The information provided is based on the published date.

Key takeaways

- Federal Reserve Chair Jerome Powell downplayed the chances of future rate hikes despite higher inflation data recently, emphasizing patience.

- The April jobs report showed a solid number of new hires, but relatively low wage growth. This combined with a patient Fed was seen by a strong positive by markets.

- Amazon and Apple delivered strong earnings results, adding onto what has been a pretty positive earnings season so far.

- Pros focus as much on volatility as they do the direction of certain key metrics. We discuss why this is and how you can follow along.

Hello and welcome to another edition of the Facet Investor Newsletter. I’m your Chief Investment Officer Tom Graff. This week we’ll discuss what happened with the Federal Reserve’s meeting last week, another jobs report, big earnings news from tech giants, and how pros think about the interplay between interest rates and stock prices.

Remember, we’re here to help. If you have a question about anything you’ve read in this newsletter or our other investment content, please send it in! Access to investment experts is part of your membership, so use it! Contact my investment team at [email protected].

Market recap

Stocks finished last week up just under 1%, although that belies some meaningful volatility. As of Wednesday’s close, the S&P 500 was down 1.5%, but rallied back on Thursday and Friday on strong earnings results and a benign jobs report. The large cap S&P 500 was actually the laggard this week. Emerging markets finished the week up 2%, with developed markets and small caps also outperforming. Bond yields fell on a surprisingly benign Federal Reserve meeting as well as a softer jobs report.

This week’s chatter

There was a lot going on this week, but I’ll try to hit it all succinctly.

There was both a Federal Reserve meeting and a jobs report this week, and really it makes the most sense to cover them together. On Wednesday Fed Chair Jerome Powell pushed back on the idea that the Fed might hike interest rates in response to relatively high inflation data recently. Reading between the lines, Powell believes that the labor market isn’t tight enough to actually spark persistently higher inflation. If that’s right, then the Fed can be patient and just leave rates where they are until inflation falls further. For more on the Fed meeting, check out our article here.

That idea was boosted by Friday’s jobs report. The headline job gains were modestly lower than expected, but traders were more focused on the wage figures. Remember, you can’t get inflation without consumers spending more dollars, and consumers need higher wages in order to spend more dollars. Wages came in softer than expected, and this touched off a pretty strong Friday for both stocks and bonds.

Earnings were broadly positive this week, with Apple and Amazon being the two biggest names to report. Amazon posted very strong cloud computing results, which is a similar story to last week’s Microsoft and Alphabet results. I’d say most professional investors came into this quarter a bit skeptical that the big AI-related names could keep delivering on strong results. So far so good.

Apple is another story. That company has been struggling with sales growth. Revenue this quarter dropped 4.3%, and iPhone sales have declined five out of the last six quarters. Apple is also seen as falling behind in the AI race. However these results were a bit better than Wall Street expected, plus the company announced a record-breaking share buy-back, and that buoyed the share price.

I’m not putting a lot of weight on Apple’s struggles when analyzing the broader market. There are always some companies performing better or worse due to issues that are company-specific. Apple matters because it is such a big part of our indices, but otherwise their problems are their problems. There’s no macro read-through.

Pro corner

In the first quarter of this year, stocks rose almost 10% despite the fact that interest rates were rising and chances for Fed rate cuts were falling. It seemed as though the market didn’t care that much about the Fed. During that time strong economic data (such as job gains, consumer spending, etc.) was seen as a positive for long-term profit growth.

So far in the second quarter, it feels like the Fed and interest rates are all the market cares about. During this quarter stocks have been down 86% of days where the 10-year Treasury yield increases by at least 0.05%, and ⅔ of days where bond yields increase at all. This tells us that the market fears that stronger economic growth will mean no Fed rate cuts and higher interest rates for longer.

What gives? Why did stock traders seem to not care about interest rates a month ago but do care now?

To understand this you have to look at what pros call the “second derivative.” If you remember your high school calculus, the first derivative is the rate of change of something. For instance, the increase in bond yields vs. decrease in stock prices. The second derivative is the increase in the increase. I.e., not just whether bond yields are rising, but how fast they are rising. Think of it like a car. The first derivative is the speed of the car. The second derivative is the car’s acceleration.

So what has changed between the first quarter and now is that bonds have become more volatile. A smooth upward trend in bond yields didn’t bother people. Bond yields jerking around does.

There are a few reasons why volatility matters, but the key one is uncertainty. Anytime the price of something whips around rapidly it is because investors are highly uncertain about what the thing is actually worth.

Since bond yields are primarily driven by expectations for future Fed hikes/cuts, more bond yield volatility tells us that traders are more and more uncertain about the Fed’s future moves.

Getting back to what has changed from 1Q to now, it is that during 1Q the Fed’s path seemed more clear. Now it is feeling less so. It isn’t that investors stopped caring about interest rates during 1Q, but that a more certain path was easier to price into stock prices.

So the lesson is two-fold. First, when uncertainty is rising (in just about anything), you are going to see prices go down. In this case, as traders became less certain about the Fed, stocks traded down a bit.

Second, if uncertainty subsides, that alone will be enough to see prices rise again. We saw that on display this week. When Powell said the Fed was not inclined to hike, stocks jumped higher. He didn’t have to say the Fed was ready to cut rates. He just narrowed the set of possible outcomes a bit, which lowers uncertainty a bit, and that allowed stocks to rise.

Don’t fall into the trap of assuming that the “problem” has to be solved for stocks to rise. In 2022, stocks fell substantially on interest rate fears. If you had assumed that the only way stocks would rise would be for rates to fall, you would have been dead wrong. Stocks are up over 30% since the end of 2022 despite the fact that interest rates have kept rising. The market can price in anything, it just needs a level of certainty in order to do so.

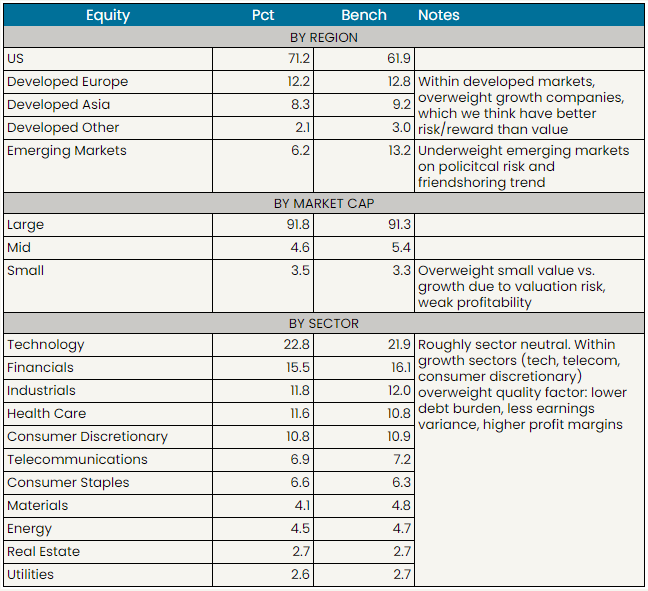

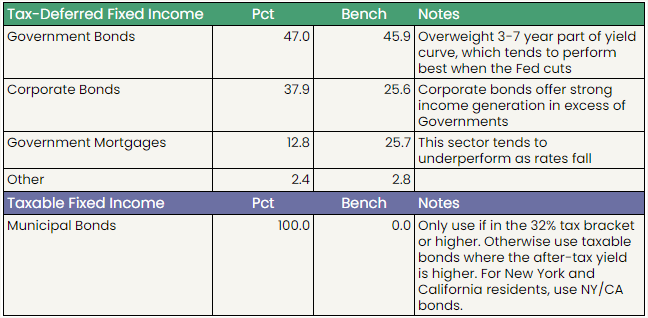

Facet portfolio positioning

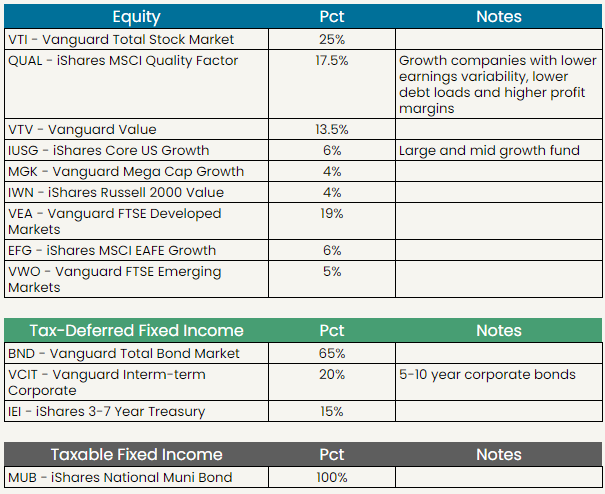

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.