Do I Need a Financial Planner?

Why Doing It Yourself Isn't Good Enough When It Comes to Your Finances

Membership Expert

Brent Weiss

CFP Professional - Fiduciary

The 60 second quick read...

Unless you’re an expert in investments, taxes, retirement planning, or other financial topics, it’s easy to miss something when doing it yourself

A financial planner can give you the power of choice in your life and freedom from worrying about your finances

Working with a financial planner can give you the confidence to handle unexpected moments in life

A good financial planner can provide unbiased, personalized advice that impacts every area and every stage of your life

Why Doing It Yourself Isn't Good Enough When It Comes to Your Finances

Most of us have questions about the areas of life that involve money. Maybe you’re thinking about your next career move, buying your dream home, starting (or raising) a family or opening a business. And what about all of the decisions that come with retirement? You want to make smart decisions with your money, and maybe you’re wondering if professional financial advice makes sense.

It can often feel like the safest answer is to handle your finances on your own. Many people choose the Do-It-Yourself (DIY) approach because they’re nervous about sharing their financial information, embarrassed about their current situation, or worry they won’t have control over all of the decisions made with their money. But as with many things in life, it’s easier to get the results you want when you work with a qualified and trustworthy professional. Let’s break down the many ways a financial planner can help you.

Three reasons why financial planning is essential to living well

Financial advice impacts everything. It’s about much more than investing and retirement. Financial planning, when done right, should have your entire life in mind. When you really think about it, every decision is a financial decision.

Advice should be unbiased and personalized. You need a plan that matches your financial decisions with the things that matter most to you, managed by someone you trust. It needs to take into account your beliefs, your values, and your vision for your future.

Financial advice impacts all facets of life. As your life and financial circumstances change, your financial plan should too. The right kind of planning is essential no matter where you are in life or how much money you have.

If You’re Just Getting Started…

You want to have a healthy relationship with your money: Your beliefs, values, and attitudes about money were developed throughout your life, and they all affect the story you tell yourself about money. Your mindset matters when it comes to improving your financial health. A financial planner can help you understand how your attitudes about money affect your financial decisions, and that knowledge can help you make better, more insightful financial choices.

You want help seeing the bigger picture: Sometimes it’s difficult to know where to start. There are many financial topics to cover (taxes, banking, insurance and investments). You have many milestones to navigate in life, such as marriage, family, and retirement. A financial planner can help you get organized, see the bigger picture, and set meaningful goals, so you can chart your future with confidence.

You want to build a strong foundation:It’s never too early to start investing in your future. A strong foundation – solid emergency fund, plan for debt, proper insurance, short-term savings, a will, and others – is critical to your peace of mind. It can free you from worry and protect you from the unexpected.

If You’re Navigating New Life Milestones…

You want your plan to adapt as life changes: You have decisions to make because you’re getting married, starting or raising a family, saving for an education and retirement, or maybe a loved one gets sick or passes away. You want to make sure those decisions are right. There will always be tradeoffs, and a planner can help you think through them and make the decisions that are best for you.

You want guidance as you advance in your career: Your work life might include a new job, a promotion, a raise, or even a new career. All of these professional events involve more than just your job. How do these changes impact your taxes, your benefit elections, retirement plan options, or your take home pay? Seeing the bigger picture, understanding how your career will affect your finances and your life, and knowing how to make the best decisions are important and can lead to better outcomes.

You want expert advice on the decisions you make with money: Your money decisions might involve cash flow, minimizing taxes, and an emergency fund. Or you might need help with more complex decisions about investments and protecting your family and your assets with insurance and proper estate planning. A planner can help you manage all facets of your finances with an integrated plan.

You want help planning for the unexpected: The unexpected can include recessions, market declines, legislative changes (e.g. tax increases), inflation, caring for a loved one, and the list goes on and on. You will have a lot of decisions to make and a financial planner can help you insulate your money from the impact these events can have. When life happens, an expert that knows you and that you trust is only a text, phone call, or laptop screen away.

A Financial Plan is More Than Just Managing Investments

We’ve left the investments for last because a well crafted and personalized financial plan is your foundation. Your investments then support that plan. Whether it’s your 401(k), your company stock, your IRA and Roth IRA, or something else, a financial planner can help you create a tailored investment strategy that’s aligned with your plan and your life.

Financial planning isn’t a series of one-off decisions. It’s a dynamically evolving strategy. With proactive planning, frequent check-ups and course corrections along the way as the expected and unexpected occur, a planner can act as an expert guide to help you navigate life, and your decisions with money, with confidence.

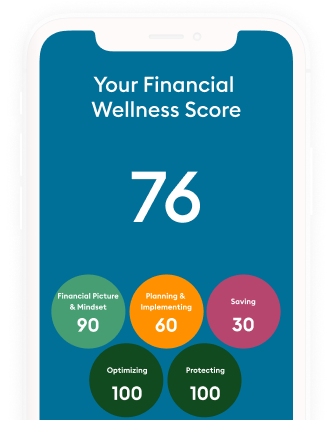

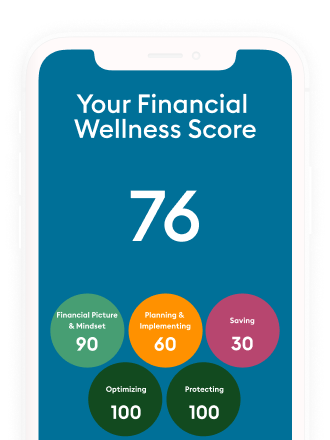

Where are you on your financial wellness journey?

Join us to unlock insights about your financial opportunities.

“[The Facet service] was like tenfold my expectations in terms of what I got. I’ve just been so overjoyed with having what I would describe as a partnership with Facet to run the business of life. I’m never looking back.”

Tyler A | Cupertino, CA

*Learn more about our community supporters.