The information provided is based on the published date.

Key takeaways

- The stock market moved sideways last week with tech stocks being the only bright spot, fueled by strong earnings from NVIDIA.

- The biggest cause for market volatility was rising interest rates as the Fed minutes came off sounding more hawkish than expected.

- Investors should focus on downside risk in the context of their financial goals, not just volatility.

- Strategies that aim to reduce volatility often come at the expense of long-term returns, and covered call strategies are a prime example.

- The best way to deal with market volatility is to stay diversified and invested for the long term.

In this week’s edition of the Facet Investor Newsletter: big earnings from NVIDIA fails to buoy the market, the Fed might be considering rate hikes, and the right way to think about downside protection in your portfolio. I’m Tom Graff, Facet’s Chief Investment Officer here to cover all of this and more. Thanks for reading.

Remember that if you have any questions, either about topics in this newsletter or anything else about investing, please e-mail us at [email protected]. The investment group is just one of the teams of experts you get as Facet members and we welcome your e-mail.

Market recap

Stocks moved sideways for the week with a fair amount of volatility. The S&P 500 finished up 0.05%. Tech stocks were really the only sector that was up, fueled by strong results from NVIDIA. Make no mistake, NVIDIA’s earnings were incredible, and certainly supports the idea that the AI boom continues to gain momentum. However it wasn’t enough to alleviate market fears about rising interest rates. Beside tech and telecom, the other nine major sectors in the S&P 500 were all lower on the week. Small caps and emerging markets also underperformed.

Rising interest rates were the main cause for stock market volatility. The biggest single event was the minutes being released for the Fed’s May meeting. The minutes came off sounding a bit more hawkish than Chair Jerome Powell’s press conference after the meeting, and this put upward pressure on Treasury bonds. The 10-year Treasury yield ended the week at 4.47%, up from as low as 4.34% last week.

This week’s chatter

We talked last week in this newsletter about how there’s a lot of skepticism among investors, which stands in contrast to the fact that stocks are trading near all-time highs. This skepticism was really driven home this week. NVIDIA’s earnings were supposed to be the dominant driver for the week, and the company’s results could hardly be better. Revenue tripled for the quarter, easily beating Wall Street expectations. Moreover, CEO Jensen Huang said that we were on the cusp of a “new industrial revolution” and emphasized that it plans to expand from mostly serving giant data centers to other markets, including consumer, carmakers, biotechnology and health-care customers.

Despite all that positivity from a company truly at the center of the AI boom, the market wound up down sharply after NVIDIA’s earnings were released. The S&P clocked its worst day of May, down just under 1% on the day. NVIDIA itself was up 10%, but the rest of the market was down.

So what can we make of this? There were rumors floating around that the drop in stocks on Thursday was related to the large Asian hedge fund Segantii shutting down. Impossible to know if that’s true, although the fact that the markets rebounded on Friday would fit such a story.

Either way, this is an example of the old Wall Street saying: “bull markets climb a wall of worry.” That is to say, even in bull markets, there’s always something to worry about. But if those “worries” don’t come to fruition, or turn out to be minor events, then the market just keeps climbing higher. Now I don’t know what comes next more than anyone else, but we remain inclined to believe that if earnings keep growing at a strong clip, stocks have every reason to keep going higher.

Pro corner

Speaking of skepticism, let’s talk about the right way to think about risk in your portfolio. For individual investors, there is exactly one risk that really matters: the chance your portfolio won’t return enough to meet your financial goals.

E.g., if your portfolio needs to grow 6% per year over the next 15 years for you to retire, then the only risk that matters is the chance that the portfolio grows by less than 6%.

Often in finance, we use volatility as a stand-in for risk. To be sure, volatility is related to risk, but if one only thinks about risk in terms of volatility you will be apt to make some bad mistakes. To use an extreme example, a Treasury Bill (T-Bill) has almost no risk of ultimately losing you money. In terms of volatility, it is a very low risk asset. But if the T-Bill yields 5% and you need to make 6% to reach your goals, then a portfolio of T-Bills is very risky to you!

It is in this context that any decision about making your portfolio “safer” needs to be considered. Some decisions, like increasing diversification, can narrow the range of returns. That indeed makes it more likely that you will hit your return goal.

What we see too often is investors buying funds that might lower short-term volatility but at the expense of long-term returns. There could be circumstances where this makes sense, but only if doing so increases the odds of making your goal.

Unfortunately there’s no free lunch. Any strategy that purports to have more stability probably has lower return too. One strategy we’re often asked about is a “covered call” strategy, which is where you buy a stock and then sell a call option on that same stock. There are many ETFs that pursue this same strategy, and the selling point is that they give you more income which can offset downside markets.

In reality, this doesn't work. In big down markets, covered call strategies take most of the downside. In big up markets, the strategy only captures a fraction of the upside. On net, that leaves these kinds of strategies way behind. The Invesco S&P 500 Buy-Write ETF is only up 5.1% in the 10-years ending April 30, vs. 12.4% for the S&P 500.

Psychologically, stomaching the market’s volatility can be difficult. But once you have adequately diversified your portfolio, from there the best thing you can do for your long-term returns is to stay consistently invested and not worry so much about shorter-term volatility.

We wrote a long-form article about the subject of downside protection strategies last year, which I encourage you to check out. But if you have specific questions, feel free to email us at the link above.

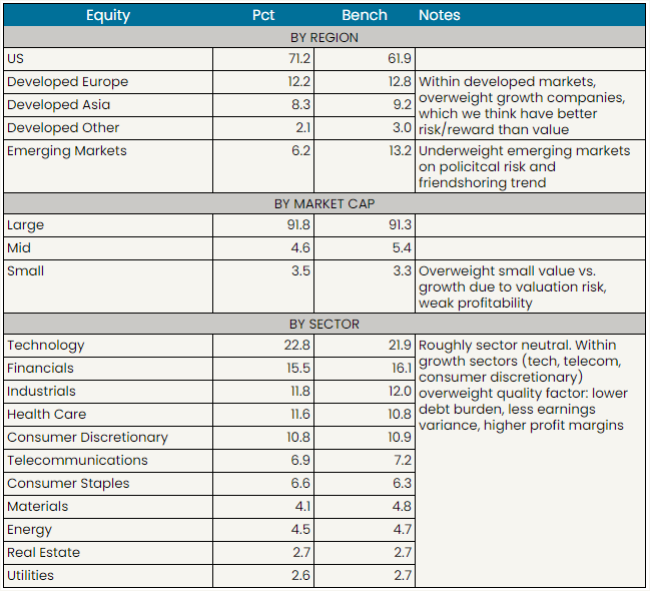

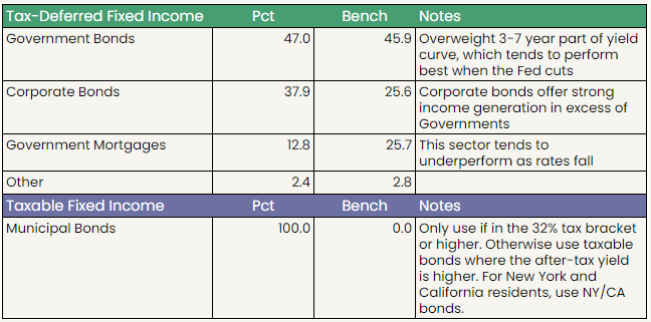

Facet portfolio positioning

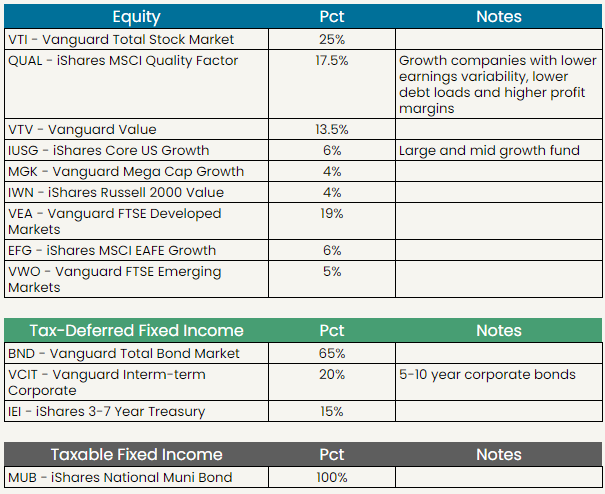

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.