By: Brent Weiss, Co-Founder and Chief Evangelist

In Part 1 we covered how to balance college savings with your other goals, the best vehicles for college savings, and the five steps you need to take to get the ideal college savings plan started. In part two we are going to hop in the DeLorean and fast forward several years to cover how to select the right school and ensure that the money you’ve saved goes as far as possible.

Choosing the right school

There are many things to consider when choosing the right college for your child(ren). Below is a matrix that has proven to help other families think through what matters most.

Make this list your own, personalizing it based on what’s important to you, then use it to make sure you know your priorities. There are also intangible factors to consider when selecting the right school, and I recommend visiting a few to get a sense of what feels right and seeking out personal opinions from current students and alumni. Considering the qualitative and quantitative will help you balance your decision (there’s that balance again!).

The million-dollar moment, how to actually pay for college

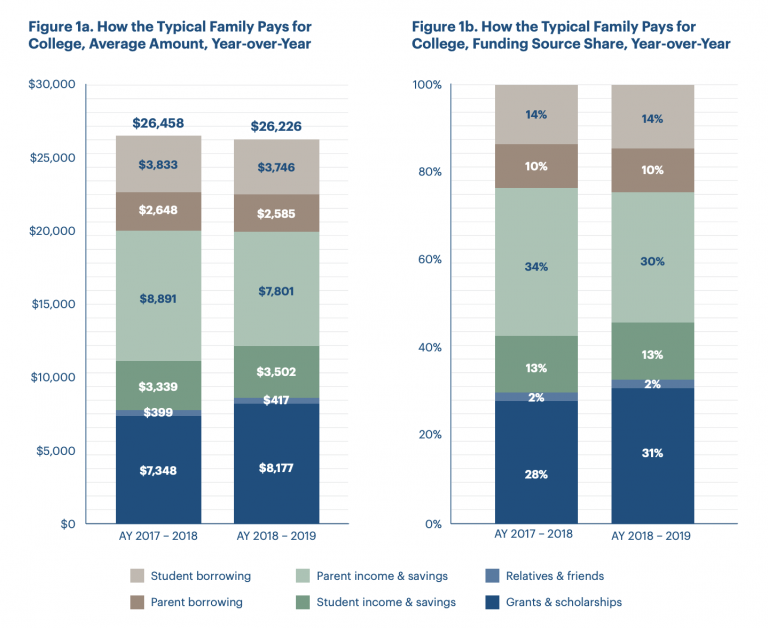

When the time comes to pay for school, know that most families require additional resources above and beyond what they have saved and what they can afford to spend from cash flow. That is to say, if you need to take loans or look at alternative funding sources, you are not alone. Sallie Mae publishes an annual report on paying for college, and here is some information on how payment breaks down for most families.

So how do we pay for college?

MOM

No, not literally mom, but M.O.M. which stands for My Own Money. This is the category that directly defines your costs for school. There are several categories that make up the MOM bucket:

- Savings. What you have saved in either an account designated for college (e.g. a 529 plan) or a general vehicle (e.g. bank account).

- Parent income. Sorry, but this applies to you. This accounts for your current income and earnings that will go towards paying for college.

- Student income and work-study programs. Are we being too optimistic that your child(ren) will work while in school? I am an optimist by trade so I’ll assume this is possible. There are specific work-study programs that offset tuition and then there are independent jobs (where they’d have to be pretty disciplined to apply the earnings to school costs).

- Loans. Many people think loans should qualify as “other peoples’ money” (more on that below) as they are borrowing from a separate institution. But, a loan is simply borrowing against your future income potential, and you eventually have to pay it back from your income or savings, so it’s all you…

OPM

O.P.M. or (you guessed it) “Other People’s Money.” This is my favorite category as it represents the “free” money that you can use to pay for college. Scholarships and grants make up this category. There is a lot to discuss on both items so I encourage you to reach out to your financial planner to discuss them in greater detail. However, know that there are many sources for both including federal, school-specific, state, and even private issued funding. Make sure to do your research here. I have found the following websites to be great resources:

Sallie Mae has a great site with plenty of educational material on saving and paying for college.

Scholly is a scholarship search tool. Scholly offers other educational resources in addition to scholarships. Not all of them will apply to you but take a look.

Don’t forget the FAFSA

Brevity is not my strong suit, but this one is pretty simple. Please, please, please complete your FAFSA (Free Application for Federal Student Aid [HYPERLINK https://studentaid.ed.gov/sa/fafsa]) and submit it. The earlier the better as scholarships and grants are generally handed out on a first-come, first-served basis.

Prevent the post-college blues

The important thing to remember in this entire process is that it all comes down to what happens after school. What career opportunities exist? What amount of student loan debt must be repaid? Always have an eye towards the post-college years. Student loan debt is now the largest consumer debt category, not including mortgages. This isn’t necessarily a bad thing but consider the impact of the debt load and the required payments coming out of school. Too many recent graduates find debt to be a burden that keeps them from enjoying their early career years.

My closing remarks

Like everything else, being prepared for college requires a plan. And not just any plan; one that should be balanced with everyday life and other goals. There will never be a perfect strategy, at least I have never seen one. However, we can focus on building a plan that fits your life now and on making progress every month. Life and plans will change over time, but we cannot let that keep us from taking the right steps toward our goals. Saving for college can feel like a daunting task, but with the right partner, it doesn’t have to be. Working with your dedicated CFP® Professional at Facet can help you create clarity around the plan that is best for you and your family.