The information provided is based on the published date.

Key takeaways

- The stock market continued to climb last week, with the S&P 500 reaching a new all-time high. This is largely driven by tech stocks.

- Job growth is still positive, but there are signs it might be cooling. The unemployment rate ticked up and revisions to past data showed lower job gains than previously reported.

- A Federal Reserve rate cut is likely coming, but probably not in July. This could be a positive for stocks in the long run.

- Rebalancing your portfolio is an important but often neglected task for investors, usually performed using a time or threshold-based approach.

Hello, I’m Tom Graff, Facet’s Chief Investment Officer. Welcome to another edition of our Investor Newsletter. This week we’ll cover another all-time high for stocks, signs the labor market could be weakening, and when to know it is time to rebalance your portfolio.

If you have any questions related to anything you read here, or about investing more broadly, please feel free to email our team directly at [email protected]. We’re happy to help!

Market recap

Stocks advanced this week, with the S&P 500 rising 1.5% to a new all-time high. Once again tech stocks led the way, as semiconductor stocks rebounded from a tough couple weeks. Bond yields fell, especially after Friday's payroll report. Small cap stocks continue to struggle, with the Russell 2000 index falling slightly for the week.

This week’s chatter

Whenever you have a market holiday that falls on a Thursday, you can bet that few traders come into work on that Friday. However this Friday happened to be the day where the monthly jobs report was released. Basically that meant that a lot of people logged in for the first hour of trading, and then logged off. It makes for a sort of strange week.

Anyway, the substance of the report was important. Overall job growth was solid at +206,000 jobs added, but that belied softness in the details. The unemployment rate ticked slightly higher to 4.1%, which is the highest it has been since 2021. The prior two months of job gains were also revised lower by a total of 111,000. This suggests that while overall job growth remains solidly positive, labor demand is cooling.

I think this only bolsters the case for a Federal Reserve rate cut in September. The Treasury bond market agrees, which is why bond yields fell on Friday. I think we'll hear some commentators forecast a cut in July, but I doubt this. Normally when the Fed makes its first move, it likes to obviously telegraph the move in one meeting and then actually act the next meeting. In my view, the only way the Fed cuts in July is if they feel like they need to get aggressive about cutting, and I don't see that as necessary.

All that being said, the exact timing of cuts isn't super important. What really matters is the Fed is going to be restricting the economy somewhat less in the coming months. I still argue this is a secondary factor to earnings growth, but on the margins this is a positive for stocks.

Pro corner

This week we got a question from a member about rebalancing your portfolio. This is a great example of one of the little things most individual investors don’t typically do well.

There are two basic approaches to rebalancing your portfolio. I’ll call them “time-based” and “threshold-based.” With time-based, you rebalance your portfolio based on the calendar, i.e., once a quarter or once a year. Threshold-based means you rebalance based on the percentage weight of one or more of your holdings breaches some predetermined threshold.

At Facet we use a threshold based approach. Specifically, we rebalance anytime a fund is more than 20% away from its target allocation. For example, if a fund’s target weight is 10%, we would trim if it reached 12% and buy more if it fell to 8%. We apply this to individual ETFs as well as the broader stock and bond allocations. So if a member had a 20% target bond allocation, we would sell if the total bond ETF allocation rose to 24% and buy if it fell to 16%.

We’ve tested various methodologies quantitatively, and this produces better results vs. time-based rebalancing historically. I think there are some logical reasons why this would be the case.

First, all rebalancing is a form of buying low and selling high, regardless of the method. You are always trimming the investments that have performed better and adding into the ones that have lagged. With a threshold-based approach, you are effectively looking for a chance to buy low and sell high. The timing of the trade is based on how the market has moved. With a time-based approach, the timing is based on an arbitrary day.

The second reason why we prefer threshold based is that it avoids doing small, insignificant rebalances. When you rebalance based on calendar periods, you typically bring all your investments back to your target weights. So if Fund A is up 10% over the last quarter and Fund B is only up 9%, you’ll buy some of B and sell some of A, even though functionally the two have performed about the same. In a threshold approach, this wouldn’t be enough to trigger a rebalance. This saves on transaction costs.

Lastly, the threshold approach respects the fact that momentum is a real thing in markets. In other words, if one segment of the market starts outperforming, it often keeps doing so for a while. By waiting for the value to rise to a certain level before selling, we’re effectively allowing for some momentum to play out. Yet we’re still trimming the fund before it becomes too large. Our research indicates that this strikes the right balance between allowing for some momentum while still getting some benefit from buy high/sell low.

Now one might wonder, if momentum is a real thing, why bother rebalancing at all? The answer is mostly about risk. When you build a portfolio, the weighting of each asset is based on a certain balance between downside risk and upside potential. E.g., your stock and bond allocation was selected based on your plan’s tolerance for volatility. So over the long-run we believe keeping that consistent downside/upside balance is the better plan.

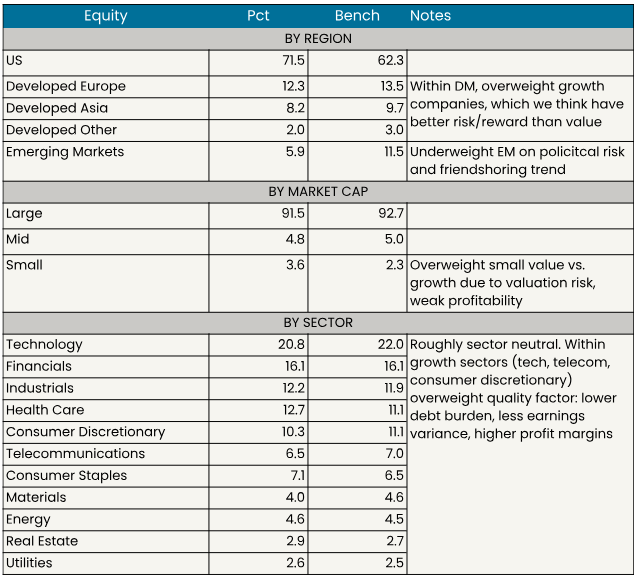

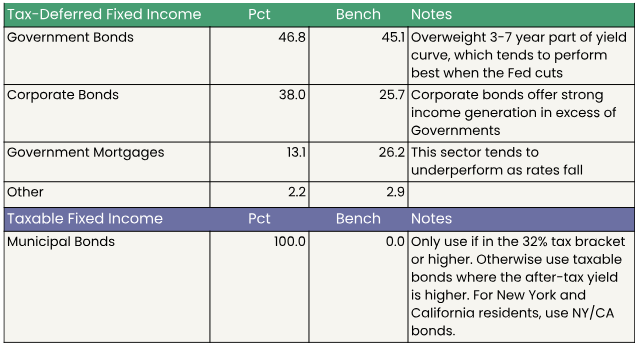

Facet portfolio positioning

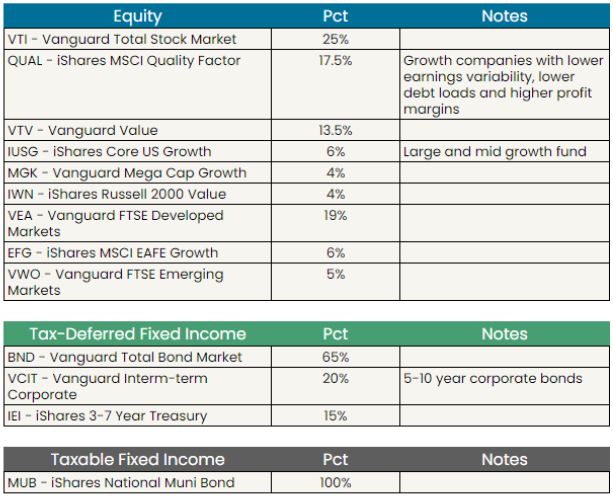

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.