Key takeaways

- Roth IRAs are funded with after-tax dollars, while traditional IRAs with pre-tax money

- Taxes are due on traditional IRAs when you withdraw in retirement

- Roth IRAs offer tax-free withdrawals and contributions can be withdrawn at any time

- Eligibility for both types of IRAs depend on income limits and other factors

- Backdoor Roth IRAs may be an option for high earners concerned about income thresholds

The main differences between a Roth IRA and traditional IRA

The main differences between a Roth IRA and a traditional individual retirement account (IRA) come down to taxes and timing. Traditional IRAs may allow for tax deductions now, but Roth IRAs are funded with after-tax dollars (money that has already been taxed).

In the future, if you withdraw money from a traditional IRA, you will have to pay taxes on any portion that has not yet been taxed, such as deductible contributions and investment earnings. However, with a Roth IRA, you can make tax-free withdrawals.

When discussing the benefits of a Roth IRA vs traditional IRA, a common assumption is that you will be in a lower tax bracket in retirement. While that may end up being the case, it's too hard to predict.

Instead of assuming your income will be lower once you retire, it's easier to decide whether you want to pay your taxes now or later.

If you'd rather get your taxes out of the way now while your account isn't that large, a Roth IRA will allow you to accomplish that goal.

If you'd rather wait until retirement, a traditional IRA will allow you to defer taxes until you decide to withdraw after the age of 591/2. If you decide to wait, the IRS will mandate required minimum distributions (RMDs), commencing in your early seventies (ages vary).

Do you qualify for an IRA?

If you or your spouse have earned income, you qualify for an IRA. However, to get tax advantages, you must meet additional government requirements. Income limits depend on your filing status, how much you'll earn this year, and whether you have an employer-sponsored plan like a 401(k).

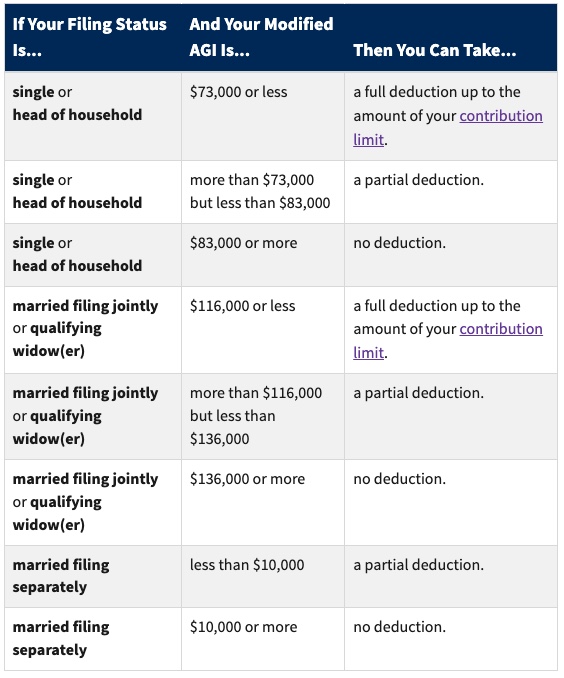

Traditional IRA income limits

The low-down

If you file as a single or head of household in 2023 and have a retirement plan at work, you must have a modified adjusted gross income (modified AGI) lower than $73,000 to get the complete deduction for a traditional IRA.

2023 IRA deduction limits if covered by an employer's retirement plan

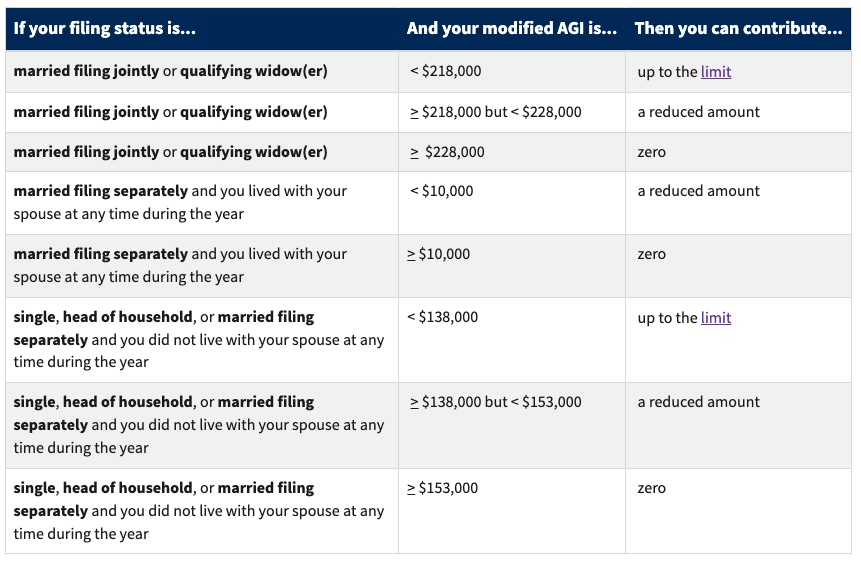

Roth IRA income limits

The low-down

If you are married filing jointly or a qualified widow(er) and earn more than $228,000, you won't be able to contribute to a Roth IRA.

2023 contribution limits for Roth IRAs

Of course, there are other limitations to consider for individuals in other situations. For up-to-date information on IRA limits and requirements, check out the IRS site here.

Option for high earners: Backdoor Roth IRA

If you're a high-earning taxpayer and concerned about income limitations, you could consider creating a backdoor Roth IRA. This involves additional steps, but it could be advantageous for your financial situation.

The backdoor Roth IRA strategy involves contributing to a traditional IRA first and then converting to a Roth IRA.

For a complete breakdown of how a backdoor Roth IRA works, read this: Backdoor Roth IRA: What it is and how to do it

Other things to consider when comparing Roth and traditional IRAs

How old are you?: It's important to compare the benefits of a Roth and a traditional IRA, especially if you're at an early stage in your career. The earlier you start, the more time you have to take advantage of compounded tax-free growth in a Roth IRA.

Longevity: People are working much longer than they ever did before, so factoring in your family history is an important consideration. If longevity runs in your family, a Roth IRA might make it easier to supplement your retirement income, given its lack of withdrawal restrictions.

Can't I have traditional and Roth IRAs at the same time?

You can have both retirement savings vehicles as long as your contributions fit within the government's guidelines. By doing so, you can benefit from a mix of tax advantages in the present and the future.

Advantages and disadvantages of traditional IRAs

Advantages

- Potential tax deduction: A traditional IRA contribution may come with a tax benefit. You may be able to deduct your contributions on your taxes, based on your income, which would reduce your annual earnings and lower your tax liability.

- Tax deferral: You don't have to pay income taxes until you start taking withdrawals in retirement.

Disadvantages

- Beware - taxes ahead: While receiving tax benefits while you're still working is fun, you will have to pay the IRS their share later in life.

- Required minimum distributions: If you're lucky enough to avoid tapping into your account by your seventies, the IRS will make sure you take out a certain amount every year for the rest of your life. These mandatory withdrawals are called RMDs. All pre-tax retirement accounts are subject to RMDs.

- Early withdrawals come with penalties: If you take out money before the designated time, it will be added to your taxable income for the year and you may have to pay an extra 10% penalty. However, in some cases, there are distribution exemptions.

Advantages and disadvantages of Roth IRAs

Advantages

- Tax-free growth: Since you paid your taxes upfront, your earnings are not subject to any additional taxes.

- No RMDs: You don't have to withdraw your money if you don't want to.

- No penalties: There is no penalty on any contributions you withdraw.

Disadvantages

- No immediate tax break: Since your Roth IRA contributions were made with after-tax money, you won't feel that tax-free bliss until much later in life (it's worth the wait).

- No take backs: While having access to your funds may seem like a nice perk, anything you take out stays out. You can't add money to your account later to compensate for your withdrawals.

Final word

Before deciding where to invest your retirement money, you should consider things like your current tax bracket, retirement age, and goals. And remember, you can contribute to both plans at the same time.

Your financial planner can help you decide which retirement plan best suits your needs. They'll also be able to provide the most up-to-date information on government limits and rules for tax-advantaged accounts.

Facet's team of experts can help you get the most out of your retirement savings. Click the button below to learn how we can create a tailored plan that meets your goals.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.