The information provided is based on the published date.

Key takeaways

- Stocks reached all-time highs despite an "as expected" inflation report, suggesting less bearishness among investors than anticipated.

- Bond yields also fell, but only slightly. Bond traders are clearly expecting rates to stay higher for longer.

- The biggest impact the Fed has on markets is through their steering of the economy.

- Some investors overrate the importance of the Fed and interest rates. They matter, but it isn't a dominant factor.

Hello and welcome to another edition of the Facet Investor Newsletter. I’m your Chief Investment Officer Tom Graff. This week we’ll cover: stocks at an all-time high, our thoughts on two major inflation reports, and dive into how the Federal Reserve does (and does not) matter for stock investors.

This is just our seventh week of writing this newsletter and we’d love your feedback. What is and isn’t helpful to you? What do you wish we would cover? Any thoughts you have on the newsletter, or any question about markets and investing, send it in! Reach me at [email protected].

Market recap

Stocks rose this week with the S&P 500 up 1.6%, hitting an all-time high on Wednesday before retreating slightly on Thursday. The big catalyst was Wednesday’s Consumer Price Index (CPI) report, which we covered in-depth in last week’s Learn article.

Bond yields fell this week, but only mildly. The 10-year Treasury yield declined by 0.08% to 4.42%. I would say this reflects investors assuming that while maybe the Fed is a bit more likely to cut a couple times after the CPI report, in general people expect interest rates generally to stay higher for longer.

This week’s chatter

The pro investor community had been eagerly anticipating last week’s CPI report. The actual number came in right on expectations, at least according to the Bloomberg economist survey. Core CPI was +0.3% for April and +3.6% for the prior 12 months, exactly in-line with the survey.

Despite the “as expected” report, stocks lurched higher. The S&P 500 finished the day up 1.2% and bond yields dropped significantly. Now it is not terribly unusual for markets to react to an in-line number, whether we’re talking about an earnings report for a company or a macroeconomic stat like the CPI. However when this happens it does tell us something about investor sentiment.

In this case, markets were clearly bracing for a worse inflation report than we actually got. In other words, maybe the official expectation was for April CPI to be 0.3%, but actual traders were worried about the number coming in higher than that. Based on how the market traded after the number was released, there were obviously a large number of short-term traders betting on stocks declining coming into the day of the release.

This dichotomy has been a topic of debate among pros for the last month or so. Stocks are at all-time highs and yet investor sentiment is weak, at least among short-term traders. Does this mean stocks will keep going higher? Who knows. But it does suggest that the investor community isn’t overly optimistic. If anything, there’s room for more buyers to buy.

The other topic of conversation this week was so-called “meme” stocks, particularly GameStop. I’ll just say that most pros view this kind of stuff as bemusing and not much more. It is true that GameStop was a kind of poster child for speculative fervor in 2021, but at least for this week, there wasn’t any broader impact of the sudden surge in these meme stocks. I’d just chalk it up as one of those weird things that sometimes happens in markets.

Pro corner

One big reason why markets are so keyed on these inflation reports is the Fed. Both stock and bond investors would prefer the Fed to cut rates a couple times in 2024, all else being equal, and inflation is really the only thing that is standing in the way of getting those cuts.

We talk about the Fed all the time, and we all see how the market seems to hang on every word Jerome Powell says. But it might be worth taking a step back and asking why the Fed matters so much for stock investors.

The first is that interest rates in general matter, and the Fed is a big part of setting interest rates. They matter in part because companies often borrow money as part of their business, and the cost of borrowing impacts profits. But it also matters because there’s a kind of competition for capital. For example, if T-Bill yields are 1%, then you might be willing to accept a return of 6-7% on a riskier investment. But if T-Bill yields are 5%, you will probably demand more like 10-12%. The higher the future return the market demands on an investment, the lower the price must be today to make that future return possible. If you want to learn more about this concept, check out this article.

This effect is pretty minor for small changes in Fed policy, such as the 1-2 cuts that might happen over the next several months. The bigger effect right now is about the Fed’s management of the real economy. When the Fed hikes rates, they are intentionally trying to slow the economy in order to quell inflation. The longer they have to keep rates this high, the more they risk overdoing it and causing a recession.

If inflation is very high, the Fed will have to keep policy restrictive even if it means causing a recession. Powell explicitly warned of such a thing many times in 2022. This would be a double whammy for stock investors: not only would interest rates stay high but company profits would almost certainly decline during the recession.

However if inflation subsides a bit and the Fed can cut if they want to, it stands to reason that they could cut more aggressively if the economy started really slowing. In other words, a relatively benign CPI report gives the Fed more freedom to manage the economy in a balanced way. That alone is pretty valuable to stock investors.

If you spend too much time online, you might run into claims about other effects the Fed has on stocks. Often these are related to the Fed’s balance sheet, QE, QT, etc. I won’t get into details of these here (feel free to email in specific questions at the address above) but suffice to say, these effects range from very small to non-existent. Watch out for anyone peddling these kinds of ideas.

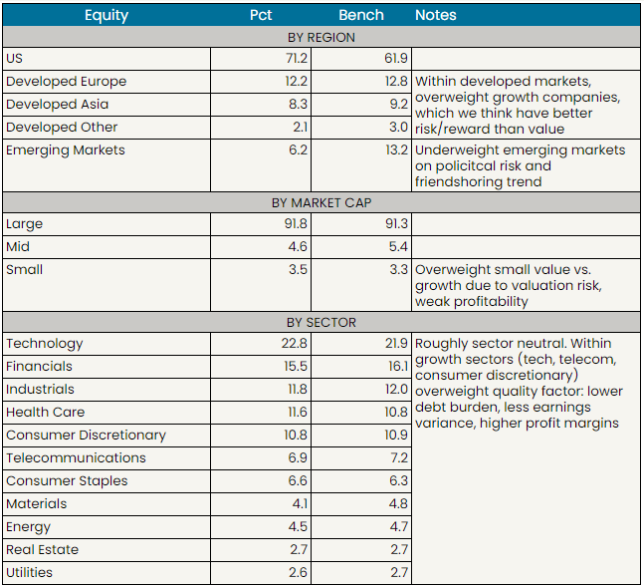

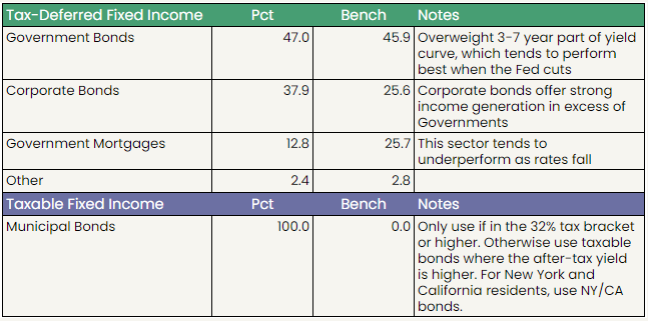

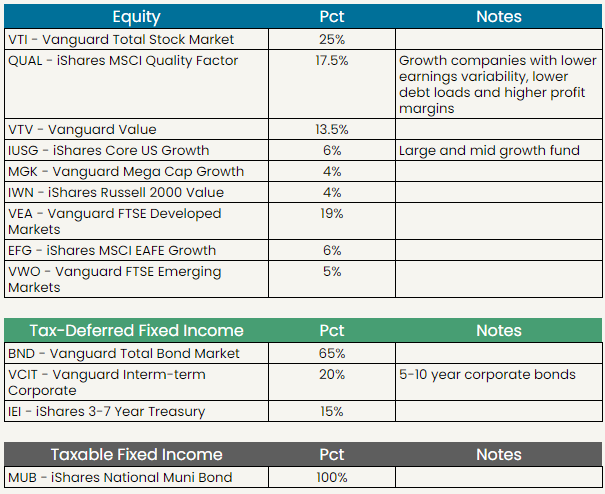

Facet portfolio positioning

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when make a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.