Key takeaways

- Restricted Stock Units (RSUs) are a form of equity compensation companies use to incentivize employees

- RSUs become accessible upon fulfilling certain milestones or vesting schedules

- Taxes are due at the time of vesting and when shares are eventually sold

- Unlike stock options, RSUs do not require an upfront purchase

- Special circumstances like death, disability, or job transitions may affect the treatment of RSUs

Many companies, both public and private, offer equity compensation to their employees as an incentive or recognition of achievement.

This type of compensation can take different forms, such as Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs), which are options to purchase company stock at a predetermined price.

Restricted Stock Units (RSUs) are another type of equity compensation with significant financial and tax differences.

Here’s a deep dive into the world of RSUs, exploring the benefits, drawbacks, and strategies for managing RSUs effectively.

What are restricted stock units (RSUs)?

Restricted Stock Units (RSUs) are a form of equity compensation companies use to attract and retain talent, offering employees ownership incentives through a vesting schedule.

Employees receive a portion of the company’s stock, a restricted stock unit, under specific conditions. The value of the RSUs becomes accessible upon fulfilling certain milestones or timeframes. Understanding how restricted stock units work is essential for employees to maximize the benefits of this equity compensation.

The basics of RSUs

RSUs represent shares of a company’s stock and have no intrinsic value until they are vested. The vesting schedule is typically based on time or performance milestones, meaning that an employee must remain with the company for a certain period or achieve specific goals to access the value of the RSUs.

RSUs are considered income once vesting has taken place. A portion of the shares is therefore withheld to cover income taxes. The employee then receives the remaining shares and has the right to do with them as they wish, whether by selling, holding for potential appreciation, or using them for other financial goals.

Why do companies offer RSUs?

Companies use RSUs to incentivize employee retention and encourage long-term commitment to the organization. RSUs have gained popularity since the mid-2000s, following accounting scandals involving companies like Enron and WorldCom, as a means of attracting and retaining talent.

From a financial standpoint, RSUs offer companies various benefits, including:

- Reducing the immediate administrative burden

- Providing an incentive for employees to assist in the company’s performance as the value of the shares can increase

- Deferring the issuance of shares until a later date, helping to delay stock dilution to existing shareholders

Vesting schedules and RSUs

Vesting schedules determine when employees can access their RSUs. The two most popular vesting schedules are called ‘graded’ and ‘cliff’ vesting—each with unique characteristics and timelines for accessing the value of the RSUs.

Graded vesting and RSUs

In a graded vesting schedule, employees receive a specific percentage of their RSUs each year on the grant’s anniversary date. Distribution intervals vary depending on the company, but a typical duration for graded vesting schedules for RSUs ranges from three to four years. For example, in a 3-year graded vesting schedule, 33.3% of the RSUs may vest yearly.

This method of incremental vesting grants employees access to a portion of their RSUs over time, helping to smooth out the potential impact of stock market fluctuations on their overall financial situation and providing a more predictable path to accessing their RSUs value.

Cliff vesting and RSUs

Unlike graded vesting, cliff vesting awards employees their entire allotment of RSUs following a set period or once a specific performance milestone is achieved. The company determines the vesting date, which may vary.

Employees who leave the company before the vesting date typically forfeit any unvested RSUs. This all-or-nothing approach can be more challenging for employees, as it requires a longer commitment to the company to access the full value of their RSUs. However, it can also provide a significant financial reward for those who remain with the company for the required period or achieve the specified performance milestones.

A common vesting schedule is a grant with a one-year cliff (grants begin vesting after one year) and a four-year vesting schedule. Here’s an example:

| Grant Date | Shares Granted | Vesting Dates | Shares Vesting | Unvested Shares |

| 6/1/2021 | 2,000 | 8/1/2022 | 500 | 1500 |

| 8/1/2023 | 500 | 1000 | ||

| 8/1/2024 | 500 | 500 | ||

| 8/1/2025 | 500 | 0 |

Example source: Facet

In this case, the employee was granted 2,000 shares. The first 25%, or 500 shares, became the employee’s after one year. The employee received an additional 500 shares every year after that until all 2,000 shares were vested.

If the employee leaves the company before the four years are up, they will forfeit any remaining (unvested) shares.

When shares vest, they are valued at the company stock’s current fair market value (FMV) and are taxable as income to the employee. At that point, the employee has some decisions to make, which are outlined below.

Tax treatment of RSUs

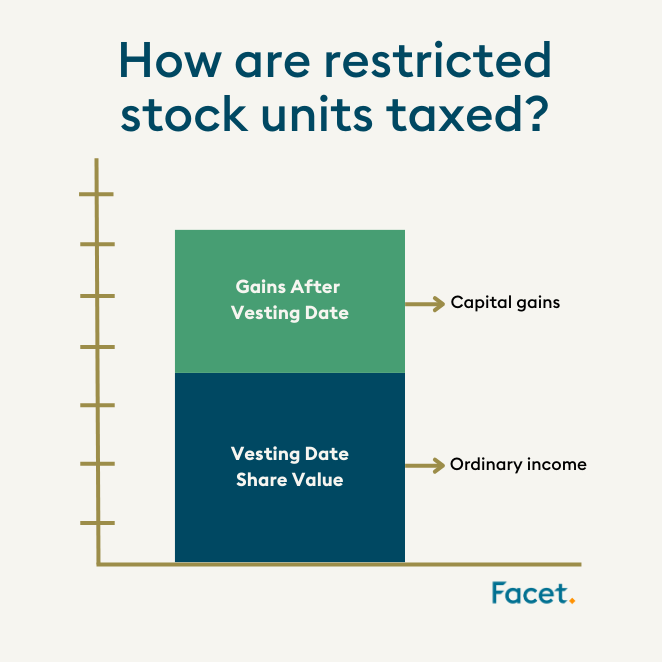

Employees should be aware of the distinct tax implications associated with RSUs, as taxes are due at the time of vesting and when shares are eventually sold. A clear understanding of these tax implications is fundamental to managing your RSUs effectively.

Taxes at vesting

The value of vested RSUs is considered ordinary income and is subject to ordinary income tax. To calculate the income tax on vested RSUs, follow these steps:

- Determine the fair market value of the RSUs at the time of vesting

- Subtract any amount you paid for the RSUs

- Apply the applicable tax rate

The resulting figure is what you will pay ordinary income tax on.

The standard approach for handling taxes when RSUs vest is to have the employee relinquish a portion of the distributed stock to the company to cover the taxes.

The company then uses its cash to pay taxes, including federal income tax, state and local taxes (where applicable), and Social Security and Medicare taxes.

Capital gains and losses

When selling RSU shares, the difference between the sale price and the fair market value at the vesting date is subject to taxation as a capital gain or loss.

The applicable tax rate for the capital gain varies based on the individual’s taxable income and can be as low as 0% or up to 20%.

You might want to consider tax-loss harvesting, a strategy that uses capital losses from RSUs to counterbalance potential capital gains tax obligations. By realizing losses from RSUs, you can:

- Reduce your overall taxable income

- Potentially lower your tax bill

- Use capital losses to offset capital gains, which can help if you owe capital gains tax

- Use capital losses to offset up to $3,000 of regular income for tax purposes

Learn how Facet’s team of experts can help you navigate your Equity Compensation.

What is the difference between RSUs and stock options?

While both RSUs and stock options are forms of equity compensation, their advantages and drawbacks differ. Understanding these differences can guide you in choosing the equity compensation type that aligns best with your financial situation and objectives.

Advantages of RSUs

One of the main advantages of RSUs is that, unlike stock options, they don’t require an upfront purchase. This means that employees can access the value of their RSUs without making an initial investment. Furthermore, RSUs retain value as long as the stock’s market price is above zero, providing a level of financial security and flexibility that may not be present with stock options.

RSUs are also more straightforward than stock options, making them a more accessible form of equity compensation for many employees. By understanding the benefits of RSUs and how they differ from stock options, employees can make more informed decisions about their equity compensation and overall financial strategy.

Drawbacks of RSUs

Yet, RSUs are not without their disadvantages. Some of the drawbacks include:

- They may incur a higher tax burden than stock options

- The uncertainty surrounding the sale of RSU shares can impact their overall value

- Employees may experience financial uncertainty due to price fluctuations that may occur before they can sell their RSU shares

Moreover, sudden valuation declines can lead to RSUs having no value, particularly if the stock price drops below the strike price.

Considering these potential pitfalls, employees should meticulously weigh the advantages and disadvantages of RSUs versus stock options to make savvy decisions about their equity compensation.

Strategies for managing RSUs

Effectively managing RSUs requires adopting strategies like diversification and consulting a financial advisor to boost their benefits.

Diversification and RSUs

Employees should diversify their investments to minimize risk and not rely solely on RSUs. Diversifying your investment portfolio allows you to:

- Mitigate losses in a declining market

- Potentially increase your chances of achieving higher risk-adjusted returns

- Capitalize on potential growth in other investments

- Control the exposure of your RSUs in your portfolio

Relying solely on RSUs as an investment strategy can expose you to various risks, such as the lack of diversification and potential fluctuations in your company’s stock price. To reduce these risks, consider selling RSU shares when they vest and invest the proceeds in a diversified portfolio.

Special circumstances: Death, disability, and job changes

Certain situations like death, disability, or job transitions can influence how RSUs are handled. Understanding how these scenarios may impact your RSUs and planning strategically is vital to safeguard your financial interests.

How to handle RSUs in the event of death or disability

The handling of RSUs in case of death or disability varies by company, with taxes owed on the value of vested shares. In the event of death, RSUs will typically vest and become payable to the employee’s estate or beneficiaries, depending on the company’s plan.

In the case of disability, the treatment of RSUs will depend on the specific provisions outlined in the stock plan and grant agreement. Reviewing the terms and conditions of your RSU plan is essential to fully grasp its specific stipulations in the event of death or disability.

Impact of job changes on RSUs

Job transitions can have implications for your RSUs, including modifications to your vesting schedule and the potential loss of unvested shares. Different types of job changes can have varying impacts on an employee’s RSUs, from switching companies to changes in employment status. Employees need to be familiar with the specific terms and conditions of their RSU agreement and consider consulting their employer or a financial advisor for personalized advice.

In some cases, companies may buy out a candidate’s unvested RSUs as part of their compensation package when switching jobs, which may involve the opportunity to purchase company stock. Understanding how your RSUs may be affected by job changes can help you make informed decisions and protect your financial interests.

Final word

Restricted stock units are a popular form of equity compensation companies use to incentivize and retain talent. Understanding the basics of RSUs, their tax implications, and the strategies for managing them effectively can help you make informed decisions and optimize your financial situation. From diversifying your investment portfolio to working with a financial advisor, taking control of your RSU knowledge and financial strategy can lead to significant benefits and financial growth.

As you navigate the world of RSUs, remember that your financial journey is unique. By understanding the benefits, drawbacks, and strategies for managing RSUs, you can make well-informed decisions and build a solid foundation for your financial future. Take charge of your equity compensation and embrace the opportunities that RSUs can offer.

Frequently Asked Questions

How does an RSU work?

Restricted stock units are a form of equity compensation used by publicly traded companies to attract and retain top talent. Upon meeting certain requirements, employees are granted a set number of shares of company stock that become vested over time. At the end of the vesting period, the employee owns the RSU and pays taxes on its value.

What’s better, stock options or RSUs?

For early-stage startups, stock options are typically the better option due to their ability to be timed for taxation and the potential for high growth. However, RSUs are usually a better choice at more established companies as they provide more stability and certainty regarding value.

Why are RSU taxed so high?

RSUs are treated as supplemental compensation and, therefore, subject to higher withholding rates of up to 37%, resulting in a high tax bill.

What happens to RSUs when you quit?

You will forfeit all your unvested RSUs back to the company when you quit your job. However, the vested RSUs already in your brokerage account are yours to keep.

Why is diversification important when managing RSUs?

Diversifying your RSUs across different assets or market sectors helps to reduce risk and minimize the effect of any single investment on your overall portfolio. This is why diversification is important when managing RSUs.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.