The information provided is based on the published date.

Key takeaways

- Stocks had a strong week, continuing a rebound from the early August volatility.

- Large tech companies and non-U.S. stocks were the best performers, but it was a broad-based rally.

- Positive news about the jobs market and consumer spending buoyed stocks, but also resulted in bets on Fed rate cuts fading.

- It is easy to fall into the trap of overconfidence. We discuss how you can keep an open mind to various market possibilities.

Hello and welcome to another edition of the Facet investor newsletter. I’m your Chief Investment Officer Tom Graff. This week we’ll cover a big market rebound, Fed rate cut bets on the wane, and some encouraging signs on consumer spending. Plus a preview of a major speech by Fed Chair Jerome Powell next Friday and how to avoid overconfidence when making investment decisions.

Have questions about anything investment related? Or feedback about this newsletter? Send us a message at [email protected]. Access to our professional investment team is part of your Facet membership, so use it!

Market recap

Stocks rose steadily this week, with the S&P 500 adding 3.9%. The index is now less than 2% from its all-time highs. It was a broad-based rally, but rebounding megacap tech stocks did lead the way. Most of the so-called “Magnificent 7” was up 10% or more on the week. Stronger economic data (detailed in the next section) eased worries of some kind of imminent slowdown.

Global stocks also rose, especially developed markets. The somewhat weaker dollar so far this quarter has helped developed markets outperform the U.S. by 1.4% over this period.

Longer-term interest rates were about unchanged, but short-term interest rates rose significantly as traders decreased bets on near-term Fed rate cuts.

This week’s chatter

Ever since the somewhat soft jobs report two weeks ago, traders have been hyper-focused on any data that might give additional clues about recession risk. Somewhat predictably, this has people kind of grasping at straws. The last two weeks this has been especially evident in Initial Jobless Claims, which measures how many people filed for unemployment benefits for the first time. In theory, this is a great stat to watch, as it should give some clue about whether layoffs are increasing. However, in practice the number comes out every week, and tends to bounce around in ways that are mostly just random noise.

Last week it was reported that 227,000 people filed an initial claim. According to Bloomberg, the expectation was for 235,000. So 8,000 fewer people lost their jobs than was expected. To put that into context, there are 168 million people in the U.S. labor force. A difference of 8,000 is just not very meaningful.

This is kind of like if you were sitting outside and the temperature drops from 91 degrees to 90.5 degrees and someone tells you it is “cooling off.” I suppose in some sense, sure. But not in any way that actually matters. I actually find evidence like the fact that the number of companies discussing layoffs in their earnings report declined this quarter as much more convincing.

Regardless, the market celebrated this slight drop in jobless claims. It was a major driver of why the S&P 500 jumped 1.6% on Thursday.

To be fair, there was also some positive news on consumer spending Thursday as well. That morning Walmart reported earnings and not only had stronger sales figures than Wall Street expected, but the company also raised their guidance for the next two quarters. Then that same morning the Census Bureau reported that Advance Retail Sales grew at a stronger pace than expected as well.

The combination of all this had market participants backing off the idea that a recession could be imminent. Not only did this lift stocks, but it also had traders reducing bets on Fed rate cuts. Last week markets had priced over 80% odds of the Fed cutting rates by 0.5% in September, but those odds are now more like 20%.

Speaking of the Fed, Jerome Powell will be giving the opening address at the Jackson Hole conference on Friday the 22nd. This is typically one of the biggest speeches the Fed Chair makes each year. I suspect Powell might use the opportunity to shape how the Fed is thinking about rate cuts over the next several months. Look for this to be a major market mover next week.

Pro corner

After the relatively soft jobs report two weeks ago and ensuing market drop the next few days, famed Wharton economist Jeremy Siegel went on CNBC and said the Fed needed to do an “emergency” 0.75% rate cut. Less than a week later, with stocks seeming to recover quickly, he recanted.

Basically Professor Siegel had become absolutely convinced that the economy was headed into a major slowdown on Monday, but by Friday had relaxed his views.

In the TV personality business, you kind of have to make audacious claims in order to get people’s attention. But when it comes to investing, having this kind of absolute conviction is dangerous to your financial health.

When we come up with an investment idea at Facet, one of the things we always do is simultaneously come up with a counter thesis. In other words, if there’s an ETF we want to add more to the portfolio, we not only write out why we think it is a good add, but we also make the argument for why it might underperform. I view this as an absolutely critical part of our process.

We do this because in an efficient market, there’s always an upside and a downside case for everything. From individual stocks, to the broad market, to interest rates, etc. Today’s price of any asset is set where buyers don’t want to buy anymore and sellers don’t want to sell anymore. Or put another way, a stock’s price keeps going up until there’s an equal number of people who think the stock is cheap vs. those that think it is expensive. Same goes for an ETF, or for the whole market.

As an example, say you think tech stocks are going to outperform in the future. You should map out your reasons why you think they will do well. But you should also map out why an intelligent, logical, and well-informed person would think the opposite. Only once you truly understand this counter argument can you know the risks inherent in your trade.

Or put another way, if you can’t think of why a trade doesn’t succeed, you haven’t done enough work yet.

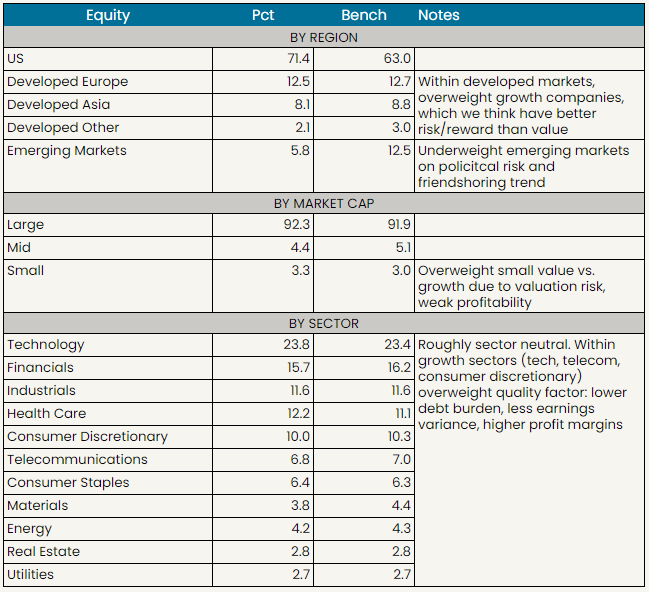

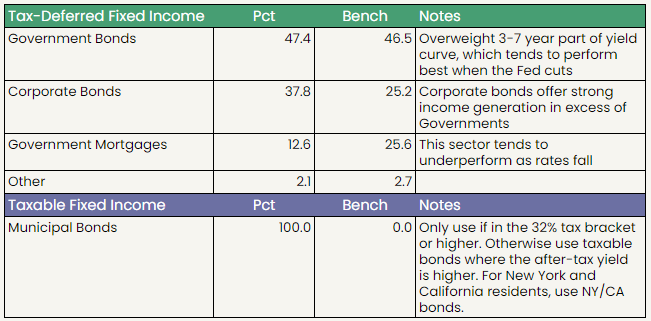

Facet portfolio positioning

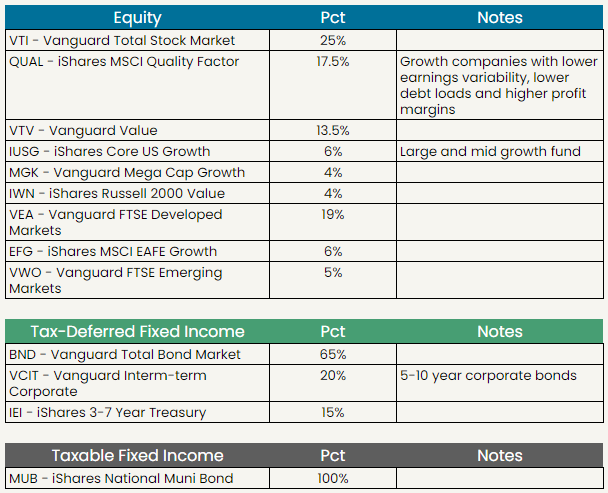

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.