The information provided is based on the published date.

Key takeaways

- Stocks fell last week after some soft data on job gains and manufacturing.

- This has investors debating whether recession risk has increased.

- The Fed is likely to be at least somewhat concerned by the softness in the jobs market, and this could lead to them getting more aggressive on rate cuts.

- It is a good idea to have some defense in your portfolio, but be careful not to make it a one-way bet.

Hello again and welcome to another edition of the Facet Investor Newsletter. I’m Tom Graff, your Chief Investment Officer. This week we’ll cover a tough week for stocks, highlighted by some disappointing data on the labor market. Is the market worried about an impending recession? And what does it mean for the Federal Reserve’s big meeting on September 18? Plus how Facet thinks about adding defense into portfolios in a world of such high uncertainty.

We have been running this newsletter for a few months now and would love to hear from you how it is going. Is it helpful? Would some other format be more helpful? Please send us any thoughts you have at [email protected]. Thanks in advance!

Market recap

The S&P 500 fell 4.2% this week, highlighted by a disappointing jobs report on Friday. Markets also contended with a relatively weak report on manufacturing on Tuesday. Semiconductor giant Broadcom also reported earnings that were very strong, but similar to Nvidia last week, future revenue guidance was not as strong as traders expected. Semiconductor stocks fell 13% this week.

Just about all corners of the market were sharply lower, but value-style stocks did outperform mildly. Small caps underperformed, which fits the “risk-off” attitude of the market this week. Non-U.S. stocks outperformed, owing mostly to dollar weakness.

This week’s chatter

This week traders were primarily debating two things: has recession risk increased? And will the Fed get more aggressive with rate hikes? I’m not going to cover the jobs report in-depth here, as we wrote a longer-form article on the Learn page. Here let’s focus on what the pros were saying behind the scenes about the state of the economy.

While stocks did drop significantly this week, it wasn’t a typical “recession fear” trade. Classically when markets start to price in a recession, you would see so-called “cyclical” stocks underperform. We didn’t see that this week, with sectors like consumer discretionary, business services, autos, travel stocks, etc., all outperforming. Perhaps a bigger tell was in the credit market. Typically prices on high-yield bonds (also known as junk bonds) are extremely sensitive to recession risk. This week high-yield bonds actually rose in price.

I think what we’re seeing is traders grappling with what the pace of earnings growth will be over the next few quarters. I don’t see the ingredients for a recession right now. Typically recessions stem from economic imbalances, and there just aren’t any obvious candidates right now. I wouldn’t say there is zero risk of recession, as we’ll discuss in the next section. But I don’t think the risk is high.

That being said, this might be enough to sway the Fed to get more aggressive with rate cuts. In August, Chair Jerome Powell said “We do not seek or welcome further cooling in labor market conditions” and later added that the Fed was prepared to respond to “unwelcome further weakening in labor market conditions.”

So I’d say that if the Fed views the August jobs report as “unwelcome further weakening” then a 0.5% rate cut on September 18 becomes a very real possibility. Alternatively, they could do the more traditional 0.25% cut, but have Powell telegraph a bigger cut in the future should there be more labor market weakness. Either way, expect the Fed to come out sounding ready to cut very aggressively over the next few meetings.

Pro corner

Remember that Facet’s approach to investing isn’t about forecasting events. So when I say recession risk is relatively low, but not zero, that means it is a scenario we’re considering.

If there is a recession, there’s a good chance stocks are lower. Over the last 50 years, stocks have been negative in any calendar year that includes a recession 50% of the time. That jumps to ⅔ of the time in the first calendar year that includes a recession. It makes sense to want to have some protection in your portfolio in case a recession hits.

However you also don’t want to be too defensive. Remember the real risk most investors face is the chance that their portfolio doesn’t grow adequately to meet their goals. I.e., if you need your portfolio to grow 6% to retire on-time, the real risk is that your portfolio only grows 4-6% over time. Volatility over shorter periods isn’t your main risk.

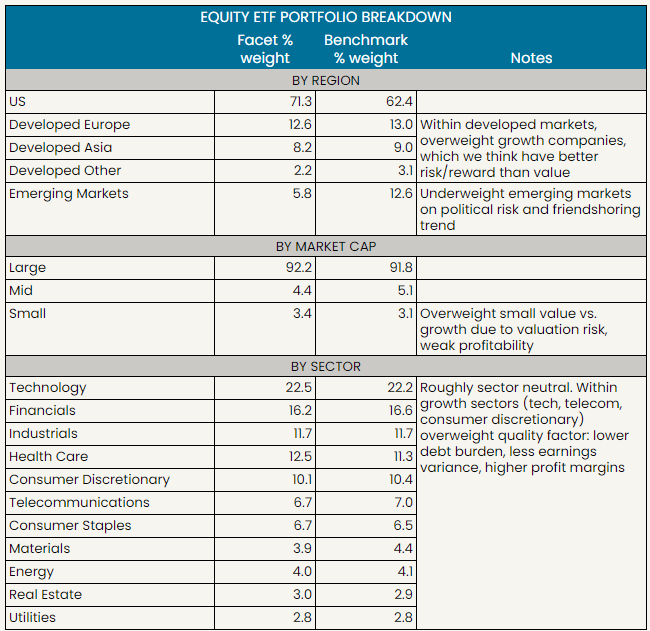

The way we try to strike this balance is by keeping a steady allocation between stocks and bonds, while building in some defensiveness within the portfolio. Right now that includes several overweights or underweights vs. our benchmarks that we think could mitigate losses in a recessionary scenario.

- Overweight companies with high profit margins and less revenue volatility

- Underweight companies with high debt burdens

- Underweight cyclical companies in non-U.S. markets

- Underweight emerging markets

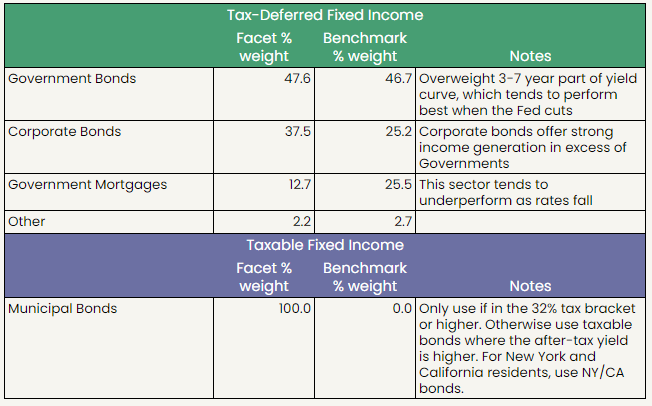

- Overweight bonds in the 3-7 year maturity range, which tend to outperform as the Fed is cutting rates

We believe each of these positionings could mitigate volatility in a recession scenario. That doesn’t mean we will completely side-step a major downturn. However we think this combination may preserve some capital in a recession, which could put you in a better position to perform well during the rebound.

Importantly though, this approach could also produce solid performance if the recession never comes. We have been adding these defensive positions over the last two years, which has been a period where the stock market has been strongly positive. Facet’s portfolios have kept up with, and generally exceeded, our benchmark during this period.

If you are investing on your own, I’d encourage you to try to think along these lines. What kinds of positions should I be holding such that I’ll be comfortable in any scenario? If a recession does hit, you’ll know you’ve got some defense. But if the economy keeps humming along, you also want to be confident that your portfolio will keep up with a rising market.

Facet portfolio positioning

Here is a brief summary of how Facet’s exchange-traded fund portfolio breaks down in terms of regions, sectors and market capitalization. The benchmark is the Morningstar Global Index. This essentially allows for a comparison between Facet’s portfolio and the broad world stock market.

This is the same view but for Facet’s fixed income allocation. The benchmark here is the Morningstar U.S. Core Bond index.

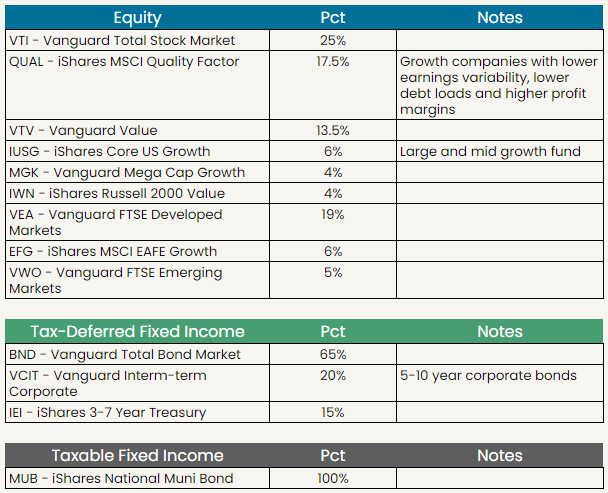

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.