The information provided is based on the published date.

Key takeaways

- The U.S. dollar's 9.4% drop in 2025 was largely fueled by Fed rate cuts, proving that interest rate differentials remain the primary driver of currency strength.

- Non-U.S. stocks serve as an effective recession hedge, offering protection against a weakening dollar and reducing over-concentration in U.S. tech valuations.

- Most individual investors don't need to hedge currency risk because their income and expenses are both denominated in dollars, making foreign fluctuations a minor concern.

- While gold rallied 65% in 2025, its volatility makes it a riskier bet than international equities for maintaining long-term non-dollar exposure.

The U.S. dollar has struggled lately. According to the ICE U.S. Dollar Index, the American currency was down 9.4% in 2025, which was the worst year for the dollar since 2017. The trend has continued so far in 2026, with the dollar down another 1.5% through February 11. So why is the dollar dropping? How does it impact your money? And what’s the best way to protect yourself against further declines? Here are our thoughts on the risks investors face with the U.S. dollar.

Why is the dollar declining? Could it continue?

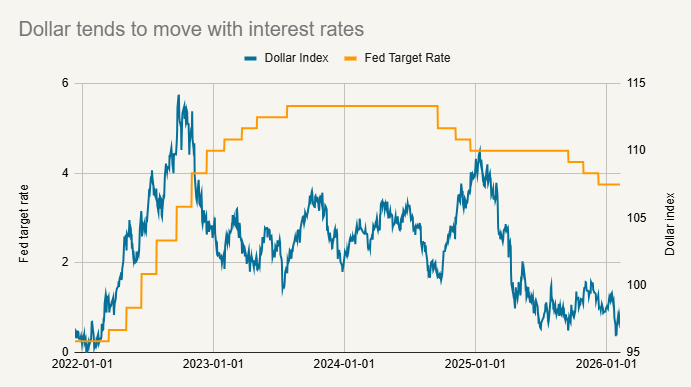

There are several reasons why the dollar has declined, but the most important is perhaps the most boring: interest rates. Global investors tend to move their money to the market where they can earn the most interest. Hence, if you have the U.S. Fed cutting rates more quickly than other central banks, you would logically expect the dollar to weaken. As with most things in the finance world, this relationship gets a little messy, since currency traders are always trying to anticipate the Fed’s next move. However you can broadly see this effect in the chart below.

Source: ICE, Federal Reserve

Here we see the dollar surging in 2022 as the Fed was hiking rates. It then levels out as the market starts anticipating that the hiking cycle is over. The dollar dips in late 2024 when the Fed starts cutting, then rebounds when the Fed pauses cuts in early 2025. It drops again starting mid-2025 when it becomes clear the Fed is going to resume cuts.

Note that when President Donald Trump nominated Kevin Warsh as Fed Chair, the dollar lurched 1.4% higher. This is precisely because markets perceive Warsh as more likely to keep interest rates high vs. other possible candidates. Interest rates really are the key factor for the dollar.

This suggests a fairly simple outlook for the dollar going forward. Right now there are two Fed rate cuts anticipated by markets for the rest of 2026. If the Fed cuts more than that, perhaps because the economy weakens, the dollar probably drops. If the Fed doesn’t cut that many times, good chance the dollar is higher.

What about other drivers of the dollar?

I don’t mean to imply that Fed policy is literally the only thing that impacts the dollar. For one, it is really relative interest rates that matter. So, for example, if the Fed is cutting rates but the Bank of Canada is cutting even more aggressively, the U.S. dollar is likely to appreciate vs. the Canadian dollar.

Equity investor flows can also influence the dollar. Global investors came into 2025 overweight the U.S., but that has reversed. According to Bank of America’s Global Fund Manager Survey global investors flipped to being underweight the U.S. in the first half of 2025. U.S. fund flows painted a similar picture.

Note that equity flows and interest rates will probably be correlated. If the outlook for the U.S. economy weakens, one would expect more Fed rate cuts. That is also likely a time when global investors are moving out of U.S. stocks.

Inflation can be another factor, but it is generally a minor factor. In theory, if the Fed completely ignored inflation then it could definitely cause the dollar to decline. However, in reality, the Fed tends to hike rates when inflation rises. Currencies are much more sensitive to that factor. Note that in 2022, when inflation peaked at 9%, the dollar rose by 8.2%.

Political uncertainty can be a driver of currency movement as well. However, be careful not to overrate this factor. It is fair to say that President Trump can be unpredictable, which does inject some degree of uncertainty into the policy environment. However, we don’t see a lot of evidence that this uncertainty in and of itself is a big driver of the dollar’s weakness over the last year.

For example, we did see the dollar decline about 1.7% on “Liberation Day,” when Trump announced a wide scale hike in tariff rates. However, that seems more tied to worries that the tariffs could cause economic weakness. Similarly, on April 21, when reports surfaced that Trump’s team was actively researching ways he could fire Fed Chair Jerome Powell, the dollar dropped 1%. However, this was a direct attempt by Trump to get lower interest rates. We would argue that it isn’t the political uncertainty that drove the dollar lower, but rather the concern that interest rates could fall.

Do you need to hedge your dollar exposure?

For companies operating in several countries, currency risk can be a big deal. Say you are a company with all of your production in the U.S., but most of your sales in Europe. You earn your money in euros, which you have to convert to dollars in order to pay the rent on your building, payroll for your employees, etc. So if the euro were to weaken, this would functionally make your whole operation more expensive. Hence the need to hedge currency risk.

The vast majority of individuals don’t have this problem. You earn your income in dollars, and you pay your bills in dollars. If the value of the dollar goes up or down vs. the euro or the yen, this has no bearing on your life. Maybe your European vacation gets a little cheaper or more expensive, but otherwise movements in currencies are of no moment to you.

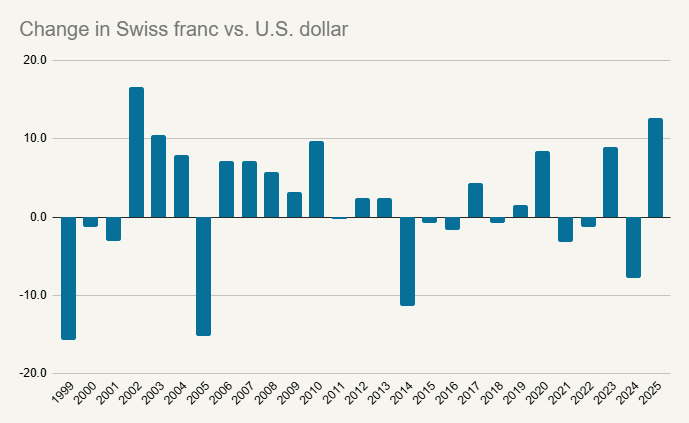

If you were to do something like open a savings account in Switzerland, you would actually be creating a currency problem. Assuming you have no bills that are denominated in Swiss francs, you’ll need to convert that money to dollars when you need to use it. What if the franc weakens vs. the dollar? Suddenly your bills will have become much more expensive, very similar to the company example we gave above. Note that currencies can be very volatile. Since 1999 the Swiss franc has suffered 12 negative years. The U.S. stock market has only had six losing years in that time.

Source: Bloomberg

For the vast majority of American investors, there is no real need to hedge currency risk.

The benefits of non-U.S. investments

That being said, there are some significant benefits to having non-U.S. stocks in your portfolio. One is simply that owning a wider variety of companies spreads out your risks. But there’s explicitly a benefit to owning stocks in various currencies.

As an investor with mostly U.S. stocks, one of your biggest risks is a U.S. recession. Historically the vast majority of elongated bear markets have occurred around recessions. When the U.S. economy weakens, it is very likely the Fed is cutting interest rates, often aggressively. As we said in the beginning of this article, that’s likely to cause the dollar to weaken. Therefore a recession tends to be a good time to own non-dollar assets, such as foreign stocks.

How much better international might perform vs. the U.S. depends on a lot of factors. The 2008-2009 recession was global in nature, and in particular a lot of non-U.S. banks were caught with large sub-prime mortgage losses. U.S. and non-U.S. stocks performed about the same. However in the period during and after the 2001 recession, the so-called “jobless recovery,” non-U.S. performed far better: 12.1% for the MSCI World ex. U.S. vs. 6.2% for the Russell 3000 from March 2001-December 2007.

As we said earlier, right now the market is anticipating two rate cuts by the Fed in 2026. However, we would argue if there is a recession sometime in 2026 or 2027, the Fed will cut much more aggressively than that. This creates a lot of room for the dollar to weaken, which in turn would create a tailwind for non-U.S. stocks. So while there’s no guarantee that non-U.S. will outperform in the next down market, the current mix of circumstances suggest to us that non-U.S. is an especially useful recession hedge right now.

We would also point out that adding non-U.S. provides some protection against a tech bust. The top 10 U.S. tech stocks make up 35% of the S&P 500. This leaves a U.S.-only investor very vulnerable to some kind of reset in tech valuations, as risk we discussed in our 2026 outlook piece. The current Facet mix cuts the percentage of those top 10 tech stocks in half, mainly because of our non-U.S. weighting.

Could the dollar collapse?

I’ve been in the investment business since the late 1990’s, and there hasn’t been a single year in that time when someone wasn’t out there warning that the dollar was on the verge of collapse. Generally speaking, I think these warnings underestimate how entrenched the dollar is in the global financial system. We wrote about this in more detail in another article.

For the dollar to truly collapse, there would need to be a viable alternative. Most of the reasons I hear for why the dollar could be in trouble would also apply to most logical alternatives.

- The U.S. debt to GDP level is about the same as most other large Western economies. The Eurozone is likely seeing debt levels rise as spending on defense increases. Chinese debt to GDP would be much higher if off-balance sheet debt were included in the official figures.

- Political uncertainty isn’t solely a U.S. phenomenon. Far-right political parties have been gaining ground all over Europe.

- The U.S. budget deficit is certainly large, but it has shrunk as a percentage of GDP vs. last year. Given the greater defense spending in Europe and the need for fiscal stimulus in China, I would expect the opposite trend in those economies.

Sometimes individual investors confuse a dollar collapse with a period of higher inflation. Although they could be related, these are really two different issues. It is much more straight-forward to build inflation protection into your portfolio. One example could be using floating-rate instruments or real estate, such as the investments in our Alternative Income strategy.

What about gold?

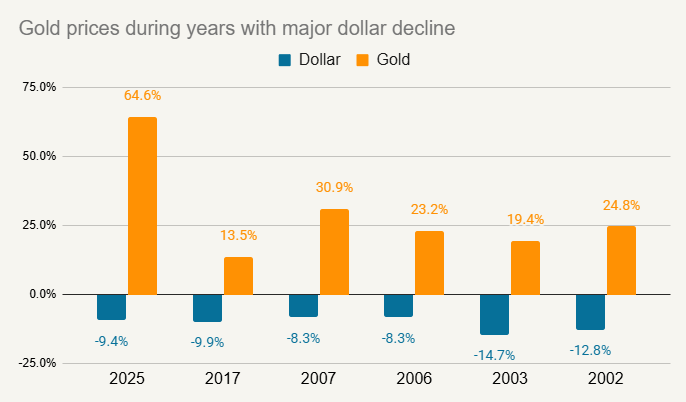

Gold has traditionally been a reasonable hedge against a declining dollar, and 2025 was no exception. Gold was up a staggering 65% in 2025 as the dollar slumped 9%. Based on history, it would seem likely that if the dollar declines again in 2026, gold prices could keep rising.

However there are good reasons for caution. First, gold’s rally in 2025 was way out of proportion with the dollar’s decline. In the chart below we show every calendar year where the dollar declined by at least 8% in the last 25 years and compared that to the change in gold prices. You can see that while gold was up strongly in each of these years, 2025’s gold rally is far in excess of the other periods.

Source: Bloomberg

This could mean that gold prices overshot in 2025, and thus might not rally as much in 2026 even if the dollar does decline. It could also mean that there is a lot of downside for gold if the dollar winds up strengthening. The huge gold and silver sell-off in response to Kevin Warsh’s nomination to the Fed could be a harbinger of how gold could react to a surprise dollar rally.

Note that gold’s 65% increase last year was the best single year since 1979. That turned out to be the beginning of a brutal bear market for gold that would ultimately see a 70% price decline from the 1980 peak.

We think utilizing non-U.S. stocks as your non-dollar exposure is much safer. A number of things can go right for non-U.S. stocks, whereas gold probably only keeps rallying if the dollar declines, and even that is questionable.

In general, investors shouldn’t spend a lot of time thinking about the value of the dollar. It does help make non-U.S. stocks a good diversifier in a recessionary scenario, but actually “hedging” the dollar isn’t something the vast majority of American investors need to do.