The information provided is based on the published date.

Key takeaways

- When choosing between renting and owning a home, personal finances play a significant role

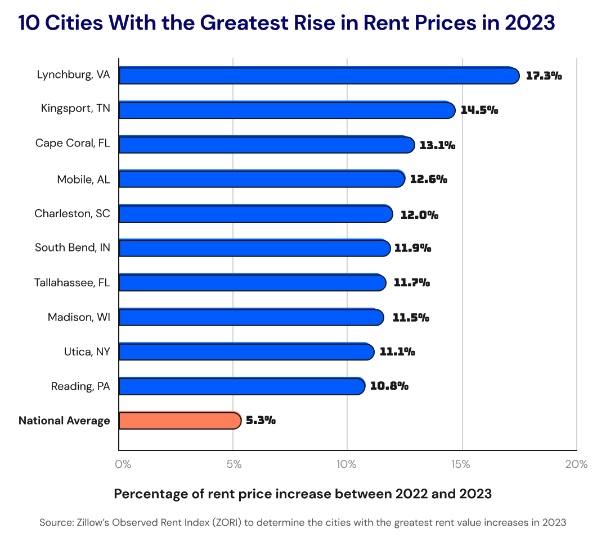

- Renting is predictable and flexible, but there is a chance of rent increases

- Renter costs include security deposits, pet fees, moving costs, and potentially renter's insurance

- Owning a home allows for personalization but can be costly and involve additional expenses

- Homeownership costs include mortgage insurance, property taxes, homeowner's insurance, HOA fees, maintenance, and potentially flood or earthquake insurance

- Mortgage interest can consume a large portion of monthly payments in the beginning

Renting and owning a home both have their advantages and disadvantages.

When deciding, your personal finances play a critical role. In most situations, it may seem cheaper to rent. However, there’s no one-size-fits-all solution, and it’s best to review all factors before making a decision.

Your lifestyle considerations will also be top of mind. Factors such as the desire for flexibility, stability, career goals, and a place to call your own can weigh heavily on your mind. Taking your time and making an informed choice that aligns with your goals and values is important.

If you’re unsure whether to rent or buy, weigh these considerations before taking the leap. Here’s what you need to know to make an informed decision that works for you.

Renting

It’s a common myth that renting is a waste of money. But the reality is everyone needs a place to call home, which comes with costs—whether you rent or own. While it’s true that monthly rent payments won’t help build equity, neither do several homeownership expenses.

Renting is predictable and (mostly) all-inclusive

When you rent, you know what you owe monthly, and that amount will cover virtually everything you have to worry about, including things like general maintenance and sometimes even utilities.

Of course, there is a chance that your landlord increases your rent, but that should only happen at renewal time, which, for most, only happens annually.

If you live in a location that is rising in popularity, it’s safe to expect regular rent hikes.

However, more established cities—like New York City, Los Angeles, and Boston—might have properties with something called “rent control,” which limits the amount landlords can raise your monthly rent, if at all. But good luck securing one of these homes. Most tenants hang on tight to these budget-friendly domiciles (wouldn’t you?!).

Renting provides flexibility

One of the benefits of renting is the ability to relocate when your lease ends. This option is great for people in certain professions, like traveling nurses or people who love trying out new cities. The only downside is if your landlord decides to sell and you have to move out suddenly.

Renter costs

Here is a list of common expenses renters can expect to pay:

- Security Deposit: This is usually between one and two months’ rent.

- Pet Deposit / Fees: If you have a pet, you may be expected to pay an additional fee.

- Moving Costs: Not only will you need to move your items, but there could also be an application fee that comes with the rental process.

- Insurance: You may need (or want) to pay for renter’s insurance, which can cover your belongings in case of theft, fire, or other disasters.

Owning

When you own your home, you get to decide how you want it to look - inside and out.

What’s more, owning a home is good for your well-being. According to Bank of America’s Homebuyer Insights Report, 93% of American homeowners feel more content than when they were renting. And 83% stated they wouldn’t consider renting again.

But remember that moving can be quite costly given that real estate isn’t a liquid asset. This means it may be challenging to sell when you hope to. Even if you’re lucky enough to find a buyer, the price you get may not be the one you want, especially in a down housing market. And even if home prices are up, high transaction costs can put a damper on your plans.

Homeownership costs

Homeownership often costs more than renting, even if your mortgage is lower than rent. Besides your mortgage payment, there are additional expenses exclusive to homeownership that you generally don’t have to pay as a renter. Some of these potential expenses include:

- Private mortgage insurance (PMI) (typically if your down payment is <20%)

- Property taxes

- Homeowners Insurance

- Garbage, water, and sewer service

- HOA fees

- Home maintenance

- Flood or earthquake insurance (in certain locations)

Mortgage interest can consume almost all your monthly payments in the beginning. Surprisingly, if you have a 30-year mortgage, you may have to wait thirteen years before a larger portion of your monthly mortgage payments go toward your principal balance.

For example, say you have a $200,000 loan with a 4% interest rate for 30 years. In this case, you’ll spend about $144,000 in interest.

On the positive side, you can potentially get some of that back if you itemize your taxes and claim certain deductions.

What’s better, renting or buying?

By now, you can probably guess there is no right or wrong answer. It all depends on your particular circumstances—how much you can spend, the life you want to live, and the goals you wish to achieve. To make an informed decision, it’s important to weigh the costs and benefits of each option based on your situation.

Is it cheaper to buy or rent?

As stated earlier, renting can provide predictability to your list of monthly costs. You feel a sense of security when you know what to expect.

However, if you’re a big spender, renting may be more costly than owning your own home, even when you factor in all of the extra costs that come with buying a house.

Are homes good investments?

A home can be a wise investment, allowing you to potentially build equity. However, like any investment, its success depends on several factors. In real estate, variables such as location, economic trends, upkeep, and environmental considerations can significantly impact its overall value. Additionally, it’s important to remember that real estate is dynamic, and circumstances can shift at any time.

Focus on what matters

The choice to rent or own depends on your financial situation and vision for the future. Disregard those who make blanket statements like “renting is throwing away money.” Life circumstances and housing markets are too varied for such oversimplifications.

In the past, land ownership was restricted based on race, ethnicity, beliefs, or marital status, which fortunately has since been made illegal. Although practices like redlining still exist, buyers shouldn’t be deterred. Most mortgage lenders do their job correctly, considering only the borrower’s ability to make their mortgage payment on time and nothing else.

Before doing anything, weigh the risks, especially when buying a home. Obtaining a mortgage often involves using significant financial leverage, which is a big financial decision to make. While homeowners can make considerable gains if housing prices rise, they can also lose just as much if prices fall.

This is why it’s important to research the local market and get advice from professionals before signing any paperwork. Begin your home-buying journey by obtaining a quote.

This is an important step in identifying homes within your budget. For even greater insights, request quotes from multiple lenders. By shopping around, you could save a significant amount on closing costs and secure a better annual percentage rate (APR).

Final word

The decision to rent or buy largely depends on your financial situation and personal preferences. There are pros and cons associated with both options, so it’s important to do your research, speak with experts, and get quotes before proceeding.

Ultimately, focus on what matters most: making an educated decision that balances your budget with your needs.

Set up a call with a Facet expert today to get help determining which path makes more financial sense for you.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.