The information provided is based on the published date.

Key takeaways

- Stocks ended the week only slightly lower overall, with tech stocks struggling and smaller company stocks performing well.

- At their July 31 meeting, the Federal Reserve is likely to signal a rate cut is coming in September after a relatively modest inflation report last week.

- Earnings reports so far indicate that companies continue to invest in artificial intelligence, but the market has growing concerns that the return on this investment is uncertain. Earnings from Google parent Alphabet last week illustrated this concern.

- When you’ve decided to make a change in your portfolio, don’t get hung up on timing. The best time to upgrade your portfolio is now.

Hello and welcome to this week’s edition of the Investor Newsletter. I’m Facet’s Chief Investment Officer Tom Graff. This week we’ll discuss the on-going rotation away from tech stocks and into small caps, Alphabet and Tesla’s earnings, as well as a quick preview of next week’s Federal Reserve meeting. Plus how to avoid being frozen by market volatility when you need to make a portfolio change.

Have questions about markets? Or feedback on anything you’ve read in this newsletter? We’d love to hear from you. Send us your thoughts at [email protected].

Market recap

Stocks finished the week only slightly down, with the S&P 500 falling about 0.8%. However there was substantial volatility. The rotation from tech stocks to small caps continued, as the tech and telecommunications sectors both fell more than 2%. Meanwhile the small cap Russell 2000 index rose 3.5%.

The Federal Reserve will hold their July meeting this week, and it is widely expected that Fed Chair Jerome Powell will telegraph a rate cut in September. Last week the Core PCE inflation gauge came in at just 0.2% for the month of June. This came after relatively modest gains in both employment and CPI inflation earlier this month. Combined this probably cements the case for at least one rate cut, with a second likely sometime later this year.

This week’s chatter

In last week’s newsletter I mentioned that whether this tech/small cap rotation continues will come down to earnings. So far we’ve really only got one major tech company to report, which was Alphabet, parent of Google.

Results were mixed. Overall profits and revenue was a bit better than Wall Street expected. This included better-than-expected revenue from their cloud computing division, which is the one that benefits most from AI-related spending by other companies. However they also announced that they spent $13.2 billion in capital expenditures in 2Q, about $1 billion higher than analysts expected. “Capital expenditures” or “capex” is the term for any spending on any long-lived asset for the company. In Alphabet’s case, the increase mostly came from spending on building out data centers for cloud computing and other AI-related spending. That increase in spending was the main reason why Alphabet’s stock fell 5% the day earnings were released.

During the post-earnings call with investors, Alphabet CEO Sundar Pichai was asked about the increase in capex, specifically if this meant the company risked “potentially being overbuilt” in data centers if capex spending continued at the current pace. Pichai responded that “the risk of underinvesting is dramatically greater than the risk of overinvesting for us here.”

So what is this Alphabet report telling us about the state of the AI boom? The strong cloud computing revenue says that companies spending on AI remains very strong. However it might also be that AI turns into a kind of arms race for some of the tech majors. I.e., they need to keep spending more and more dollars to keep up with the competition, with questionable returns on that investment.

Specifically in the case of Google, AI represents a threat to their core search business. Just last week OpenAI announced their own AI-powered search engine. Alphabet may have to make very expensive investments in AI just to maintain the status quo in their own search business. That kind of heavy spending with unknown returns has Wall Street concerned.

I think the overall point is that the AI boom is continuing, but it may be morphing into a new phase. We’ll have to see more earnings reports to get a better sense of what this new phase entails. Some of this will come this week, with Microsoft, AMD and Meta all set to report. If the last couple weeks are any indication, this new phase could be one where the winners are a broader set of companies than was the case in recent quarters.

Some readers may be wondering why I’m calling Alphabet the “only” major tech earnings release when Tesla also reported last week. Tesla is obviously a big company and therefore can have an impact on major market indexes. In fact, Tesla’s results were a significant miss vs. expectations and the stock dropped 12%. However Tesla’s issues are specific to Tesla. They don’t really provide insight into what else is going on in the economy. Hence why I’m more focused on Alphabet and less on Tesla.

Pro corner

Speaking of highly volatile stocks, sometimes volatility can get in the way of an investor making portfolio decisions. For example, maybe you own an individual stock that is too big within your portfolio. However you are hesitant to sell because the stock has recently declined in value. Or maybe these last few weeks has you thinking don’t own enough in small caps. But you don’t want to buy now after the big rally.

In both cases, you will be tempted to wait before acting. Very often investors in this kind of situation suffer from something called regret aversion. In this case, you might think “I just know this stock is going to go higher as soon as I sell.” Or maybe “I know I should sell some, but the stock is clearly due for a rebound!”

Regret aversion is one of many cognitive biases that we all suffer from as human beings. Professional investors aren’t immune. But like most biases, it tends to lead to making bad decisions, especially when it comes to your portfolio.

There’s two sayings I’ve drilled into every investment team I’ve ever led to help us avoid regret aversion. Hopefully they can also help you.

The first is “the best time to upgrade our portfolio is right now.” The idea behind this phrase is that if we believe we should make a portfolio change, we shouldn’t let worrying about the timing of the change get in our way. I’ve never been a short-term trader, so when my team has decided to make a portfolio change, we always had a reasonably long horizon in mind. If that’s the case, why get caught up in small day-by-day fluctuations?

The second saying I’ve used is “if we’re going down, we’re going down with our best ideas.” This one is actually meant to invoke regret aversion but in a different way. I’ve always managed money for other people, and this means that if we didn’t produce strong investment results, I’d have to explain that to disappointed clients.

For example, say we conclude that we want to add more small caps. Which would make me feel more regret? To tell an investor that we underperformed because we were wrong about needing more small caps? Or that our analysis was right and small caps did well, but we never bought any because we were waiting for a dip to buy?

Getting your analysis wrong is one thing. No one gets every idea right in this business. But to produce poor performance despite being right about your analysis? That would give me a much greater feeling of regret!

This does not mean you should rush your decision. You should take your time with your analysis. Volatility can sometimes lead investors to make knee-jerk moves, and that can also lead to big mistakes. However once you have reached an informed conclusion, don’t wait. Pull the trigger and don’t look back.

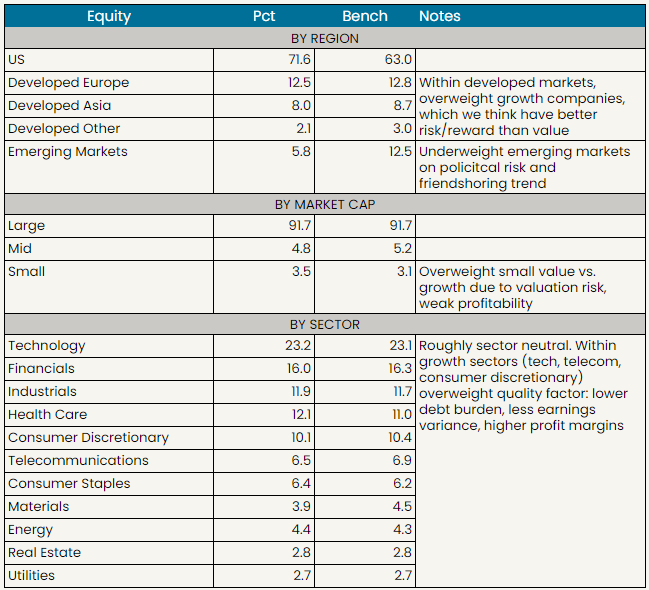

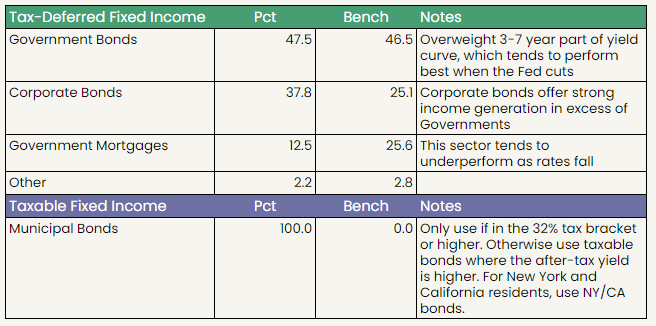

Facet portfolio positioning

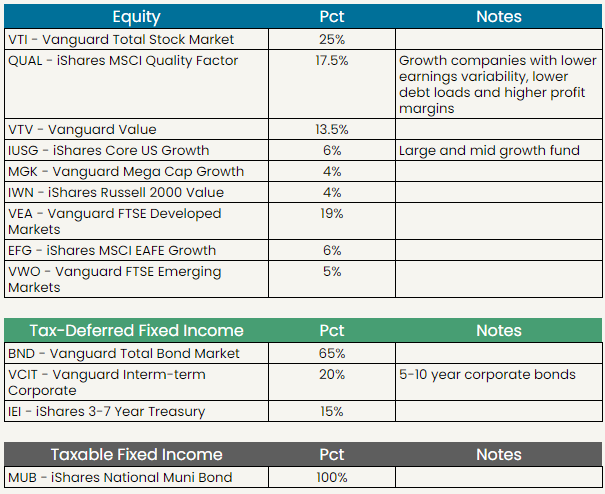

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.