Key takeaways

- Diversification is an investment strategy that helps to reduce risk and limit volatility by spreading money across various asset classes

- Most individual stocks underperform the broad market, while a relatively small number are the major drivers of performance. A significant benefit of broad diversification is that you are guaranteed exposure to those crucial performance drivers

- To get the benefits of diversification, you need to own items that perform differently, not just a large number of securities

- Markets also sometimes have paradigm shifts, where certain segments of the market lead performance for an extended period but later fall off. Broadening your holdings can help ensure you don’t get left behind should this happen

Want to achieve financial freedom? One way is to diversify your investments.

While you’ve likely heard the term repeatedly, do you know what diversification really means and how to do it?

Here's a deep dive into what diversification is and how to master this essential piece of your financial puzzle.

What is diversification?

In investing, diversification is a term for holding different types of investments within an investment portfolio to spread out risk. It works by ensuring that no one security (stocks and bonds, mutual funds, ETFs, etc.) will have an outsized impact on the portfolio's overall risk and return.

If your asset allocation acts differently enough, it should be that when one basket of securities is performing poorly, it will be offset by another that is performing well.

Learn more about our investment philosophy

Why broad diversification is important

Spreading out your investments is extremely important. Not only can it lower the volatility of your investment portfolio, but it also tends to improve investment returns over picking a smaller set of securities.

In this way, a broadly diversified portfolio often increases the chance you will meet your financial goals, which is the whole point of investing in the first place.

Here’s how it works and why it is such a benefit.

Risk and volatility

In finance, the term “volatility” is used to describe how variable the return of a given asset is from one period to the next.

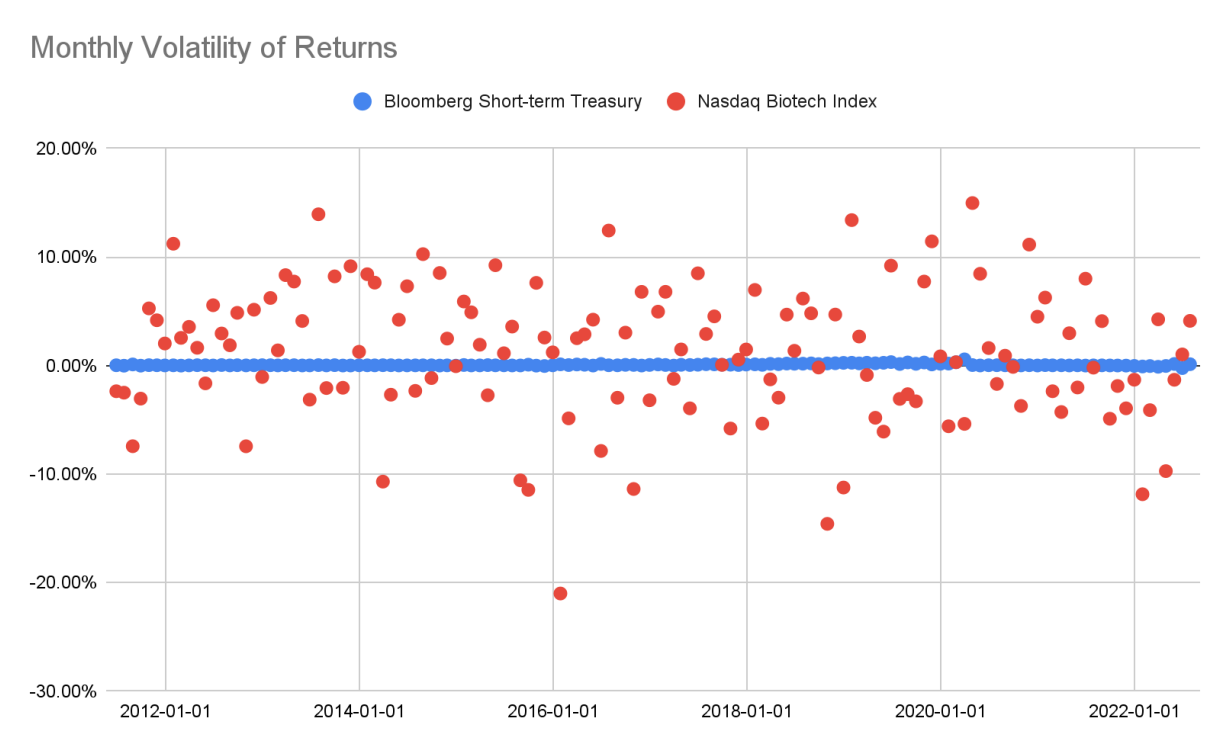

For example, the chart below compares a very low volatility asset (short-term Treasury bonds) with a high volatility asset (biotechnology stocks). Each red dot represents the one-month return of the biotech index.

You can see that returns above +10% or below -10% are fairly common. The blue dots are the short-term Treasury index. That index never has a return higher than 0.6% or lower than -0.3%.

While market volatility is not a perfect measure of risk, it is a good proxy. Basically, a portfolio with high volatility also has high uncertainty, i.e., a wide range of possible outcomes, which could include permanent loss of your money.

On the other hand, a portfolio with lower volatility is more reliable (you can see what we mean in the chart above).

And when you have a very concentrated investment strategy, like having a large position in an individual stock, your risk also includes a complete loss of your investment (which diversification can help to eliminate).

Diversification balances risk and reward

All else being equal, we want less uncertainty in our portfolios. But, unfortunately, all else usually isn’t equal.

Using our two extreme examples above, $10,000 invested in short-term Treasuries ten years ago would be worth about $10,758 today. If you invested in biotechs, your ten grand would be worth $27,753 (assuming you were able to stomach the volatility and remain invested).

Most of us need to make a certain return on our investments to meet our goals, so the conversation can’t be just about minimizing volatility; it should be about creating the right balance between risk and return.

Diversification is frequently the best way to accomplish this. Of course, a broadly diversified portfolio doesn’t always wind up with the highest return or the lowest risk, but it usually yields a better than average result for both in the long run.

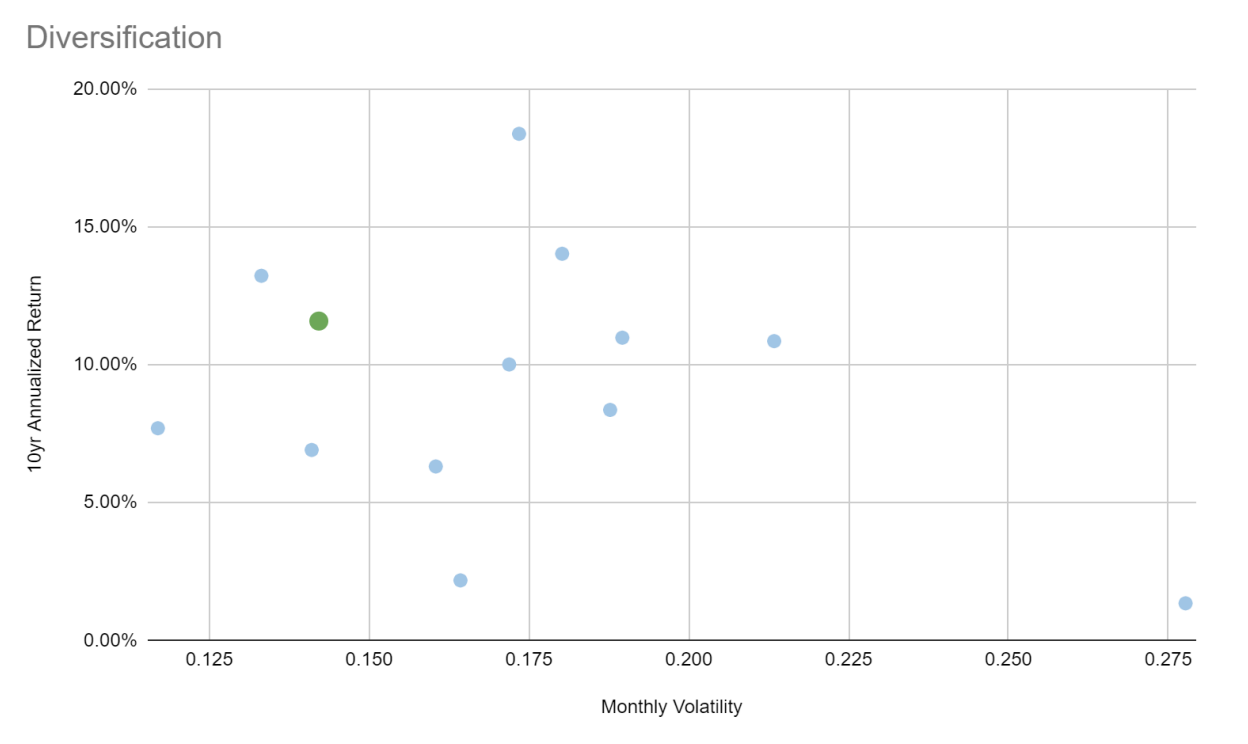

To illustrate, let’s look at the individual sectors within the S&P 500 over the last ten years and compare them to the S&P as a whole.

This chart shows the ten-year annualized return on the vertical axis and the volatility on the horizontal axis. In other words, higher dots have more return, and dots to the right have more risk.

Source: Yahoo! Finance

Source: Yahoo! Finance

The green dot is the whole S&P 500. The light blue dots are individual sectors, like energy, utilities, or technology.

We see on the chart that only three dots lie above the green dot, meaning that only three out of 12 sectors did better than the S&P on a pure returns basis.

Looking left to right, only three dots lie to the left of that green dot, which means of all 12 sectors, the whole S&P had less volatility than all but three as well.

You'd see similar results if we ran this same analysis for other periods. The overall S&P 500 would probably never have the absolute best return or the lowest risk, but it would always be better than most in either situation.

Moreover, the sector that performs the best is always changing. One period it would be technology, another period energy, another real estate. But the whole S&P would always tend to be near the top in performance and near the bottom in risk.

This diversification effect looks even starker when one looks at individual stocks. We pulled a list of over 5,300 US-based stocks that were outstanding at any point over the last five years and compared that to the performance of the Russell 3000—an index meant to match the performance of the entire US stock market.

The result: Only 20% of individual stocks performed better than the Russell 3000, and only 9% had lower volatility over that five-year period.

It’s critical to own the winners

A key insight here is how crucial it is that you don’t miss out on the stock market’s big winners. Considering the stat above, only 20% of individual stocks did better than the broad US equity markets over the last five years.

That means that the best 20% of stocks drive the returns for the entire market. This is also not unusual because there is a natural skew to stock returns: a stock can go up by 1,000%, but it can only drop by 100%.

So it is critical that you don’t miss out on this 20% of stocks that will drive returns. How? Broad diversification helps to ensure this won’t happen.

Diversification requires different kinds of assets

The key to maximizing the diversification effect is to own assets that act differently from each other.

You can own 50 stocks, but if they are all technology companies, they will tend to act the same. Some will do better than others, but they will likely be down or up on the same days, weeks, and months.

Mathematically we use “correlation” to measure how alike two assets tend to move. A correlation of 1.0 indicates the assets always move the same way, while -1.0 means they always move in the opposite direction.

For example, Microsoft and Apple stock have a correlation of 0.80 over the last three years. If you already own Microsoft, there’s limited diversification benefit of adding Apple. That high of a correlation suggests that if Microsoft performs poorly, Apple probably will too.

On the other hand, Boston Properties, an owner of office buildings, has a correlation of just 0.37 with Microsoft. A correlation that low suggests the two companies have very little to do with each other.

Most stocks have some correlation with each other. That's because the broader economy impacts all stocks. If the economy is booming, most companies benefit, and thus most stocks rise.

Conversely, if the economy hits a recession, most companies suffer.

This is why just owning a larger number of stocks isn’t enough. You also want assets like fixed income securities that typically have no relationship with the stock market at all.

For example, the correlation between Microsoft and the Treasury Bond market is actually -0.15 over the last three years, according to Bloomberg.

Diversification also helps capture paradigm shifts

Markets go through cycles where a certain set of assets are the best performers, then this rotates, and something else becomes the winner.

In 2020 and 2021, technology stocks dominated, while energy stocks were the worst performers.

Earlier, we pointed out that a small number of stocks sometimes are the drivers of market performance (growth stocks). When this happens, it is often because something about the macro environment boosts a certain industry or region.

For example, it might be technology for a few years and then emerging markets for a few years. Very broad diversification often ensures you will catch these risers when they happen.

Since we don’t know who the winners will be ahead of time, owning a little bit of everything helps to ensure you will participate in the big winners, which is critical to achieving strong long-term results.

Diversification is one of the few “free lunches” available in investing. If done well, it lowers portfolio risk and may even enhance returns. It ensures that your portfolio will often include the winners in markets going forward, which is critical to meeting your long-term goals.

Final word

Diversification is a crucial aspect of successful investing. By spreading your investments across different asset classes, industries, and geographies, you can minimize risk and increase potential returns. It may not always be exciting, but it is an essential investing strategy for achieving long-term financial goals. So the next time you're tempted to put all your eggs in one basket, remember the benefits of diversification and how it can help you achieve financial stability and success in the long run.

This is something your Facet team can help with. We can analyze your current portfolio, including any tax considerations of changing your positions, and help craft a way to improve your diversification. This may help lower your portfolio volatility and ensure that whatever the market brings, you will have exposure to the best performers of tomorrow.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.