The information provided is based on the published date.

Key takeaways

- The Fed cut its target interest rate by 0.25%, but signaled a pause in rate cuts is coming.

- Stubborn inflation and a strong economy is driving the decision to slow rate cuts.

- By cutting rates despite inflation remaining well above target, the Fed is telling us they’d rather risk inflation staying a bit above 2% than cause a recession.

- This is a tough environment for bonds, but as long as the economy keeps growing, it could still be a good environment for stocks.

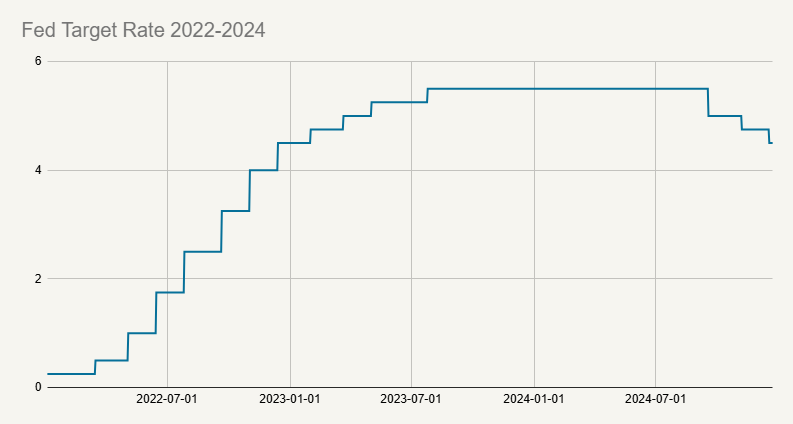

The Federal Reserve cut its target interest rate at its December meeting, which was widely expected. However, Fed Chair Jerome Powell suggested that this could be the last rate cut for a while, as the Fed grapples with stubbornly high inflation and uncertainty over how incoming President Donald Trump’s policies could impact the economy. Here are our thoughts on what the Fed is currently thinking and how that will impact your investments in 2025.

Source: Federal Reserve

Fed cuts rates, but signals a pause

While the Fed did cut rates for the third time in 2024, the biggest news out of this meeting is that a pause is coming. In the post-meeting press conference, Powell said that “inflation is moving sideways” and that the “uncertainty around inflation we see as higher.” Both of these issues has the Fed concerned.

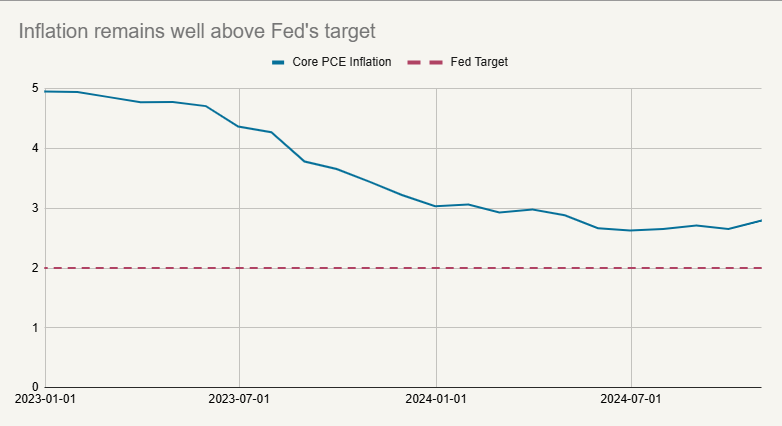

The chart below shows the 12-month Core PCE inflation rate, which is the rate the Fed uses for their official inflation target. The most recent release estimated inflation at 2.8% over the last year, well above the Fed’s 2% target.

Source: Bureau of Economic Analysis

Powell said that Fed policy would “enable further progress on inflation.” However, he also said the Fed could be “more cautious as we consider further adjustments to our policy rate.” This was meant to be a signal that further rate cuts were not a given. He emphasized this by saying “we are not on any preset course.” As Powell does at every Fed meeting, he reiterated the Fed’s ironclad commitment to their 2% inflation target.

Why cut at all?

The first question Powell got at the press conference was about why the Fed bothered to cut at all given that inflation seems to have leveled off so far above the 2% target. In my view, this is actually the most interesting question coming out of the December Fed meeting. The true answer to this question would tell us a lot about how the Fed will act in 2025.

Powell’s answer to the question was straight-froward. Even after this rate cut, the Fed believes policy is still “meaningfully restrictive.” In other words, the Fed thinks that rates are high enough that they are restricting economic activity, and this should support inflation continuing to subside. Maybe it is slightly less restrictive than it was before this cut, but still restrictive.

Second, Powell said that monetary policy operates with a “lag.” What he’s saying here is that economists believe that it takes time for Fed actions to filter through the economy. Because of this lag effect, the Fed often needs to cut or hike rates in anticipation of where the economy is going. In this case, if the Fed still thinks inflation is likely to resume falling in the coming months, cutting today is probably the right idea.

If we take this at face value, the Fed is telling us that they have quite a bit of confidence that indeed inflation will resume easing relatively soon.

Fed isn’t in a hurry to get inflation to 2%

However another possibility is that the Fed is willing to be patient in letting inflation get down to 2%, and therefore isn’t concerned about a few months of inflation stalling. Powell didn’t say anything of the sort in the press conference, but the Fed did give us a hint that this might be the case.

In the Fed’s quarterly “Summary of Economic Projections,” members of the Fed committee each give their economic forecasts for a number of major variables, including inflation. A new set of projections were released following this meeting. This showed the median forecast for Core PCE inflation at the end of 2025 was 2.5%, with the median forecast not reaching 2.0% until sometime in 2027. The most recent actual Core PCE inflation figure was 2.8%.

In other words, the Fed’s own forecasts have inflation falling, but very slowly, and not hitting their target for at least another two years.

By cutting today, and based on this forecast, they are telling us they aren’t in a hurry to get inflation back to the 2% target.

This probably also has to do with the Fed’s risk preferences. In order to get inflation down faster, the Fed would have to restrict the economy more. This risks unemployment rising and/or causing a recession. The Fed is telling us they’d rather risk inflation staying a bit above 2% than cause a recession.

Is the Fed done cutting completely?

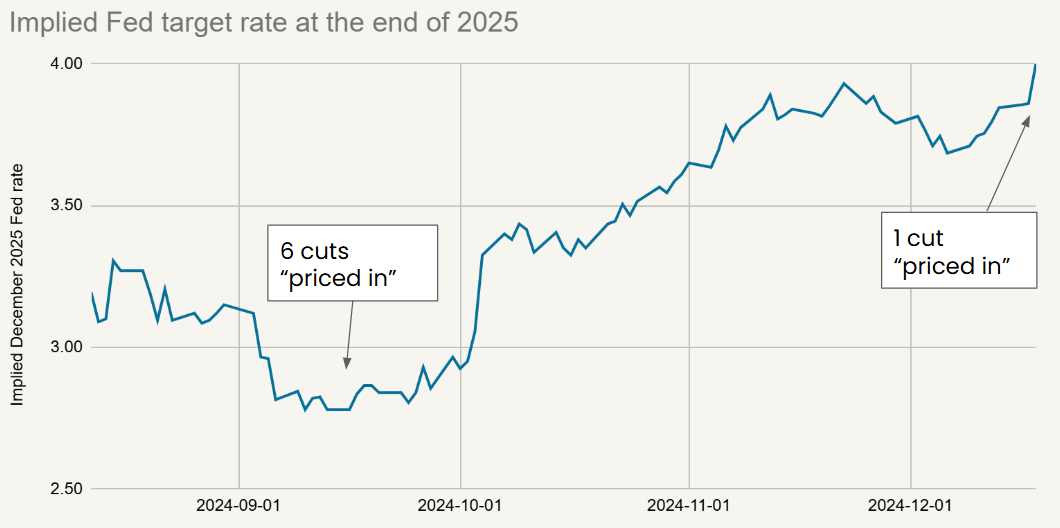

Markets still think the Fed is likely to cut a couple more times in 2025, but this is a big change from just a few months ago. Based on futures markets trading, as recently as mid-September, traders were anticipating the Fed cutting rates to around 2.8% over the course of 2025. Based on today’s levels, that would mean six cuts of 0.25% each. Now the same futures markets indicate only one rate cut.

Source: CME group

This tells us that the market also has confidence that inflation will resume its slide, and therefore the Fed will have room to cut later in 2025. However I wouldn’t rule out the possibility that the Fed is done hiking completely. I would say the Fed remains on hold until there are at least two or three months of lower inflation figures. Moreover, I suspect the longer inflation remains in the 2.8% range, the more hesitant the Fed will be to resume cutting. I.e., the bar for cuts will get higher and higher as the year progresses.

What about Trump’s tariff and immigration policies?

During the press conference, Powell was asked several questions about whether President-elect Trump’s tariff, tax and immigration policies could revive inflation, and if so how would the Fed react? As always, Powell carefully avoided wading into politics, saying that he wasn’t “a question in front of us right now” given Trump hasn’t even taken office yet. He went on to say they would certainly analyze the impacts of policies, but there isn’t enough information about what Trump’s policies will actually be to speculate about how the Fed should react.

I definitely agree that the Fed shouldn’t be in the business of guessing about political decisions. Sure, we know that generally speaking, Trump favors more tariffs, tax cuts, and curbs on immigration. Each of those policies is likely to cause higher inflation, all else being equal.

But there are still so many unknowns. Actual policy is very likely to be different from what was said on the campaign trail. Powell said that the Fed may very well make adjustments to their forecasts based on changes in policy, but only after there was clarity about what the policy would actually be.

That being said, if inflation does rise 2025, whether that’s due to Trump policies or some other reason, the Fed would certainly stop cutting rates. I wouldn’t rule out that they resume hiking either.

What does this mean for markets?

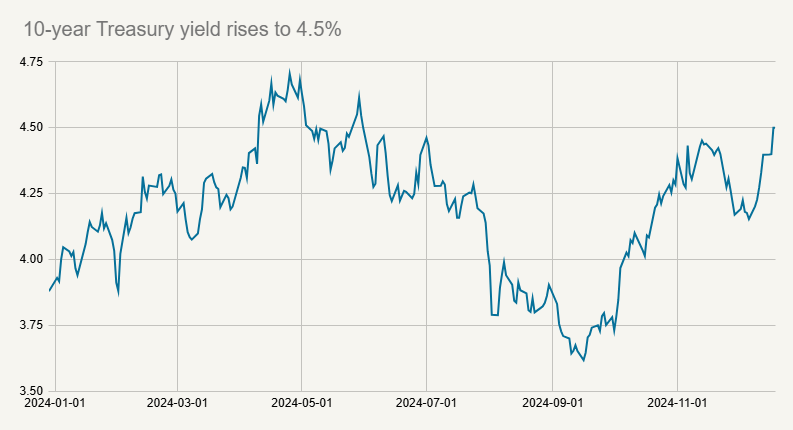

Treasury bond yields have been rising since mid-September, around the time that inflation stopped falling. This has closely tracked markets’ forecast for Fed rate cuts in 2025. I.e., as markets expect fewer cuts, bond yields have been rising.

Source: Bloomberg

This is the biggest risk to markets should the Fed stop cutting entirely. Higher bond yields aren’t necessarily a problem for the economy, but it does create some risks. This will likely keep mortgage rates high, which puts pressure on the housing market. It also puts additional pressure on the commercial real estate market, which is already struggling from occupancy and rent growth challenges.

For the stock market, higher rates are less of a worry. If the economy keeps growing in 2025, it is likely that stock prices will continue to rise. The primary risk for stocks is that economic growth wanes, causing company profits to stagnate. Mitigating that risk is the fact that if the economy were to weaken by even a small degree, that would probably cause inflation to fall, allowing the Fed to cut quickly. That could help forestall a recession, similar to 1995 or 2018.

If anything, recent economic data has suggested the economy has accelerated a bit. If that proves sustainable, it might mean fewer (if any) Fed rate cuts in 2025, but it should be good news for investors in general.