The information provided is based on the published date.

Key takeaways

- Soaring home prices are driven by a lack of supply, not risky mortgages like what caused the 2008 crash.

- Mortgage rates are high, and affordability is at a historic low, making it a tough time for homebuyers.

- A recent surge in apartment construction is slowing down rent increases, offering some relief to renters.

- The decision to buy a house depends on your individual situation, and what you’re looking to get out of homeownership.

It has been a tough time to be a homebuyer recently. Not only are mortgage rates near multi-decade highs, but home prices also keep rising. The National Association of Realtors estimates that home affordability is as low as it has been since they started keeping data in 1989. For those looking to buy a home, is there any relief in sight? Could this extreme affordability challenge create a risk of a housing market crash? What does this mean for investors in real estate? Here are our thoughts on the state of the real estate market.

Why do home prices continue to rise?

There is a very basic reason why home prices continue to rise, even in the face of very high mortgage rates: demand is outpacing supply.

Since 2010, the total adult population in the U.S. has risen by 28.5 million. Meanwhile, the total number of housing units (including apartments and houses) has only increased by 14.3 million. Moreover, the Millennial generation recently became the largest generational group in the U.S. This age grouping (roughly age 27 to 43) is in their prime ages to be buying their first house. These demographic forces are creating substantial demand for home buying.

Meanwhile, not only are there not enough new houses being built, few are for sale. According to research by the Federal Housing Finance Agency, 63% of homeowners with a fixed mortgage have a rate below 4%. That’s nearly 3% below the current available rate for prime borrowers. In effect, these homeowners are locked into their current residence: unable or unwilling to reset their mortgage rate.

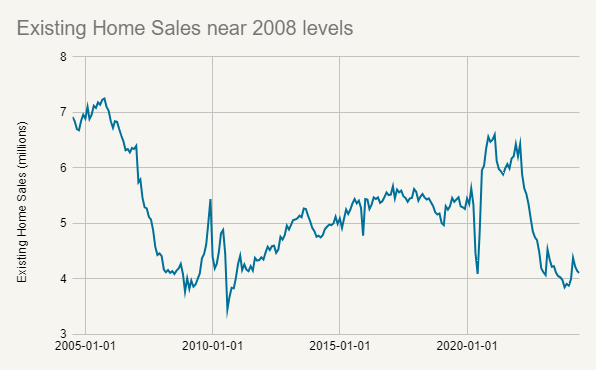

As a result, the pace of existing home sales has plunged, currently near levels not seen since 2010.

Source: National Association of Realtors

The data above shows that home prices are being supported by a lack of supply, both generally slow home construction since 2010 and a lack of willing sellers currently.

What could cause home prices to fall?

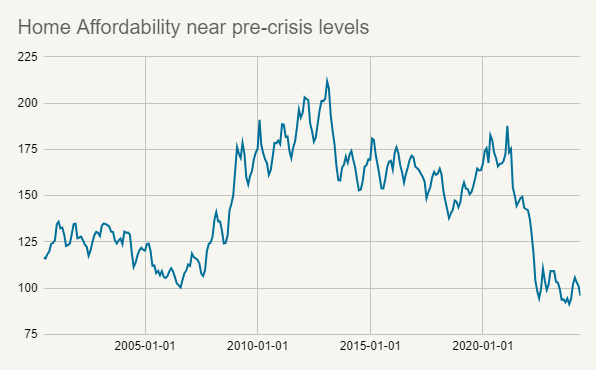

The last time home affordability was even close to today’s level was in the lead-up to the 2008 Financial Crisis. Naturally this begs an important question: could the current challenges trigger another housing price collapse?

Source: National Association of Realtors

The big difference between now and then is that there are no forced sellers of homes. Part of what precipitated the 2008 crisis was that many home buyers had taken out mortgages where the rate reset higher after some very short period, often just two or three years. This was either done to make the monthly payment palatable or because the buyer was planning on “flipping” the house after a short period.

This created a breaking point for many borrowers. They either couldn’t afford the new payment and wound up in foreclosure or otherwise were forced to sell the house perhaps before the renovations were complete.

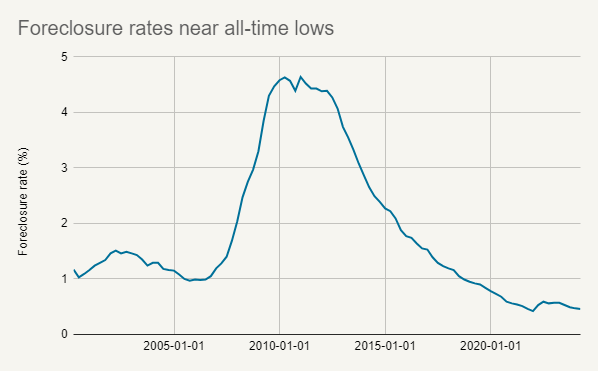

Such an outcome seems unlikely today. Banks no longer offer short reset mortgages of the kind that existed in the 2000’s. In fact, the rate of home foreclosures, currently 0.46% is near an all-time low. In other words, those that have a home today are, broadly speaking, having no problems making their payments.

Source: Mortgage Bankers Association

That’s not to say that home prices cannot fall. One scenario could be that a recession pushes up unemployment, resulting in a somewhat higher foreclosure rate. But at present, there aren’t signs of an impending large decline in home prices. Given the very strong demand profile, it may be that any small decline in home prices is met with many willing buyers, which would also prevent prices from falling all that much.

Could mortgage rates start falling?

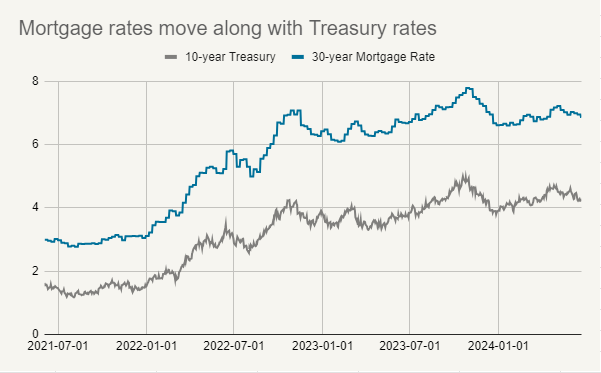

The going rate for home mortgages is very closely related to other long-term interest rates like Treasury bond yields. This is partly because about 65% of mortgages are sold to investors in the public bond market, and part because banks often use bond market instruments to hedge interest rate risk. We can see this by looking at a chart of mortgage rates and Treasury bond yields over time.

Source: Bloomberg, Freddie Mac

So when asking what would cause mortgage rates to fall, you are basically asking what would cause Treasury bond yields to fall.

Treasury rates are mostly a function of what investors expect the Federal Reserve’s target rate to be over time. E.g., the 10-year Treasury rate shown above should be roughly equal to the average Fed target rate traders expect over the next 10 years.

With the 10-year Treasury rate around 4.2%, the market is probably expecting the Fed will cut rates 4-5 times (for a total of 1-1.25%) over the next 18 months and then be on hold for an extended period thereafter. For mortgage rates to decline meaningfully, the Fed will likely have to cut more than 4-5 times.

For that to occur, we probably need either inflation to fall faster than most economists currently expect or for there to be a meaningful slowdown in job growth. For mortgage rates to drop all the way to around 5%, the economy probably needs to go into a recession.

Any of those things could happen. Certainly given enough time the economy will eventually hit a recession. However bear in mind that just because the Fed is likely to cut rates later this year, that does not automatically mean mortgage rates will decline.

Apartment rent rates mixed

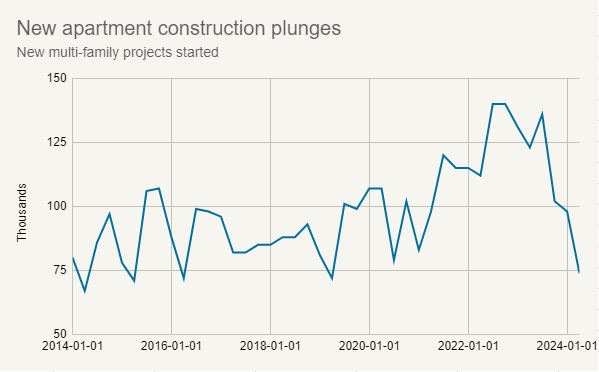

Because single-family homes are so hard to afford, more people are staying in rental units longer. However the supply conditions are quite different in the apartment market. In 2020 and 2021, construction of new apartment buildings surged, spurred by very low interest borrowing costs and a lot of investor interest in real estate. However, that has reversed in a big way in the last few months.

Source: Census Bureau

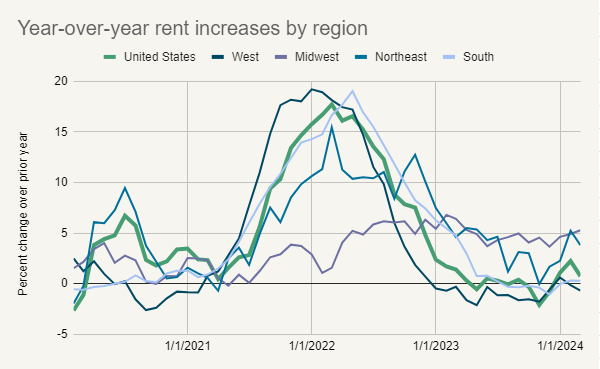

The good news for renters is that a lot of the projects that started in 2022 and 2023 are only just now coming on market for rent. This has pushed the rate of rent increases lower recently despite relatively low vacancy rates.

Source: Rent.com

Unfortunately this doesn’t mean that rents are actually going down for the most part. They are just not rising by as much as they did in 2022.

Real estate investments mostly about interest rates

For the owners of apartment complexes, this is really the worst of all worlds. High interest rates are squeezing profits, rent rates aren’t rising much, and investor interest in real estate has waned.

We can see this in the price of publicly traded real estate stocks, often called REITs. So far in 2024, real estate is the only major sector of the S&P 500 that has lost money year-to-date, and this would mark the third year in a row that real estate has underperformed the broad index.

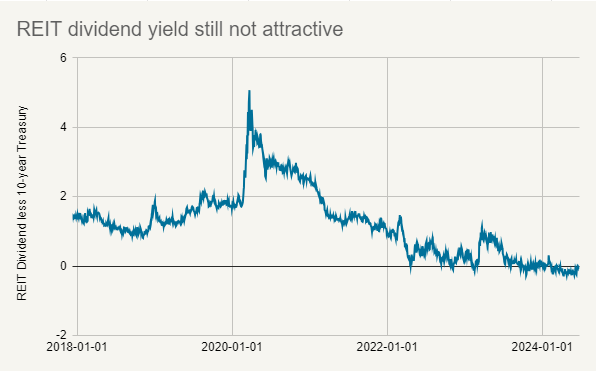

Despite this, REITs still appear expensive on a dividend yield basis. The chart below shows the dividend yield on the REIT index less the 10-year Treasury bond yield. You can see that normally REITs offer extra income compared with government bonds, but currently they are about equal.

Source: Bloomberg

A year ago we wrote about the four major reasons why we weren’t bullish on real estate investments. Not much has changed. Interest rates are even higher today than when we wrote that article, and that remains a big key to real estate recovering. That’s not to say we have zero weight to real estate in our portfolios, but it is a sector with a lot of questions and currently, not a lot of answers.

Is now a good time to buy a house?

I’m sorry to say it, but we don’t have a lot of good news for those looking to buy real estate. The housing market is very expensive, both in terms of cost to borrow and the price of homes, and it isn’t obvious that either of these circumstances are about to improve.

That being said, waiting to buy a house might not be the right answer either. Given how strong demand is, home prices could keep rising. Moreover, if interest rates fall, there might be a rush to buy.

So what should you do? First, check your emotions. Don’t get wrapped up in fear of missing out or frustration over rising prices. Buying a house is a huge financial decision. Make it an objective and well-thought out one.

Second, make sure you are ready to be a home owner, not just a buyer. Buying a house is a big commitment. You’ll be dealing with all kinds of new costs as well as less flexibility. Understand how it will affect your finances and overall plan today and for years to come.

Remember also that a home shouldn’t be considered a traditional investment. Yes, it is true that home prices could easily keep going up, but they might not. We would argue that buying a home expecting price appreciation makes it more likely to make a mistake.

There’s no one-size-fits-all answer to all of these questions, but getting the plan right can make a huge financial difference to you. With all that said, if you're ready and you've planned to purchase a home, go for it and enjoy it!