The information provided is based on the published date.

Key takeaways

- Lower-than-expected inflation numbers suggest the Fed might cut rates in September.

- Political uncertainty in France, with the potential for higher spending and wider budget deficits, led to a sell-off in European markets.

- Political events can impact markets, but only when they have clear economic consequences.

- For investing decisions, analyze how political events affect the economy, not just your personal feelings about them.

Greetings, I’m Tom Graff, Chief Investment Officer here at Facet. In this week’s Investor Newsletter, we’ll look back at a big week of economic data, a sneaky pivotal Fed meeting, and some major political news out of France that has reverberated in global financial markets. Plus we’ll use France as an example of when political events do and do not matter for investors, with an eye toward the U.S. election later this year.

As always, we’d love to hear your questions and feedback. This newsletter is still in beta phase, and we’d love your help in making sure the content is useful to you. Email my team at [email protected].

Market recap

Stocks finished solidly higher last week, with the S&P 500 adding 1.6% and hitting a new all-time high on Thursday before slipping slightly Friday. However, it was a narrow market this week. Only 182 of the S&P’s stocks were higher on the week, with most of the gains coming from tech stocks. Small caps and value stocks were broadly lower.

European stocks were especially weak. The MSCI Europe index was down 3%, led by French stocks. Political uncertainty and rising interest rates led to the decline. More on that below.

This week’s chatter

This was a really positive week in terms of inflation data. The Core Consumer Price Index (CPI) came in lower than expected at 0.16% for the month of May vs. 0.3% expected. Then on Thursday the Producer Price Index (PPI) was a good bit lower than expected: the Core measure was unchanged vs. +0.3% expected.

Now of course, the Fed’s actual inflation target is based on Core Personal Consumption Expenditures (PCE), which doesn’t get released until June 28. However because the Core PCE is mostly calculated based on certain elements of both the CPI and the PPI, traders will triangulate into the PCE well ahead of the actual release. Based on all that, it looks like Core PCE will probably come out around 0.1%. That would imply inflation over the prior year was around 2.56%.

Assuming that is how it plays out, and assuming there aren’t any surprises between now and then, I believe that will be enough to get the Fed to cut rates at its September meeting. You can read our more in-depth Fed analysis here.

Meanwhile, French President Emmanuel Macron unexpectedly dissolved parliament over the weekend, triggering elections that will be held later this month. While the parliamentary elections don’t impact the French Presidency, it is thought that Marine Le Pen’s National Rally party is likely to gain a large number of seats. Based on past campaign promises, Le Pen could push for various expensive initiatives that would in turn widen the French budget materially.

This has sent French bond yields rising materially: the 10-year French government yield hit its highest yield since November this week, and the highest yield gap vs. German bonds since 2017. French stocks also tumbled, falling over 7% this week. It was also evident that European traders were feeling more bearish in general. Even in U.S. trading, we saw stocks trading weaker during the European session and recovering after European markets closed several days this week.

Pro corner

We are often asked about how politics will impact markets, particularly with the U.S. Presidential election coming later this year. What’s going on in France right now is an excellent illustration of how politics can have an effect on stock prices, but only in the right circumstances.

We talked a few weeks ago in this newsletter about how uncertainty tends to weigh on stock prices. However when it comes to politics specifically, the uncertainty has to be economic in nature to have an effect on financial markets. If an election is seen as very close, that is absolutely a kind of uncertainty. But that doesn’t automatically mean the stock market will care.

One simple way to think about it is this: stock prices are a function of company profits. If an election isn’t going to have a material impact on demand for Nvidia chips or Ford F-150s or McDonalds hamburgers, then it isn’t really going to move the stock market.

In the case of France, Le Pen’s National Rally party is often described as “far-right” in the media. But French stocks aren’t selling off because investors fear a far-right regime per se. They are selling off because as we said above: it is thought that Le Pen’s party will push for lower taxes and more spending. France’s government debt to GDP and its current budget deficit is 5.5%, well above European Union legal targets of 3%.

Here there’s a worry that higher French deficits could cause interest rates to rise. It is kind of like what would happen if the Fed suddenly announced a rate hike. Stocks would fall over worries about what higher interest rates would mean for the economy.

To be clear, I’m not trying to downplay the importance of political events, whether in Europe or in the U.S. Rather I’m trying to say that when it comes to making investment decisions specifically, be careful not to let your own personal political opinions taint your analysis.

For politics to matter for investment decisions, you need to make a direct connection with economic events. If you can’t do that, or if you conclude that it will only have secondary impacts, then better to just ignore politics when it comes to your portfolio.

For more on politics and investment markets, check out our longer article on the subject here.

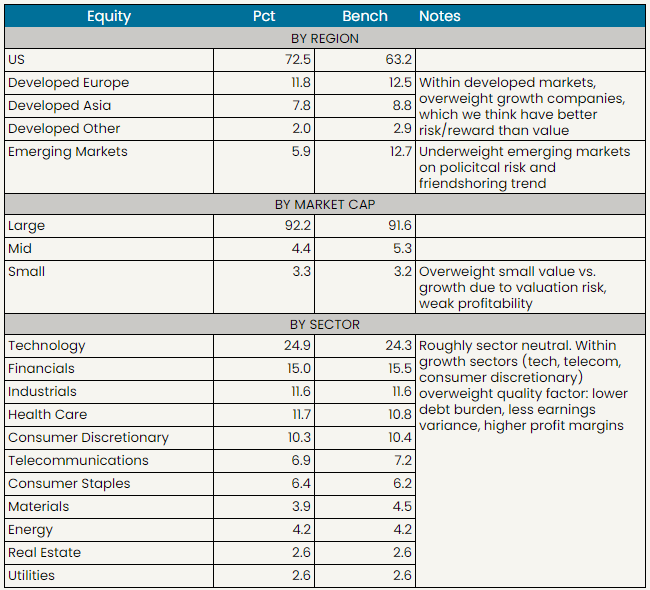

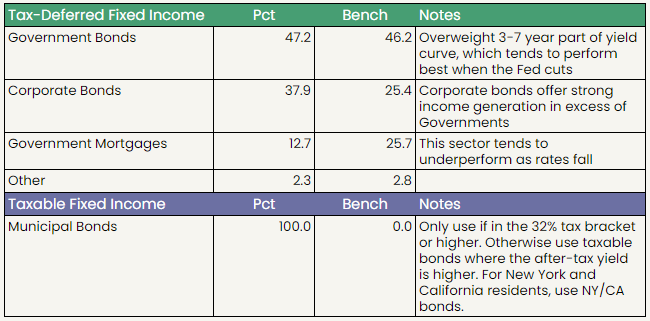

Facet portfolio positioning

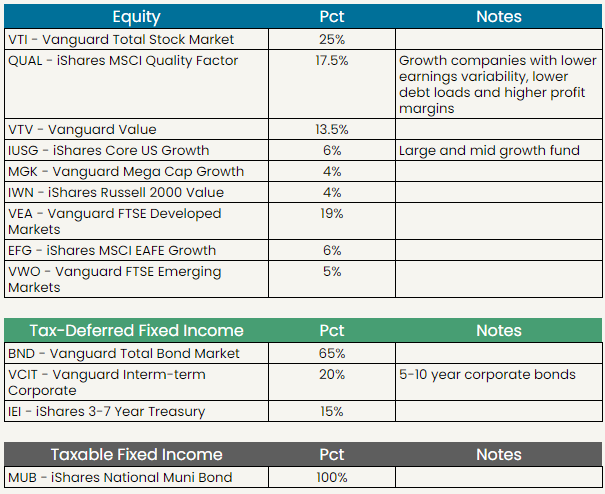

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.