The information provided is based on the published date.

Key takeaways

- Stocks were generally higher last week, with non-US and smaller companies outperforming.

- Nvidia reported earnings last week. Despite strong results in almost all respects, it still fell short of trader expectations. The stock fell 10%.

- This incident shows the importance of a diversified portfolio. The broad market has performed well the last two months even while tech stocks, including Nvidia have struggled.

- We give some pointers on how pros think about situations where a stock becomes very expensive.

Welcome to the Facet Investor Newsletter. I’m Tom Graff, the Chief Investment Officer for Facet. This week we’ll cover a solid week for stocks despite disappointing earnings from Nvidia. We’ll look at what went wrong and what it says about the broader market. Plus how to handle a stock that has become expensive.

As always, we’d love to hear your feedback. This newsletter is a pilot program and we’d love to know what you do or do not like about it. Send us your thoughts at [email protected].

Market recap

The S&P 500 finished the week slightly higher, adding 0.3% and ending Friday within a fraction of an all-time high. Non-U.S. stocks outperformed, as they have most of this quarter. This has propelled the Morningstar Global index to a fresh all-time high this week. Tech stocks did struggle a little, falling 1.5%, dragged down by fall out from Nvidia’s earnings report. More on that later.

Meanwhile interest rates rose modestly, with the 10-year Treasury yield rising 0.1% to 3.90%. While there were no blockbuster economic releases this week, what we did get seems to point to continued economic strength, making rapid Fed cuts seem less and less likely.

This week’s chatter

Semiconductor giant Nvidia was the last of the megacap tech companies to report earnings, doing so Wednesday after market close. This event dominated the conversation both before and after it happened.

The results were a good allegory for the broader market today, especially among tech stocks. All of the following were true about Nvidia’s results:

- Profits were higher than expected.

- The company raised their guidance for next quarter’s revenue and profit growth from prior forecasts. I.e., they are projecting faster sales growth than they were a quarter ago.

- Many traders actually expected the revenue acceleration to be even higher.

So despite the first two bullets, the stock dropped on Thursday after these results. So in the eyes of Wall Street, the report was very good, but not good enough. Expectations were just too high. The stock closed down 6.4% just on the day, and was down 10% on the week.

This kind of thing can happen when a stock gets very expensive. We’ll talk more about that in the next section. That being said, the fact that Nvidia continues to see tremendous growth in semiconductor sales, and specifically the kind used for AI development, suggests that core demand remains strong. Overall that’s a good sign for the broader market.

We did get a question from a member this week about the extent to which Facet’s portfolio is dependent on Nvidia. It is true that Nvidia is a big holding in our portfolios. If we looked at all the underlying stocks within the funds in our primary long-term equity portfolio, Nvidia itself represents about 3% of holdings. It is also true that a lot of the market volatility this year has been AI-related. No company has benefited more from the explosive growth of AI demand than Nvidia. So in a sense, in 2024, as Nvidia has gone, so has the market.

However it is an exaggeration to say that a widely diversified portfolio like Facet’s is dependent on Nvidia. From July 10 to Friday’s close, Nvidia stock is down 12%. Facet’s ETF portfolio is up 2%. To be sure, Nvidia and other tech stocks have been a drag on our portfolio during this period, but other things such as smaller caps and non-U.S. stocks have boosted our results.

Right now, AI is certainly a central theme for the market, but it won’t always be. This is why we maintain a widely diversified portfolio rather than try to bet on narrower segments of the market. The narrative in stocks is always shifting, and no one tells you ahead of time when the shift is about to happen.

Pro corner

A lot of times you’ll see people on TV say that a specific stock (or the market) is too expensive and that you should sell. Nvidia’s story above is the kind of thing people will cite. Again, Nvidia’s earnings report was very good, but not good enough given extremely high expectations. Another way of putting this was that Nvidia’s stock price on Wednesday reflected these lofty expectations. When the report was not quite as strong as hoped, the stock price dropped.

The price to earnings ratio (P/E) is a common way to measure how “expensive” either a stock or the whole market is. Today that ratio for the S&P 500 is 23.2. The average over the last 20 years is 17.2. So objectively, the market is more expensive than it has typically been over the last two decades.

Is this a reason to sell? Despite what you hear on TV, experienced pros will generally agree: selling solely on valuation is usually a loser trade. Here’s why.

When stocks are expensive, it is because conditions are good. Take Nvidia above. Things are going amazingly well for the company. Their revenues are up more than 120% over the last year with profit margins of 75%. Logically a stock like that is going to be more expensive than, say, a steel making company that is hardly growing. Yes, expectations for Nvidia are high, but that’s because things are going really well.

The same is basically true of the broader market. Conditions are a lot better than, say, 2011. The economy is growing more quickly, company profit margins are up, debt levels are down, etc. It stands to reason that the market should be more expensive today than in other periods. In other words, it is perfectly rational for today’s market to be more expensive than average. It would be strange if it weren’t.

This is why selling solely on price tends to be a mistake. If conditions just keep being good, the market keeps performing. Put another way, historically you don’t see lasting sell-offs (say, a year or more of negative returns) occur when the economy is strong but prices are high. You only see lasting sell-offs during periods where profit growth grinds to a halt, usually because there’s a recession. Even in 2022, where there was no official recession, profit growth for the overall S&P 500 was less than 1% for the year.

The same basic concept applies to individual stocks, but is a bit more complicated. It is probably true that Nvidia’s stock isn’t going to keep dropping if their business continues to grow at this pace. The difference is that with an individual stock, there’s a lot more that can go wrong. With the broad economy, you usually need a recession or near recession to cause a big sell-off. Individual stocks can have idiosyncratic things go wrong in their own business that have little to do with the broader economy. For example, one reason why Nvidia’s revenue growth wasn’t even stronger had to do with some production delays on their new Blackwell chip. Stuff like that is hard to predict.

At Facet, we believe that picking stocks is extremely hard, and prefer to own more diversified portfolios. Hence, if you want to sell some of your individual stocks that have recently run up in price to diversify your portfolio, we would probably agree with that decision. However, it would more or less always be our advice to diversify. This Nvidia episode is a good example of why stock picking is so hard. To successfully own individual stocks, you have to predict whether earnings growth is accelerating or decelerating, and do so better than everyone else analyzing the stock. That’s just very difficult to consistently achieve.

Facet portfolio positioning

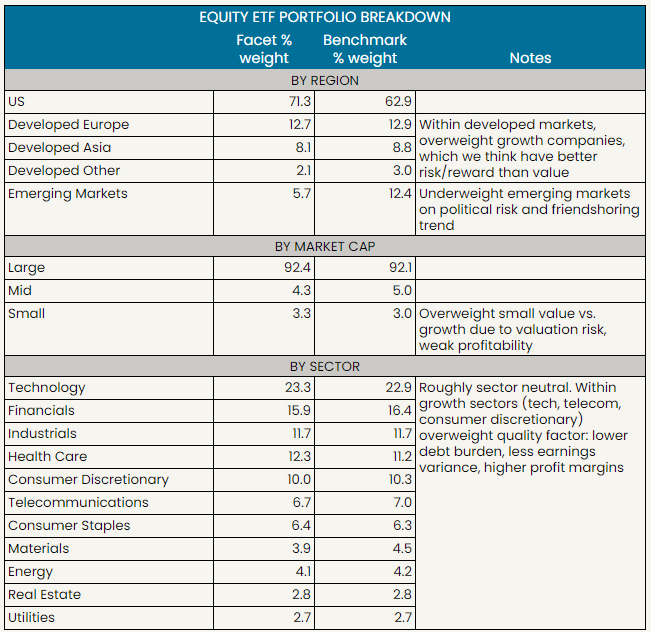

Here is a brief summary of how Facet’s exchange-traded fund portfolio breaks down in terms of regions, sectors and market capitalization. The benchmark is the Morningstar Global Index. This essentially allows for a comparison between Facet’s portfolio and the broad world stock market.

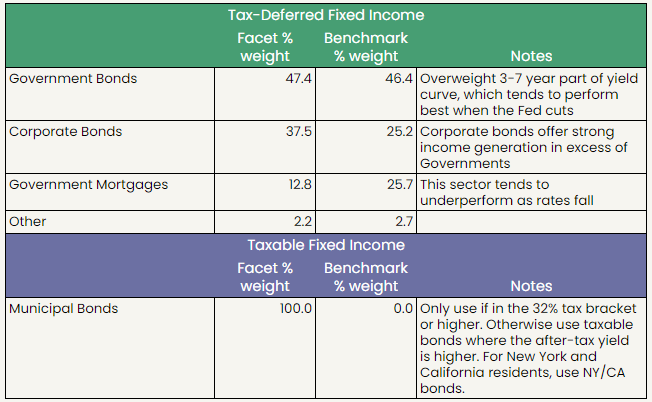

This is the same view but for Facet’s fixed income allocation. The benchmark here is the Morningstar U.S. Core Bond index.

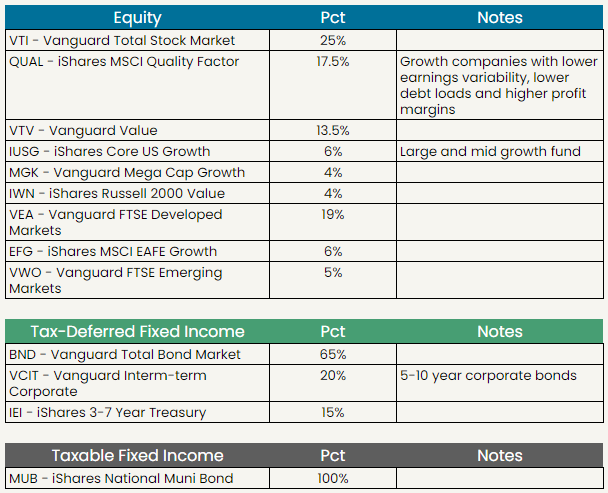

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.