The information provided is based on the published date.

Key takeaways

- The Fed leaves interest rates unchanged at this meeting, pledging to leave rates high for as long as it takes to bring inflation back down.

- Fed Chair Jerome Powell strongly pushed back against the possibility of hiking rates again, saying that current policy and patience will be enough to combat inflation.

- The Fed did make a minor change to the “runoff” of its bond holdings that accumulated during the COVID recession, but this is of less importance than some commentators claim.

- Even if the Fed does wind up cutting rates later in 2024, expect general interest rates, including mortgage rates, to remain higher for longer.

The Federal Reserve ended its May 2024 meeting without changing their official interest rate target. We might have to get used to that result. Given that inflation has stayed stubbornly high, the Fed is in no hurry to cut rates. However there were some important outcomes from this meeting and Chair Jerome Powell’s post-meeting press conference, including a major change in the Fed’s balance sheet strategy. Here are our thoughts on everything that transpired.

Inflation not cooperating

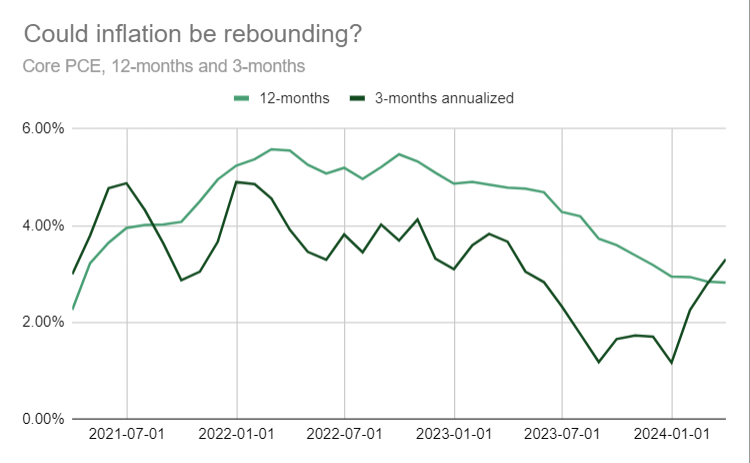

At the start of the year, inflation looked like it was rapidly improving and might soon hit the Fed’s official 2% target. Since then, economic activity appears to be accelerating, and with it inflation progress has stalled. The chart below shows the Core Personal Consumption Expenditures inflation index, which is the Fed’s official target measure.

Source: Bureau of Economic Analysis

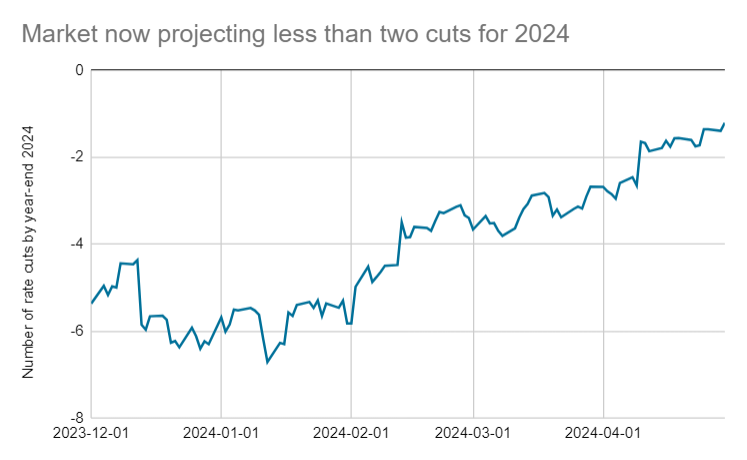

Accordingly, the Fed has recently been trying to walk back expectations for rate cuts in 2024. For several months Powell has been saying that the Fed needed “greater confidence” that inflation was heading “sustainably” toward their 2% inflation goal. At this week’s meeting Powell admitted that “it is likely that gaining such greater confidence will take longer than previously expected.” The clear implication is that the Fed is in no hurry to cut rates in 2024.

The market had already come to this conclusion before the Fed’s meeting. At the start of the year, futures markets had indicated expectations for six rate cuts totaling 1.5%. Now markets are evenly split between just one or two.

Source: Bloomberg

Could the next move be a hike?

With the prospects for Fed rate cuts fading, the natural next question is whether the Fed could wind up having to hike rates. Powell was asked about this during the press conference today, and while he didn’t rule anything out, he downplayed this possibility. Instead he said that the Fed was “prepared to maintain the current target rate for as long as appropriate” and that a rate hike was “unlikely.”

The Fed is saying that if inflation stays above their 2% target, they will simply keep rates where they are for longer.

Why is the Fed hesitant to hike? There’s a few inter-related reasons. In Powell’s prepared remarks he said that “Our restrictive stance of monetary policy has been putting downward pressure on economic activity and inflation.” If it is true that policy is currently “restrictive” then inflation should keep subsiding. Perhaps it will decline slowly, but it will decline.

The second issue is that hiking rates too much carries a lot of risk. In late 2018, the Fed hiked rates to 2.5%, but then there was a sudden slowdown in economic activity. Today economists believe that slowdown was caused by the Fed hiking one too many times. The Fed wound up cutting three times shortly thereafter, which forestalled an actual recession. However the lesson might be that small changes in Fed policy can have big impacts.

Lastly, there’s the issue of the balance of risks. On one hand, there’s the risk of hiking too much as we just described. On the other hand, there’s the risk of inflation staying too high for even longer than expected.

At this week’s press conference, Powell said these risks had come into “better balance.” By that he means that when inflation was running at 4%, the Fed had no choice but to risk a recession in order to get prices back under control. But with inflation at 2.8%, the Fed can be more patient. Again, as long as policy is at least somewhat restrictive, inflation will slowly decline. Powell is saying that kind of slow decline is good enough, and rate hikes are unnecessary.

Is policy actually restrictive?

That begs another question: what if policy isn’t restrictive?

In theory, the Fed’s target rate is in “restrictive” territory if it is above the “neutral” rate. In this case, neutral just means the rate where the Fed is neither stimulating nor restricting economic activity.

The thing is, the neutral rate isn’t constant. It changes over time. We previously mentioned the 2018 episode where the Fed seemed to cause a material slowdown by hiking too far. At that time “too far” was just 2.5%. Now the Fed is at 5.5% and the economy is humming along.

Powell himself has argued that if the neutral rate is unknown, the Fed has to pay attention to actual economic activity to know if the policy is restrictive or not. Given how strong the economy is right now, we can guess that the neutral rate is at least close to 5.5%.

But there is good evidence that indeed policy is at least somewhat restrictive. Things like declining job openings, stable wage growth, relatively weak bank lending, etc., all support the idea that policy is probably a bit above neutral.

That being said, the uncertainty about the neutral rate only highlights the risks we described above. Unless inflation actually accelerates higher, the Fed is going to be very hesitant about hiking rates.

Balance sheet

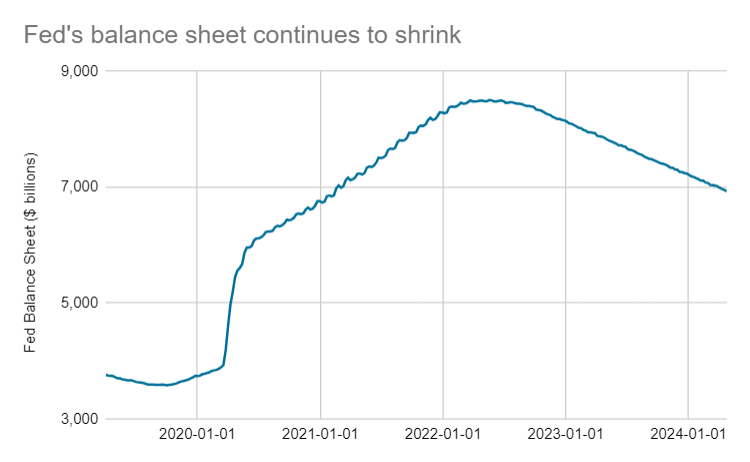

We mentioned this as a strong possibility after the Fed’s last meeting, and now it is official. The Fed will be slowing the runoff of their balance sheet. Since 2022, the Fed has been allowing any Treasury and mortgage bonds that they hold to mature without reinvesting up to a limit of $95 billion per month. This process is also sometimes called “quantitative tightening” or QT.

This week the Fed announced this runoff would be slowed to a pace of $60 billion per month.

Source: Federal Reserve

The Fed has long said that they would first “slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level it judges to be consistent with ample reserves.” There have been some signs that bank reserves are becoming somewhat less “ample,” including some volatility in certain bank funding rates. That has led to the Fed’s decision to slow the pace of runoff.

The Fed’s balance sheet size is an important part of managing risks in the banking system, but beyond that it doesn’t matter much. For the vast majority of investors, this so-called QT process just isn’t very important. It gets way more attention in the media than it should. If you read any market commentary that tries to make a big deal of the Fed’s decision to slow the pace of runoff, read something else.

Plan for higher rates for longer

The surge in interest rates over the last couple years has resulted in some big changes for your financial planning. On one hand, savers can earn higher rates on safe investments, which can make it easier to save for near-term goals. On the other hand, if you are trying to borrow to buy a house or start a business, the cost of doing so is considerably higher. It has also caused people to stay in their current homes longer than they would have otherwise, due to an unwillingness to give up a relatively low mortgage rate from years past.

As we said above, the Fed is very unlikely to hike rates further, but the odds of the Fed cutting rates aggressively anytime soon has diminished considerably. Unless a surprise economic slowdown hits, odds are that interest rates are going to remain about as high as they are now. Eventually a recession will come, and when it does rates will likely fall. But we recommend planning as though that moment is several years away and make decisions accordingly.