Financial planning as it should be.

No matter where you’re at on your financial journey, a Facet membership can help by offering valuable financial advice and services to help you reach your full potential.

Take our free Financial Wellness Quiz below or book an introductory call with a Facet expert today.

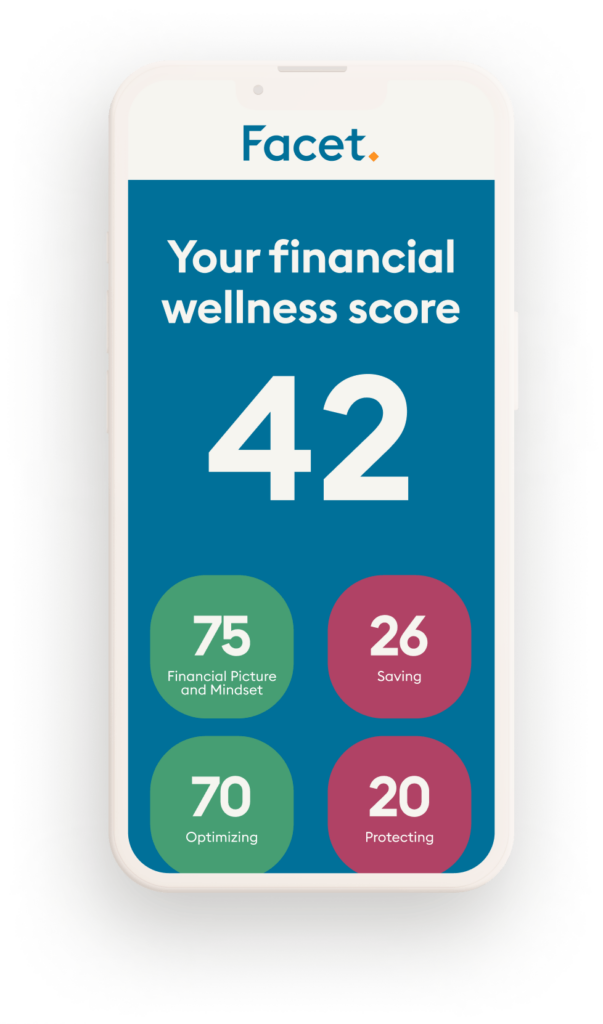

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

How Facet memberships work.

Our flat-fee membership model means no commissions

Support from a team of CFP® professionals and experts.

Secure, industry-leading technology to manage and organize your entire financial life in one place.

Exclusive partner offers that complement your financial outcomes.

How we’re different.

What Facet members are saying.

Colby is a current Facet member and received a free membership for providing this testimonial. Zach, Maggie, and Alyssa are current Facet members and did not receive compensation for providing this endorsement. All opinions are their own and not a guarantee of a similar outcome. Facet is an SEC RIA. Facet’s specific investment management services vary depending upon the chosen service level. This is not an offer to sell securities.

Grow your knowledge.

We think financial planning information should answer more of the questions we all have and be less complicated. Learn about how we approach personal finance through our library of free articles that will help you deepen your financial literacy.

Are AI stocks in a bubble? A 2026 market update.

As artificial intelligence continues to dominate headlines, many investors are left wondering if we are witnessing a sustainable technological revolution or a repeat of the late-90s dot-com bubble. While AI infrastructure spending has powered stocks higher over the last couple years, concerns are mounting regarding the sustainability of these capital expenditures and the actual pace ... Read more

Should you hedge against a weak dollar? A guide to 2026 currency risk

The U.S. dollar has struggled lately. According to the ICE U.S. Dollar Index, the American currency was down 9.4% in 2025, which was the worst year for the dollar since 2017. The trend has continued so far in 2026, with the dollar down another 1.5% through February 11. So why is the dollar dropping? How ... Read more

Who is Kevin Warsh? Trump’s Fed Chair nominee and what he means for your money

President Donald Trump will nominate Kevin Warsh as the next Chair of the Federal Reserve. If confirmed by the Senate, Warsh would take over for Jerome Powell, whose 8-year tenure at the helm of the Fed saw the stock market nearly triple in value. Warsh has long been a critic of the Fed, and may ... Read more