The information provided is based on the published date.

Key takeaways

- The large-scale government layoffs do pose some economic risks, but may not be large enough to cause a recession.

- Around 2 million civilians work for the federal government, while recessions typically increase unemployment by over 4 million. So, even if the government laid off 300,000 workers, it's unlikely to have an obvious macroeconomic impact.

- Overall government spending could decrease enough to cause a recession, but this may be offset by tax cuts.

- In general it’s important to separate your own political opinions from your investment decisions.

The pace of federal government layoffs appears to be accelerating. This could have many implications, ranging from budget savings to diminished government services. Certainly the actions of Elon Musk and his “Department of Government Efficiency” (or DOGE) team have led to a lot of controversy. However investors should be focused on one particular question: how will these changes impact the macroeconomy, and therefore financial markets?

Could government layoffs cause a recession?

Certainly it is true that when someone loses their job, their spending tends to decline. If there’s less spending in the economy in general, that could cause a recession. The question is, how many government jobs would need to be eliminated to cause such a slowdown.

Neither the DOGE team nor the Office of Management and Budget, which functions as the government's HR department, have given exact numbers as to how many federal workers have been laid off. A recent estimate came up with about 30,000 government workers who have officially been told they are fired. However, due to the speed at which Trump and Musk are moving, it is almost certain this number will grow substantially.

The U.S. labor force is large and highly dynamic

How big could the layoffs get? There is no way to know for sure, but we can try to put it into some kind of context. About 3 million people get a paycheck from the federal government, with about 1 million of those are in the armed services. That leaves roughly 2 million people with civilian jobs working for the U.S. government.

Given that number, it would be tough for government layoffs by themselves to cause a recession. There’s about 164 million people employed in the US. Every month, about 5 million people are hired and fired (or quit).

With a labor force this large, and with such substantial turnover every month, it takes a very large number of layoffs to actually impact the macro economy. A number like 30,000 layoffs isn’t going to have any effect. Even 200,000 or 300,000 government layoffs is unlikely to have an obvious macroeconomic impact in and of itself.

Recessions tend to involve 2 million or more layoffs

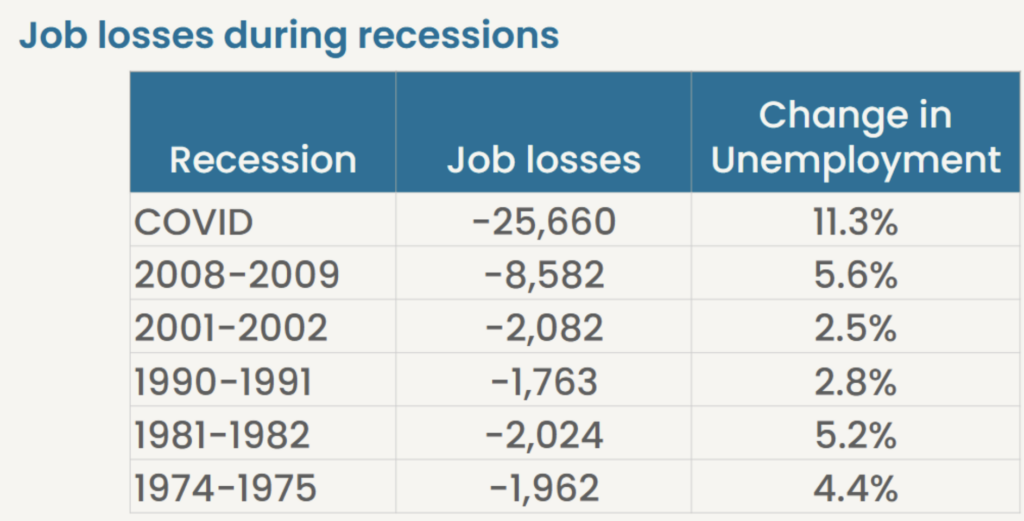

We can look at recent recessions to get a sense of what a recessionary jobs market looks like.

Source: Bureau of Labor Statistics

The COVID recession was a unique situation, but during the 2008 Financial Crisis, job losses reached about 8.6 million. Even in the most mild recession of the last 50 years, unemployment rose about 2.5%. To get an increase of 2.5% in the unemployment rate today, between 4 and 4.5 million people would need to lose their jobs. In other words, even laying off the entire government workforce wouldn’t by itself cause unemployment to rise by 2.5%.

Total government spending is a bigger risk

This is not to say there are no risks related to government spending. However total government spending is probably the more important indicator as opposed to the number of layoffs. More specifically, we are most focused on the net change in government spending.

To see why, consider a scenario where the government cuts spending by 10%. This could have a severe impact on the economy, at least in the short-run. Not just direct layoffs, but also impacting companies that sell products to the government, government contractors, etc.

However if Congress also cut taxes by 10%, the net effect on the broad economy would probably be minimal, again at least in the short-run. Any decrease in government spending would be made up by increased spending by consumers.

Watch the deficit, not just spending

However if there were to be a large and sudden decrease in the deficit, this would have a negative economic impact. A lower deficit might be a benefit in the long-run, but it would result in less total economic activity in the short-run.

That being said, it is unlikely Musk’s DOGE effort could create anything like that kind of effect. It is unclear exactly how much savings he’s actually found so far. At the time we’re writing this, estimates range from less than $10 billion to as much as $65 billion. Regardless, these figures pale in comparison to the $6.8 trillion U.S. government budget, and even moreso relative to the $29 trillion U.S. economy.

The DOGE effort alone is very unlikely to change the trajectory of the economy. For all the controversy around Elon Musk’s efforts, we think it is safe to discount the chances DOGE spending cuts cause a recession.

Current budget deal suggests a large deficit, not smaller

To get a bigger impact on the deficit, Congress will need to act. However, right now Congressional Republicans do not seem to be focused on deficit reduction. On February 25, the House passed a budget that does call for about $2 trillion in spending cuts, but offsets that with $4.5 trillion in tax cuts. This budget is a long way from being law, but it does suggest that deficit reduction is not currently a priority.

In terms of the impact to the macro economy, if anything this is probably a stimulative budget. Consumers will have more money to spend if taxes are cut, and this won’t be fully offset by cuts in government spending. If this is the final budget, there will be an expansion, not contraction in government contribution to overall economic growth.

Don’t let personal politics dictate investment decisions

As a citizen, you may agree or disagree with this budget plan yourself. Maybe you’d like to see a lower deficit, even if it means some economic pain. Or maybe you’d prefer a different mix of spending and taxes. That is your prerogative.

However do not let those feelings be overly influential on your investment decisions. Whether you are a big fan of Musk and Trump or not, try to keep the big picture economic effects in proper perspective.