The information provided is based on the published date.

Key takeaways

- The stock market will be watching closely for news about tariffs, which are likely to be the biggest source of market volatility.

- Immigration will also be one of Trump’s first priorities, and this could have implications for inflation.

- Wall Street will also closely be watching progress on the budget and taxes, which could turn contentious given the slim majorities Republicans hold in Congress.

- Other Trump priorities could have some impact on markets, ranging from healthcare to regulation.

President Donald Trump formally took office on January 20, and he has a packed agenda for the first 100 days in office. These include some items that could have major economic impacts, such as immigration, taxes, tariffs and regulations. Here we examine how the administration’s early priorities will impact the economy, financial markets and your money.

Tariffs

We expect Trump’s first actions will focus on things he can do without Congressional action. Perhaps surprisingly, one of those items is imposing tariffs. Congress has delegated authority for imposing tariffs to the White House through a series of laws passed between the 1930’s and 1970’s.

As we have said in the past, economists widely view tariffs as bad policy in a vacuum. However, what is unclear is how Trump intends on using tariffs. Does he intend on imposing them temporarily to negotiate more favorable trade arrangements with other countries? Or does he genuinely think tariffs are a good way to raise government revenue and thus should be permanent?

Wall Street is going to be watching this closely. That tariffs are coming is inevitable and to some extent are priced into the market already. However the specifics of how they are enacted will probably telegraph which of the strategies above the administration is pursuing.

It will also be an important clue as to which advisors are influencing Trump. Scott Bessent, nominee for Treasury Secretary, has indicated he’s more in the camp that tariffs are primarily a negotiation tool. However Stephan Miran, nominee to chair the Council of Economic Advisors, favors a much more aggressive approach.

We’ve already seen significant volatility on news about tariffs. A Washington Post story suggesting tariffs might not be “universally” imposed sent stocks soaring on January 6th, but later a Trump denial pared those gains. Expect this kind of volatility to continue.

Immigration

Border security and immigration have been centerpieces of Trump’s platform since his first run for office. This time around, Trump plans a large-scale deportation of illegal immigrants along with other measures to better control the flow of immigration.

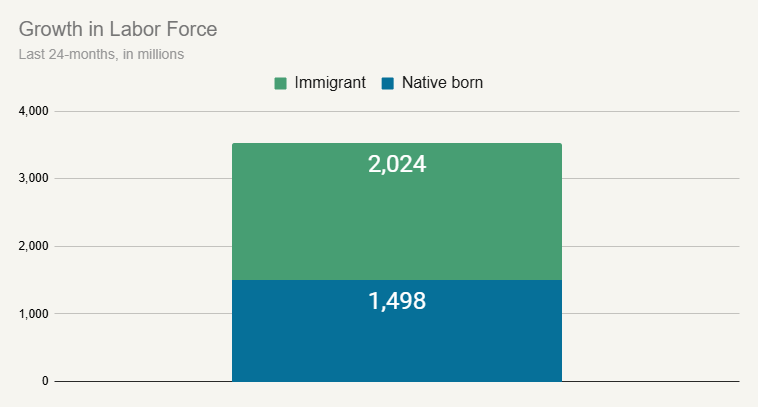

Immigration has been a significant positive factor for the economy over the last couple years. Relatively high immigration has allowed the labor force to grow at a faster pace than economists assumed during this period. Even though immigrants only account for 19% of the labor force, they have been responsible for 57% of labor force growth over the last two years.

Source: Bureau of Labor Statistics

This is probably one of the key reasons why inflation has subsided without the need for a recession over the last couple years. Hiring demand outpacing the supply of workers is thought to be one of the key drivers of inflation. The fact that the labor force grew at a faster pace eased this pressure.

The impact of Trump’s immigration policies aren’t likely to be obvious within the first 100 days of his term. Even the mass deportation plan Trump has pushed will take time to actually implement. Trump’s “border czar” Tom Homan has said he intends on focusing on illegal immigrants already incarcerated in one manner or another. These people are not currently part of the labor force, and therefore wouldn’t have any impact on worker availability.

One thing we’ll be watching closely is whether the pace of legal immigration slows. This could be an early sign of whether immigration policies could have an inflationary impact.

Taxes and the budget

The single biggest reason why stocks rallied just after Trump’s election was taxes. The 2017 tax cuts passed during Trump’s first term expires in 2025. Wall Street was hoping that Republican control of all three branches of government would make extending these tax cuts a slam dunk.

Two things have since happened that make this a bit more tricky. First, passage of a budget deal this past December was much more difficult than expected. This showed the market that the Republican caucus wasn’t uniformly united behind Trump. It also set up a March deadline at which time some kind of new budget deal must be in place.

The second thing is that Trump himself has been pushing this idea of “one big beautiful bill” to encompass many of his priorities. Doing so would force Congress to consider how both new spending and tax cuts will impact the deficit. This was a key reason why the December budget deal became so contentious.

Given how small the Republican majority is, especially in the House of Representatives, and given how much politicians like to play brinksmanship, expect considerable volatility if it appears this tax extension is at risk. We would still guess that a tax-cut extension is likely to ultimately pass, but there is more risk now than it appeared a few weeks ago.

Other agenda items might make headlines, but probably have limited market impact

Trump has a number of other agenda items but we see these as having little to no major impact on financial markets, or be limited to only pockets of the market.

- Climate regulations: Trump will likely roll back some of Joe Biden’s executive orders related to environmental regulations. This could have some impact on individual stocks, such as electronic vehicle makers, but won’t be a source of overall market movement.

- Oil drilling: Trump has promised to “drill baby drill” for more oil, ostensibly to lower the price of gasoline for consumers. The problem is that oil companies are already not drilling as fast as they could. They have been cautious about overinvesting in new capacity since the bust in shale oil in 2015. Simply opening up off-shore drilling probably doesn’t increase overall oil production materially.

- Mergers and acquisitions: The Federal Trade Commission under the Biden administration was relatively hostile toward mergers, whereas Trump is likely to be more permissive. This could definitely result in a pick-up in merger activity, and that could help boost small and mid-cap stocks, but the impact will be felt over time.

- Healthcare: There has been some concern that Robert Kennedy, nominee for Health Secretary, could be hostile toward healthcare companies and/or medical innovations. Healthcare stocks did drop right after Kennedy’s nomination, but have outperformed so far in January.

- Other regulations: The Trump team has cited a number of other regulations they would like to reduce. While some of these will be announced in the first 100 days, the economic impact of regulation tends to take a long time to be apparent.

Politics still a secondary factor

When writing about how politics influences markets in the past, we called it a “secondary factor at best.” That might sound odd now, given how much seems to be changing since Trump’s election. But we think this actually proves our point. Since Trump’s election, the S&P 500 is up about 4% through January 17. That’s a solid return, but nothing out of the ordinary.

If stocks are going to finish 2025 higher, it is very likely because companies continue to grow profits at a strong clip. If stocks finish in the red for the year, it’s probably because the economy slowed. Things like Trump’s policies may have some impact on the margins, but it won’t be the primary driver.