the next section, but so far the reports from Meta, Microsoft and Alphabet are supporting the AI boom story.

We’ve brought this up several times but I’m going to keep emphasizing it. Stocks can easily keep climbing if earnings growth remains strong, regardless of what interest rates do. It is probably true that if inflation were subsiding more quickly, stocks would be even higher. So what the Fed does matters. But it isn’t dominant. We’re going to stay focused on profit growth as the primary driver, and the Fed as a secondary factor.

Next week we’ll get a Fed meeting on Wednesday. I expect the Fed will downplay the chances of near-term rate cuts, but this won’t surprise anyone. The theme will be flexibility and data dependency. I still think the Fed would prefer to cut once or twice this year, but inflation data will have to cooperate. I also think Powell will strongly downplay the chances of rate hikes. If inflation stays high, they just won’t cut.

Meanwhile earnings will continue to come in heavy. The biggest company reporting this week will be Amazon on Tuesday, with a number of consumer companies (Coca-Cola, McDonalds) and semiconductors (NXPI, ON) also likely to be market movers.

Pro corner

Speaking of earnings, the market went through a bit of a whipsaw this week. How it played out makes for a good illustration of why we spend so much time reading earnings reports even though we aren’t picking individual stocks.

On Thursday, stocks fell substantially on a disappointing report from Meta, parent company of Facebook and Instagram. Meta’s core financials were all positive: revenue rose 27% and profits doubled. Both of those were better than Wall Street expected. The problem was that the company said they’d be spending about $5 billion more than previously forecasted on investments in AI technology and infrastructure. That amounted to about a 20% increase in total spending on total capital expenditures for Meta. Meta’s stock itself was down as much as 15% on Thursday, closing down about 10%.

Facet is invested in Meta indirectly through the ETFs we own, just like we basically own every stock. So why bother spending time understanding this Meta report in detail? Because it gives us several important clues about the broader economy as well as market sentiment.

First, there’s been some talk that there’s an AI bubble going on right now. So it is notable that the market punished Meta for making a big push into AI. Meta CEO Mark Zuckerberg said that these investments would turn into higher profit growth in the long term, and that may well turn out to be the case. But currently markets want companies to focus on profitable growth as opposed to big spending on an uncertain future. In other words, the market still has limited tolerance for companies taking big risks.

Second, Meta is spending this extra $5 billion on things like servers, cloud computing capacity, semiconductors, etc., in their AI push. All those things are costs for Meta, but their revenue for the companies that produce those things.

Enter Alphabet (parent of Google) and Microsoft, which reported earnings the next day. Both companies said that growth in cloud computing was being boosted by AI demand. And both companies are benefiting from adoption of their own in-house AI tools (Gemini for Alphabet and OpenAI/ChatGBT for Microsoft).

So if we rewind to Meta’s results, a stock picker probably gets nervous that Zuckerberg is taking too big of a risk and/or maybe losing cost control discipline. That’s bad for Meta specifically. But Meta investing that aggressively on AI capabilities probably means other companies will as well. From a macro perspective, a boom in investment spending is great news. Not only does it benefit the companies that sell AI-related software and other infrastructure, investment spending tends to boost productivity over the long-run.

Bringing it back to how Facet invests, we recently added a mega-cap growth fund (Vanguard Mega Cap Growth, ticker MGK) partly because we felt the companies within it were in a good position to benefit from this investment boom. Even though that fund underperformed on Thursday, we felt like the details of Meta’s report was positive for that fund’s longer-term prospects. Now we don’t usually get the one-day turnaround that we got this week, but this episode does illustrate how to put individual company reports into a more macro context, and then apply that to investment decisions.

Facet portfolio positioning

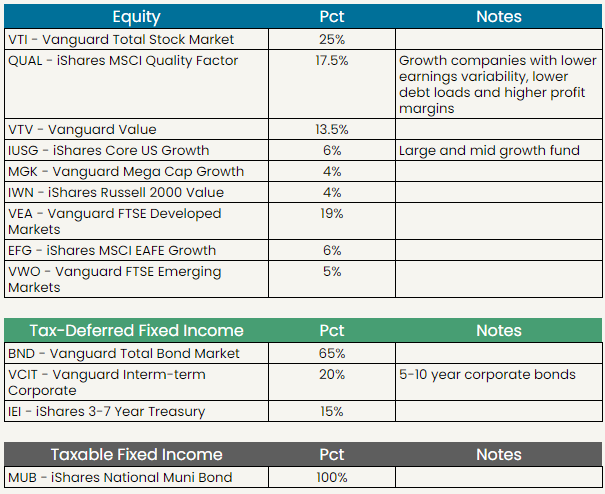

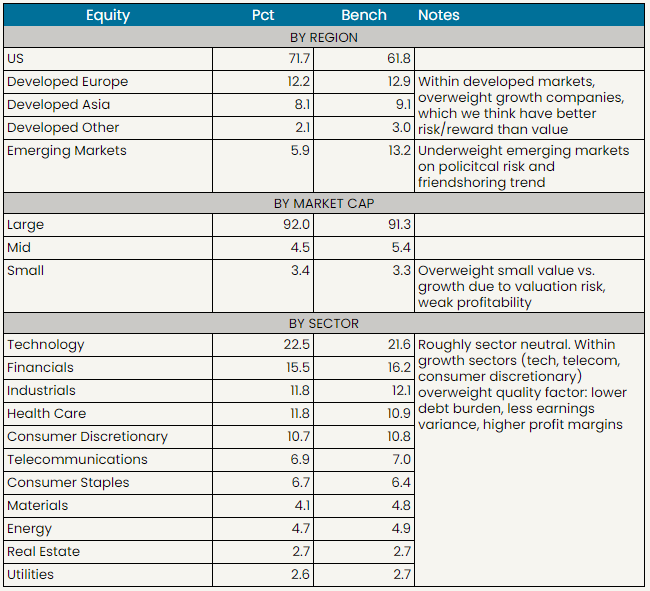

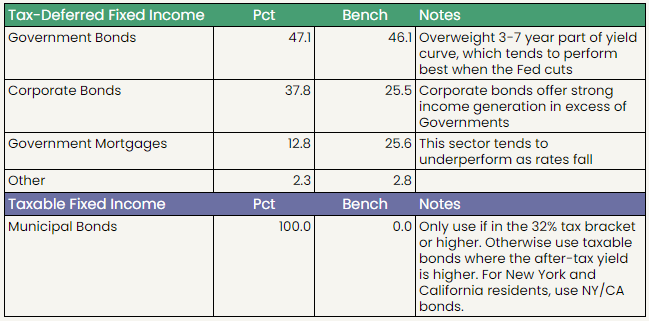

Facet's current ETF model