The information provided is based on the published date.

Key takeaways

- The Federal Reserve is signaling future interest rate cuts for late 2025, adopting a "dovish pause" as it waits for more economic clarity.

- A potential "one-time" inflation spike from tariffs is the main factor delaying immediate rate cuts, even as underlying core inflation shows signs of cooling.

- While the Fed is closely monitoring the softening U.S. job market, current labor conditions are not yet weak enough to force an immediate interest rate cut amid inflation risks.

- Investors should look towards the end of 2025, possibly September at the earliest, for the Federal Reserve to begin cutting rates once the tariff price shock passes.

As was widely expected, the Federal Reserve left its interest rate target unchanged at the June 18 meeting. This meeting comes at a difficult moment for the Fed. As Fed Chair Jerome Powell discussed at the meeting, there are elevated risks to both the economy and inflation. The Fed is waiting to see which of those factors become more problematic, and this will guide their next moves. However, we think if you read between the lines, it's clear that Powell is more concerned about economic weakness. Here are our thoughts on this Fed meeting, and what it tells us about what the Fed might do next.

What will it take for the Fed to cut rates?

The Fed’s post-meeting press release stated that economic uncertainty “remains elevated.” Fed Chair Jerome Powell followed this up in his press conference, saying that the substantial increase in tariffs “are likely to push up prices and weigh on economic activity.”

On its face, if there is an increase in both inflation and unemployment risk, we might think that the Fed is equally likely to cut or hike rates next. However it's clear the Fed is leaning toward cutting rates. We can see that from the Summary of Economic Projections released after this meeting. This shows that a large majority of Fed committee members expect to be cutting rates later this year, with the committee split between one and two or more cuts.

Powell gave a little more detail in his press conference. He said that the tariffs could cause a “one-time shift in the price level.” In other words, prices will probably rise due to tariffs, but after the initial increase there’s no reason to think prices will keep rising. This is an idea we discussed in more depth in a prior article.

If this is the case, then how soon the Fed might cut rates comes down to two things. First, how strong is inflation pressure outside of tariffs? And second, is the labor market weakening?

So far, inflation has been tame

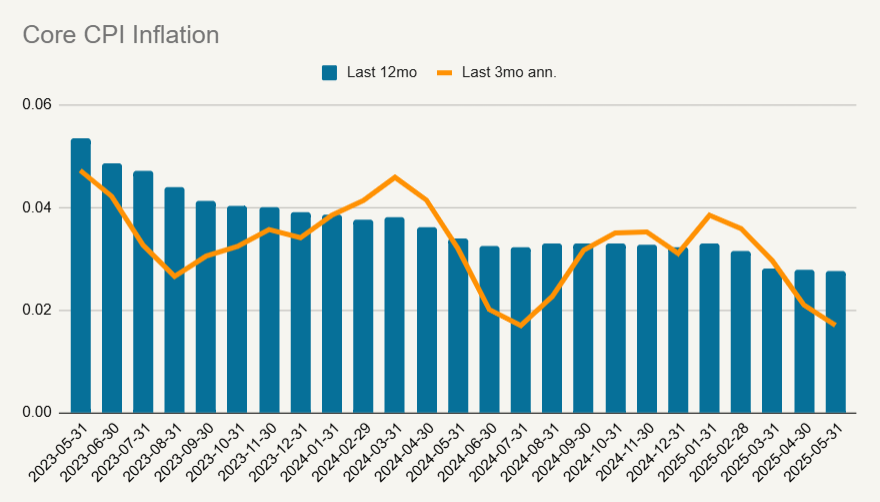

Inflation seems to be subsiding based on recent data. On a year-over-year basis, core inflation (as measured by the Consumer Price Index excluding food and energy) rose 2.77% through May. That’s the lowest since early 2021. In addition, over the last three months, inflation has only advanced at a 1.7% pace. This is good news for the Fed, as it indicates that the underlying inflation pressure in the U.S. economy is tame.

Source: Bureau of Labor Statistics

During the press conference, Powell was careful to not sound too excited about this encouraging inflation data. For one reason, it's likely that most of the tariff effects haven’t yet impacted CPI data, something Powell pointed out in his press conference. It's also true that we’ve seen similar dips in short-term inflation only to see it rise again, such as the summer of 2024 in the chart above. The Fed’s own inflation projections for 2025 was increased from 2.7% last quarter to 3.1% after this meeting.

However the most important reason Powell wants to sound cautious on inflation is reputational. It's critical that markets believe the Fed is absolutely committed to its price stability mandate. Powell knows he made a big mistake in 2021 when he was somewhat dismissive of nascent inflation pressure building at that time. This is not a mistake he is inclined to make again.

Hence, even if Fed officials believe that tariff-based price increases will be short-lived, they won’t take that for granted. The Fed will need to see prices rise, and then see clear evidence that the rate of inflation is subsiding from there. Only once that happens do rate cuts become a possibility. That likely means the earliest we could see a rate cut would be the Fed’s September 17 meeting.

Job growth has softened

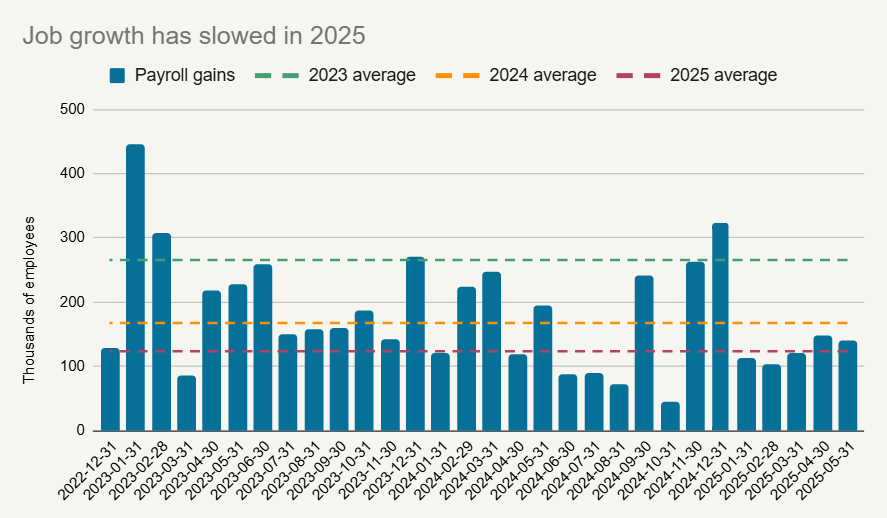

The other indicator the Fed is watching closely is employment. While job growth remains solidly positive, it has clearly slowed in the last few months. U.S. companies have added an average of 124,000 employees per month. That’s down from an average of 168,000 in 2024 and 266,000 in 2023.

Source: Bureau of Labor Statistics

Notably this slowing in job gains is coming with few signs of increased layoffs. According to a Labor Department survey, the rate of company layoffs has not increased in 2025 compared with 2024, and in fact is a bit lower than 2023. It appears that companies aren’t confident enough to hire aggressively but aren’t yet worried enough to lay people off either.

In his press conference, Powell described the labor market as “solid” and “consistent with maximum employment.” During the Q&A with reporters, Powell suggested the Fed was closely monitoring the labor market, but sees no signs of acute pressures. This is Powell’s way of saying that labor market conditions aren’t compelling the Fed to cut rates right now.

Fed not cutting now, but the time is likely coming

As I said above, the Fed is loath to cut rates while inflation is actually rising. Hence, almost no matter what happened with job growth, the Fed isn’t going to be cutting rates for a few months. However bear in mind that the Fed cut rates in 2024 during a period where job growth was a good bit stronger than it's now.

So I believe that if not for the impending price increases likely coming from tariffs, the Fed probably would have cut rates at this meeting. It would be framed as an “insurance” rate cut, similar to the cuts the Fed made in 2019. At that time the economy broadly was fine, but there were some signs of softness in both inflation and employment. The Fed cut rates to get ahead of that softness.

Unfortunately, the Fed can’t get ahead of the labor market softness we are seeing today. It would be taking too big of a bet on tariff-based inflation being short-lived. This is the irony of President Donald Trump calling Jerome Powell “Mr. Too Late.” It's policy coming from the White House that is making it hard for the Fed to cut, not some sort of recalcitrance on Powell’s part.

As it's, we believe rate cuts are very likely toward the end of the year. As long as inflation behaves broadly as expected, there will probably be at least 2-3 cuts over the course of 4Q 2025 and 1Q 2026. If the labor market deteriorates more than we are currently seeing, the Fed could get substantially more aggressive than that.