The information provided is based on the published date.

Key takeaways

- Gold lacks any fundamental driver of future returns, such as cash flow or industrial use. Its price is driven primarily by speculation.

- Historically gold has suffered through more frequent deep downturns compared to stocks, without producing commensurate upside returns.

- Gold has not outperformed during periods of high or low inflation, calling into question its value as an inflation hedge.

- Over the last few years, gold has seen large inflows from individual investors, which could reverse at any time. This makes an investment in gold even more speculative than it typically is.

As the stock market has experienced some volatility recently, partly driven by uncertainty around President Trump's tariff plans, one asset often highlighted for its perceived stability is gold. With its price showing strength, you might be wondering: should you be adding gold to your portfolio now?

Frankly, we are not proponents of holding gold as a strategic, long-term investment. There are fundamental, long-standing reasons for this view, as well as some more immediate, tactical considerations that make us cautious about gold in the current environment. Let's examine the long-term perspective first, then address the present situation.

Making the easiest bets

Our core investment philosophy centers on identifying straightforward, reliable ways to grow capital over time. We focus on assets that possess what finance professionals call "positive drift" – a fundamental, underlying reason why their value should generally increase over long periods.

Stocks are a prime example. They should generally appreciate over time because, as long as the broader economy grows, companies tend to increase their profits. These profits ultimately accrue to shareholders through dividends or business reinvestment. Betting on long-term economic growth, while not without bumps, is a relatively sound premise for investment.

Gold, however, lacks this inherent positive drift. It doesn't generate cash flow like dividends or interest. Its industrial uses are minimal relative to its total supply. Consequently, the value of gold is overwhelmingly driven by supply and demand dynamics – essentially, whether more people are buying or selling at any given time.

This means gold prices are largely fueled by speculation, not underlying value creation. To profit consistently from gold often requires accurately timing entries and exits, making it a significantly more challenging proposition than investing in assets with fundamental growth drivers.

Gold's long-term track record vs. stocks

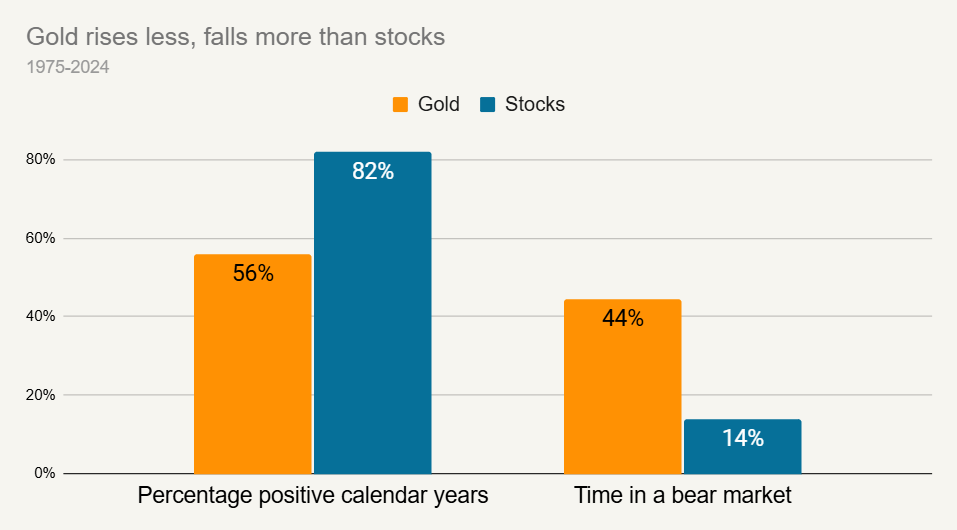

Historical data underscores gold's speculative nature and its limitations as a long-term holding compared to stocks. Looking back over the last 50 years, stocks (represented by the S&P 500) delivered a positive annual return in 82% of calendar years. Gold provided a positive annual return in only 56% of those years.

Furthermore, gold experiences deep downturns more frequently. Over the same 50-year period, gold has spent approximately 44% of trading days in a "bear market" (defined as being 20% or more below its recent high). For stocks, that figure is considerably lower, at about 14%.

Source: Bloomberg, Dow Jones S&P Indices

Despite this higher volatility and more frequent drawdowns, gold hasn't compensated investors with superior long-term upside. An investment of $10,000 in gold 50 years ago would be worth around $180,000 today. That same $10,000 invested in the S&P 500 stock index would have grown to over $3 million.

This historical comparison strongly suggests that gold behaves more like a trading vehicle than a reliable long-term investment. Its tendency for frequent, deep downturns and significant long-term underperformance relative to stocks indicates it can act as a drag on overall portfolio returns.

Addressing the "inflation hedge" argument

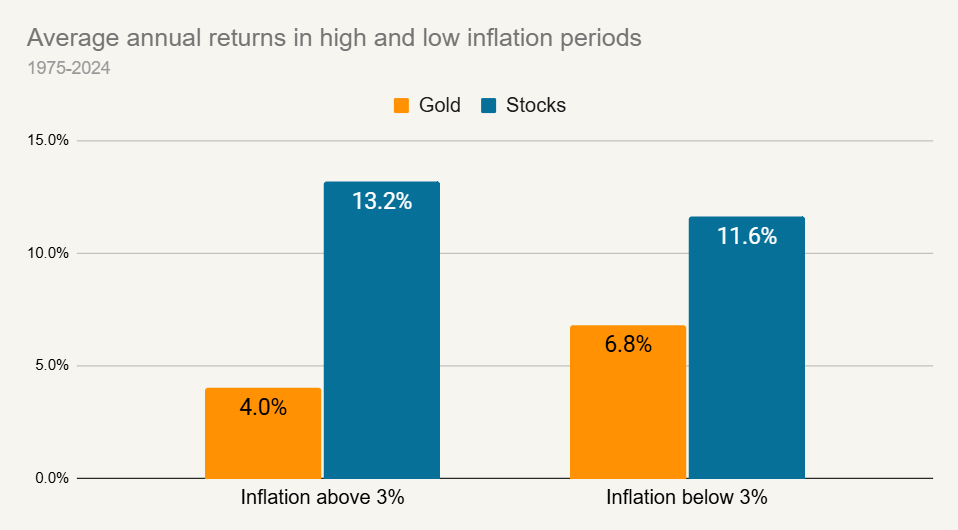

Even considering the current environment, where President Trump's tariff plans might spark concerns about rising inflation, the argument for gold as an inflation hedge doesn't hold up well under scrutiny. If gold were an effective inflation hedge, one would expect it to perform best when inflation is high.

However, historical data over the last 50 years shows the opposite. During years when U.S. inflation (measured by CPI) was 3% or higher, gold produced an average annual return of about 4%. In years when inflation was below 3%, gold's average annual return was actually higher, closer to 7%. This pattern contradicts the notion that gold reliably protects purchasing power during inflationary periods.

Source: Bureau of Labor Statistics, Bloomberg, Dow Jones S&P Indices

Gold as a dollar hedge: Is it necessary?

Another common argument is that gold acts as a hedge against declines in the U.S. dollar. This relationship does have more historical support. Because gold is priced globally in dollars, a weaker dollar makes gold cheaper for foreign buyers, potentially increasing demand and its dollar price (and vice versa for a stronger dollar). Essentially, sometimes gold's price movement reflects changes in the dollar's value more than changes in gold's intrinsic appeal.

In recent months, the dollar has indeed shown some significant weakness against other major currencies. Could it continue to decline? Possibly.

However, for investors holding a globally diversified stock portfolio, significant non-dollar exposure already exists. For example, our typical equity portfolios at Facet maintain around 30% in non-U.S. investments. This international stock exposure inherently provides a hedge against dollar depreciation, likely sufficient for most investors' needs without requiring a separate allocation to gold.

The influence of recent demand flows

Finally, it's important to consider the specific factors driving gold's price now. As mentioned, gold prices ultimately depend on flows – is money moving into or out of the asset? Over the past couple of years, significant support for gold prices came from large purchases by central banks (notably China) and strong demand from individual investors in countries like India and China. This demand helped gold perform well even during periods when the dollar was relatively strong.

Therefore, a bet on gold today isn't just a bet on continued dollar weakness. It's also implicitly a bet on the continuation of these specific, potentially less predictable, buying patterns from certain central banks and Asian retail investors. This reliance on potentially "flighty" flows adds another layer of speculation beyond just currency movements.

Sticking with productive assets

Considering both the long-term historical data and the current market dynamics, gold does not present a compelling case for inclusion in a strategic investment portfolio aimed at long-term growth. Its historical returns have significantly lagged productive assets like stocks, it suffers frequent and deep drawdowns, and its purported hedging benefits against inflation are not well-supported by data.

While it can act as a dollar hedge, sufficient non-dollar exposure is typically achieved through global stock diversification. Furthermore, its recent strength appears heavily reliant on specific buying flows that may not be sustainable. Given these factors, we remain comfortable obtaining non-dollar exposure through global equities and see little need to add gold into the mix.