The information provided is based on the published date.

Key takeaways

- Stocks finished the week slightly lower, with large cap tech stocks dragging the market down.

- The AI boom hasn’t helped every company, as some software and hardware companies reported weak earnings this week.

- The Core Personal Consumption Expenditures (PCE) inflation report came in the lowest in over three years.

- Pros set hard limits on the size of any stock in their portfolio to avoid the temptation of letting one stock dominate results.

Welcome to our latest edition of the Facet Investment Newsletter. I’m your Chief Investment Officer Tom Graff. Today we’ll cover the week that was in markets, including a crucial inflation report, some rough tech earnings reports, and how to think about a stock that’s become a bit too large in your portfolio.

As always, if you have any questions about investing, markets or even feedback on this newsletter, please email us at [email protected]. We’d love to hear from you!

Market recap

Stocks finished the week mildly lower for the week, with the S&P 500 dropping 0.5%. It could have been worse if not for a ferocious rally in the last 20 minutes of trading on Friday, where the S&P went from being down slightly to up 0.8% in that short time frame. Value and small cap outperformed this week, while big cap tech underperformed on some weak software earnings reports. Emerging also underperformed after some poor economic news out of China.

This week’s chatter

A lot going on this week. The biggest piece of macro news was the Core Personal Consumption Expenditures (PCE) report. Core PCE is the inflation measure the Federal Reserve uses as their official inflation target. In the 12-months ending in April, Core PCE rose 2.75%. That’s well above the Fed’s 2% inflation target, but it is the lowest figure in over three years. Inflation is definitely going to have to keep subsiding for the Fed to consider cuts, but it probably won’t have to subside much.

Earnings season is just about over, and overall it was very strong. But this week we got some reminders that the AI boom isn’t uniformly pushing all stocks (or even all tech stocks) higher. Dell Technologies’ stock was up over 120% year-to-date pre-earnings, but the stock dropped over 20% after the release. The company said they were selling AI-related servers at “near zero margins” which spooked traders. Meanwhile Salesforce also dropped about 20% after releasing earnings this week. That company warned that sales growth would be weaker than previously forecasted.

It might seem to the casual observer that there’s a lot of euphoria around AI, and that is true to an extent. But there’s also a lot of scrutiny. If a company isn’t showing strong margins, the market isn’t going to care about rapid growth rates. And if a company appears to be falling behind peers in AI adoption, especially a software company like Salesforce, the market is definitely going to punish the stock.

Pro corner

A very common challenge our members face is what to do with a single stock that has become a bit too large in your portfolio. Maybe you bought NVIDIA stock in 2021 and watched the value increase seven-fold. Exciting! But now it has become such a large percentage of your investments that your whole financial future feels like it is riding on just one company. How do the pros handle these kinds of situations?

First of all, virtually all pros have limits on how large any one position can get within a portfolio. When I was a mutual fund manager, the prospectus limited holdings in any one company to no more than 5% of the fund’s value. Even more aggressive strategies, like hedge funds or proprietary trading, almost always have various limits on position sizes.

The core reason for this is that a pro doesn’t want one mistake to ruin what is otherwise a good strategy. Markets can always do unpredictable things, but individual stocks can be especially idiosyncratic. You want to bet on your investment process being successful over time. You don’t want all of your good decisions erased by getting one stock wrong.

I bring this up because pros struggle with selling big winners too. Everyone gets good feelings about a stock that has gone way up. The company will be getting all kinds of positive press. The CEO will be hailed as a genius. This is called the “halo effect,” and can make you feel like the company has it all figured out and the stock will just keep going up forever. Look no further than all the positive press surrounding NVIDIA now!

It is precisely because of this difficult psychology that pros set these strict position limits. They want their hands tied when the moment comes, because otherwise maybe they wouldn’t follow through with the difficult decision to trim a holding.

So if you are going to dabble in individual stocks, consider setting these kinds of rules for yourself and stick to them. This should go for any stock you actually control, including shares from your employer.

How large should the limit be? It should be small enough that taking a serious impairment on the stock wouldn’t ruin your financial plan. Take another popular holding for individual investors: Tesla. That stock dropped almost 75% from its peak in 2022 and is still down almost 60%. Maybe the stock eventually recovers, but maybe it doesn’t. Can you afford that kind of drawdown? If not, the position is too large.

Or put another way, say the following sentence to yourself: “My retirement is highly dependent on whether company X is able to execute on its business strategy.” Or “Whether I can buy a house or not depends on this stock rebounding.” If that makes you a little uncomfortable, you may want to trim the position.

Taxes can be another reason why people hang on to large positions too long. If you hold the stock in a taxable account, selling could result in a painful tax bill next April. I know no one likes paying taxes, but this should not stop you from getting your portfolio into the right position. A lot of investors mistakenly think of taxes like fees, i.e., they can be avoided. That is not the case.

If you own a stock at a gain today, there’s only two ways to avoid paying taxes. Either the stock declines back to your cost, or you pass away and leave the stock to your heirs. In either case, you don’t get to enjoy the benefits of the gain.

Another way to look at this is to ask: what benefit do you get from waiting to sell the stock? If the stock keeps going up, your portfolio becomes more concentrated and you owe more tax in order to diversify. The stock could even wind up underperforming the broad market, but as long as it goes up at all, you owe more tax. Alternatively, the stock could drop. You might owe less tax, but you have less money!

Basically, the sooner you sell, the better chance you have at keeping your tax bill controlled while diversifying your risk. The longer you wait, the more of a problem it could become.

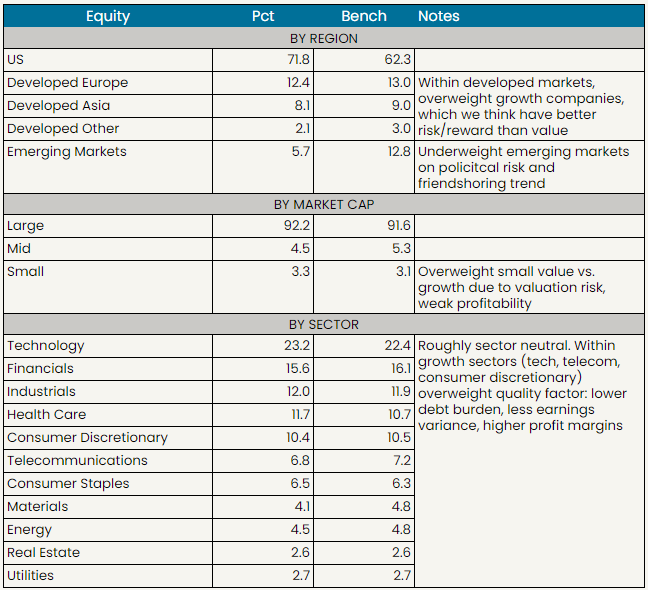

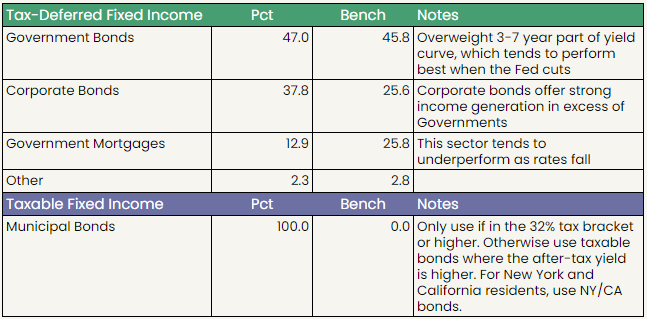

Facet portfolio positioning

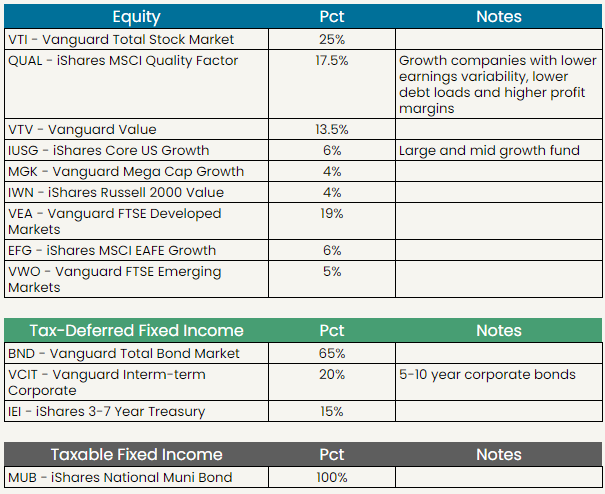

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.